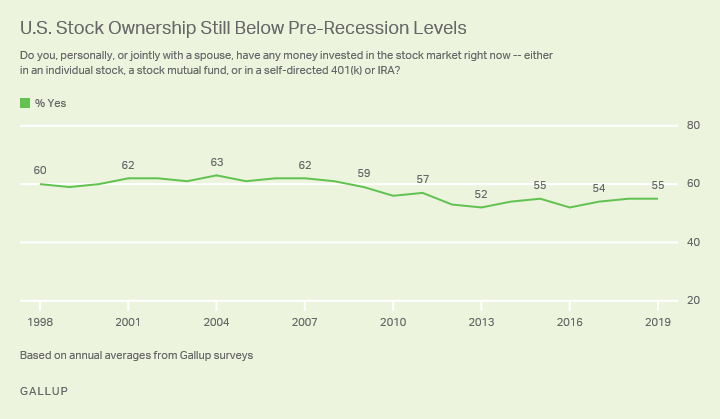

Only half of Americans own stocks, and 84 percent of all stocks are held by just 10%

And that is why it is critically important to choose your primary candidate who

has the strongest agenda on helping the other 90% who own only 16% of all stocks.

https://theweek.com/articles/894128/vanguard-anomaly-investment-world-stay-that-way

RandySF

(58,488 posts)Because many more hold stock through mutual funds.

progree

(10,892 posts)RandySF

(58,488 posts)progree

(10,892 posts)https://money.com/stock-ownership-10-percent-richest/

RandySF

(58,488 posts)progree

(10,892 posts)and I haven't seen anything counter to it...

Edited to add a couple more (granted they are all the same source, Edward Wolff) :

https://www.marketwatch.com/story/the-biggest-bull-market-ever-yet-disaster-looms-for-millions-of-retirees-2019-07-18

https://www.nber.org/papers/w24085.pdf

at140

(6,110 posts)Their stats are more likely to be massaged.

There are millions of Americans living pay check to paycheck.

They can not set aside funds in 401-K type accounts.

Then only 165 million have jobs. The other 160 million are a large contributors to non-owners section.

progree

(10,892 posts)The original source of that is Professor Edward Wolff, and he writes a lot about the problem of growing inequality, and not from a Wall Street perspective either. He has proposed a wealth tax.

https://www.nber.org/papers/w24085.pdf

lastlib

(23,152 posts)how many of that 160 million don't have jobs because they have stocks from which to generate income?

Maybe not a huge number, but possibly significant....IDK....

progree

(10,892 posts)

I note they didn't ask about Defined Benefit pension plans... so that's not included ... see discussion in #13 and #14 below.

And who knows how accurate people's understanding of what they own, and what they actually own are. For example, some might not be aware that a "balanced fund" or "target date retirement fund" holds some stocks (I believe I read that target date retirement funds are default choices for some 401k's), or they might not think about those when answering Gallup's question.

SWBTATTReg

(22,065 posts)happened. Where is the land of opportunity?

progree

(10,892 posts)I salute you! (not)

Admin instructions: https://www.democraticunderground.com/10139260

at140

(6,110 posts)Besides Warren, Sanders is also has similar agenda. Mentioning Warren was simple an after-thought.

My main objective in posting thread is to show how Trump policies have benefited the top 10%.

How much tax cut did you get as a percentage of your gross income?

progree

(10,892 posts)want the entirety of DU to be filled with all the bashing and nastiness that goes on in the Democratic Primaries forum.

The Democratic Primaries forum and its participants provide a very important function and service, and some degree of criticism of candidates and their supporters is to be expected there, and getting heated is to be expected (and tolerated within some limits), but again, I'd like to see that confined to that forum and not be all over DU, and I think that was the admins' intent too.

I'm glad this thread so far has not gone any further on the candidates.

And that is why it is critically important why Warren becomes president. She has the strongest agenda on helping the other 90% who own only 16% of all stocks.

This plug for Warren doesn't look "incidental" to me.

progree

(10,892 posts)I did itemized deductions in both 2017 (the old law), and 2018 (the new law). So the increase in the standard deduction didn't help me at all. But the loss of the $4,050 personal exemption did hurt me.

On the other hand, I only paid $141 in federal taxes in 2018, so that's the most I lost out. But I did lose out.

Edited title: credit -> question

A HERETIC I AM

(24,362 posts)But Progree is absolutely correct. This is not the group for promoting one political candidate over another.

As host of this group, had I seen your OP earlier in the day, I would have messaged you privately and asked you to kindly reword your OP. I would have considered locking it earlier in the day had you not done so, but by now I feel the conversation has evolved to offer some value to the readership over and above your expressed political sentiment.

As I said in this thread from December of 2018, when I requested and was granted Host responsibilities, I do not want to be heavy handed in any way whatsoever in moderating the content here. And for what it’s worth, I have written exactly ONE PM to a member in all of that time, asking them to reword their OP and I have not locked a single thread. That individual deleted the thread on their own.

For the most part, the folks that participate in this group keep their OP’s strictly to the point, and I think that is important so that this tiny little back corner of DU stays free of acrimony and controversy, offers honest, straightforward, ACCURATE information, as free from bias as possible and focuses on the subject matter at hand.

I’ll let this go because, as I said, it has evolved to offer some value, I feel. Having said that, I would ask that in the future OP’s are composed in such a way as to avoid specific endorsements of candidates as well any direct recommendations to purchase securities.

at140

(6,110 posts)A HERETIC I AM

(24,362 posts)Thanks for your understanding.

The rest of the idea clearly sparked some interest.

Thanks.

Wellstone ruled

(34,661 posts)Mutual Funds and Stocks as the same measure when talking about Stock distribution through out the public.

The CEO of Vanguard in his last Bloomberg interview stated his alarm about the Wealth accumulation by the top 1% and how the Stocks including Mutuals owned by Individual households was less than 50% and dropping with each passing year. As he stated,with the alarming rate of Defined Pensions disappearing ,and the new Digital Jobs,we are going to have to come up with a different type of Retirement Savings Nationally.

jls4561

(1,253 posts)because my dad, who left school at 13, taught me how to read a stock table. Over the years,I have made some good picks and some bad picks, and I have had mutual funds. I am not rich, but I'm comfortable - I define comfortable as enough to pay the mortgage, get health insurance, feed the dog and occasionally buy a theatre ticket.

Would Liz Warren like to take .5% of my money to help the country?

OK, I'm down with that.

Progressive dog

(6,899 posts)All of them, to some extent, depend on the economy. Of course, some stock investments are in pension funds that pay to individuals but are not directly held by them.

For example

If earnings on the investment funds decrease, then the governments contributions increase as a percentage of the covered workers salaries. So, there are lots of people who are dependent upon stocks and other investments for their retirement income. Some people will see their taxes go up if the value of stocks go down.

progree

(10,892 posts)Edited to add - Also, some defined benefit (pension) plans have reneged on their promises, both corporate and government entities due to investment returns being below what was assumed.

Progressive dog

(6,899 posts)included in the stock ownership statistics. The investments are held by a fund. The fund is not owned by the beneficiaries.

progree

(10,892 posts)Last edited Sun Feb 9, 2020, 10:14 PM - Edit history (1)

https://money.com/stock-ownership-10-percent-richest/emphasis on the word "indirectly". (but read on, where in the NBER paper, defined benefit pension plans are apparently excluded, but will have to read a little more)

https://www.marketwatch.com/story/the-biggest-bull-market-ever-yet-disaster-looms-for-millions-of-retirees-2019-07-18

https://www.nber.org/papers/w24085.pdf

EDITED - Just flying through the last link searching on the word "pension", but not doing any more reading for context --

Hit #5, p. 6 -

from defined benefit pension plans ("DB pension wealth" ). Even though these funds are a source of

future income to families, they are not in their direct control and cannot be marketed.

Hit #56, p. 35 -

It appears that "pension" in his statistic only covers Defined Contribution plans (e.g. 401k's), not what I think of as a pension at all. I have never heard the word pension applied to 401k or Defined Contribution plans before.

That said, how many people are covered by traditional pensions (defined benefit) anymore? And the majority who are fortunate enough to have pensions probably also own stocks by other means (401k's, IRAs, mutual funds, direct stock ownership) that are covered by his statistic.