General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsDoes the Democratic Party need to return to a platform of .....?

Higher taxes on the wealthy? No more of this 0% taxation bullshit and a shitload of exemptions for everyone in the top 1%?

How about returning to a tax rate of 70% on those like the CEO's of FaceBook and Amazon and the people that collect money just for the purpose of being wealthy, not for investment?

Now, we are sitting at about $30 trillion dollars in debt and it's only a problem when Democrats are in power. Never mind that it is the Republicans that drive up the debt or create the conditions to drive up the debt, as they have done with Trump. The largest debt increase in history, that started with a $2 trillion dollar tax cut for Trump and his cronies.

How about a platform that calls for cuts to the Defense budget? Is $740 billion a year really necessary? What happened to the old Democratic Party that used to challenge this spending for the rich and the defense contractors?

How about more social spending on our people? On education, on housing, on job training, etc?

Does the entire political system need reform?

OnDoutside

(19,982 posts)you give to Republican ad makers, the better.

kentuck

(111,110 posts)Wait until they are in power and then apply their agenda with sheer political power.

You may have something there.

OnDoutside

(19,982 posts)and in his book, that people vote on emotion, not policies. All policies do is provide a menu of Republican attack ads, and he should know !

The better strategy is to generalize messages that give people a reason to vote, not specifics on why they shouldn't.

kentuck

(111,110 posts)Perhaps, in the past, platforms served a different function?

But now, it is only ammo for attacks from the opposition.

After all, we did not hear the Republicans say that once they won the White House, the first thing they were going to do was a $2 trillion tax cut for their friends.

When in Rome, do as the Romans do.

OnDoutside

(19,982 posts)they will have learnt from this election where they made the election about Trump...make the Republicans fight on their own ground rather than yours. I see Warnock/Ossoff doing something similar.

DownriverDem

(6,232 posts)run on raising taxes on the rich. It needs to be a priority.

OnDoutside

(19,982 posts)would generally agree that the rich/top 1% should pay their fair share.

FBaggins

(26,775 posts)The challenge is implementing a tax-the-rich strategy when we don’t have the votes.

kentuck

(111,110 posts)Republicans had no problem passing their $2 trillion dollar tax cut, did they?

FBaggins

(26,775 posts)How many Democrats voted for the so-called TCJA?

That’s right... none.

Response to kentuck (Reply #4)

TwilightZone This message was self-deleted by its author.

StarfishSaver

(18,486 posts)questionseverything

(9,664 posts)If dems don’t have sixty votes it doesn’t seem like we get anything done but repubs had no problem giving the rich the biggest tax cut in history and they didn’t have sixty votes

FBaggins

(26,775 posts)You don't need 60 votes.

But you still need 51 and a majority in the House.

Republicans were able to pass their bill with 13 defections in the House and one in the Senate. Similar numbers for Democrats would mean failure in both chambers.

questionseverything

(9,664 posts)That the reason obama could not deliver a public option was we “only” had 60 votes for four months

We did not used reconciliation to pass a public option even tho the aca was originally passed with a simple majority

FBaggins

(26,775 posts)Reconciliation is for spending/taxing/debt. It can't be used to create new programs like the ACA or a public option. Either required 60 votes (or a minority that didn't filibuster). A tax cut can pass with 51 votes.

Many of the ACA weaknesses were caused by that very issue. We lost our 60th vote as it was working through the conference process aligning House/Senate versions... so the House was forced to go back and pass the previously-passed Senate version without changes (because a changed bill could no longer pass the Senate).

betsuni

(25,712 posts)Tired of blame-the-Democrats, "Why didn't Democrats ____ ?" and it's something impossible.

walkingman

(7,673 posts)We need to stop this whole "trickle down" philosophy. It is easy to see over the last 5 decades that is has always been a scam.

We need to concentrate on sustaining the social safety net of SS, Medicare, Pension Protection. They will mean informing the public of the real status of our economy.

Understand that issues such as guns, god, and gays are killing our Party with the majority of Americans. We desperately need to reform our justice system that ensures that those with wealth play by a different set of rules than working people.

The Democratic Party has to understand that the demographics of our nation are changing. We need to focus on issues such as immigration reform, education, take the church out of Government, and taking money out of politics.

But probably the most important factor that has to be changed is that as of today Corporations own our government - people are so dependent on big business for jobs that they put their interests over their own knowing that they have to survive.....whatever it takes.

NoRoadUntravelled

(2,626 posts)The first link shows the Federal Income Tax brackets for 1957. The second link shows median household income for that same year as being right around $5,000.

As you'll see in the first link, Married Jointly with an income of $4,000 per year (the equivalent of $30k today) was taxed at a whopping 22%.

https://www.tax-brackets.org/federaltaxtable/1957

The second link shows income dollars adjusted for inflation from 1950-1990

https://web.stanford.edu/class/polisci120a/immigration/Median%20Household%20Income.pdf

Just for comparison, here are the 2020 tax rates

https://www.irs.com/articles/2020-federal-tax-rates-brackets-standard-deductions/

beachbumbob

(9,263 posts)JHB

(37,163 posts)The brackets used to reach much higher up the income scale, and there used to be more of them. In 1955 there were 24 brackets. Adjusted to 2013 dollars, two thirds of them (16) kicked in at levels above the equivalent of $250,000, and 11 of those kicked in at levels above the equivalent of $500,000.

The chart below is adjusted to 2013 dollars.

Data from:

https://taxfoundation.org/us-federal-individual-income-tax-rates-history-1913-2013-nominal-and-inflation-adjusted-brackets

ProfessorGAC

(65,279 posts)Tax rate brackets in the 50s were, as you stated, more progressive with more tiers and a higher ceiling.

But, deductibility & loopholes for high income people were so prevalent that almost nobody paid the aggregated rate the brackets would suggest.

Less than 3% of such earners.

When JFK lowered the max rate to 50%, there was actually little negative impact because so many loopholes for rich people were closed. (Not all, after all his dad was loaded.)

The effective tax rate on people making 6 figures or more actually went up, even with the ceiling lowered 40% absolute.

I do like the idea of expanding brackets greatly. This "simplification of the tax code" is PR, with no economic benefit to anybody. Most 1040 filers can do it in 25 minutes instead of 45. Bid deal! That 20 minutes a year is what real benefit?

And, the brackets need to reach higher! Agreed totally on that, too!

But, I don't think the numbers from the 50s, within the greater context, is an apt comparison.

kentuck

(111,110 posts)The top rate was about 90% during Eisenhower years.

ProfessorGAC

(65,279 posts)Down to 65% in the first move. Corporate rates went from 52 to 48.

Already scheduled to go to 50, but I think that happened after he was killed.

JHB

(37,163 posts)...released his tax returns, ranging from a high of 45.8% in 1961 to a low of 16.8% in 1966.* For some of those years his pre-deduction income would have reached into the top marginal rate zone (91%). His taxable income was quite a bit smaller due to deductions.

So yes, it was more complicated than just the rates and brackets, but it was complicated both ways. The rates strongly encouraged doing things with high incomes beyond amassing more of it. They put a bottleneck on shooting money upward, since to avoid the top rates one had to "spend" chunks of it on deductible charities. A "tax" that wasn't a tax, if you will.

I don't propose simply going back to the 50s way of doing things, but some of the practices back then worked and should inform current policy decisions. And as a bonus, we can paint the Republicans as the sort of fringers who called Ike a socialist, because they've completely become that sort of fringer.

And yes, whenever someone talks about "simplifying the tax code" and then talks about cutting brackets, they are at best self-deluded and at worst simply lying. The highest number of brackets we had were for three years around 1920, when there were 57 of them. This was an era where the tax calculations were done by hand, or with the help of adding machines that would qualify as gym equipment today. All the complicated stuff is about deductions and types of income, not the brackets. The brackets are just straightforward math. This is the 21st century. We can make tee shirts with enough computing power to handle it.

*The average rate is from multiple sources, the high and low rates via https://money.cnn.com/2012/01/18/news/economy/romney_taxes/index.htm

ProfessorGAC

(65,279 posts)The idle accumulation of wealth creates no upward pressure on economic growth.

None!

A more assertive tax code encouraging reinvestment in new business & innovation would be far better.

It would increase the velocity of money, encourage expansion without reducing labor costs as the go-to first choice, and expand product portfolios.

But, the supply side liars have gotten their way for 30 of the last 40 years.

JHB

(37,163 posts)Last edited Sat Dec 26, 2020, 11:13 PM - Edit history (1)

We can set things up to help people trying to get ahead, or to help people who already are.

Sometimes there's a sweet spot where you can do both, but usually it's a choice. Since Reagan the choice has been the latter. It's time to go back to the former.

RVN VET71

(2,698 posts)The loopholes were numerous and provided legal ways of avoiding the full rate. If the Dems win in Georgia, maybe something will be done to construct a tax structure that is fair and equitable, one that does require the wealthy to pay a progressively higher rate depending on their earnings. (I said maybe. The Dems are not walking in step on this, never have and never will.)

That and taking a look at spending, in general, will make it possible to reel in the debt.

Response to kentuck (Original post)

Baked Potato This message was self-deleted by its author.

Lunabell

(6,128 posts)Large corporations need to pay their fair share. And they've been squeezing out Mom and Pop stores for decades. There is no "trickle down". It's all staying in the hands of the few ultra rich.

Bucky

(54,087 posts)They are a financial instrument to help individuals profit from large business ventures. They could continue to operate profitably if they had an active 90% tax rate, as long as dividends to shareholders are exempted.

Chicago School conservatives will argue they need to make a sizable profit for future investment in job building. The corporations never fund capital improvements from cash on hand. They always get loans, expecting that return on investment will easily exceed the tiny interest rates they secure with their cash on hand. So there's really not a reason for a corporation to turn a profit anyway.

If they want to reduce their tax rates because they are "job creators", then let them document the jobs they actually create. Republican tax cut fanatics are basically junkies, getting off on half informed rah-rah capitalism rhetoric. Like all junkies, they don't care how much they lose or how bad they suffer, just so long as they feel that high.

jalan48

(13,904 posts)can agree on.

ProfessorGAC

(65,279 posts)That's what Ike was talking about when he warned us.

It's now so big, the economy & defense are symbiotic

jalan48

(13,904 posts)Bucky

(54,087 posts)...when Republicans get control of the Congress

tirebiter

(2,539 posts)DEMOCRATIC NATIONAL CONVENTION LAND ACKNOWLEDGEMENT 4 PREAMBLE 5 PROTECTING AMERICANS AND RECOVERING FROM THE COVID-19 PANDEMIC 8

BUILDING A STRONGER, FAIRER ECONOMY 13

Protecting Workers and Families and Creating Millions of Jobs Across America 14 Raising Wages and Promoting Workers’ Rights 14 Enacting Robust Work-Family Policies 16 Investing in the Engines of Job Creation 16 Building A Fair System of International Trade for Our Workers 20

Putting Homeownership in Reach and Guaranteeing Safe Housing for Every American 20 Leveling the Economic Playing Field 22 Reforming the Tax Code to Benefit Working Families 22 Curbing Wall Street Abuses 23 Ending Poverty 23 Protecting Consumer Rights and Privacy 25 Tackling Runaway Corporate Concentration 25 Guaranteeing a Secure and Dignified Retirement 25

ACHIEVING UNIVERSAL, AFFORDABLE, QUALITY HEALTH CARE 26

Securing Universal Health Care Through a Public Option 28 Bringing Down Drug Prices and Taking on the Pharmaceutical Industry 29 Reducing Health Care Costs and Improving Health Care Quality 29

Expanding Access to Mental Health and Substance Use Treatment 30

Expanding Long-Term Care Services and Supports 30 Eliminate Racial, Gender, and Geographic Health Inequities 31 Protecting Native American Health 32 Securing Reproductive Health, Rights, and Justice 32 Protecting and Promoting Maternal Health 33 Protecting LGBTQ+ Health 33 Strengthening and Supporting the Health Care Workforce 33 Investing in Health Science and Research 34

PROTECTING COMMUNITIES AND BUILDING TRUST BY REFORMING OUR CRIMINAL JUSTICE SYSTEM 35

HEALING THE SOUL OF AMERICA 39

Protecting Americans’ Civil Rights 39

Achieving Racial Justice and Equity 39 Protecting Women’s Rights 42 Protecting LGBTQ+ Rights 42 Protecting Disability Rights 43 Honoring Indigenous Tribal Nations 44 Ending Violence Against Women 47 Ending the Epidemic of Gun Violence 47 Supporting Faith and Service 48 Supporting Press Freedom 48 Supporting the Arts and Culture 49

COMBATING THE CLIMATE CRISIS AND PURSUING ENVIRONMENTAL JUSTICE 49

RESTORING AND STRENGTHENING OUR DEMOCRACY 55

Protecting and Enforcing Voting Rights 55 Reforming the Broken Campaign Finance System 57 Building an Effective, Transparent Federal Government 57 Making Washington, D.C. the 51st State 58 Guaranteeing Self-Determination for Puerto Rico 59 Supporting the U.S. Territories 59 Strengthening the U.S. Postal Service 60

CREATING A 21ST CENTURY IMMIGRATION SYSTEM 61

PROVIDING A WORLD-CLASS EDUCATION IN EVERY ZIP CODE 64

Guaranteeing Universal Early Childhood Education 65 Supporting High-Quality K-12 Schools Across America 66 Making Higher Education Affordable and Accessible 69 Providing Borrowers Relief from Crushing Student Debt 70

RENEWING AMERICAN LEADERSHIP 72

Revitalizing American Diplomacy 73 Rebuilding America’s Tool of First Resort 73 Reinventing Alliances 74 International Institutions 74 Foreign Assistance and Development 75

Transforming Our Armed Forces for the 21st century 75 Ending Forever Wars 75 Securing our Competitive Edge 76 Defense Spending 77 Keeping Faith with Our Veterans and Military Families 77 Civil-Military Relations 78

Mobilizing the World to Address Transnational Challenges 78 Global Health and Pandemics 78 Climate Change

Technology 80 Nonproliferation 81 Terrorism 81 Democracy and Human Rights 82

Advancing American Interests 85 Global Economy and Trade 85 Africa 86 Americas 87 Asia-Pacific 87 Europe 89 Middle East

Bucky

(54,087 posts)JHB

(37,163 posts)Back before Reagan, the public stance was that corporations had to balance the concerns of various stakeholders: stockholders, employees, and the public. Even when management didn't really believe this, it was the stand they felt they needed to take publicly.

That broke down in the 70s, where shareholder revolts and conservative/libertarian economic ideology attacked that balancing act directly and placed shareholder value above all.

Since Reagan, most policy has been to lower taxes (particularly at the top) and deregulate. The end result of this has been an economy where the highest virtue has been shooting money skyward. As much as possible, as fast as possible, as high as possible. And anything that might impede or bottleneck that upward pipeline is berated as "socialism!" There is a Divine Right, not of kings but of money.

Off the top of my head, I recall hearing several times over the years of studies finding that where policies favored by a majority conflict with policies favored those with the highest incomes, it is the latter policies that prevail and are enacted.

The basic structure of our government as laid out in the constitution and amended over the years has been to create the ability to have enough centralization to prevent factionalism from gumming up the works while also breaking apart that centralization enough that majority factions cannot run roughshod over minority factions.* The checks and balances are there to prevent excessive consolidation of power that will be used against anybody who threatens or even impedes that consolidation of political power.

However, one thing that has become crystal clear over the past 150 years is that this principle applies to economic power too. From the Gilded Age to Progressive Era to the Roaring Twenties to the New Deal and postwar prosperity to Reaganomics and today, when money becomes too concentrated it buys political power. When there are bottlenecks on that upward flow, there is more general prosperity because far fewer people being squeezed at every turn.

*The most obvious failure of this is when both majority and minority factions agreed on running roughshod over parts of the population.

Bobstandard

(1,329 posts)During the Obama administration Defense Secretary Panetta warned about cyber war, saying it was the most serious security threat the nation faced. Apparently the Pentagon and the military industrial complex were preparing to fight the last war to prepare for this one. Clearly the bloated budget is being spent in the wrong places, especially on private contractors doing what should be a serviceman’s job

bringthePaine

(1,736 posts)Nululu

(842 posts)End tax subsidies for job exports. A trillion dollars to billionaires during pandemic needs to be reversed.

End the law and order idiocy. Close private prisons & fire mercenaries.

Marcuse

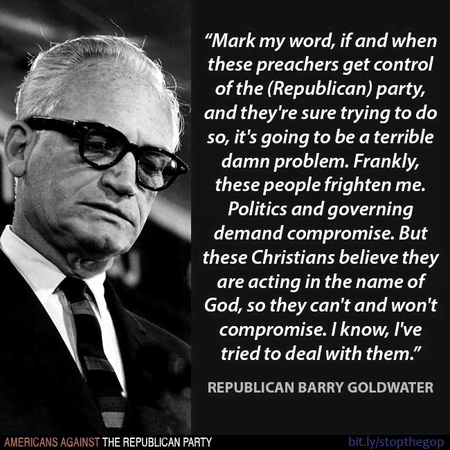

(7,532 posts)

Bucky

(54,087 posts)It was the hucksters and con men who sweep in to profit after the Christian Pharisees soften the ground by making Republican voters so gullible.

erronis

(15,390 posts)Get rid of the individual income tax.

Ford_Prefect

(7,927 posts)for some time now and they are not alone within the party.

BTW the last time a Democratic President took on the Defense establishment and engaged in serious cost reduction he got sideswiped by the MIC, the "Any Oil War We Want" faction within Intel Community and State Department, and the Reagan/Bush GOP Neo-Cons. It seems like any time someone suggests cost savings or applying the "Peace Dividend" to other agendas the threat level at DHS gets raised or some new magic weapons upgrade is announced as the next must-have defense option we cannot guarantee peace without.

Mr.Bill

(24,338 posts)every time the republicans complain about the debt, pass a tax increase. And make it clear the debt is why they are doing it. Call it the Trump debt reduction act. That should shut them up rather quickly.

kentuck

(111,110 posts)It's not that complicated.

pecosbob

(7,545 posts)By the end of the sixties we had entered the era of the great shakedown...the gold standard was gone and the Federal Reserve and the City of London began creating trillions in fiat money. We're still doing it today.

Just my opinion...

tritsofme

(17,419 posts)Gold bugs and rants against fiat money... 🤦?♂️

pecosbob

(7,545 posts)Rich people hate paying taxes...they have found ways to avoid it for the most part. Our nation's infrastructure is falling apart brick by brick. Blame whatever or whomever you choose.

tritsofme

(17,419 posts)betsuni

(25,712 posts)Democrats are left alone to try and fix everything but they don't have the unlimited money and power Republicans do, and when they can't do everything by themselves because they don't have large majorities in the legislature some people get mad and blame them and think both parties are the same: Democrats could've stopped this or that, why don't they go back to the future like in FDR's time when things were nice. Democrats always raise taxes, increase social spending on education, on housing and on job training. Pretending they don't helps Republicans. If people voted on policy it wouldn't be a problem. And nobody lived happily ever after because too many people don't have any damn common sense.

The End

JanMichael

(24,897 posts)3. Tax extreme wealth (if you have to ask you do not know what it is). 4. Bust, break-up, monopolies. 5. Make the internet a public utility which it is now. 6. Say NO to the third wave. Say NONONONO! 7. We socialize roads and public schools do it for healthcare. 8. Give the power in the rental market to what are called Social Housing Agencies in Canada and the UK. Break the private "landlord" model.

And how about...oh just forget it. It won't happen. Too much $$ in the hands of horrible people.

Sewa

(1,264 posts)The flat 15% rate for everyone is wrong in age of billionaire stock holders.