Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

JonLeibowitz

JonLeibowitz's Journal

JonLeibowitz's Journal

January 17, 2016

Why has HRC's campaign spent ~$300k of party committee money opposing other dems?

I am basing this OP on the data that opensecrets.org has on outside spending, available at: https://www.opensecrets.org/outsidespending/summ.php?cycle=2016&disp=C&pty=N&type=A

Please do independently verify the screenshots below.

These two pictures pretty much say all that needs stating:

$3,607,885 - $3,306,964 = $300,921

This is ignoring the $20,886 spent by candidate(?!?!?) Bill Clinton.

Okay I actually do have one (obviously rhetorical) question as a follow up:

Why is Party Committee money being used against other democratic candidates in a primary contest?

January 14, 2016

Much more at:

http://www.politifact.com/truth-o-meter/statements/2016/jan/14/chelsea-clinton/chelsea-clinton-mischaracterizes-bernie-sanders-he/

Politifact: Chelsea Clinton mischaracterizes Bernie Sanders' health care plan

Ruling:Chelsea Clinton said Sanders’ health care plan would "empower" governors "to take away health insurance for low-income and middle-income working Americans."

Under Sanders’ plan, Americans would lose their current health insurance. However, his proposal would replace their health insurance and cover the currently uninsured. The program would auto-enroll every citizen and legal resident, all of whom would be entitled to benefits. While the plan would give governors authority to administer health insurance within their states, it includes provisions to allow federal authorities to take over if the governors refuse to implement it.

It’s impossible to predict with certainty how Sanders’ plan would play out in real life. But Clinton’s statement makes it sound like Sanders’ plan would leave many people uninsured, which is antithetical to the goal of Sanders’ proposal: universal health care.

We rate her claim Mostly False.

Under Sanders’ plan, Americans would lose their current health insurance. However, his proposal would replace their health insurance and cover the currently uninsured. The program would auto-enroll every citizen and legal resident, all of whom would be entitled to benefits. While the plan would give governors authority to administer health insurance within their states, it includes provisions to allow federal authorities to take over if the governors refuse to implement it.

It’s impossible to predict with certainty how Sanders’ plan would play out in real life. But Clinton’s statement makes it sound like Sanders’ plan would leave many people uninsured, which is antithetical to the goal of Sanders’ proposal: universal health care.

We rate her claim Mostly False.

Much more at:

http://www.politifact.com/truth-o-meter/statements/2016/jan/14/chelsea-clinton/chelsea-clinton-mischaracterizes-bernie-sanders-he/

January 9, 2016

https://twitter.com/BernieSanders/status/685616288467648513

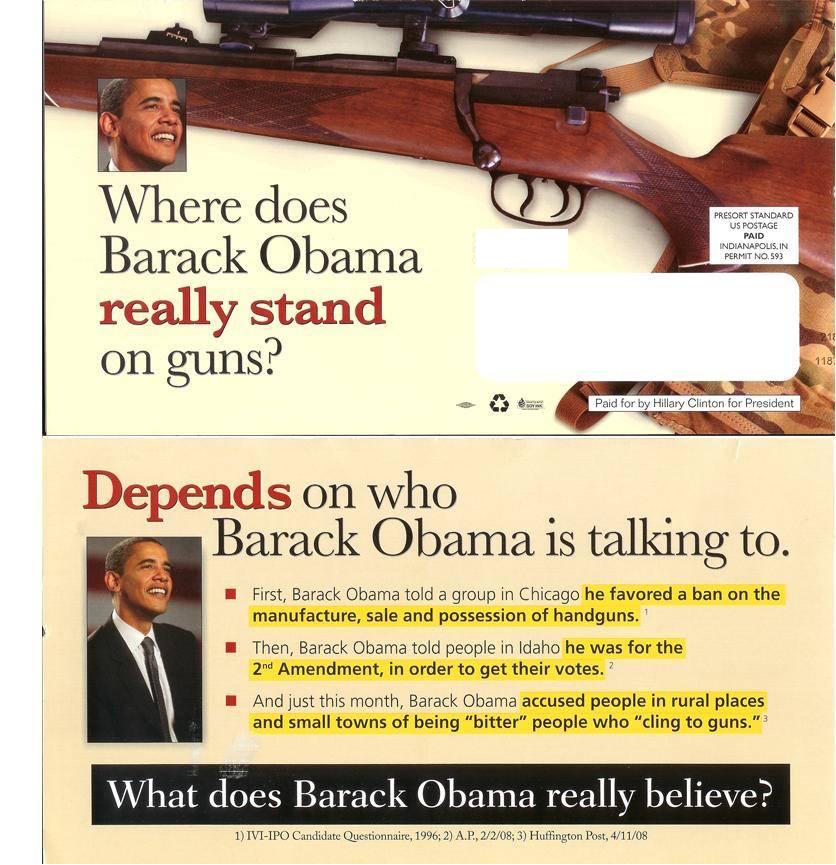

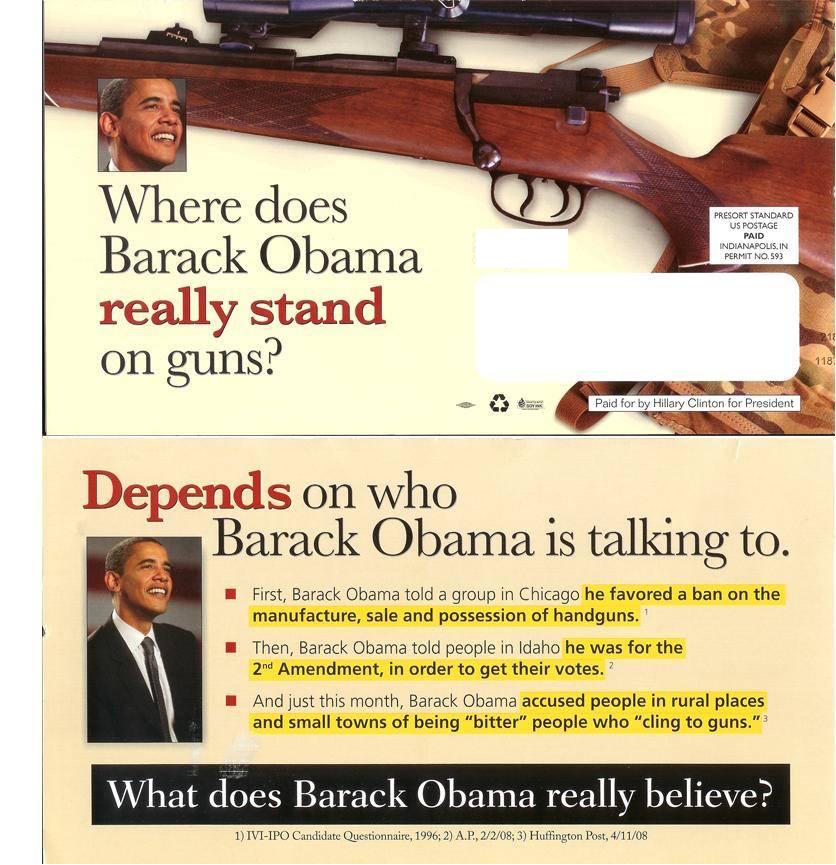

@BernieSanders: "Maybe Hillary Clinton should apologize for this?"

https://twitter.com/BernieSanders/status/685616288467648513

January 6, 2016

http://www.nytimes.com/2016/01/06/us/politics/bernie-sanders-attacks-hillary-clinton-over-regulating-wall-street.html

Yes, I am quite sure Wall St. is keenly interesting in what Hillary says and does. After all, they are shareholders in her!

Bernie on Wall St: And the award for unintentionally saying more than one should goes to...

Les Funtleyder, a portfolio manager at E Squared Asset Management, said that Mrs. Clinton’s remarks about regulating companies tended to move the market more than those of Mr. Sanders.

“This suggests to me The Street is more interested in what Hillary says at this point,” Mr. Funtleyder said.

“This suggests to me The Street is more interested in what Hillary says at this point,” Mr. Funtleyder said.

http://www.nytimes.com/2016/01/06/us/politics/bernie-sanders-attacks-hillary-clinton-over-regulating-wall-street.html

Yes, I am quite sure Wall St. is keenly interesting in what Hillary says and does. After all, they are shareholders in her!

January 3, 2016

http://www.cjr.org/the_audit/bill_clinton_the_republicans_m.php

http://www.huffingtonpost.com/charles-ferguson/hillary-clinton-documentary_b_4014792.html

100% Pure Anadulturated Bullshit.

Now it’s true that Clinton faced an extremely hostile Republican Congress for the last six years of his presidency. But his administration actively encouraged the big deregulatory legislation, and squashed its own dissenters, like Brooksley Born, who saw disaster ahead.

Clinton would have you believe that he signed those bills because his administration was forced to by a GOP that was beholden as usual to Big Business, but then what about the deregulatory legislation he signed in 1994, before Gingrich & Co. took Congress?

Riegle-Neal hasn’t got a tenth of the press that the CMFA and Gramm-Leach-Bliley have, but it was a milestone in the creation of Too Big to Fail, allowing banks to cross state lines, effectively gutting state regulation of banking. The Christian Science Monitor that year quoted a Wall Street analyst saying that, “‘It also didn’t hurt that NationsBank president Hugh McColl has a working relationship with President Clinton or that the comptroller of the currency, Eugene Ludwig, was a successful lawyer at Covington & Burling and NationsBank had been a major client.’” Hugh McColl gave us Bank of America.

From across the pond, The Independent wrote in a piece that was prescient in more ways than one:

Clinton, on signing Riegle-Neal, praised McColl and the head of Chase Manhattan, and said, ” It represents another example of our intent to reinvent Government by making it less regulatory and less overreaching and by shrinking it where it ought to be shrunk and reshaping it where it ought to be reshaped.”

Again, this was before the Republicans took over Congress.

In 1999, on signing Gramm-Leach-Bliley into law, Clinton said, “This is a day we can celebrate as an American day” and that ” the Glass-Steagall law is no longer appropriate for the economy in which we live” and “today what we are doing is modernizing the financial services industry, tearing down these antiquated laws and granting banks significant new authority” and “This is a very good day for the United States.”

Clinton would have you believe that he signed those bills because his administration was forced to by a GOP that was beholden as usual to Big Business, but then what about the deregulatory legislation he signed in 1994, before Gingrich & Co. took Congress?

Riegle-Neal hasn’t got a tenth of the press that the CMFA and Gramm-Leach-Bliley have, but it was a milestone in the creation of Too Big to Fail, allowing banks to cross state lines, effectively gutting state regulation of banking. The Christian Science Monitor that year quoted a Wall Street analyst saying that, “‘It also didn’t hurt that NationsBank president Hugh McColl has a working relationship with President Clinton or that the comptroller of the currency, Eugene Ludwig, was a successful lawyer at Covington & Burling and NationsBank had been a major client.’” Hugh McColl gave us Bank of America.

From across the pond, The Independent wrote in a piece that was prescient in more ways than one:

“In effect, Congress has said let the merger mania begin. There is virtual consensus that the legislation will allow both the big US banks and their foreign rivals in America - British banks among them - to grow much bigger.

Nor was that the only thing the banks got that year. The American Banking Association wrote about Riegle-Neal, the Bankruptcy Reform Act of 1994, and the Community Banking Development Act that “the 103rd will be remembered as the first Congress in recent memory to pass “clean” pro-banking legislation.”

Clinton, on signing Riegle-Neal, praised McColl and the head of Chase Manhattan, and said, ” It represents another example of our intent to reinvent Government by making it less regulatory and less overreaching and by shrinking it where it ought to be shrunk and reshaping it where it ought to be reshaped.”

Again, this was before the Republicans took over Congress.

In 1999, on signing Gramm-Leach-Bliley into law, Clinton said, “This is a day we can celebrate as an American day” and that ” the Glass-Steagall law is no longer appropriate for the economy in which we live” and “today what we are doing is modernizing the financial services industry, tearing down these antiquated laws and granting banks significant new authority” and “This is a very good day for the United States.”

http://www.cjr.org/the_audit/bill_clinton_the_republicans_m.php

In June, I attended a dinner for Bill Clinton, which was educational. Clinton spoke passionately about his foundation, about African wildlife, inequality, childhood obesity, and much else with enormous factual command, emotion, and rhetorical power. But he and I also spoke privately. I asked him about the financial crisis. He paused and then became even more soulful, thoughtful, passionate, and articulate. And then he proceeded to tell me the most amazing lies I've heard in quite a while.

For example, Mr. Clinton sorrowfully lamented his inability to stop the Commodity Futures Modernization Act, which banned all regulation of private (OTC) derivatives trading, and thereby greatly worsened the crisis. Mr. Clinton said that he and Larry Summers had argued with Alan Greenspan, but couldn't budge him, and then Congress passed the law by a veto-proof supermajority, tying his hands. Well, actually, the reason that the law passed by that overwhelming margin was because of the Clinton Administration's strong advocacy, including Congressional testimony by Larry Summers and harsh public and private attacks on advocates of regulation by Summers and Robert Rubin.

For example, Mr. Clinton sorrowfully lamented his inability to stop the Commodity Futures Modernization Act, which banned all regulation of private (OTC) derivatives trading, and thereby greatly worsened the crisis. Mr. Clinton said that he and Larry Summers had argued with Alan Greenspan, but couldn't budge him, and then Congress passed the law by a veto-proof supermajority, tying his hands. Well, actually, the reason that the law passed by that overwhelming margin was because of the Clinton Administration's strong advocacy, including Congressional testimony by Larry Summers and harsh public and private attacks on advocates of regulation by Summers and Robert Rubin.

http://www.huffingtonpost.com/charles-ferguson/hillary-clinton-documentary_b_4014792.html

Profile Information

Member since: Sun Oct 25, 2015, 10:50 PMNumber of posts: 6,282