Public-Private Investment Program for Dummies: How does the new Treasury Plan Impact Housing and the Market? Poorly Planned Investment Program (PPIP).

The much-awaited Public-Private Investment Program, curiously labeled PPIP was released on Monday creating a massive rally on Wall Street. Initially we were getting glimpses of the plan through cracks in the financial wall over the weekend and what I was seeing was disappointing. The confirmation was made when the plan was made public early on Monday. The public has a right to be outraged. Not so much for the bonuses to A.I.G., which are disturbing but the fact that our political system seems to be an extension of the Wall Street and banking elite. I remember when the $700 billion Troubled Asset Relief Program was released back in the fall on the pretense that it was going to buy toxic assets. Remember the storm that created? The public was appalled and that initial gut reaction was proven to be right. Ultimately the first $350 billion of the TARP went directly to banks as capital injections and did absolutely nothing for the health of our economy and ultimately was a major safety net for the banks. Yet the bad assets remained. No credit lending to average Americans. Bad assets still there. TARP 1 was a gift to banks and Wall Street. Which brings us to the PPIP.

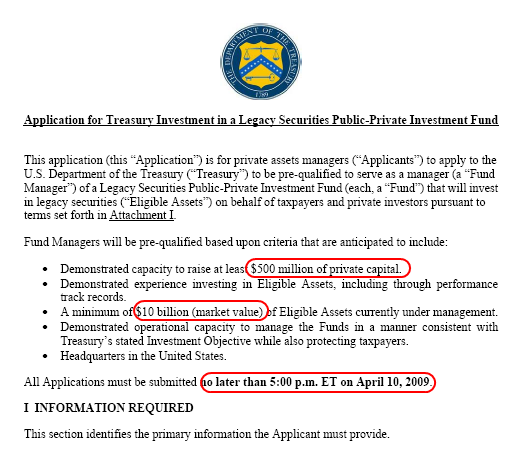

The problem with the PPIP is that it is designed to provide a major subsidy to so-called private investors to buy up toxic assets. This is a misnomer. Why is that? Language is important in any legislation and especially when presenting a money grab like this one. First, there is very little about this plan that encourages the private sector in buying these toxic assets. At least it isnt private in the sense that you and 95 percent of Americans would like to think of it as private. That is to say, if you had some capital laying around and wanted to buy up some toxic assets yourself, you would not be able to do so? Why? Well let us take a look at the application for this PPIP on the Financial Stability website:

Ill get into the details of the plan later in this article but this application pretty much sums up everything that is wrong with this program. First, participating institutions must have the capacity to raise $500 million of private capital. This is great for bailout participants that are deemed too big to fail since theyll have that money easily accessible. Next, theyll need a minimum of $10 billion in market value assets under management. This is important to keep out the riff raff of small time investors since only the big boys know how to mange money. Finally, the deadline for the PPIP application is get this, April 10, 2009 at 5:00pm Eastern Time. Bwahahaha! They already know who is going to get the bids! So much for that open market place notion. They spent such a long time devising this plan and now they expect solid plans to come out in a little over 2 weeks? The Treasury already has an idea who is going to play in this game on taxpayer funds and it is the same institutions that created this mess.

http://www.doctorhousingbubble.com/public-private-investment-program-for-dummies-how-does-the-new-treasury-plan-impact-housing-and-the-market-poorly-planned-investment-program-ppip/