Base Money Supply

Chart Courtesy of St. Louis Fed

I must admit that chart looks pretty scary. However, let's look at it another way.

Base Money % Change From A Year Ago

Now that looks even scarier. The only other times we have seen base money supply soar like this were in the Great Depression and World War II.

While on this subject let's look at the same chart as above one more way.

The only other time since 1918 that the base money supply chart looks like it does recently was right before the great depression.

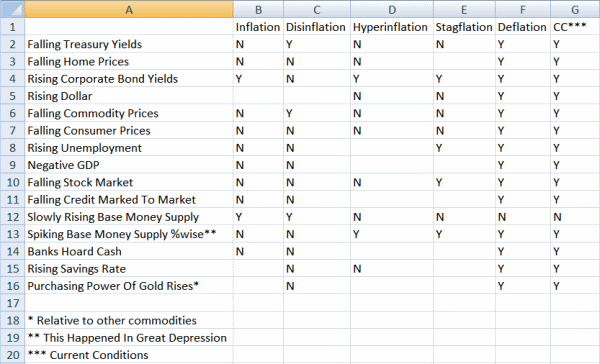

A Practical Look At "Flation"Here is a table of conditions and whether or not one would expect to see those conditions in inflation, deflation, stagflation, hyperinflation, and disinflation. Some expectations are debatable so I left those blank.

I see a perfect match on 15 items using Case-Shiller CPI (CS-CPI) for number item 7. See Case Shiller CPI vs. CPI-U November 2008 Analysis, for why CS-CPI is a far better measure of consumer prices than the reported CPI-U. CS-CPI is explains treasury rates and the Fed's actions quite nicely.

Those using practical definitions have an easy time explaining things. Those lost souls screaming hyperinflation missed the boat completely. Hyperinflationists have had trouble for years explaining falling home prices, and falling treasury yields.

Those screaming stagflation no longer have a case with falling commodity prices, a rising dollar, and falling treasury yields.

Disinflation makes no sense with stock prices down 40% and corporate bond yields soaring. Stocks do best in disinflation. Corporate bond yields drop in disinflation. This is not disinflation by any stretch of the imagination.

Routine inflation makes no sense in light of corporate bond yields priced for bankruptcy, collapsing stocks, plunging commodity prices and a negative CPI.

Those who think inflation is about prices alone were busy shorting treasuries, and looking the wrong direction for over a year. Only after the stock market fell 50% and gasoline prices crashed did the media start picking up on "deflation". Only those who knew what a destruction in credit would do to jobs, to lending, to retail sales, to the stock market, to corporate bond yields and to treasury yields got it right.

What It's NotIt's Not Disinflation

It's Not Stagflation

It's Not Inflation

It's Not Hyperinflation

What's left looks like a duck, walks like a duck, flies like a duck, and squawks like a duck. And that duck is deflation no matter what Humpty Dumpty suggests.

Well, I'm convinced. Anyone else?