The bottom line is that there is a massive wave of actual foreclosures that will hit beginning in April that cant be stopped without a national moratorium this wave is so big I would not put it past them trying it.

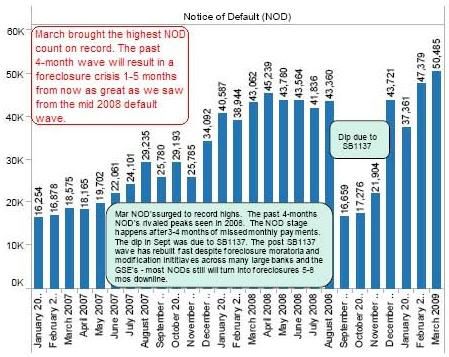

CA foreclosure background - in mid-2008 the foreclosure wave was artificially held back as a result of the CA law SB1137 enacted in Sept 2008. This also kept NODs and NTSs at much lower levels than the actual defaults that were occurring. Other bubble states and several banks/servicers also went on random moratoria and the foreclosure wave was held back for the past six months. But just like so many other intervention and moratoria in the past, the problem just comes out the other side even more violent than if they would have done nothing. Adding insult to injury, the GSEs announced this week that they were coming off moratorium, which could increase foreclosures by 20-25% alone.

Particularly interesting to see that higher-end middle class properties are starting to come through foreclosure at titanic levels.

I've recently remarked on falling absolute levels of inventory in housing in spite of accelerating price declines as a possible intermediate-term precursor to a bottoming process. information like this is a good reason to defer judgment for the time being. the foreclosure problem is clearly still accelerating along with price declines, interrupted only by temporary legal injunctions.

http://declineandfallofwesterncivilization.blogspot.com/2009/04/foreclosures-in-pipe.html