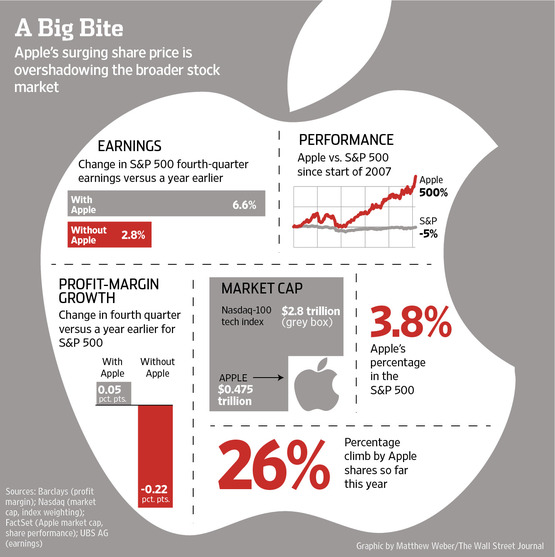

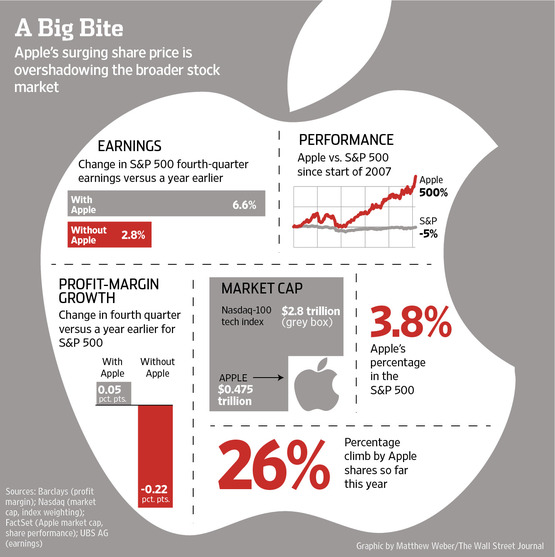

Apple's Size Clouds Market

In analyzing U.S. corporate earnings and stock-market trends, apples-to-apples comparisons may now require tossing out the Apple. Apple Inc.'s success selling consumer gadgets has pushed its share price above $500, cementing its place as the U.S.'s largest company, with a market capitalization of $475 billion. But its gargantuan size is making it difficult for Wall Street to get a big-picture view of the earnings and margins for other American corporations.

As a result, some equity analysts are cutting Apple out of the frame—and finding a dimmer outlook for the broader market.

Earlier this month, Jonathan Golub, the chief U.S. equity strategy at UBS AG, caused a stir among his clients by publishing two versions of his regular quarterly earnings update: one for the companies that make up the S&P 500, and another for what he calls "S&P 500 ex-Apple." "In two and a half years, I haven't got as much response as I did to that note," Mr. Golub says.

Strategists at Morgan Stanley, Goldman Sachs, Barclays Capital and Wells Fargo have done similar analyses recently to offset Apple's impact. The results are striking: For all the companies in the Standard & Poor's 500-stock index, earnings are on track to post a 6.6% year-on-year rise in the fourth quarter. Once Apple's earnings are factored out, the expected fourth-quarter gain shrivels to just 2.8%, according to UBS.

http://finance.yahoo.com/news/apple-s-size-clouds-market.html