Environment & Energy

Related: About this forumSHALE REVOLUTION: Forecasters Say The US Could Become Energy Independent In 20 Years

http://www.businessinsider.com/r-shale-boom-confounds-forecasts-as-us-set-to-pass-russia-saudi-arabia-2014-09

File photo of rigs contracted by Apache Corp drill for crude oil locked tight in shale in west Texas’ Permian Basin near the town of Mertzon

NEW YORK (Reuters) - Four years into the shale revolution, the U.S. is on track to pass Russia and Saudi Arabia as the world's largest producer of crude oil, most analysts agree. When that happens and by how much, though, has produced disparate estimates that depend on uncertain factors ranging from progress in drilling technology to the availability of financing and the price of oil itself.

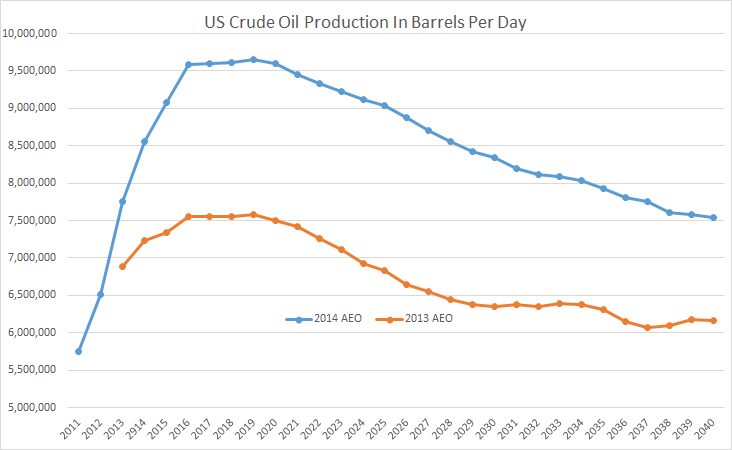

Forecasts for U.S. shale oil production vary from an increase of 7.5 million barrels per day by 2020 – almost doubling current domestic output of 8.5 bpd -- to a gain of 1.5 million bpd, or less than half of what Iraq now produces.

The disparities are a function of the novelty of the shale boom, which has consistently confounded forecasts. In 2012, the U.S. Energy Information Administration (EIA) estimated that production from eight selected shale oil fields would range from 700,000 bpd of so-called tight oil to 2.8 million bpd by 2035. A year later, those predictions had been surpassed.

"The key issue is not whether production grows, it's by how much," said Ed Morse, global head of commodities research at Citigroup in New York. "We're only at the beginning of the first inning and this is a nine-inning game."

Read more: http://www.businessinsider.com/r-shale-boom-confounds-forecasts-as-us-set-to-pass-russia-saudi-arabia-2014-09#ixzz36xtxs5Gl

Ichingcarpenter

(36,988 posts)The banksters always have our interests at heart

xchrom

(108,903 posts)Champion Jack

(5,378 posts)happyslug

(14,779 posts)Some reports that Shale Oil is expected to peak in 2017:

http://www.postcarbon.org/drill-baby-drill/es

Other say Shale Oil is a Bubble:

http://www.desmogblog.com/2013/02/19/fracking-wall-street-housing-bubble

The people making the predictions are being attack as over simplifying oil production, but that is the only way they predictions can be attacked for they agree production will increase over the next two to four years, but at about that time period is when production from new wells will fail to match the drop in production of older wells.

http://peakoilbarrel.com/will-us-light-tight-oil-save-world/

Remember for Shale Oil to be profitable, the price of oil MUST exceed $80 a barrel:

http://www.resilience.org/stories/2013-10-30/the-peak-oil-crisis-the-shale-oil-bubble

There is 42 gallon in a Barrel of oil, thus $1.94 a gallon is the lowest the price of Gasoline can get, and that is NOT including the cost of refining or shipping the oil (nor taxes on Gasoline). While the Federal tax on Gasoline is 18.4 Cents a gallon, the average tax (including the Federal Tax) is 49.5 Cents a gallon.

http://en.wikipedia.org/wiki/Fuel_taxes_in_the_United_States

Today, the "average" Crude Gasoline costs about $2.55 a gallon, and sells for $3.90 a gallon", That is a difference, of $1.35 a gallon, of which only 49.5 Cents represents taxes:

http://energyalmanac.ca.gov/gasoline/margins/

When it comes to ACTUAL Shale oil production, we are talking of tow fields, one in Texas, the other in North Dakota. The other fields that were to duplicate those fields have all turned out to be busts (most down graded up to 95% less oil then had been claimed).

http://fivethirtyeight.com/datalab/a-national-drilling-boom-but-a-two-state-oil-boom/

I have read recently (I can NOT find the site right now) that the number of new wells being drilled in both the Texas and North Dakota shale oil fields are barely covering what is going dry. If that is the case, then both have peaked and will start to decline. Given the other Shale Oil Fields are NOT that large (most have been down graded to to 95%), the US may peak its oil production this year and go back into decline.