Wholesale prices fell 0.1% in August amid inflation fears

Last edited Wed Sep 14, 2022, 07:24 PM - Edit history (1)

Source: CNBC

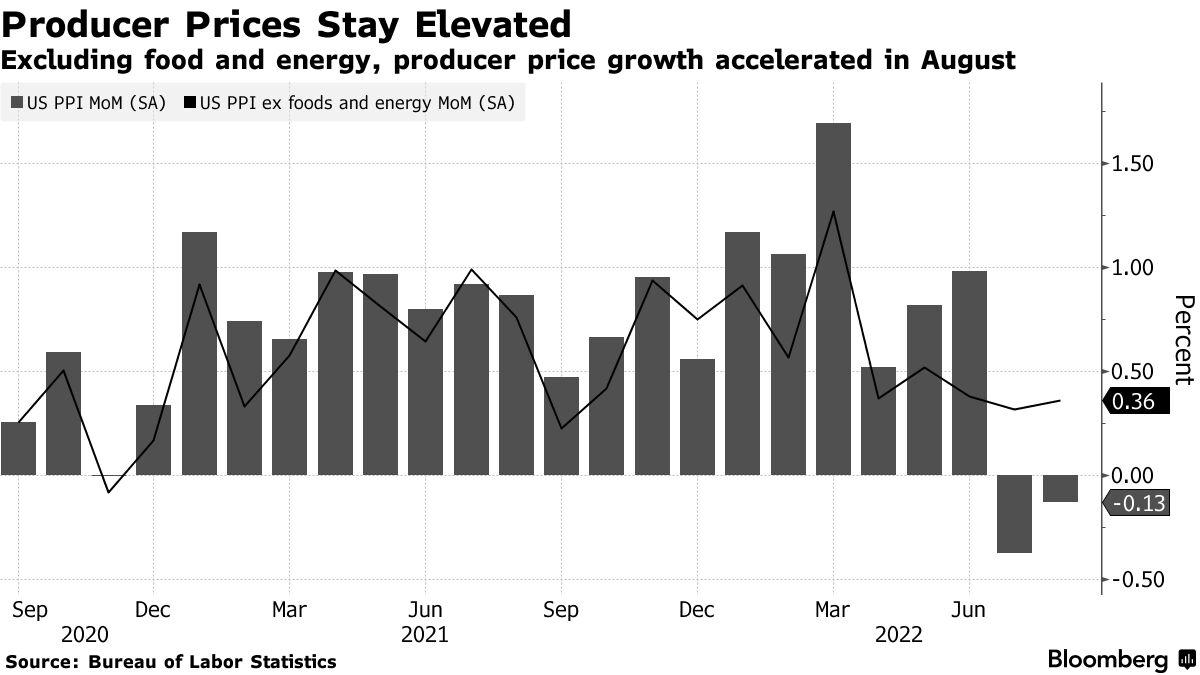

The prices that producers receive for goods and services declined in August, a mild respite from inflation pressures that are threatening to send the U.S. economy into recession. The producer price index, a gauge of prices received at the wholesale level, declined 0.1%, according to a Bureau of Labor Statistics report Wednesday. Excluding food, energy and trade services, PPI increased 0.2%. Economists surveyed by Dow Jones had been expecting headline PPI to decline 0.1%.

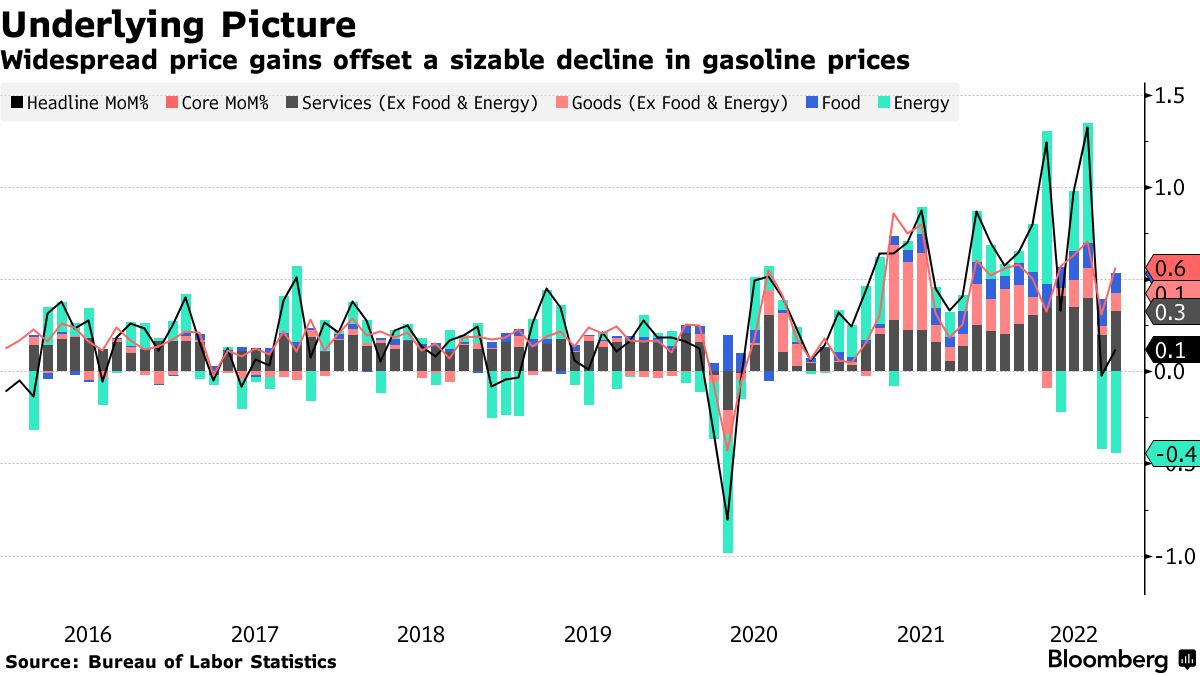

On a year-over-year basis, headline PPI increased 8.7%, a substantial pullback from the 9.8% increase in July and the lowest annual rise since August 2021. Core PPI increased 5.6% from a year ago, matching the lowest rate since June 2021. As has been the case over the summer, the drop in prices came largely from a decline in energy. The index for final demand energy slid 6% in August, which saw a 12.7% slide in the gasoline index that was responsible for more than three-quarters of the 1.2% decline in prices for final demand goods.

That helped feed through to consumer prices, which fell sharply after briefly surpassing $5 a gallon at the pump earlier in the summer. Wholesale services prices increased 0.4% for the month, indicating a further transition for a pandemic-era economy where goods inflation soared. Final demand services prices increased 0.4% for the month, with the balance of that coming from a 0.8% increase in trade services.

Those numbers come a day after the BLS reported consumer price index data for August that was higher than expected. The two reports differ in that the PPI shows what producers receive for finished goods, while the CPI reflects what consumers pay in the marketplace. The PPI can be leading indicator for inflation as wholesale prices feed through the economy. However, it's importance has been tempered over the years as manufactured goods make up less of a share of total spending.

Read more: https://www.cnbc.com/2022/09/14/producer-price-index-august-2022.html

Link to tweet

@BLS_gov

·

Follow

PPI for final demand declines 0.1% in August; goods fall 1.2%, services increase 0.4% https://bls.gov/news.release/ppi.nr0.htm

#PPI #BLSdata

8:30 AM · Sep 14, 2022

Wanted to slide this in from a Bloomberg article - https://www.bloomberg.com/news/articles/2022-09-14/us-producer-prices-fall-for-a-second-month-as-fuel-costs-retreat

And from their take on the CPI yesterday - https://www.bloomberg.com/news/articles/2022-09-13/us-inflation-tops-forecasts-cementing-odds-of-big-fed-hike

Article updated. Last update -

Economists surveyed by Dow Jones had been expecting headline PPI to decline 0.1% and core to rise 0.3%. On a year-over-year basis, headline PPI increased 8.7%, a substantial pullback from the 9.8% increase in July and the lowest annual rise since August 2021. Core PPI increased 5.6% from a year ago, matching the lowest rate since June 2021.

As has been the case over the summer, the drop in prices came largely from a decline in energy. The index for final demand energy slid 6% in August, which saw a 12.7% slide in the gasoline index. That helped feed through to consumer prices, which fell sharply after briefly surpassing $5 a gallon at the pump earlier in the summer.

Those numbers come a day after the BLS reported consumer price index data for August that was higher than expected. The two reports differ in that the PPI shows what producers receive for finished goods, while the CPI reflects what consumers pay in the marketplace.

Original article -

The producer price index, a gauge of prices received at the wholesale level, declined 0.1%, according to a Bureau of Labor Statistics report Wednesday. Excluding food, energy and trade services, core PPI increased 0.2%.

Economists surveyed by Dow Jones had been expecting headline PPI to decline 0.1% and core to rise 0.3%.

This is breaking news. Please check back here for updates.

Fullduplexxx

(7,870 posts)The Protagonist

(74 posts)Well done, Mr. President!