General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums~ THE WEALTH ON THIS EARTH 2016 ~

Last edited Fri Jan 22, 2016, 09:44 PM - Edit history (1)

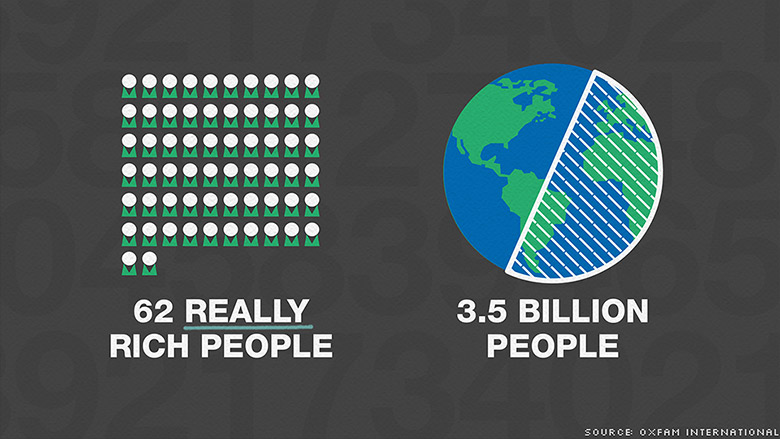

Jan. 17, 2016. New Oxfam Report coinciding with the World Economic Forum at Davos, Switzerland states that 62 people have the same wealth as half the world, 3.6 billion people. It was 338 people in 2010, five years ago.

*CNN, 'The 62 RICHEST PEOPLE HAVE AS MUCH WEALTH AS HALF THE WORLD", Jan. 18, 2016.

http://money.cnn.com/2016/01/17/news/economy/oxfam-wealth/

The world's 62 richest billionaires have as much wealth as the bottom half of the world's population, according to a new report from Oxfam International.

>The wealthiest have seen their net worth soar over the five years ending in 2015. Back in 2010, it took 388 mega-rich people to own as much as half the world.

>And the Top 1% own more than everyone else combined -- a milestone reached in 2015, a year earlier than Oxfam had predicted.

Oxfam released its annual report ahead of the World Economic Forum in the Swiss city of Davos, a yearly gathering of political and financial leaders. The study draws from the Forbes annual list of billionaires and Credit Suisse's Global Wealth Databook.

Related: How Hillary Clinton wants to make the rich pay their 'fair share'

The anti-poverty group, whose leader co-chaired the forum last year, wants to call even more attention to the widening wealth divide. The top 62 saw their net worth rise by more half a trillion dollars between 2010 and 2015, while the 3.6 billion people in the bottom >half of the heap lost a trillion dollars.

Each group has $1.76 trillion.

>>"Wealth is moving rapidly to concentrate at the tippy, tippy top of the pyramid," said Gawain Kripke, the director of policy and research at Oxfam America.

>The income gap between the richest and poorest is also growing. The poorest 20% of the world -- who live below the extreme poverty line, living on less than $1.90 a day -- barely saw their incomes budge between 1988 and 2011, while the most prosperous 10% enjoyed a 46% jump.

"The global economy is not working to pull these people out of extreme poverty," said Deborah Hardoon, Oxfam's deputy head of research.

A separate report published last year by the Pew Research Center found that poverty worldwide has fallen by nearly half over the past decade. Still, 71% of the world's population remain low-income or poor, living off $10 or less a day.

>As for a global middle class, Pew called it more promise than reality. While the middle class has nearly doubled over the decade to 13% in 2011, it still represents a small fraction of the world's population.

Related: The rich are paying more in taxes, but not as much as they once were

>To help counter inequality, Oxfam is renewing its call for global leaders to crack down on tax havens, where the rich have socked away $7.6 trillion, the group estimates.

>Other things Oxfam is advocating: pay workers a living wage and protect workers' right to unionize; end the gender pay gap and promote equal inheritance and land rights for women; minimize the power of big business and lobbyists on governments; shift the tax burden away from labor and consumption and towards wealth and capital gains, and use public spending to tackle inequality.

appalachiablue

(41,168 posts)

JP Morgan CEO Jamie Dimon

USA Today, Jan. 22, 2016

Even as Wall Street braces for more cuts to jobs and bonuses, JPMorgan Chase CEO Jamie Dimon was paid $27 million in 2015, up from $20 million the year before, the company said Thursday.

The pay raise comes after JPMorgan announced record annual profits last week, thanks to cost-cutting that helped to offset stagnating revenue growth.

JPMorgan's board paid Dimon a $1.5 million salary, a $5 million cash bonus and $20.5 million in performance-based stock grants, the company said in a regulatory filing.

Last year, Dimon was paid a $7.4 million cash bonus and $11.1 million in stock awards. His $1.5 million salary has remained unchanged.

This year's stock grants are tied to new, three-year performance metrics. This could could help alleviate criticisms, which bubbled up last year, that Dimon's pay is not properly tied to performance.

JPMorgan "is now one of the few, if not the only, large financial institution that does not tie any element of CEO pay to achievement of goals for a specific metric or metrics," proxy advisory firm ISS said last year ahead of a controversial shareholder vote on the bank's pay.

Banks emerged from a tough 2015 only to face worsening conditions this year, including rising costs tied to souring energy loans.

As a result, bank CEOs are expected to take the ax to personnel costs — their single largest expense — as they scout for new ways to boost profits.

Morgan Stanley and Bank of America have already said they are planing to slash expenses this year through either layoffs or by moving jobs to cheaper cities.

In 2015, JPMorgan cut staff by 3%, or 6,761 jobs. Compensation costs at the New York bank fell by 1% last year.

http://www.msn.com/en-us/money/companies/jpmorgan-ceo-gets-a-35-percent-pay-raise-amid-cutbacks/ar-BBoxMnv

appalachiablue

(41,168 posts)Last edited Fri Jan 22, 2016, 09:37 PM - Edit history (1)

*Jan. 2016, WEF: Vice Pres. BIDEN on Dangers of Rising Inequality, Middle Class Loss, Tax Code. World Econ. Forum Davos, Switz.

appalachiablue

(41,168 posts)Last edited Fri Jan 22, 2016, 11:30 PM - Edit history (1)

* RICHEST 62 PEOPLE WEALTHY AS HALF OF WORLD'S POPULATION, SAYS OXFAM *

The Guardian, Jan. 18, 2016.

The vast and growing gap between rich and poor has been laid bare in a new Oxfam report showing that the 62 richest billionaires own as much wealth as the poorer half of the world’s population.

>Timed to coincide with this week’s gathering of many of the super-rich at the annual World Economic Forum in Davos, the report calls for urgent action to deal with a trend showing that 1% of people own more wealth than the other 99% combined.

Oxfam said that the wealth of the poorest 50% dropped by 41% between 2010 and 2015, despite an increase in the global population of 400m. In the same period, the wealth of the richest 62 people increased by $500bn (£350bn) to $1.76tn. Number of female billionaires increases sevenfold in 20 years. The charity said that, in 2010, the 388 richest people owned the same wealth as the poorest 50%. This dropped to 80 in 2014 before falling again in 2015.

>Mark Goldring, the Oxfam GB chief executive, said: “It is simply unacceptable that the poorest half of the world population owns no more than a small group of the global super-rich – so few, you could fit them all on a single coach.

>“World leaders’ concern about the escalating inequality crisis has so far not translated into concrete action to ensure that those at the bottom get their fair share of economic growth. In a world where one in nine people go to bed hungry every night, we cannot afford to carry on giving the richest an ever bigger slice of the cake.”

Leading figures from Pope Francis to Christine Lagarde, the managing director of the International Monetary Fund, have called for action to reverse the trend in inequality, but Oxfam said words had not been translated into action. Its prediction that the richest 1% would own the same wealth as the poorest 50% by 2016 had come true a year earlier than expected.

>The World Economic Forum in Davos comes amid fears that the turmoil in financial markets since the turn of the year may herald the start of a new phase to the global crisis that began eight years ago – this time originating in the less-developed emerging countries.

>Oxfam said a three-pronged approach was needed: a crackdown on tax dodging; higher investment in public services; and higher wages for the low paid. It said a priority should be to close down tax havens, increasingly used by rich individuals and companies to avoid paying tax and which had deprived governments of the resources needed to tackle poverty and inequality.

Three years ago, David Cameron told the WEF that the UK would spearhead a global effort to end aggressive tax avoidance in the UK and in poor countries, but Oxfam said promised measures to increase transparency in British Overseas Territories and Crown Dependencies, such as the Cayman Islands and British Virgin Islands, had not been implemented.

Goldring said: “We need to end the era of tax havens which has allowed rich individuals and multinational companies to avoid their responsibilities to society by hiding ever increasing amounts of money offshore. “Tackling the veil of secrecy surrounding the UK’s network of tax havens would be a big step towards ending extreme inequality. Three years after he made his promise to make tax dodgers ‘wake up and smell the coffee’, it is time for David Cameron to deliver.” Oxfam cited estimates that rich individuals have placed a total of $7.6tn in offshore accounts, adding that if tax were paid on the income that this wealth generates, an extra $190bn would be available to governments every year.

The charity said as much as 30% of all African financial wealth was thought to be held offshore. The estimated loss of $14bn in tax revenues would be enough to pay for healthcare for mothers and children that could save 4 million children’s lives a year and employ enough teachers to get every African child into school.

>Oxfam said it intended to challenge the executives of multi-national corporations in Davos on their tax policies. It said nine out of 10 WEF corporate partners had a presence in at least one tax haven and it was estimated that tax dodging by multinational corporations costs developing countries at least $100bn every year. Corporate investment in tax havens almost quadrupled between 2000 and 2014. The Equality Trust, which campaigns against inequality in the UK, said Britain’s 100 richest families had increased their wealth by at least £57bn since 2010, a period in which average incomes declined.

>Duncan Exley, the trust’s director, said: “Inequality, both globally but also in the UK, is now at staggering levels. We know that such a vast gap between the richest and the rest of us is bad for our economy and society. We now need our politicians to wake up and >>address this dangerous concentration of wealth and power in the hands of so few.”

*Much More: http://www.theguardian.com/business/2016/jan/18/richest-62-billionaires-wealthy-half-world-population-combined

laundry_queen

(8,646 posts)have a new personality disorder named after them.