General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsBrookings Institute: Romney Tax plan raises taxes on 95% (major issue)

(the Obama campaign from here on out needs to campaign on this and Medicare cuts)

A new Brookings Institution/Tax Policy Center study finds Mitt Romney's plan to overhaul the tax code would produce cuts for the richest 5% of Americans -- and larger bills for everybody else.

The Washington Post notes the researchers seemed "to bend over backward to be fair to the Republican presidential candidate" but "none of it helped Romney."

"His rate-cutting plan for individuals would reduce tax collections by about $360 billion in 2015, the study says. To avoid increasing deficits -- as Romney has pledged -- the plan would have to generate an equivalent amount of revenue by slashing tax breaks for mortgage interest, employer-provided health care, education, medical expenses, state and local taxes, and child care -- all breaks that benefit the middle class."

http://politicalwire.com/archives/2012/08/01/romney_tax_plan_would_raise_taxes_on_95.html

jpljr77

(1,004 posts)Remember: it's more important to let the rich grow their money through no effort than to let "lucky duckies" live off the gov't teat. /sarcasm

WI_DEM

(33,497 posts)DallasNE

(7,403 posts)That is the problem. Romney has not spelled out any details so people are assuming what Romney would have to do on the revenue side. I think it is more likely that he would "pay" for the reduced revenue by sharply slashing expenses, even abolishing entired government departments. Beyond that, he would turn Medicare into a voucher system where the vouchers would only pay a small part of the insurance costs and set the country back 60 years. On Social Security the retirement age would again be increased, future benefits would not keep pace with inflation and a host of other degrading measures.

starroute

(12,977 posts)He's also talked about "broadening" the tax base -- which typically means finding some way to squeeze federal income taxes out of the working-poor who don't currently have enough income to pay them.

The Brookings report notes that "Representative Paul Ryan’s plan calls for collapsing the income tax rates into two brackets, 10 percent and 25 percent (which is more than a 20 percent reduction in the top marginal rate), and proposes offsetting some or all of the revenue losses through broadening the tax base, also without specifying which tax expenditures would be cut."

And here's Paul Krugman from a couple of weeks ago, referring to "Base Broadening Baloney:

http://krugman.blogs.nytimes.com/2012/07/15/base-broadening-baloney/

Krugman thinks that Romney's proposals are just campaign rhetoric -- but I think we have to take them very seriously, especially coupled with all the recent "lucky ducky" rhetoric about the "parasites" who don't pay taxes and need to be made to "have some skin in the game." The GOP doesn't normally work up elaborate propaganda offenses unless they actually mean to apply them.

JHB

(37,161 posts)

stockholmer

(3,751 posts)On so many fronts, they would utterly destroy the vast majority of legitimate capital formation and the brain-drain from highly-skilled labour's flight outward would make you jaw drop. Furthermore, it would barely increase (and I would say it actually would decrease) the government's intake of revenue, as a percentage of GDP.

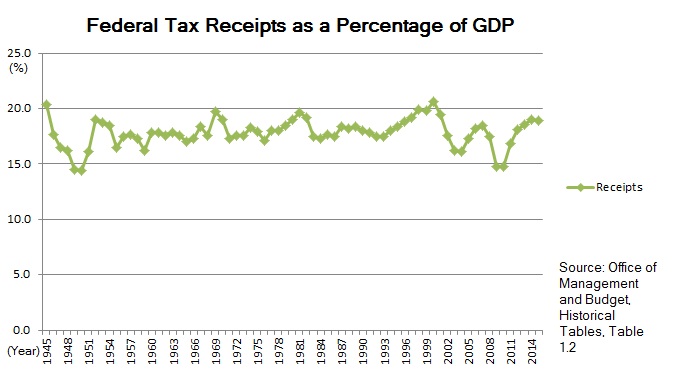

Over the past 65 years, no matter what the tax rates were, the US governments revenue take vs. GDP has been between 15% and 21%. This includes the 1955 rates you posted.

JHB

(37,161 posts)The current range of debate is so stilted and ahistoric that the Republicans talk as if simply letting the Bush tax cuts expire is a step on the Long March to Stalinism. In that situation, it is useful to remind people what our tax structure looked like when there were actual Stalinist nations in the world, especially since that period is generally remembered here as economic good times for ordinary people.

For instance, we currently have six tax brackets, the Ryan plan wants to collapse it to two, like we had from 1988 to 1990 except with even lower rates (10%/25% brackets under Ryan compared to 15%/28% under G.H.W. Bush). The earlier experiment was unsustainable, but the radicals on the Republican side crucified Bush for not sticking to his "read my lips, no new taxes" line in the face of reality. Even on the Democratic side, $250K was treated as a stark dividing line (the whole "is $250K rich?" debate). So it has value to note that within living memory we used to have some 24 brackets, with 16 of them affecting incomes over the equivalent of $250K.

I'm also inclined to use the 50's-era rates as a starting point, no matter how unreasonable they may be, simply because it allows us to talk towards reasonable. The other side has staked out a far more radical position and argues that any course other than the one they prescribe amounts to the end of life as we know it and the transformation of the nation into the socialist hellhole of their fevered imaginations.

I'm curious, though: how long do you think America has before turning into a 3rd world country if it stays on its present course? Or if a Ryan-type plan were enacted?

stockholmer

(3,751 posts)Last edited Thu Aug 2, 2012, 01:47 PM - Edit history (1)

10 plus years. Using very simple math, if the US GDP is 15 trillion per year, I could see the current situation being maintained even with a 30 to 35 trillion dollar federal debt, although this is utterly dependent on a ZIRP regime of financial repression being enforced. Just a an uptick to, say 5 or 7% in Fed's baseline rate would (even at todays 16 trillion debt) mean well over 1 trillion per year payments in debt service alone. At that point, the global bond market will flay the USA alive, as a 'flight to safety' will no longer be the historical default position of US dollars and treasuries.

This (ability to keep the ponzi scheme of debt going) is due to one main fact; the US dollar is enforced as the world's reserve currency (especially through it's petrol dollar linkage) via its empiric gunboat diplomacy. Another thing that drives the trillions in hot money into US treasuries and dollars is a 'beggar-thy-neighbor' policy that emanates out the global banking system via The City of London and Wall Street.

The 800-pound gorillas in the room are Medicare, (not Social Security) which has close to 100 trillion in unfunded liabilities, and the total notional value of global derivatives, which is well over 1 quadrillion. These derivatives, should they even suffer a 10% failure rate (or 100 to 125 trillion dollars) will be sorely pushed to be made whole (see AIG in 2008/2009) for the benefits of the private banksters, whilst the debt load is dumped onto the globe's citizens. This is the essence of neo-feudalism.

This all said, a Ryan-style regime of austerity will hasten the fall, as will a failure to break the clock of the private bank's network of global systemic control (including their national and supra-national central banks ie. the Fed, ECB, BoC, IMF, BoE, World Bank, the BIS, etc), and a removal of the profit motive for healthcare in the US via a single-payer scheme.

uponit7771

(90,348 posts)DallasNE

(7,403 posts)Namely, that Romney may do a few things at the margins, like eliminating the tax credit for wind energy, but little else regarding loopholes which means he is mostly looking at the expense side of the ledger. As I have been saying, going all austerity means the country would be plunged into recession within about 10 months of his taking office should those measures get around a Democratic filibuster in the Senate.

starroute

(12,977 posts)One of the problems on the left has been not taking the Republicans seriously when they spell out the extremism of their agenda. This has been true to an extent since Reagan. It was true when Bush tried to privatize Social Security in 2005. And it's even more true since the rise of the Tea Party.

You look at what these people say they want to do. You look at who owns Romney and how little he knows about his own alleged policies. And you've got to figure that if they held power, they'd start with the Ryan budget and go on from there.

Don't misunderestimate them.

Bucky

(54,041 posts)God bless Mitt Romney. His only accomplishment so far is giving a new definition to the word "no-brainer".

SDjack

(1,448 posts)create demand, and that creates job creation. He is going to tax us into a depression.

hfojvt

(37,573 posts)until the nonsense about how the mortgage interest deduction "benefits the middle class"

Yeah, right. http://journals.democraticunderground.com/hfojvt/151

36.5 million tax returns took a mortgage interest deduction in 2009. That's out of 140 miillion returns. The mortgage deductions were worth $420 billion. Of that amount 47% went to those with incomes over $100,000. A group that is only 12% of tax filers. The TOP 12% of tax filers.

There were 29.5 million filers in the middle class - those with AGI between $40,000 and $75,000. Of that group only 10.6 million took a mortgage interest deduction - less than 36%.

And 42% of the itemizers were in the $60,000 - $75,000 part of that group.

40% of filers in the $50,000 - $75,000 range took a mortgage interest deduction whereas only 28% did in the $40 - 50,000 range.

And 67% took a mortgage interest deduction in the $1,000,000 to $1,500,000 range.

Their average deduction was worth $31,569 whereas the average deduction for the $60,000 - $75,000 group was $9,738.

Things like the mortgage interest deduction are simply worth much more to a much greater percentage of people - at the top. The middle class, and the country, would be better served by eliminating them, eliminating the extra work in tracking them and filling out the extra form - and just increasing the standard deduction.

The deduction for state and local taxes was worth $15.5 billion to those with incomes over $10,000,000. That's 8,057 filers.

Meanwhile, it was only worth $4.8 billion to the 3.4 million filers with income between $30,000 and $40,000. 76% of filers with incomes between $30 and $40k did NOT itemize whereas 97% of those with income over $10 million DID itemize for state and local taxes.

Tell me again, how that is a break that benefits the middle class. It benefits 97% of the super-rich by an average of $1.9 million and only 24% of those making under $40,000 (and over $30,000) by an average of $1,412.

edit - and that does not even include multiplying the bigger number by the HIGHER marginal tax rate and the smaller number by the LOWER marginal tax rate. Because the richer person pays a 35% (should be 55%, if I had my druthers) and the middle class person pays a 15% tax rate. The rich person's deduction is worth $665,000 and the middle class person's deduction is worth $212.

AND when you figure that an itemized deduction is only worth something to a taxpayer of the amount OVER the standard deduction of $10,900 for a couple (in 2008). Well, the rich person has already saved $661,000 in taxes while the middle class person hasn't saved anything until they come up with another $9,500 in deductions

JDPriestly

(57,936 posts)who don't look at the behavioral side of the equation.

Having been a homeowner with a modest income, I must say that while the amount of tax relief that I received thanks to my mortgage interest deduction would not, even when added to all the others in my earnings bracket, sound like much money from a statistical point of view, it really, really, really meant a lot to me. In fact in the years shortly after we bought our house when our interest payments were high compared to our income, that mortgage interest deduction meant the difference between being able to afford our house and not being able to afford it.

Republicans are very wrong to focus on the aggregate numbers -- how much the mortgage interest deduction saves when you look at it in terms of national incomes and figures. That mortgage deduction means a whole, whole, whole lot to families just starting to buy their first or second home -- or their home for life.

We needed the mortgage interest deduction because, as a lower middle class family, it meant that we qualified to take deductions for other things. You have to meet a minimum level of deductible income in order to be able to itemize your deductions. Without our mortgage interest deduction, we could deduct nothing.

On an emotional level and in the lives of real lower middle class people, real families, that mortgage interest deduction means a whole lot.

Republicans are way wrong, way out-of-touch on this one. In fact, one of the main reasons people want to buy houses is to have the ability to deduct the interest on the home.

When you rent, you pay, hidden in your rent, your landlord's mortgage payment. That will be, for your landlord, a deductible business expense regardless. (Don't think the Republicans would dare take away a deduction that means a lot to greedy landlords.) If you buy your own home, have your own mortgage, you should get that deduction.

The numbers are misleading.

hfojvt

(37,573 posts)So the mortgage interest deduction meant a lot to you. Well, the fact is that is does NOT mean a lot to most members of the lower and middle classes. It means nothing to the 72% of tax filers with incomes between $40,000 and $50,000 who do not itemize deductions. A higher standard deduction would benefit 100% in that group, and save a bunch of paperwork too.

It means a lot more to the rich, more of whom itemize and who have bigger deductions.

The main reason people want to buy houses is to get away from rent and apartments.

JDPriestly

(57,936 posts)If we don't keep the deduction for mortgage interest, we will have neither the higher standard deduction nor the mortgage interest deduction.

hfojvt

(37,573 posts)Because a tax break for the lower classes is impossible, we won't even try for that - thus definitely proving our contention that it is not possible.

Then why don't we propose even more tax breaks for the wealthy and claim they benefit the middle class?

Oh wait, "we" already did that with the disgusting permanent payroll tax cut.

It's the best of all possible plans.

JDPriestly

(57,936 posts)There are lots of deductions for people with limited incomes. I don't think you can even take the student loan deductions if you have more than a certain middle class (very middle class) income.

If the home loan interest deduction is to be scrapped, these deductions would never make it.

Face it. Romney opposes the deductions that the poor and middle class use -- like the child care deduction which does not, as it is, come close to covering the expense of child care.

Small businesses get lots and lots of deductions for their business expenses. So should working people. And the deductions I mentioned benefit lower-paid working people.

hfojvt

(37,573 posts)because those are not itemized deductions.

The student loan interes deduction is on line 33 of the 1040, not on Schedule A.

The credit for child care expense is on line 47 of the 1040, not on Schedule A

First of all, I am only talking about schedule A. One that gives massive benefits to the rich, as I tire of pointing out as the lone voice in the wilderness. ![]()

![]()

The other fact of the matter is, because many with lower incomes are already paying no income taxes, most of the benefits of those credits goto people with higher incomes. It's the upper middle class who get those deductions, not the lower working class. That's why I was adamant that Obama's Making Work Pay credit needed to be refundable. Because unless some credits are refundable, then many lower income people do not get them. http://journals.democraticunderground.com/hfojvt/62

bucolic_frolic

(43,252 posts)He's not acting in the best interests of the country, or working Americans,

or middle class Americans, or business in general.

He's working for the 5% at the top.

Same ol', same ol'

In other words, NO CREDIBILITY, NO LEGITIMACY

He is SO dense that he doesn't even see the NEED to

perpetuate the ILLUSION that he's there for the other 95%

Make my Day, Mitt!

Quantess

(27,630 posts)Kick

mrmpa

(4,033 posts)"we knew it wasn't 99% v 1%"

cantbeserious

(13,039 posts)eom

Kalidurga

(14,177 posts)They are too busy slapping each other on the back right now after consuming their hate sandwiches. Maybe Monday would be a good time to tell them gives a couple of days plus the weekend to sober up after their hate feast.

Berlum

(7,044 posts)...so typical