General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsApple Becomes First Company to Hit $3 Trillion Market Value

The iPhone maker’s value tripled since 2018 as its sales continued to soar and it spent hundreds of billions of dollars on its own stock.https://www.nytimes.com/2022/01/03/technology/apple-3-trillion-market-value.html

Combine Walmart, Disney, Netflix, Nike, Exxon Mobil, Coca-Cola, Comcast, Morgan Stanley, McDonald’s, AT&T, Goldman Sachs, Boeing, IBM and Ford. Apple is still worth more.

Apple, the computer company that started in a California garage in 1976, is now worth $3 trillion. It became the first publicly traded company to ever reach the figure on Monday, when its stock briefly eclipsed $182.86 a share before closing at $182.01.

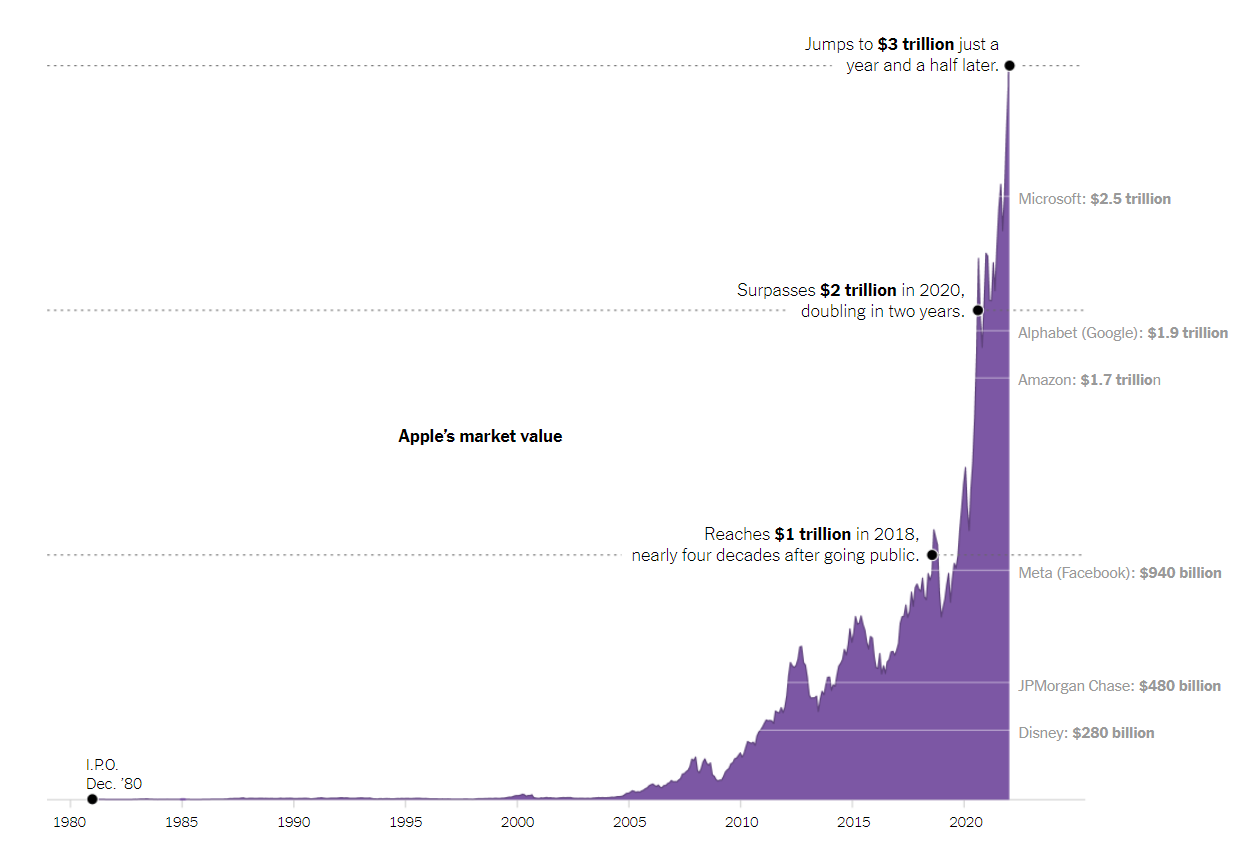

Apple’s value is even more remarkable considering how rapid its recent ascent has been. In August 2018, Apple became the first American company ever to be worth $1 trillion, an achievement that took 42 years. It surged past $2 trillion two years later. Its next trillion took just 16 months and 15 days.

Such a valuation would have been unfathomable a few years ago. Now it seems like another milepost for a corporate titan that is still growing and appears to have few tall hurdles in its path. Another tech giant, Microsoft, could follow Apple into the $3 trillion club early this year.

snip

Brother Buzz

(36,450 posts)So then I got a call from him, saying we don't have to worry about money no more. And I said, that's good! One less thing.

ProfessorGAC

(65,128 posts)$63 billion in shareholder equity (assets - liabilities).

$3 trillion in market cap.

Hmmmm.

sir pball

(4,756 posts)Amishman

(5,559 posts)Shiller P/E is higher than the Black Tuesday crash of 1929 and close to that of the dot com crash. Stocks are badly overvalued relative to the actual revenue of the companies.

The Fed's reverse repo market hit 1.9 trillion recently. This is excess capital reserves of major financial companies that they are simply parking short term because they can't find better ways to lend or invest it. Buyers are willing to overpay for stocks because there are few better places to invest right now.

ItsjustMe

(11,236 posts)sir pball

(4,756 posts)I was an "EvangeLister", subscribed to the Macintosh EvangeList Mailing List, back in the mid-90s; I had a subscription to MacAddict magazine to go along with it. I was always baffled when I'd meet someone who used a Mac and they weren't as... enthusiastic as I was.

I am still kicking myself over one thing from that timeframe though - my freshman year of college, September 1997, I almost spent the $3,000 from my summer job on AAPL, but decided to just buy beer instead.

I did the math last year, IIRC it would have been close to $4,000,000 now ![]()