General Discussion

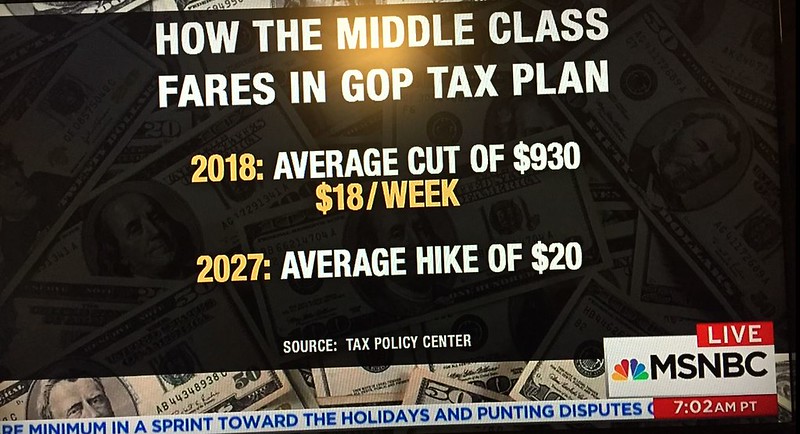

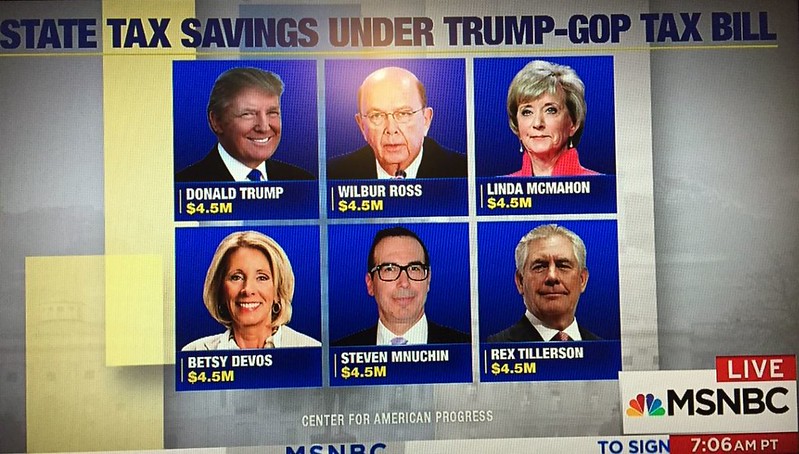

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsMiddle class tax cut is average of $18/wk vs. 4.5 million estate savings for wealthy

Middle Class Tax savings

Estate Tax Savings

----

$18/week. I'm tired of the GOP saying this will make a difference in ppl's lives. I couldn't even take me and my two kids to the movies on this amount.

guillaumeb

(42,641 posts)and continued working for 1000 years or so, you too would be very rich.

madinmaryland

(64,933 posts)me with only a few cents left.

Horizens

(637 posts)"By 2027, this hypothetical family with two kids would wind up paying an additional $150 in taxes, compared with what they'd pay under today's framework because the enhanced child tax credits — and a range of individual income tax provisions — expire in 2025, the Tax Policy Center found.

That family would also suffer because the tax overhaul changes the metric the IRS uses to adjust brackets, standard deductions and other details for inflation.

Today, inflation adjustments are based on the consumer price index. The bill, however, changes to the chained consumer price index, which rises more slowly."

In 2025 the temporarily enhanced standard deduction ($12,000) returns to 6,350. At the same time the personal exemption returns to where it is today $4,050 for oneself and dependents. However, due to change in inflation adjustment, your getting less in terms of real dollars. And will continue to get increasingly less every year.

iluvtennis

(19,864 posts)AJT

(5,240 posts)now, not in 10 years. I don't see the tax bill having impact in 2018 or even much of one by 2020 for a majority of americans.

The message needs to be felt now. It must be focused and coordinated. Right wing PACs have put aside millions and will begin putting out their message immediately.

roamer65

(36,745 posts)Sorry, ladies.![]()

![]()

Fuck you, Grassley.

iluvtennis

(19,864 posts)AJT

(5,240 posts)Horizens

(637 posts)The Democratic Party needs to take lessons from the R's re messaging.

Pick a few points and drive them home constantly.

Everyone - elected officials, national committees, candidates, need to stay on message.

I have some ideas as to the best points to stress. Anyone want to begin a list?