Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 23 March 2016

[font size=3]STOCK MARKET WATCH, Wednesday, 23 March 2016[font color=black][/font]

SMW for 22 March 2016

AT THE CLOSING BELL ON 2 March 2016

[center][font color=red]

Dow Jones 7,582.57 -41.30 (-0.23%)

S&P 500 2,049.80 -1.80 (-0.09%)

[font color=green]Nasdaq 4,821.66 +12.79 (0.27%)

[font color=red]10 Year 1.94% +0.04 (2.11%)

30 Year 2.72% +0.02 (0.74%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

2/25/16 Jason Keryc sentenced to 9 years in prison, 3 years supervised release and to pay back $180MM to investors he bilked in a Ponzi scheme while an acct. mgr at Agape World.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Hotler

(11,396 posts)Four of the 17 members of the Federal Open Market Committee have now publicly indicated their disagreement with the dovish guidance in last week's policy statement and in comments from Fed Chair Janet Yellen at her press conference.

The latest dissenter is Patrick Harker, the new president of the Philadelphia Fed, who said in a speech Tuesday night that the Fed should "get on with" rate hikes and consider another move in April.

He joins centrists John Williams of San Francisco and Dennis Lockhart of Atlanta who earlier this week said the Fed should consider an April hike. Esther George, the Kansas City Fed president who is thought to be among the more hawkish Fed members, dissented at the meeting last week and called for a 25 basis point hike.

<snip>

While Yellen said at her press conference that April, like all meetings, was a live meeting, she otherwise indicated she was wary of rate hikes in the near future.

"like all meetings, was a live meeting" What the hell does that mean?![]()

"Proceeding cautiously in removing policy accommodation at this time will allow us to verify that the labor market is continuing to strengthen despite the risks from abroad," Yellen said.

"Such caution is appropriate given that short-term interest rates are still near zero, which means that monetary policy has greater scope to respond to upside than to downside changes in the outlook."

http://www.msn.com/en-us/money/economy/fed-chair-yellen-has-a-mini-revolt-on-her-hands/ar-BBqOqEv?li=BBnbfcL&ocid=iehp

I really don't know what this article is saying. If there is a split at the Fed could there be a split among the big banks and what they agree with as far as their money goes????

Hotler

(11,396 posts)A good read about profit at all cost. Isn't that greed? Greedy investors wanting big gains and as long as they were getting them all is well until they take a hit and then they start crying.![]()

For years, he was a member of the elite of Swiss bankers. Now, the former Credit Suisse wealth manager is in a prison hospital in Geneva, charged with fraud, misappropriation, and criminal mismanagement, facing as many as 10 years behind bars.

The case reaches beyond the executive, who under Swiss law can’t be identified in public. Credit Suisse now faces criminal accusations from three clients, alleging it played a role in the fraud.

The timing is terrible for Switzerland’s No. 2 bank. Its new CEO, Tidjane Thiam, is betting its future on managing money for the rich. Wednesday, he announced plans for more cuts at its investment bank.

At least one client involved in the Geneva case -- one of Credit Suisse’s largest -- is pulling his accounts from the bank. In criminal complaints with prosecutors, his lawyers accuse the bank of money laundering and “churning” his accounts to boost its revenue with unnecessary trades. Wealthy men from the former Soviet Union, the clients said their losses reach into the hundreds of millions of dollars.

“The catastrophic situation in the accounts wasn’t caused by an unfortunate investment policy but by a chain of trades, the vast majority of them unauthorized, that created excessive concentrations of risks for clients in order to simultaneously procure important revenues for the bank,” lawyers for one said in a complaint filed with prosecutors in January.

http://www.bloomberg.com/news/articles/2016-03-23/credit-suisse-the-jailed-banker-and-an-oligarch-s-missing-money

Hotler

(11,396 posts)The dollar is on its longest winning streak in a month as speculation builds that the Federal Reserve is moving closer to raising interest rates -- and that’s weighing on oil, gold and emerging markets.

The U.S. currency strengthened for a fourth day after Chicago Fed President Charles Evans joined officials who’ve said this week they expect to raise rates more aggressively than the market has priced. The greenback’s appreciation dragged lower the Bloomberg Commodity Index, which nearly erased its gains of the past two days, while emerging-market stocks halted a five-day rally. European bonds fell and stocks rose, recovering after explosions that killed at least 31 people in the Belgian capital.

U.S. monetary policy is in the spotlight after the Fed a week ago halved its projection for rate increases this year to two, a shift that drove global stocks higher and weighed on the dollar. Traders put the chances of at least one 25-basis-point move by December at 76 percent, climbing from 54 percent at the end of February.

“People have been underestimating the Fed,” said Sonja Marten, head of currency strategy at DZ Bank AG in Frankfurt, who sees the dollar strengthening to as much as $1.05 per euro this year. “The data has actually been consistently better than the market has been anticipating and that’s at odds with the assessment that the Fed might not do much more, if anything.”

http://www.bloomberg.com/news/articles/2016-03-22/japan-stock-futures-rise-as-dollar-hits-yen-pound-nurses-losses

Okay I'm confused. One day the Fed is said to be driving the dollar down and the next day the dollar strengthens up. I have to got to get an economics refresher.

Hotler

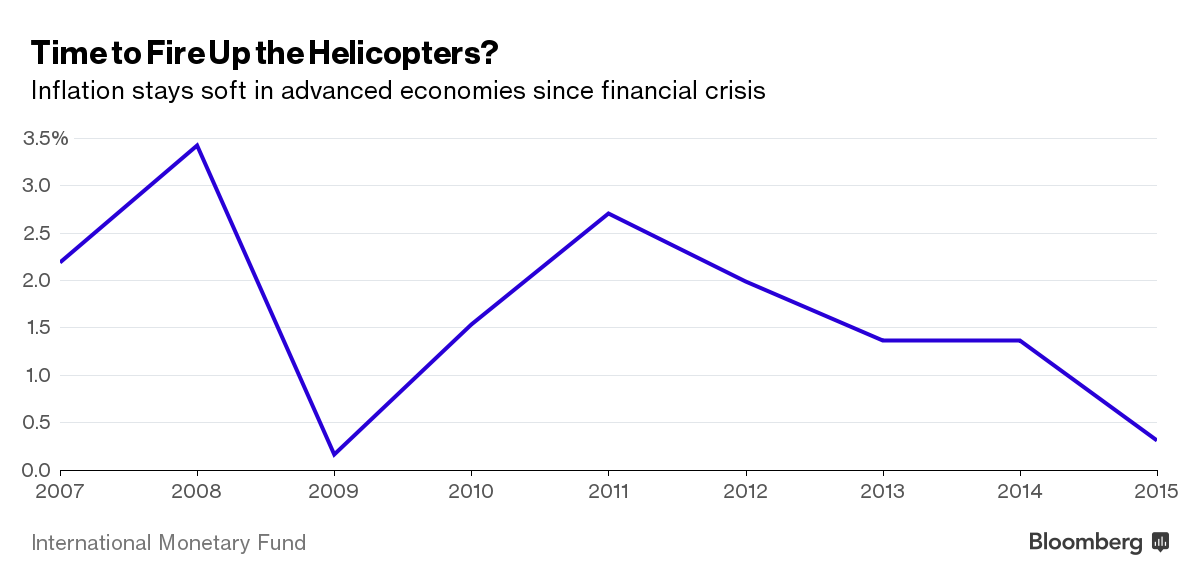

(11,396 posts)After more than 600 interest-rate cuts and $12 trillion of asset purchases failed to move the inflation needle enough, central banks may need to head even deeper into uncharted territory.

The way to get the world out of its disinflationary rut could lie in them directly financing government stimulus -- a strategy known as deploying “helicopter money” after a 1969 proposal from Nobel laureate Milton Friedman.

Economists at Citigroup Inc., HSBC Holdings Plc and Commerzbank AG all published reports to investors on the topic in the past two weeks, while hedge fund titan Ray Dalio sees potential in the idea. European Central Bank officials are already squabbling about what President Mario Draghi calls a “very interesting concept.”

“We don’t know for certain that ‘helicopter money’ will be the next attempted silver bullet, however the topic is receiving considerably more attention,” said Gabriel Stein, an economist at Oxford Economics Ltd. in London. “The likelihood is reasonably high of some form being implemented somewhere.”

The theory -- never attempted by a modern major economy -- is to fuse monetary and fiscal policies now both running out of room. Cash-strapped governments sell short-term debt straight to their central bank for newly printed money that is then injected straight into the economy via tax cuts or spending programs. The usual intermediaries, like banks, are bypassed.

The idea is to spur spending and investment directly rather than influence bond yields or sentiment. Central banks can be saved from permanently underwriting governments by establishing growth or inflation limits.

In a 2002 speech that earned him the nickname “Helicopter Ben,” then-Federal Reserve Governor Ben S. Bernanke said taking to the skies would “almost certainly be an effective stimulant to consumption and hence to prices.”

http://www.bloomberg.com/news/articles/2016-03-22/billions-from-heaven-helicopter-money-option-wins-fans

I'm thinking the 1%ers are worried. They may see another recession coming and they just might not be setting as pretty and untouchable as they were back in 2007. There is a lot of corporate debt on the books and it just may be coming due soon. I hope they are scared.

Hotler

(11,396 posts)a Friday news dump and went away fast.

Files Open New Window on $182-Million Halliburton Bribery Scandal in Nigeria.

British lawyer facilitated bribes through secret Swiss HSBC accounts in his name and names of family members; revelations may place Nigerian government under pressure

“There is no day when I do not regret my weakness of character,” said a contrite British lawyer in a Houston courtroom. “I allowed myself to accept standards of behavior in a business culture which can never be justified. I accepted the system of corruption that existed in Nigeria. I turned a blind eye to what was happening, and I am guilty of the offenses charged.”

The lawyer, Jeffrey Tesler, was speaking at the end of his 2012 sentencing hearing after pleading guilty to U.S. corruption charges for his role in what became known as the Halliburton Bribery Scandal. A network of secretive banks and offshore tax havens was used to funnel $182 million in bribes to Nigerian officials in exchange for $6 billion in engineering and construction work for an international consortium of companies that included a then Halliburton subsidiary. In 2010 Nigeria indicted former U.S. Vice President Dick Cheney, who was CEO of Halliburton before he was elected, only to later clear him when Halliburton worked out a $35 million settlement.

Leaked records from HSBC, a huge global bank based in London, reveal new details about the bank’s role as a conduit for the bribes — and new details about how Tesler operated. The files, obtained by the French newspaper Le Monde and the International Consortium of Investigative Journalists, show ties between Tesler and high-ranking Nigerians not previously named publicly in connection with the scandal, raising the possibility of renewed questions about Nigeria’s handling of the affair.

The Halliburton Bribery Scandal dates to 1994 when the Nigerian government launched ambitious plans to build the Bonny Island Natural Liquefied Gas Project.

http://www.icij.org/project/swiss-leaks/files-open-new-window-182-million-halliburton-bribery-scandal-nigeria

Hhmmmm.... Dates back to 1994. I'm thinking of our old friend Dick Cheney.