2016 Postmortem

Related: About this forumBernie's Tax Plan Helps the Middle Class: Only Millionaires & Billionaires Can Complain:

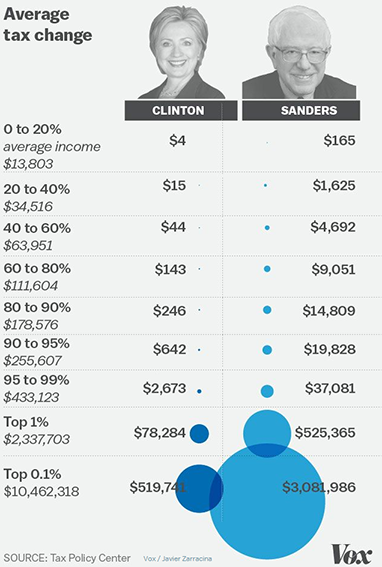

Based on a tax foundation chart, it’s clear that, for middle class taxpayers, there is very little difference between Hillary’s tax plan and Bernie’s tax plan.

Bernie’s plan raises taxes for wealthy households; and that’s what upsets corporate- and millionaire- and billionaire-lovers.

One Example:

Hillary 43.6% of 5 million = 2,180,000

Bernie 50.2% of 5 million = 2,510,000 difference of $330,000 more per year

Hillary 15% of 13,250= 1,722

Bernie 17.2% of 13,250 = 2,279……this is $557 more per year, a lot, if you are struggling financially.

However: Politifact Confirms: Bernie’s Health Plan Will Save EVERY American Family $1200 per year

http://usuncut.com/news/bernie-sanders-healthcare-plan-would-save-the-average-american-family-1200/

The real reason corporatists and millionaire- and billionaire-lovers hate Bernie’s plan:

“Bernie’s plans go an additional step further, by including a direct financial transaction tax on Wall Street as well as by lifting the (arbitrary) cap on income subject to the Social Security payroll tax, a move that would ensure the long-term solvency of Social Security. Together, these two plans would raise trillions of dollars in revenue over ten years. – “

http://inequality.org/democratic-candidates-propose-tax-rich/

Table 1. Tax Brackets under Hillary Clinton’s Tax Plan

Ordinary Income Capital Gains and Dividends Single Filers Married Filers Head of Household

10% 0% $0 to $9,275 $0 to $18,550 $0 to $13,250

15% 0% $9,275 to $37,650 $18,550 to $75,300 $13,250 to $50,400

25% 15% $37,650 to $91,150 $75,300 to $151,900 $50,400 to $130,150

28% 15% $91,150 to $190,150 $151,900 to $231,450 $130,150 to $210,800

33% 15% $190,150 to $413,350 $231,450 to $413,350 $210,800 to $413,350

35% 15% $413,350 to $415,050 $413,350 to $466,950 $413,350 to $441,000

39.6% 20% $415,050 to $5 million $466,950 to $5 million $441,000 to $5 million

43.6% 24% $5 million and above $5 million and above $5 million and above

Individual Income Tax Brackets under Senator Bernie Sanders’s Tax Plan

Ordinary Income Capital Gains and Dividends Single Filers Married Filers Heads of Household

12.2% 2.2% $0 to $9,275 $0 to $18,550 $0 to $13,250

17.2% 2.2% $9,275 to $37,650 $18,550 to $75,300 $13,250 to $50,400

27.2% 17.2% $37,650 to $91,150 $75,300 to $151,900 $50,400 to $130,150

30.2% 17.2% $91,150 to $190,150 $151,900 to $231,450 $130,150 to $210,800

35.2% 17.2% $190,150 to $250,000 $231,450 to $250,000 $210,800 to $250,000

39.2% 39.2% $250,000 to $500,000 $250,000 to $500,000 $250,000 to $500,000

45.2% 45.2% $500,000 to $2,000,000 $500,000 to $2,000,000 $500,000 to $2,000,000

50.2% 50.2% $2,000,000 to $10,000,000 $2,000,000 to $10,000,000 $2,000,000 to $10,000,000

54.2% 54.2% $10,000,000 and up $10,000,000 and up $10,000,000 and up

Note: The bracket thresholds above are based on 2016 parameters.

• Eliminates the alternative minimum tax.

From (Right Wing) Tax Foundation: http://taxfoundation.org/article/details-and-analysis-senator-bernie-sanders-s-tax-plan

amborin

(16,631 posts)JaneyVee

(19,877 posts)Latest analysis

angstlessk

(11,862 posts)Employer ‒ $14,198 Employee ‒ $10,473*

"*Includes out-of-pocket expenses incurred at the point-of-care ($4,065) and premium costs through payroll deductions ($6,408).

Source: Forbes from the actuarial firm of Milliman, Inc

http://www.forbes.com/sites/danmunro/2015/05/19/annual-healthcare-cost-for-family-of-four-now-at-24671/#235da2374dfb

Annual Cost of a College Education (2015-2016)

In its most recent survey of college pricing, the College Board reports that a "moderate" college budget for an in-state public college for the 2015–2016 academic year averaged $24,061. A moderate budget at a private college averaged $47,831

Source: COLLEGEdata

http://www.collegedata.com/cs/content/content_payarticle_tmpl.jhtml?articleId=10064

Median Weekly Earnings (4th Qtr 2015)

Median weekly earnings of the nation's 109.9 million full-time wage and salary workers were $825 in the fourth quarter of 2015 (not seasonally adjusted)

12 Weeks Family Leave Annual Benefit $9,900

Source: Bureau of Labor Statistics

http://www.bls.gov/news.release/wkyeng.nr0.htm