That means that the proportional impact of credit swaps will be like a nuclear payload compared

to a conventional one.

Take a look at this.

The Money Party (6): Meltdown Perpetrators Position ThemselvesGross size of the Over the Counter Derivatives Market & Growth

In Billions:

==========================

6/6/2006--------$370,178

12/1/2006-------$$414,845

6/1/2007--------$$516,407

12/1/2007-------$$595,341

6/1/2008--------$$683,725

Semiannual OTC derivatives statistics at end-June 2008

Bank for International Settlements (BIS)

http://www.bis.org/statistics/derstats.htmBIS estimates that the the market beyond OTC derivatives is over 1 Quadrillion.

Somewhere in that fantasy world of 'notational values' for derivatives is the subprime

market, the one that cashed our economy. There is risk in these instruments and it's outlined

here

http://interfluidity.powerblogs.com/posts/1176870506.shtmlBut the real risk is having a market where people bet madly on just about anything WITHOUT

regulation or even real visibility.

But the credit swaps are much bigger (keep in mind the "World Domestic Product", like our GDP

was $65 Trillion in 2007.

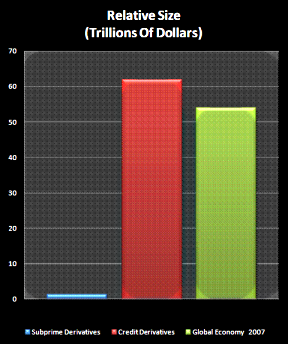

Here's what it looks like in graphic form.

Subprime derivatives were the cause of our crisis. Look at the size of that derivatives market compared to credit derivatives.

(Subprimes, left; Credit, center; World economy, right)

Chart & great article:

http://sayanythingblog.com/readers/entry/credit_derivatives_the_economic_crisis_which_pisses_on_sub_prime/So the risk insured in the subprimes, the risk that is crushing us, is tiny compared to the

the credit derivatives.

Leverage MadnessDerivatives, as you may know, are essentially unregulated, high-risk credit bets. Unlike the earnest farmer who might employ a futures contract to hedge the price of the beans hes worked so hard to grow, many of todays institutions use futures, forwards, options, swaps, swaptions, caps, collars and floorsany kind of leverage device they can cook upto bet the hell out of virtually anything.

What drives derivatives, at their very roots (if you can somehow get back that far), are base assets that get leveraged to a demented degree. Martin Mayer writing for the Brookings Institute, said, "the receiver of the payments on these loans or securities has bought the securities for the duration of the swap on 95% margin, even though the law says nobody can buy securities without putting up half the price."

============

There's a private market for derivatives. Maybe that's where the banks dumped all that money

the Fed gave them last year, you know the $3.2 trillion.

FINALLY:

http://interfluidity.powerblogs.com/posts/1176870506.shtmlQuestion: Do we need to worry that the "notional principal" of derivatives outstanding is several times the wealth of the entire world? Isn't "notional principal" meaningless, since actual cash flows between parties are mere fractions of this principal?It is true that, when everything goes right, most derivatives compel cash flows that are small fractions of notional principal per year.

But some common and ever-more-popular derivatives (e.g. CDSs, forwards and futures) can provoke sharp cash flows whose magnitude approaches the notional liabilities. More importantly, even "balanced" derivatives like vanilla fixed/floating interest rate swaps can subject parties to liability for the full notional principal, should one party default and enter bankruptcy, if the lawyers haven't been careful to write watertight "netting" agreements. Even where the legalese is solid, the credit-risk assumed by the "in-the-money" party to a derivative contract is proportional to notional principal. The hazard associated with a large notional principal is not primarily associated with the cash-flows that would be triggered by parties fulfilling their contractual obligations.

Notional principal is a measure of the mayhem that would result should counterparties fail to meet their obligations in significant numbers.