Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

In reply to the discussion: Weekend Economists Celebrate the Season! December 18-20, 2015 [View all]Proserpina

(2,352 posts)21. IMF Reform Is Too Little, Way Too Late

http://www.bloombergview.com/articles/2015-12-18/imf-reform-is-too-little-way-too-late

Provided the U.S. Congress passes the 2016 appropriations bill on Friday, a major reform of the International Monetary Fund can proceed. But the five-year delay since the changes, meant to give more power to big emerging economies, were proposed makes them less useful in bolstering the IMF's role as the world's most important international financial institution.

In a changing world, governance of the lender of last resort needed modernizing. Leaders of the Group of 20 agreed in 2010 that individual IMF quotas and voting rights needed to better reflect its members' standing in the world economy. That meant reducing the role of advanced European countries and Gulf states, and increasing that of emerging nations, particularly China:

The reform required U.S. approval of an amendment to make all of the fund's executive directors elected (some are currently appointed). The U.S. wanted to safeguard its standing as the fund's dominant voice; doubling all quotas would achieve that. The changes wouldn't cost the U.S. more money; its commitment would remain at about $170 billion, with the quota increase coming from the extra funds it, like many other countries, provided to the IMF after the global financial crisis of 2008. Congress just needed to approve moving some of that commitment to the quota -- a mere technicality.

IMF critics in Congress, however, opposed the fund's decision to lend to Greece despite grave doubts about its repayment abilities. The IMF had invoked a rule that allowed such lending if a failing country threatened international contagion. To U.S. conservatives, that wasn't their problem; U.S. financial institutions had much less exposure to toxic Greek assets than European ones did, and Europe should take care of its own.

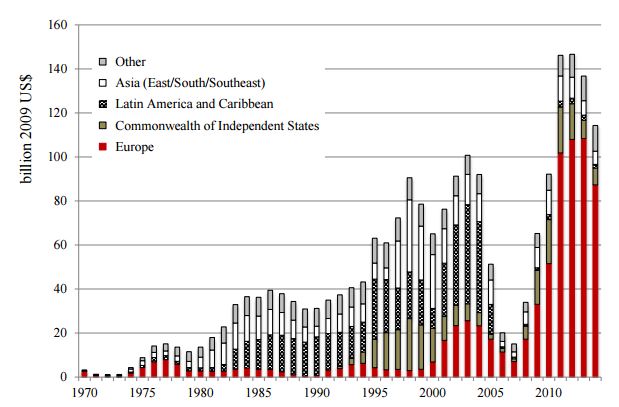

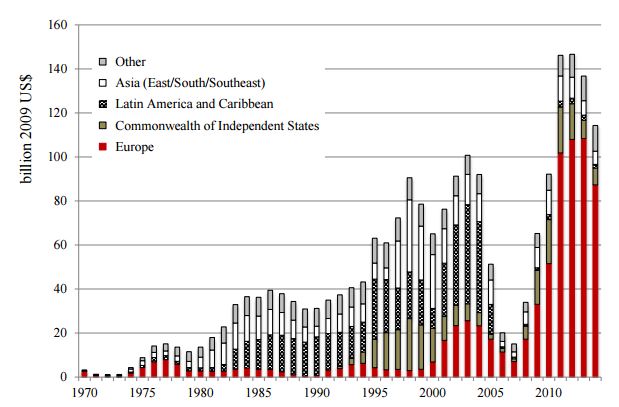

Indeed, Europe has benefited disproportionately from IMF lending in recent years:

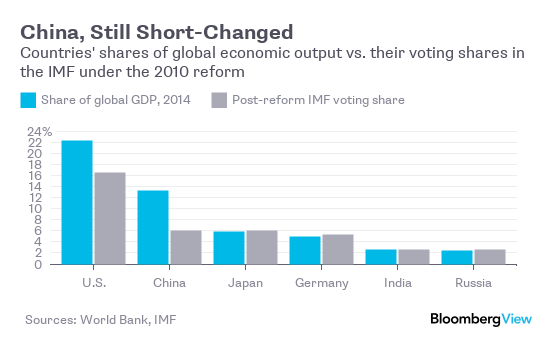

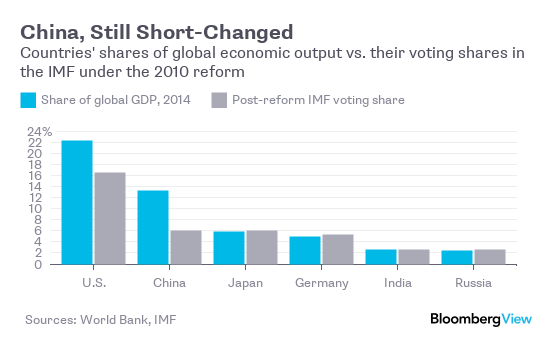

Those U.S. objections make little sense now. Greece's latest bailout has proceeded without IMF participation: The fund still doubts that the country can repay its debt, but Greece no longer poses a systemic risk. The European Union turned out to be rich enough to fund Greece's 85 billion euro ($92 billion) rescue package. Besides, a political deal has been struck: The appropriations bill calls on the U.S. representative to the IMF to use his voting power for the repeal of the "systemic exception," which allowed IMF participation in Greece's previous bailout. So the long-delayed rearrangement -- which former IMF Managing Director Dominique Strauss-Kahn called "the most important reform in the governance of the institution since its creation" -- should now go smoothly. It'll be useful to bailout recipients; the doubled quotas will make it easier for the IMF to lend them more, on shorter notice and under more flexible requirements. Yet the changes are probably too little, too late by now. For one thing, the new distribution of voting shares still doesn't do justice to China. Though the U.S., too, has a smaller say than its share of the world economy warrants, the gap between China's economic might and its IMF influence is bigger:

The power redistribution will, no doubt, please China -- an added bonus after the IMF decision to designate the yuan as a reserve currency next year -- but it won't deter Beijing from building alternative institutions such as the Asian Infrastructure Investment Bank. China, huge as it is, cannot afford to put all its eggs in the U.S.-dominated basket. Nor can other big emerging nations, such as India, Russia, Brazil and South Africa. They, with China, have already set up an IMF alternative -- the so-called New Development Bank. It's not going to be particularly important in the coming years, given the economic weakening of Russia and Brazil. Still, the desire for a lending pool independent of the West isn't going away.

Europeans, for their part, are also creating their own emergency infrastructure: advance notice that their role at the IMF would shrink highlighted that their needs in a serious crisis would exceed the fund's ability to help...

Provided the U.S. Congress passes the 2016 appropriations bill on Friday, a major reform of the International Monetary Fund can proceed. But the five-year delay since the changes, meant to give more power to big emerging economies, were proposed makes them less useful in bolstering the IMF's role as the world's most important international financial institution.

In a changing world, governance of the lender of last resort needed modernizing. Leaders of the Group of 20 agreed in 2010 that individual IMF quotas and voting rights needed to better reflect its members' standing in the world economy. That meant reducing the role of advanced European countries and Gulf states, and increasing that of emerging nations, particularly China:

The reform required U.S. approval of an amendment to make all of the fund's executive directors elected (some are currently appointed). The U.S. wanted to safeguard its standing as the fund's dominant voice; doubling all quotas would achieve that. The changes wouldn't cost the U.S. more money; its commitment would remain at about $170 billion, with the quota increase coming from the extra funds it, like many other countries, provided to the IMF after the global financial crisis of 2008. Congress just needed to approve moving some of that commitment to the quota -- a mere technicality.

IMF critics in Congress, however, opposed the fund's decision to lend to Greece despite grave doubts about its repayment abilities. The IMF had invoked a rule that allowed such lending if a failing country threatened international contagion. To U.S. conservatives, that wasn't their problem; U.S. financial institutions had much less exposure to toxic Greek assets than European ones did, and Europe should take care of its own.

Indeed, Europe has benefited disproportionately from IMF lending in recent years:

Those U.S. objections make little sense now. Greece's latest bailout has proceeded without IMF participation: The fund still doubts that the country can repay its debt, but Greece no longer poses a systemic risk. The European Union turned out to be rich enough to fund Greece's 85 billion euro ($92 billion) rescue package. Besides, a political deal has been struck: The appropriations bill calls on the U.S. representative to the IMF to use his voting power for the repeal of the "systemic exception," which allowed IMF participation in Greece's previous bailout. So the long-delayed rearrangement -- which former IMF Managing Director Dominique Strauss-Kahn called "the most important reform in the governance of the institution since its creation" -- should now go smoothly. It'll be useful to bailout recipients; the doubled quotas will make it easier for the IMF to lend them more, on shorter notice and under more flexible requirements. Yet the changes are probably too little, too late by now. For one thing, the new distribution of voting shares still doesn't do justice to China. Though the U.S., too, has a smaller say than its share of the world economy warrants, the gap between China's economic might and its IMF influence is bigger:

The power redistribution will, no doubt, please China -- an added bonus after the IMF decision to designate the yuan as a reserve currency next year -- but it won't deter Beijing from building alternative institutions such as the Asian Infrastructure Investment Bank. China, huge as it is, cannot afford to put all its eggs in the U.S.-dominated basket. Nor can other big emerging nations, such as India, Russia, Brazil and South Africa. They, with China, have already set up an IMF alternative -- the so-called New Development Bank. It's not going to be particularly important in the coming years, given the economic weakening of Russia and Brazil. Still, the desire for a lending pool independent of the West isn't going away.

Europeans, for their part, are also creating their own emergency infrastructure: advance notice that their role at the IMF would shrink highlighted that their needs in a serious crisis would exceed the fund's ability to help...

Edit history

Please sign in to view edit histories.

52 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

RecommendedHighlight replies with 5 or more recommendations

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

RecommendedHighlight replies with 5 or more recommendations

Vilified for drug pricing, CEO Shkreli busted for securities fraud XMAS CHEER!

Proserpina

Dec 2015

#2

U.S. tax, spending deal meets resistance from lawmakers AVERTING A GOVT. SHUTDOWN

Proserpina

Dec 2015

#5

Finance and tech heavyweights join forces as blockchain initiative grows BITCOIN FOR BANKSTERS

Proserpina

Dec 2015

#6

A person could get whiplash on DU, and the primaries haven't even started yet

Proserpina

Dec 2015

#7

Fed will have to reverse gears fast if anything goes wrong (but they won't, you know)

Proserpina

Dec 2015

#25