Celerity

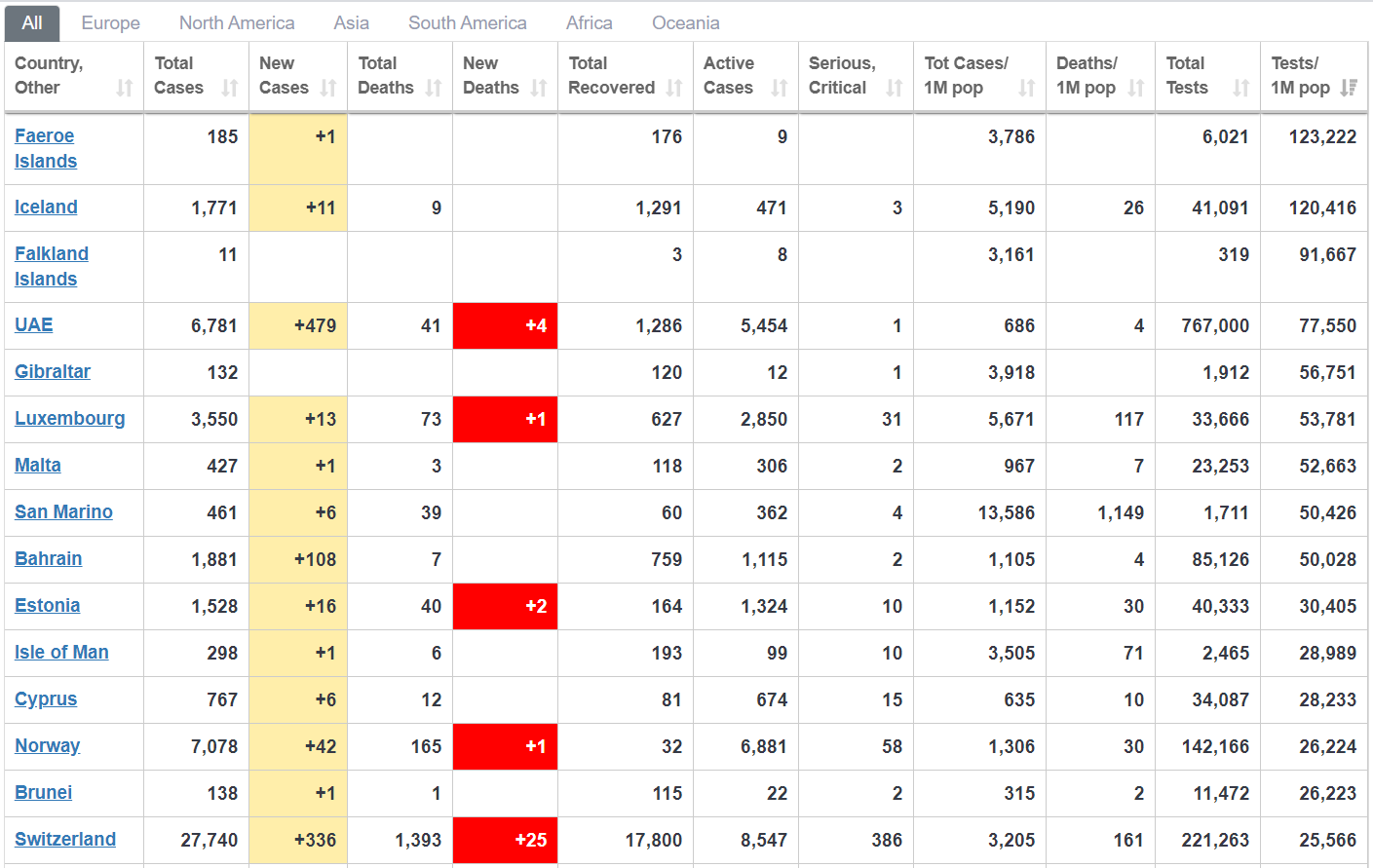

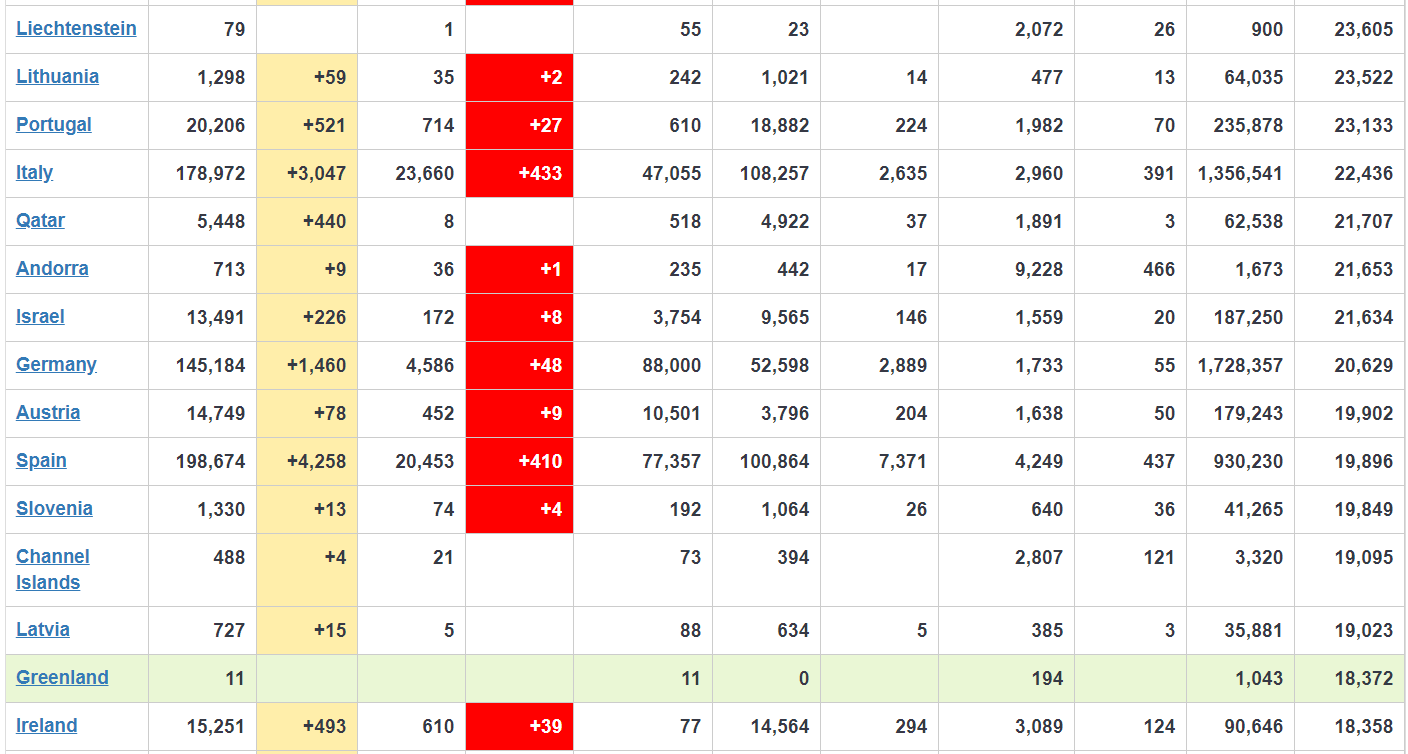

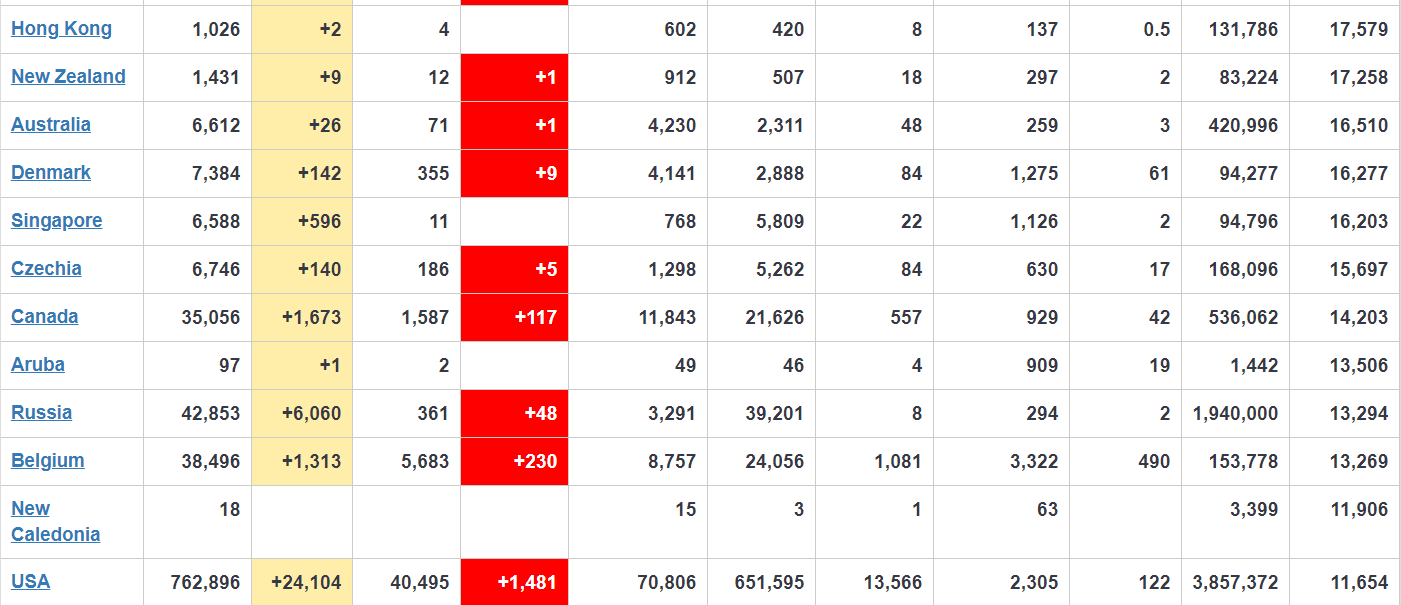

Celerity's JournalThe US is 42nd in tests per million, and falling (was 39th), Trump is a fucking pure galighter

https://www.worldometers.info/coronavirus/

Auburn mayor Bill Kirby, who was exiting post over Trump comments, dies in plane crash, family says

California mayor was ‘stepping down after comparing Trump supporters to the Ku Klux Klan’https://www.sacbee.com/news/local/article242118886.html

Auburn mayor Dr. Bill Kirby, who decided Monday to step down after making social media posts comparing supporters of President Donald Trump to the Ku Klux Klan, was killed Saturday morning in a plane crash near the Auburn Municipal Airport, officials confirmed.

Kirby, a urologist and Auburn city councilman since 2009, was the pilot of the plane that crashed shortly after 11 a.m. A passenger in the plane suffered minor injuries and was transported to a hospital, according to the California Department of Forestry and Fire Protection.

A Facebook post from Sacramento political consultant Jeff Raimundo carried a statement from the Kirby family confirming he was the victim. Photos provided by the Sheriff’s Office show flames in a field with scattered shrapnel near the airport.

“Our family is devastated by this tragic news,” the statement by the family said. “Bill devoted decades of enthusiastic and loving support to his family, his patients and the Auburn community he loved so much. We will miss him immensely but take comfort in knowing he died while flying – one of the other loves of his life.”

snip

RIP

'Live Free or Die': Protesters march against California stay-at-home rules in Huntington Beach

https://www.latimes.com/california/story/2020-04-17/protesters-california-stay-at-home-coronavirus

A group of more than 100 protesters converged on Huntington Beach on Friday in a demonstration against California’s coronavirus stay-at-home rules, part of a series of national demonstrations organized by conservative groups. The protesters — some with Trump banners and American flags — mostly were not wearing masks or practicing social distancing by standing at least six feet apart. And they offered views about the spread of the coronavirus that differed sharply from scientific findings and experts’ recommendations.

One of the first people to trickle into the afternoon’s protest in Huntington Beach was 62-year-old Paula Doyle. The Costa Mesa resident arrived with a hand-held American flag and a “Live Free or Die” sign and was “sick” of social distancing and Gov. Gavin Newsom’s stay-at-home order, which she said was “killing business.” “I don’t think there’s any reason for us to be on lockdown now,” she said shortly after arguing with another Trump supporter who was in favor of quarantine. “We didn’t have any dangers; we have no danger in our hospitals now of overflowing.”

The comments of protesters fly in the face of what California public health officials and other experts have been saying about the coronavirus. California’s relatively quick action to close businesses and order residents to stay home has tamped down the coronavirus pandemic and left many hospitals largely empty, waiting for a surge that has yet to come. The initial success of the unprecedented shutdown of schools, businesses and other institutions has pleased experts and public health officials, prompting calls to keep the restrictions in place at least into May to help cement the progress.

Social distancing will be a critical factor. Lifting restrictions too early would likely lead to dangerous new jumps in cases. Dr. Howard Markel, a professor of the history of medicine at the University of Michigan, said earlier this week deploying stay-at-home measures required a degree of patience not to pull back too early. “If you pull the triggers off too early, not only is there a circulating virus to do what it naturally does, but you will have incurred all the economic and social disruptions of [stay-at-home orders] for nothing,” Markel said in a webinar hosted by the American Public Health Assn. last month.

snip

Forget Potatoes. Beef Cheek Is the Irish Staple You're Not Making

https://gearpatrol.com/2020/04/16/the-irish-cookbook-beef-cheeks-recipe/

The humble potato is as Irish as a pint of Guinness. But the Michelin-starred chef and restauranteur JP McMahon, notes in his The Irish Cookbook ($35) that the potato’s association to Ireland only came about within the last 200 years. Missing from the history of Ireland and its cuisine are thousands of years of foraging and cultivating the land for its native provisions. McMahon’s cookbook contains 480 recipes that utilize the bounties of the country’s land. From seafood to wild game, these recipes take a look at Irish recipes of yore, with a nod towards the future of Ireland’s culinary scene. The recipe for beef cheeks, published below, is a braise made with shelf stable vegetables and an uncommon cut of beef.

Beef Cheeks with Barley and Onions

Serves four

Ingredients:

For the beef cheeks:

4 beef cheeks, cap removed and trimmed of sinew

2 tablespoons canola oil

4 carrots, chopped

2 onions, quartered

2 cloves garlic

4 tablespoons butter

A few sprigs of rosemary and thyme

2 cups stout

For the barley and onions:

2 cups beef stock

2 1/2 cups barley

2 onions, halved, skin on

4 tablespoons butter, cubed

sea salt

Preparation:

1. Preheat the oven to 325°F.

2. To braise the beef cheeks, season the cheeks with sea salt. Heat the oil in a large frying pan, add the cheeks and fry for 1-2 minutes on each side until nicely browned. Add the carrots, onions and garlic. After a minute, add the butter and herbs and baste for 2-3 minutes until the vegetables are caramelized.

3. Transfer to an ovenproof dish and discard any excess fat. Pour the stout and stock over the cheeks until completely submerged. Cover the dish with a lid or aluminum foil and put into the preheated oven for 3 hours.

4. Meanwhile, simmer the barley in a large pan of water over a low heat for 40 minutes until tender. Strain and reserve. Strain the sauce from the cheeks and carrots and keep them warm. Allow the fat to settle and skim it off the top. Heat the sauce in a pan over a high heat for about 15 minutes until reduced by half.

5. Put the onions in a dry pan over a medium–low heat and cook for 18–20 minutes until soft to touch and the edges are blackened. Peel into individual pieces, keeping the lobes intact. Remove any large charred pieces.

6. When ready to serve, melt the butter in the barley and season with sea salt to taste. Spoon the barley over the plates and add the charred onions. Slice the beef cheeks and lay near the onions. Finish with some sauce.

Note: The cheeks can also be cooked in a lower oven at 250°F for 5 hours for a more tender meat.

The Coronavirus Is a Disaster for Feminism

Pandemics affect men and women differently.https://www.theatlantic.com/international/archive/2020/03/feminism-womens-rights-coronavirus-covid19/608302/

Enough already. When people try to be cheerful about social distancing and working from home, noting that William Shakespeare and Isaac Newton did some of their best work while England was ravaged by the plague, there is an obvious response: Neither of them had child-care responsibilities. Shakespeare spent most of his career in London, where the theaters were, while his family lived in Stratford-upon-Avon. During the plague of 1606, the playwright was lucky to be spared from the epidemic—his landlady died at the height of the outbreak—and his wife and two adult daughters stayed safely in the Warwickshire countryside. Newton, meanwhile, never married or had children. He saw out the Great Plague of 1665–6 on his family’s estate in the east of England, and spent most of his adult life as a fellow at Cambridge University, where his meals and housekeeping were provided by the college.

For those with caring responsibilities, an infectious-disease outbreak is unlikely to give them time to write King Lear or develop a theory of optics. A pandemic magnifies all existing inequalities (even as politicians insist this is not the time to talk about anything other than the immediate crisis). Working from home in a white-collar job is easier; employees with salaries and benefits will be better protected; self-isolation is less taxing in a spacious house than a cramped apartment. But one of the most striking effects of the coronavirus will be to send many couples back to the 1950s. Across the world, women’s independence will be a silent victim of the pandemic. Purely as a physical illness, the coronavirus appears to affect women less severely. But in the past few days, the conversation about the pandemic has broadened: We are not just living through a public-health crisis, but an economic one. As much of normal life is suspended for three months or more, job losses are inevitable. At the same time, school closures and household isolation are moving the work of caring for children from the paid economy—nurseries, schools, babysitters—to the unpaid one.

The coronavirus smashes up the bargain that so many dual-earner couples have made in the developed world: We can both work, because someone else is looking after our children. Instead, couples will have to decide which one of them takes the hit. Many stories of arrogance are related to this pandemic. Among the most exasperating is the West’s failure to learn from history: the Ebola crisis in three African countries in 2014; Zika in 2015–6; and recent outbreaks of SARS, swine flu, and bird flu. Academics who studied these episodes found that they had deep, long-lasting effects on gender equality. “Everybody’s income was affected by the Ebola outbreak in West Africa,” Julia Smith, a health-policy researcher at Simon Fraser University, told The New York Times this month, but “men’s income returned to what they had made pre-outbreak faster than women’s income.” The distorting effects of an epidemic can last for years, Clare Wenham, an assistant professor of global-health policy at the London School of Economics, told me. “We also saw declining rates of childhood vaccination [during Ebola].” Later, when these children contracted preventable diseases, their mothers had to take time off work.

At an individual level, the choices of many couples over the next few months will make perfect economic sense. What do pandemic patients need? Looking after. What do self-isolating older people need? Looking after. What do children kept home from school need? Looking after. All this looking after—this unpaid caring labor—will fall more heavily on women, because of the existing structure of the workforce. “It’s not just about social norms of women performing care roles; it’s also about practicalities,” Wenham added. “Who is paid less? Who has the flexibility?” According to the British government’s figures, 40 percent of employed women work part-time, compared with only 13 percent of men. In heterosexual relationships, women are more likely to be the lower earners, meaning their jobs are considered a lower priority when disruptions come along. And this particular disruption could last months, rather than weeks. Some women’s lifetime earnings will never recover. With the schools closed, many fathers will undoubtedly step up, but that won’t be universal.

snip

WaPo : Stimulus checks and other relief hindered by 1960s technology and rocky rollout

On Friday, Trump hailed the ‘incredible success’ of getting out payments, but millions are still awaiting stimulus checks, unemployment aid and small-business loanshttps://www.washingtonpost.com/business/2020/04/17/stimulus-unemployment-checks-delays-government-delays/

The national effort to get coronavirus relief money to Americans is at risk of being overwhelmed by the worst economic downturn in 80 years, as understaffed and underfunded agencies struggle to deliver funds. Three weeks after Congress passed a $2 trillion package to lessen the economic impact of the coronavirus pandemic, millions of households and small businesses are still waiting to receive all the help promised under the legislation, according to government data and firsthand accounts.

The bulk of the challenges have occurred with three initiatives designed to get cash to struggling Americans: $1,200 per adult relief payments that launched this week, $349 billion in Small Business Administration loans, and $260 billion in unemployment benefits for the more than 22 million people — and growing — out of work. The SBA ran out of money to make small business loans this week, almost no unemployment aid has reached eligible self-employed and gig workers, and a significant number of Americans who were due to receive relief payments this week went on the IRS.gov website only to see this message: “payment status not available.”

Current and former government officials say it would be a tall order for any president to execute massive new programs in a matter of weeks, and tens of millions of Americans did receive direct deposits worth $1,200 or more this week. But the Trump administration’s promise of swift and effective action — President Trump called the small business program “flawlessly executed” this week — is colliding with a federal and state apparatus not well designed to deliver so much money so fast. The technological backbone to much of the relief — including the distribution of relief checks and the unemployment insurance system — requires knowledge of a software programming language not widely used in decades. An administration that had made little priority of keeping senior positions staffed, meanwhile, is struggling now to quickly implement one of the biggest government interventions in history.

snip

The IRS uses a decades-old software — its “MasterFile” software responsible for processing individual and business tax filings was developed in 1962 — and a computer programming language called COBOL. The stimulus program has required multiple coding changes, and the agency has at least 16 other databases with taxpayer information, none of which easily can communicate with the other, said a person familiar with the matter.

snip

Vulture funds prepare to feast on troubled company debt

Distressed debt funds begin to circle troubled companies hit hard by the impact of the coronavirus pandemichttps://www.fnlondon.com/articles/vulture-funds-prepare-to-feast-on-troubled-company-debt-20200417

The world’s biggest distressed debt funds are gearing up to capitalise on the worst market turmoil in decades as they look to snap up the debt of troubled companies at deep discounts. The near shut down of the global economy has left plenty for the vulture funds to feed on – although competition could be fierce. “There are now huge opportunities for distressed debt funds, particularly in the transport, retail and hospitality sectors," Stavros Siokos, managing partner at real estate asset specialist Astarte Capital said. “Even core assets which are supposed to be risk-free, such as infrastructure, are at risk which is something we never expected to see in our lifetime,” he added.

For distressed debt investors and private equity firms with specialist funds, buying the bonds of companies in financial difficulty can lead to better returns as they are compensated for the higher risk they are taking. The hope is that once a company’s financial health recovers and the bond price goes up, they can make a profit. There is no shortage of cash. In the last five years, distressed debt funds have raised $130.6bn across 128 strategies to invest in troubled companies, according to data provider Preqin. And more money is being raised. On April 8, there were 50 funds in the market, looking to raise a total of $34.8bn, Preqin said.

Apollo Global Management, one of the world’s biggest investors, told investors in early April that it had invested $10bn into credit and private equity in March, and that it is looking to raise a new vehicle to find opportunities, WSJ reported. Citing people familiar with the matter, the WSJ also wrote that General Atlantic is teaming up with credit investor Tripp Smith to launch a nearly $5bn fund to provide financing to companies hit by the coronavirus pandemic.

JP Morgan Asset Management launched its first-ever special situations fund in November, raising just over $1bn to invest in stressed, distressed and event driven situations across North American and European private and public credit markets; while private equity firm CVC closed its global special situations fund in June on $1.4bn. Default rates have remained low for ten years, according to managing director Brendan Beer at Oaktree, as companies borrowed and reborrowed, thanks to easy and cheap credit. He says now cyclical default expectations are being pulled forward.

snip

US coronavirus stimulus offers taxpayer cash to buyout firm companies

Private equity appears to have won access to federal stimulus funds through the Federal Reserve- with strings attachedhttps://www.penews.com/articles/us-coronavirus-stimulus-offers-taxpayer-cash-to-buyout-firm-companies-20200416

Private equity firms won a victory in getting access to stimulus funds intended to blunt the economic pain of the coronavirus, after missing out on their first effort to secure government cash for their businesses. The Federal Reserve last week detailed plans to fund $2.3tn in aid to companies affected by the virus, with few restrictions on private equity firms seeking assistance for companies they own, according to analysis by experts and lobbyists.

But while the Fed’s plan has few roadblocks for private equity, taking advantage could come with risks—from both a business and a reputational standpoint. Private equity groups praised the Fed’s planned intervention, with the American Investment Council, the largest industry lobbying group, calling it “a step in the right direction.”

The Fed plans to backstop the markets for large companies’ debt, and to fund $600bn in loans to midsize businesses. The interest-deferred loans can be for as much as $25m. Groups critical of private equity practices slammed the Fed’s plans for lacking safeguards against misuse. The AFL-CIO and the American Federation of Teachers were among more than a dozen groups that last week signed a letter warning that allowing private equity firms access to stimulus money would mean giving a “taxpayer subsidy” to a “predatory business model”.

Private equity is likely to have “almost unlimited access” to the Fed’s loan program, said Marcus Stanley, policy director for Americans for Financial Reform, a progressive group that advocates for stricter regulations on Wall Street. “For somebody with a bunch of lawyers and a lot of money you have to be sitting there drooling looking at this,” he said.

snip

Truth: MAGATs want to re-open because this pandemic disproportionally kills PoC, the old, & the poor

It's a greedy RW white nationalist's and a RW oligarch's wet dream.

They want to fuck up the deep blue states to lessen their population so they can steal back Electoral College votes via reduced House seats, plus make the pinkish and purple states whiter. It is a balancing act, as they do not want to kill off too many in deep red states, just enough so that the State House and State Senate seats can become even more Rethug. They also are hoping that the deep blue states have thinned out herds to the point that there is an above-average movement to them from pink/purple's more left wing types as opportunities open up via deaths. Again that is a balancing act as they do not want too many to move so that it undercuts the red states' House districts and EV and also does not replace the blue stats populations to the point they do not lose House districts/EV's.

They also want less on the dole and on Medicare and Social Security overall.

Make no mistake, there are millions of younger Rethugs who are already spending their grandparents or parents estate money in their heads. I guarantee that there have been millions of rushed, cajoled 're-write or write out for the first time' will shenanigans going on. Probably a shedload of life insurance fraud too.

I put NOTHING past these fucking monsters. NOTHING.

Profile Information

Gender: FemaleHometown: London

Home country: US/UK/Sweden

Current location: Stockholm, Sweden

Member since: Sun Jul 1, 2018, 07:25 PM

Number of posts: 43,328