General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsPresident Obama’s Financial Fraud Enforcement Task Force STRIKES AGAIN! $200 Million Fraud

by War on Error

This is the real reason the 1% hate Obama. Unlike BushCo, Obama and Holder, along with the FBI are busting these criminals right and left. Crime has paid for too long. We have to end the corruption in America.

Keep in mind, Lanny Breuer is the DOJ Assistant Attorney General that Issa wanted Eric Holder to have resign. Very telling, Mr. Issa, very telling.*

Three Former Executives Convicted for Roles in $200 Million Fraud Scheme Involving Fair Financial Company Investors

Following an eight-day trial, a federal jury in the Southern District of Indiana returned its verdict late yesterday. Timothy S. Durham, 49, the former chief executive officer of Fair, was convicted of one count of conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud. James F. Cochran, 56, the former chairman of the board of Fair, was convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud. Rick D. Snow, 48, the former chief financial officer of Fair, was convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

“Mr. Durham and his co-conspirators used lies and deceit as their business model,” said Assistant Attorney General Breuer. “They duped investors into thinking they were running a legitimate financial services company and misled regulators and others about the health of their failing firm. But all along, they were lining their pockets with other people’s money. The jury held them accountable for their crimes, and they each now face the prospect of significant prison time.”

“No matter who you are, no matter how much money you have, no matter how powerful your friends are, no one is above the law,” U.S. Attorney Hogsett said. “The office of the United States Attorney will not stand idly by to allow a culture of corruption to exist in this community, this state, or this country. The decision made in this courtroom sends a powerful warning that if you sacrifice the truth in the name of greed, if you steal from another’s American dream to try to make your own, you will be caught.”

It's not the first Financial Fraud conviction, either.

You can view the pages of Million Dollar Fraud Schemes at the FBI's website. Click here.

Below are a few examples of just how sick and wrong the criminal minds work, proving that the FBI and the DOJ MUST be given the resources to stop these Million Dollar Fraudsters.

But first, we must look at another IRRESPONSIBLE TACTIC used by the Bush Administration. The FBI Whitecollar Crime Division was gutted by BushCo, resulting in the near destruction of the World's Economy!

<...>

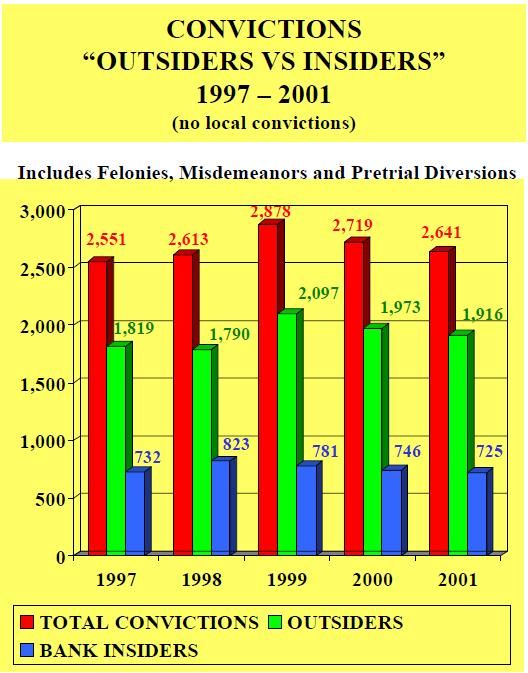

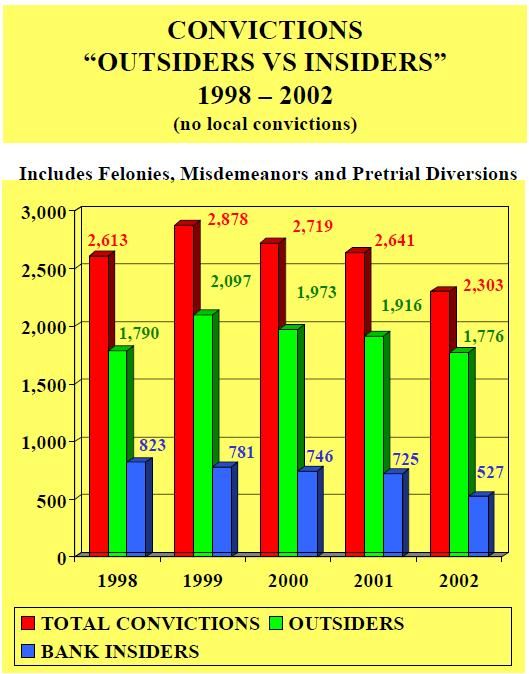

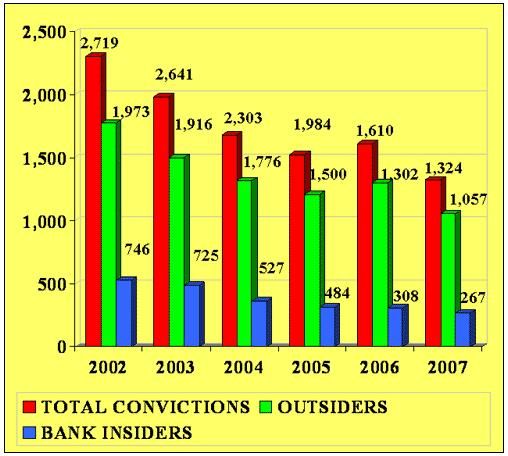

CHARTS SHOWING THE INCREASE IN TAKING DOWN THE CRIMINALS

First, the Bush Administrations abysmal record:

THE IMPROVEMENTS ARE EASY TO SEE:

Charts are found within Financial Crimes Report to the Public, Fiscal Years 2010-2011 (October 1, 2009 – September 30, 2011)

During FY 2011, cases pursued by the FBI resulted in 242 indictments/informations and 241 convictions of corporate criminals.

<...>

<...>

- more -

http://www.dailykos.com/story/2012/06/22/1102296/-President-Obama-s-Financial-Fraud-Enforcement-Task-Force-STRIKES-AGAIN-200-Million-Fraud

Another valuable link: http://www.stopfraud.gov/news-index.html

banned from Kos

(4,017 posts)I almost went back and signed on to rec.

Tarheel_Dem

(31,234 posts)lamp_shade

(14,836 posts)ProSense

(116,464 posts)freshwest

(53,661 posts)HooptieWagon

(17,064 posts)But its like busting street level pushers while the Wall St Cartel heads are still free.

banned from Kos

(4,017 posts)The deals, bonds, mortgages, foreclosures, etc were all signed by underlings.

Quit listening to Taibbi and other know-nothings.

abelenkpe

(9,933 posts)spanone

(135,843 posts)malaise

(269,026 posts)Hmmmmmmmmmmmmmmm

LoisB

(7,206 posts)many callers to talk shows deride both President Obama and A.G. Holder for not doing anything about Wall Street crime. They ARE!!

malaise

(269,026 posts)It's crazy

freshwest

(53,661 posts)Time for change

(13,714 posts)administrations, or even going back earlier? I think that would be very interesting.

brentspeak

(18,290 posts)http://latimesblogs.latimes.com/money_co/2011/11/federal-financial-fraud-prosecutions-tumble-to-lowest-level-in-20-years.html

Federal financial fraud prosecutions tumble to lowest level in 20 years

Financial criminals are facing the lowest number of federal prosecutions in at least 20 years, according to a new report.

The government has filed 1,251 new prosecutions against financial institution fraud so far this fiscal year, according to the Transactional Records Access Clearinghouse at Syracuse University. If the same pace holds, federal attorneys will file 1,365 such cases by the end of the year –- the lowest number since at least 1991.

The report, compiled from Justice Department data gleaned through the Freedom of Information Act, considers crimes involving crooked mortgage brokers, bank executives with something to hide and accounts hiding illegal activity.

The expected volume of prosecutions by the end of 2011 would be 2.4% smaller than that of last year, 28.6% thinner than that of five years ago and less than half the amount from a decade ago. The number of federal bank fraud cases has slipped every year since 1999.

http://economix.blogs.nytimes.com/2011/11/15/prosecutions-for-bank-fraud-fall-sharply/

Prosecutions for Bank Fraud Fall Sharply

Federal prosecutions for financial institution fraud have tumbled over the last decade, despite the recent troubles in the banking sector, according to a new analysis of Justice Department data by the Transactional Records Access Clearinghouse (TRAC) at Syracuse University.

This category can refer to crimes committed both within and against banks. Defendants include bank executives who mislead regulators, mortgage brokers who falsify loan documents, and consumers who write bad checks. (Here are some recent cases of bank fraud prosecutions.)

During the first 11 months of the 2011 fiscal year, the federal government filed 1,251 new prosecutions for financial institution fraud. If that pace continues, TRAC projects a total of 1,365 prosecutions for the fiscal year. That’s less than half the total a decade ago.

The decline in these new cases stands in contrast to the government’s broader approach to federal criminal prosecutions. Federal prosecutions for other crimes have grown tremendously, with the number of total new prosecutions filed for all federal crimes nearly doubling over the last decade.

banned from Kos

(4,017 posts)read your own dog food label.

freshwest

(53,661 posts)girl gone mad

(20,634 posts)is false if interpreted as an assertion that the decrease in bank fraud prosecutions reflect a decline in bank control frauds over the preceding years.

Have our standards really fallen this far?

banned from Kos

(4,017 posts)Time for change

(13,714 posts)What I read is "Prosecutions for Bank Fraud Fall Sharply".

There is a footnote at the bottom that says that such prosecutions include fraud within and against banks. Do you believe that any substantial portion of the bank fraud prosecutions noted in the chart apply to fraud against banks? If so, where do you get that information?

freshwest

(53,661 posts)girl gone mad

(20,634 posts)As I said, your assertion that control fraud diminished in the years preceding the decline in prosecutions is completely false.

Autumn

(45,102 posts)"crimes involving crooked mortgage brokers, bank executives with something to hide and accounts hiding illegal activity." I'm curious about the last one, accounts hiding illegal activity and how many prosecutions against consumers who write bad checks.

JNelson6563

(28,151 posts)Time for change

(13,714 posts)You have provided no information to show that prosecutions or convictions for financial fraud have improved under the Obama administration.

To the contrary, poster # 11 shows data indicating just the opposite -- that financial institution fraud prosecutions have reached new lows under the Obama administration -- despite the widely known criminal behavior of financial institutions during this period.

goclark

(30,404 posts)Keep it coming!

HiPointDem

(20,729 posts)that crashed the economy.

hobbit709

(41,694 posts)ProSense

(116,464 posts)"I'll be more impressed when they stop going after the small potatoes and go after the banksters"

..."small potatoes" count.

Former Chief Investment Officer of Stanford Financial Group Pleads Guilty to Obstruction of Justice

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-785.html

Former Corporate Chairman of Consulting Firm and Board Director Rajat Gupta Found Guilty of Insider Trading in Manhattan Federal Court

http://www.stopfraud.gov/iso/opa/stopfraud/NYS-120615.html

Hedge Fund Founder Raj Rajaratnam Sentenced in Manhattan Federal Court to 11 Years in Prison for Insider Trading Crimes

http://www.stopfraud.gov/news/news-10132011.html

CEO and Head Trader of Bankrupt Sentinel Management Indicted in Chicago in Alleged $500 Million Fraud Scheme Prior to Firm’s 2007 Collapse

http://www.stopfraud.gov/iso/opa/stopfraud/ILN-120601.html

Yahoo! Executive and California Hedge Fund Portfolio Manager Plead Guilty in New York for Insider Trading

http://www.stopfraud.gov/iso/opa/stopfraud/NYS-120521.html

Three Former Financial Services Executives Convicted for Roles in Conspiracies Involving Investment Contracts for the Proceeds of Municipal Bonds

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-at-620.html

Former Chairman of Taylor, Bean & Whitaker Sentenced to 30 Years in Prison and Ordered to Forfeit $38.5 Million

http://www.stopfraud.gov/news/news-06302011-2.html

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-342.html

Former Chief Financial Officer of Taylor, Bean & Whitaker Pleads Guilty to Fraud Scheme

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-342.html

Seattle Investment Fund Founder Sentenced to 18 Years in Prison for Ponzi Scheme and Bankruptcy Fraud

http://www.stopfraud.gov/iso/opa/stopfraud/WAW-120210.html

Former Hedge Fund Managing Director Sentenced to 20 Years for Defrauding 900 Investors in $294 Million Scheme

http://www.stopfraud.gov/iso/opa/stopfraud/ILN-111117.html

These hedge funds, or "small potatoes," reeked havoc on the economy during the last decade.

HiPointDem

(20,729 posts)Time for change

(13,714 posts)You refer to the Bush administration's "abysmal record", yet you offer no explanation for how you arrive at the conclusion that his record is abysmal. I don't doubt that it is abysmal, compared to previous administrations, but the chart you show makes no comparisons with any other administrations, as it stops at 2007.

As for Obama's record, all you do is show charts of "fraud pending cases". Those charts mean nothing. Obviously, a large proportion of cases originating in 2007 will no longer be pending today, because we've had 5 years to resolve them, one way or the other -- even if they were resolved by means of the Obama administration dropping them.

The only chart that I see that makes a comparison of prosecutions for bank fraud by different administration is the one provided by brentspeak. That chart shows bank prosecutions declining substantially during the Bush administration, and then declining further, to the lowest levels in 20 years, in three years of the Obama administration.

Do you think that the fact that Obama's main source of campaign contributions come from the financial industry is unrelated to that?

ProSense

(116,464 posts)As for Obama's record, all you do is show charts of "fraud pending cases". Those charts mean nothing. Obviously, a large proportion of cases originating in 2007 will no longer be pending today, because we've had 5 years to resolve them, one way or the other -- even if they were resolved by means of the Obama administration dropping them.

The only chart that I see that makes a comparison of prosecutions for bank fraud by different administration is the one provided by brentspeak. That chart shows bank prosecutions declining substantially during the Bush administration, and then declining further, to the lowest levels in 20 years, in three years of the Obama administration.

...the information at the original link offers plenty to support that fact that Bush's record is "abysmal." If you don't "doubt that it is," why do you reject that information in search of more justification? You seem upset that Bush was worse than Obama.

The chart you cite shows prosecutions, not convictions. It's also not conclusive because it doesn't state what specifically it includes and appears to be related to bank fraud. Here's the reference:

This category can refer to crimes committed both within and against banks. Defendants include bank executives who mislead regulators, mortgage brokers who falsify loan documents, and consumers who write bad checks. (Here are some recent cases of bank fraud prosecutions.)

Goldman Sachs is not a bank. Still, even if it is bank fraud, it does offer more evidence of Bush's "abysmal" record, as these prosecutions dropped significantly during his Presidency.

The following is from the Financial Institution Fraud and Failure Reports for each fiscal year.

http://www.fbi.gov/stats-services/publications/fiff_00-01

http://www.fbi.gov/stats-services/publications/fiff-2002

(b): Types of Subjects Convicted in FIF Cases During FY 2007*

SUBJECT TYPE NUMBER OF SUBJECTS

Legal Alien 8

Illegal Alien 20

All Other Subjects 1,038

Bank Officer 88

Bank Employee 179

International or National Union Officer 1

President 1

Business Manager 2

Office Manager 2

Financial Secretary 1

Federal Employee - GS 12 & Below 1

State - All Others 1

Local Law Enforcement Officer 1

City Councilman 1

Possible Terrorist Member or Sympathizer 1

Company or Corporation 7

Local - All Others 2

Total 1,354

http://www.fbi.gov/stats-services/publications/fiff_06-07/fiff_06-07

http://www.fbi.gov/stats-services/publications/fiff_06-07/fiff_06-07

Remember this from the information you cited:

Given the charts directly above and the break out for 2007, it appears that most of the convictions were not bank executives. In fact, the majority were bank "outsiders," likely meaning more bad-check writers and document falsifiers.

Also, bank fraud is separate from corporate fraud, mortgage fraud, and securities and commodities fraud.

The following is from the Financial Crimes Report to the Public for each fiscal year:

(Note: The 2005 report does not break out securities and commodities fraud. The 2010-2011 report is the only one that breaks out financial institution fraud. All reports show corporate fraud and mortgage fraud.)

http://www.fbi.gov/stats-services/publications/fcs_report2005/fcs_2005#CORPORATE

http://www.fbi.gov/stats-services/publications/fcs_report2005/fcs_2005#MORTGAGE

_________

http://www.fbi.gov/stats-services/publications/fcs_report2006

http://www.fbi.gov/stats-services/publications/fcs_report2006/financial-crimes-report-to-the-public-fiscal-year-2006#Securities

http://www.fbi.gov/stats-services/publications/fcs_report2006/financial-crimes-report-to-the-public-fiscal-year-2006#Mortgage

___________

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#corporate

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#securities

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#mortgage

______________

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#corporate

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#securities

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#mortgage

____________

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#securities

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#mortgage

_____________

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Corporate

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Securities

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Financial-ins

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Mortgage

Pending cases are important because they can still result in convictions.

Time for change

(13,714 posts)fraud between the Obama adminisration and ANY other presidential administration.

I don't want to see a hundred pages of links. Just show us ONE comparison. Just ONE.

ProSense

(116,464 posts)fraud between the Obama adminisration and ANY other presidential administration.

I don't want to see a hundred pages of links. Just show us ONE comparison. Just ONE.

Use the data provided and make your own. I suspect you don't want to "see" that Obama is not worse than Bush ("ANY other presidential administration"

BTW, the data smacks down the bullshit talking points.

Time for change

(13,714 posts)You provide no data to support what you say.

I would like to see Obama have a good record on prosecuting bank fraud. I would love to see that. But I don't appreciate people making stuff up like you do.

ProSense

(116,464 posts)You provide no data to support what you say.

I would like to see Obama have a good record on prosecuting bank fraud. I would love to see that. But I don't appreciate people making stuff up like you do.

...say anything nonsense. You have no response. As for the rest, bullshit!

Time for change

(13,714 posts)Your response to my request to do so is for me to make the chart myself -- from the data that you DID NOT provide.

What a transparent copout.