U.S. payrolls surged by 261,000 in October, better than expected as hiring remains strong

Source: CNBC

Job growth was stronger than expected in October despite Federal Reserve interest rate increases aimed at slowing what is still a strong labor market.

Nonfarm payrolls grew by 261,000 for the month while the unemployment rate moved higher to 3.7%, the Labor Department reported Friday. Those payroll numbers were better than the Dow Jones estimate for 205,000 more jobs, but worse than the 3.5% estimate for the unemployment rate.

Average hourly earnings grew 4.7% from a year ago and 0.4% for the month, indicating that wage growth is still likely to pressure inflation. The yearly growth met expectations while the monthly gain was slightly ahead of the 0.3% estimate.

(snip)

The new figures come as the Fed is on a campaign to bring down inflation running at an annual rate of 8.2%, according to one government gauge. Earlier this week, the central bank approved its fourth consecutive 0.75 percentage point interest rate increase, taking benchmark borrowing rates to a range of 3.75%-4%.

Read more: https://www.cnbc.com/2022/11/04/jobs-report-october-2022-.html

And... "expected" 200K or less, and a

Stay tuned for our monthly analysis from DU's economic monitors!

From the source:

Link to tweet

@BLS_gov

·

Follow

Payroll employment increases by 261,000 in October; unemployment rate rises to 3.7% https://bls.gov/news.release/empsit.nr0.htm

#JobsReport #BLSdata

8:30 AM · Nov 4, 2022

Original article (and OP updated) -

This is breaking news. Please check back here for updates.

ADDITIONAL

Alexandra Semenova·Reporter

Fri, November 4, 2022 at 8:32 AM·1 min read

The U.S. economy added more jobs than expected in October, even as the Federal Reserve pressed on with its most aggressive monetary tightening campaign in decades.

Here are the highlights from the Labor Department's monthly jobs report released Friday, compared to consensus estimates from Bloomberg:

Non-farm payrolls: +261,000 vs. +195,000 expected Unemployment rate: 3.7% vs. 3.6% expected Average hourly earnings, month-over-month: +0.4% vs. +0.3% expected Average hourly earnings, year-over-year: +4.7% vs. +4.7% expected

https://finance.yahoo.com/news/october-jobs-report-november-4-2022-202231255.html

mahatmakanejeeves

(61,729 posts)Fri Nov 4, 2022: Links to earlier reports: (this one)

Wed Nov 2, 2022: Links to earlier reports:

Fri Oct 7, 2022: Links to earlier reports:

Wed Oct 5, 2022: Links to earlier reports:

Fri Sep 2, 2022: Links to earlier reports:

Wed Aug 31, 2022: Links to earlier reports:

Fri Aug 5, 2022: Links to earlier reports:

Wed Aug 3, 2022: ADP has suspended its report until September.

Fri Jul 8, 2022: Links to earlier reports:

Wed Jul 6, 2022: ADP has suspended its report until September.

Fri Jun 3, 2022: Links to earlier reports:

Wed Jun 1, 2022: Links to earlier reports:

Fri May 6, 2022: Links to earlier reports

Wed May 4, 2022: Links to earlier reports:

Fri Apr 1, 2022: Links to earlier reports:

Wed Mar 30, 2022: Links to earlier reports:

Fri Mar 4, 2022: Links to earlier reports:

Wed Mar 2, 2022: Links to earlier reports:

Fri Feb 4, 2022: Links to earlier reports:

Wed Feb 2, 2022: Links to earlier reports:

Wed Jan 12, 2022: Links to earlier reports:

Wed Jan 5, 2022: Links to earlier reports:

Sat Dec 4, 2021: Links to earlier reports:

Wed Dec 1, 2021: Links to additional earlier reports:

Fri Nov 5, 2021: (I had to split the links into two posts, due to "Forbidden 403" issues)

Links to earlier reports:

Links to additional earlier reports:

Wed Nov 3, 2021: Links to earlier reports:

Fri Oct 8, 2021: Links to earlier reports:

Wed Oct 6, 2021: Links to earlier reports:

Fri Sep 3, 2021: Links to earlier reports:

Thu Sep 2, 2021 (in the Friday, August 6, BLS thread): Links to earlier reports:

Wed Aug 4, 2021: Links to earlier reports:

-- -- -- -- -- --

[center]Past Performance is Not a Guarantee of Future Results.[/center]

Bureau of Labor Statistics, for employment in October 2022 (this one):

U.S. payrolls surged by 261,000 in October, better than expected as hiring remains strong

ADP® (Automatic Data Processing), for employment in October 2022:

Private payrolls rose 239,000 in October, better than expected, while wages increased 7.7%, ADP says

Bureau of Labor Statistics, for employment in September 2022:

Jobs report: U.S. payrolls grew by 263,000 in September, unemployment rate falls to 3.5%

ADP® (Automatic Data Processing), for employment in September 2022:

Businesses added 208,000 jobs in September, better than expected, ADP reports

Bureau of Labor Statistics, for employment in August 2022:

August jobs report: U.S. payrolls grew by 315,000 last month

ADP® (Automatic Data Processing), for employment in August 2022:

Private payrolls grew by just 132,000 in August, ADP says in reworked jobs report

Bureau of Labor Statistics, for employment in July 2022:

Employers added 528,000 jobs in July, as the hot labor market powers on

ADP® (Automatic Data Processing), for employment in July 2022:

ADP has suspended its report until September.

Bureau of Labor Statistics, for employment in June 2022:

June jobs report: Payrolls rise by 372,000 as unemployment holds at 3.6%

ADP® (Automatic Data Processing), for employment in June 2022:

ADP has suspended its report until September.

Bureau of Labor Statistics, for employment in May 2022:

May jobs report: Payrolls rise by 390,000 as unemployment holds at 3.6%

ADP® (Automatic Data Processing), for employment in May 2022:

U.S. Treasury yields fall as data show slowest job growth in pandemic recovery

Bureau of Labor Statistics, for employment in April 2022:

April jobs report: Payrolls rise by 428,000 as unemployment rate holds at 3.6%

[ADP® (Automatic Data Processing), for employment in April 2022:

U.S. Companies Added 247,000 Jobs in April, ADP Data Show

Bureau of Labor Statistics, for employment in March 2022:

U.S. economy adds 431,000 jobs in March

ADP® (Automatic Data Processing), for employment in March 2022:

Private payrolls rose by 455,000 in March, topping expectations: ADP

Bureau of Labor Statistics, for employment in February 2022:

February jobs report: Payrolls rise by 678,000 as unemployment rate falls to 3.8%

ADP® (Automatic Data Processing), for employment in February 2022:

Private payrolls rose by 475,000 in February, topping expectations: ADP

Bureau of Labor Statistics, for employment in January 2022:

January jobs report: Payrolls jump by 467,000 as unemployment rate rises to 4.0%

ADP® (Automatic Data Processing), for employment in January 2022:

Companies unexpectedly cut 301,000 jobs in January as omicron slams jobs market, ADP says

Bureau of Labor Statistics, for employment in December 2021:

December jobs report: Payrolls rise by 199,000 as unemployment rate falls to 3.9%

ADP® (Automatic Data Processing), for employment in December 2021:

December private payrolls rose by 807,000, far exceeding expectations: ADP

Bureau of Labor Statistics, for employment in November 2021:

U.S. economy adds just 210,000 jobs in November

ADP® (Automatic Data Processing), for employment in November 2021:

November private payrolls rose by 534,000 topping expectations: ADP

Nonetheless, what is important is not this month's results, but the trend. Let’s look at some earlier numbers:

ADP® (Automatic Data Processing), for employment in November 2021:

November private payrolls rose by 534,000 topping expectations: ADP

Bureau of Labor Statistics, for employment in October 2021:

October jobs report: Payrolls grew by 531,000 as unemployment rate fell to 4.6%

ADP® (Automatic Data Processing), for employment in October 2021:

October private payrolls rose by 571,000, topping expectations: ADP

Bureau of Labor Statistics, for employment in September 2021:

Yahoo Finance September jobs report: Economy adds back disappointing 194,000 jobs, unemployment rate

ADP® (Automatic Data Processing), for employment in September 2021

September private payrolls rose by 568,000, topping estimates: ADP

BumRushDaShow

(144,455 posts)Have updated the OP. CNBC was scooping this morning!

doc03

(36,990 posts)bad, need to get that unemployment up.

![]()

BumRushDaShow

(144,455 posts)progree

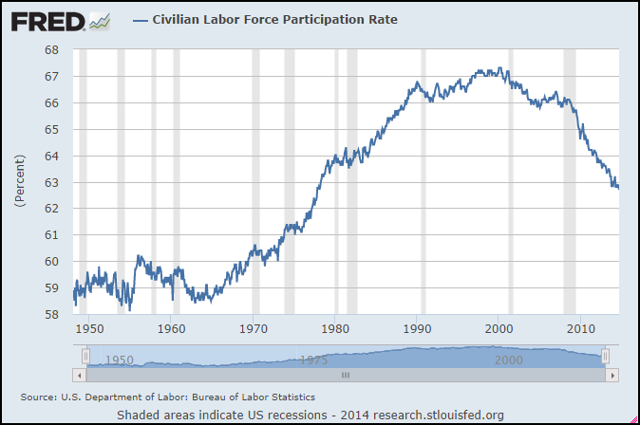

(11,463 posts)Labor Force Participation Rate dropped 0.1%, Unemployed increased by 306,000.

Usually when the unemployment rate rises unexpectedly it's because a lot of people joined the labor force (started looking for work in the past 4 weeks, thus they are counted in the unemployment rate and labor force stats). But this time unemployment rate rose despite a small exodus (22,000) from the labor force.

Table A (Household Survey Summary) - https://www.bls.gov/news.release/empsit.a.htm

Table B (Establishment Survey Summary) - https://www.bls.gov/news.release/empsit.b.htm

The whole enchilada -- http://www.bls.gov/news.release/pdf/empsit.pdf

I agree with Johnny2X2X it's a good report -- anything less than 4% unemployment rate has long been considered full employment, and the headlines job number increase of 261,000 (Establishment Survey) is a good increase, especially considering Powell trying to hammer that down for most of the year.

Addendum And the payroll job numbers for the previous 2 months (August and September) were revised up by a combined 29,000.

BumRushDaShow

(144,455 posts)from "the great resignation". You have a lot of job shuffling/disruptions going on (e.g., schools). There is actually a tech sector shakeout going on but then other sectors have picked up as people who have waited to travel/go on vacation post-covid, are picking up steam big time.

I think at some point, due to the extreme weather events over the summer and into fall (tornadoes, floods, hurricanes), and with the Infrastructure bill starting to kick in, there should be some kind of shift in the manufacturing and housing sectors.

progree

(11,463 posts)Year January February March etc. etc.

2021 --487 +175 +272 +347 --177 +313 +261 +130 --34 +139 +516 +168

2022 +1393 +304 +418 --363 +330 --353 --63 +786 --57 --22

The first 2 months of each year is subject to population controls.

I made the minuses into double minuses to stand out better

Note August's 786,000 increase (bolding added by me)

EDIT - these are seasonally adjusted number before someone starts carrying on about summer jobs or whatever.

Labor Force http://data.bls.gov/timeseries/LNS11000000?output_view=net_1mth

The labor force is the sum of employed and unemployed. To count as unemployed, one must have actively sought work in the past 4 weeks (just looking at want ads and job postings doesn't count)

BumRushDaShow

(144,455 posts)the 2022 LF "trend" looks to be going down, excluding that outlier figures.

Do they actually go back and revise earlier months for this indicator (am guessing they do)?

progree

(11,463 posts)I've mostly consoled myself looking at the LF participation rate of the prime age 25-54 http://data.bls.gov/timeseries/LNS11300060 (see #9 for lots of LFPR and Employment to Population Ratio links). The LFPR age 25-54 is about where it was pre-pandemic, excluding the last 4 months of 2019 and the first 2 months of 2020.

The regular LFPR, which is age 16 to infinity, not so well (https://data.bls.gov/timeseries/LNS11300000). I'm thinking its boomer retirements. But there are plenty of stories that age discrimination is even worse recently than before, and I'd think that there are a lot of not-too-old olds looking at their 401k's declining (S&P 500 down 22.4% from January 3 high) and the purchasing power of that being eroded even further. So I'm not comforted by thinking its mostly voluntary boomer retirement on the high-age end.

Something like every 3 or 5 years or somesuch. Maybe an annual one that's done every March? But not sooner than that. Not at all like the Establishment Survey (nonfarm payroll jobs) which they revise the previous 2 months every time.

BumRushDaShow

(144,455 posts)although the "boomer retirements" had been predicted and warned about (in some cases, in a hyperbolic way) for over 20 years, having expected to start some time in 2011 when the oldest boomers turned 65 (or 2008 for age 62). But then those predictions didn't materialize until almost a decade later - much of it apparently in direct relationship to the pandemic.

However you also have many boomers who are still in a "sandwich" phase where they have elderly parents and have near-grown or grown grandchildren, along with young great-grandchildren. So just that lifespan range has added to the financial needs for themselves, their parents, and their children (and later), and put some back into the workplace again. In this case, they seem to have attempted to pick and choose but that has now brought to light what you have mentioned - the ageism that has bubbled up.

As a side note of the LPR, I did find this from 2014, which offered an interesting "generational" perspective, and also did a dive into demographics of the LPR. Of course this was all pre-pandemic but I expect the underlying factors were and still are present.

And thanks for the info on revisions. I know obviously some releases need more updates based on the fact they are rolling submissions and some data had not been received when a report came out....

Johnny2X2X

(21,900 posts)Wage growth remains strong too. UE bouncing between 3.5% and 3.7% for a few months is basically full employment and then some.

News will either ignore this report or talk about how it's somehow bad for Dems.

IronLionZion

(47,157 posts)

Personally, I won't declare a recession until DUers accuse US citizens like me of being H1B.

It's kind of like back in the day when uppity women were obviously witches

Sancho

(9,109 posts)mahatmakanejeeves

(61,729 posts)The BLS had the numbers a few days ago.

Ace Rothstein

(3,302 posts)progree

(11,463 posts)Table B - Summary of Establishment Survey (produces the headline payroll jobs number and the average earnings) - https://www.bls.gov/news.release/empsit.b.htm

Every one of these data series comes with a table and graph:

# Nonfarm Employment (Establishment Survey, https://data.bls.gov/timeseries/CES0000000001

Monthly changes (in thousands): https://data.bls.gov/timeseries/CES0000000001?output_view=net_1mth

NOT SEASONALLY ADJUSTED: https://data.bls.gov/timeseries/CEU0000000001

# Employed in thousands from the separate Household Survey, http://data.bls.gov/timeseries/LNS12000000

Monthly changes (in thousands): http://data.bls.gov/timeseries/LNS12000000?output_view=net_1mth

NOT SEASONALLY ADJUSTED: https://data.bls.gov/timeseries/LNU02000000

# Nonfarm PRIVATE Employment (Establishment Survey, https://data.bls.gov/timeseries/CES0500000001

Monthly changes: https://data.bls.gov/timeseries/CES0500000001?output_view=net_1mth

^-Good for comparison to the ADP report that typically comes out a few days earlier

NOT SEASONALLY ADJUSTED: https://data.bls.gov/timeseries/CEU0500000001

# INFLATION ADJUSTED Weekly Earnings of Production and Non-Supervisory Workers http://data.bls.gov/timeseries/CES0500000031

# Labor Force http://data.bls.gov/timeseries/LNS11000000?output_view=net_1mth

The labor force is the sum of employed and unemployed. To count as unemployed, one must have actively sought work in the past 4 weeks (just looking at want ads and job postings doesn't count)

# ETPR (Employment-To-Population Ratio) aka Employment Rate http://data.bls.gov/timeseries/LNS12300000

# LFPR (Labor Force Participation rate) http://data.bls.gov/timeseries/LNS11300000

Unemployed, Unemployment Rate

# Unemployed http://data.bls.gov/timeseries/LNS13000000

# Unemployment rate http://data.bls.gov/timeseries/LNS14000000

# Black unemployment rate (%), https://data.bls.gov/timeseries/LNS14000006

# Hispanic or Latino unemployment rate (%), https://data.bls.gov/timeseries/LNS14000009

# White unemployment rate (%), https://data.bls.gov/timeseries/LNS14000003

# U-6 unemployment rate http://data.bls.gov/timeseries/LNS13327709

------------ end unemployed, unemployment rates --------

# NILF -- Not in Labor Forcehttp://data.bls.gov/timeseries/LNS15000000

# NILF-WJ -- Not in Labor Force, Wants Job http://data.bls.gov/timeseries/LNS15026639

# Part-Time Workers who want Full-Time Jobs (Table A-8's Part-Time For Economic Reasons) http://data.bls.gov/timeseries/LNS12032194

# Part-Time Workers (Table A-9) http://data.bls.gov/timeseries/LNS12600000

# Full-Time Workers (Table A-9) http://data.bls.gov/timeseries/LNS12500000

# Multiple Jobholders as a Percent of Employed (Table A-9) https://data.bls.gov/timeseries/LNS12026620

# Civilian non-institutional population

Seasonally adjusted (they seem to have gotten rid of this) https://data.bls.gov/timeseries/LNS10000000

NOT seasonally adjusted: https://data.bls.gov/timeseries/LNU00000000

LFPR - Labor Force Participation Rate for some age groups

The LFPR is the Employed + jobless people who have looked for work in the last 4 weeks (and say they want a job and are able to take one if offered). All divided by the civilian non-institutional population age 16+.

SA means Seasonally adjusted. NSA means Not Seasonally Adjusted

16+: SA: http://data.bls.gov/timeseries/LNS11300000 NSA: http://data.bls.gov/timeseries/LNU01300000

25-34: SA: http://data.bls.gov/timeseries/LNS11300089 NSA: http://data.bls.gov/timeseries/LNU01300089

25-54: SA: http://data.bls.gov/timeseries/LNS11300060 NSA: http://data.bls.gov/timeseries/LNU01300060

55-64: -------------------- NSA: https://data.bls.gov/timeseries/LNU01300095

55+: SA: http://data.bls.gov/timeseries/LNS11324230 NSA: http://data.bls.gov/timeseries/LNU01324230

65+: SA: ---------------- NSA: http://data.bls.gov/timeseries/LNU01300097

LFPR - Labor Force Particpation Rate (prime age 25-54) by gender

All: http://data.bls.gov/timeseries/LNS11300060

Men: http://data.bls.gov/timeseries/LNS11300061

Women: http://data.bls.gov/timeseries/LNS11300062

ETPR - Employment to Population Ratio for some age groups

SA means Seasonally adjusted. NSA means Not Seasonally Adjusted

16+: SA: http://data.bls.gov/timeseries/LNS12300000 NSA: http://data.bls.gov/timeseries/LNU02300000

25-34: http://data.bls.gov/timeseries/LNS12300089 NSA: http://data.bls.gov/timeseries/LNU02300089

25-54: SA: http://data.bls.gov/timeseries/LNS12300060 NSA: http://data.bls.gov/timeseries/LNU02300060

55-64: SA: ---------------- NSA: https://data.bls.gov/timeseries/LNU02300095

55+: SA: http://data.bls.gov/timeseries/LNS12324230 NSA: http://data.bls.gov/timeseries/LNU02324230

65+: SA: ---------------- NSA: http://data.bls.gov/timeseries/LNU02300097

Inflation rate (CPI)

. . . Monthly report: https://www.bls.gov/news.release/cpi.nr0.htm

. . . The Data Series: https://data.bls.gov/timeseries/CUSR0000SA0

. . . . . . Monthly changes: https://data.bls.gov/timeseries/CUSR0000SA0?output_view=pct_1mth

. . . Calculator at: https://www.bls.gov/data/inflation_calculator.htm

Grocery prices (food at home) inflation compared to overall inflation rate

. . . . . https://www.in2013dollars.com/Food-at-home/price-inflation

. . . From 1947 to 2021 and from 2000 to 2021, food at home inflation very slightly lagged the overall inflation rate

. . . . . https://www.democraticunderground.com/10142735789

Data series finder: https://www.bls.gov/data/#employment

The entire report: http://www.bls.gov/news.release/pdf/empsit.pdf

Archives of previous reports - The monthly payroll employment reports from the BLS are archived at Archived News Releases (https://www.bls.gov/bls/news-release/ ). In the list up at the top, under Major Economic Indicators, select Employment Situation ( https://www.bls.gov/bls/news-release/empsit.htm ). That opens up links to reports going back to 1994. Hat tip Mahatmakanejeeves.

mahatmakanejeeves

(61,729 posts)Employment Situation Summary

Transmission of material in this news release is embargoed until 8:30 a.m. (ET) Friday, November 4, 2022

Technical information:

Household data: (202) 691-6378 * cpsinfo@bls.gov * www.bls.gov/cps

Establishment data: (202) 691-6555 * cesinfo@bls.gov * www.bls.gov/ces

Media contact: (202) 691-5902 * PressOffice@bls.gov

THE EMPLOYMENT SITUATION -- OCTOBER 2022

Total nonfarm payroll employment increased by 261,000 in October, and the unemployment rate rose to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in health care, professional and technical services, and manufacturing.

This news release presents statistics from two monthly surveys. The household survey measures labor force status, including unemployment, by demographic characteristics. The establishment survey measures nonfarm employment, hours, and earnings by industry. For more information about the concepts and statistical methodology used in these two surveys, see the Technical Note.

{snip something about Hurricane Ian}

Household Survey Data

The unemployment rate increased by 0.2 percentage point to 3.7 percent in October, and the number of unemployed persons rose by 306,000 to 6.1 million. The unemployment rate has been in a narrow range of 3.5 percent to 3.7 percent since March. (See table A-1.)

Among the major worker groups, the unemployment rates for adult women (3.4 percent) and Whites (3.2 percent) rose in October. The jobless rates for adult men (3.3 percent), teenagers (11.0 percent), Blacks (5.9 percent), Asians (2.9 percent), and Hispanics (4.2 percent) showed little or no change over the month. (See tables A-1, A-2, and A-3.)

Among the unemployed, the number of permanent job losers changed little at 1.2 million in October, and the number of persons on temporary layoff also changed little at 847,000. (See table A-11.)

The number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 1.2 million in October. The long-term unemployed accounted for 19.5 percent of all unemployed persons. (See table A-12.)

The labor force participation rate, at 62.2 percent, and the employment-population ratio, at 60.0 percent, were about unchanged in October and have shown little net change since early this year. These measures are 1.2 percentage points below their values in February 2020, prior to the coronavirus (COVID-19) pandemic. (See table A-1.)

The number of persons employed part time for economic reasons was little changed at 3.7 million in October. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs. (See table A-8.)

The number of persons not in the labor force who currently want a job was little changed at 5.7 million in October and remains above its February 2020 level of 5.0 million. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job. (See table A-1.)

Among those not in the labor force who wanted a job, the number of persons marginally attached to the labor force was little changed in October at 1.5 million. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, decreased by 114,000 to 371,000 in October. (See Summary table A.)

Establishment Survey Data

Total nonfarm payroll employment increased by 261,000 in October. Monthly job growth has averaged 407,000 thus far in 2022, compared with 562,000 per month in 2021. In October, notable job gains occurred in health care, professional and technical services, and manufacturing. (See table B-1.)

In October, employment in health care rose by 53,000, with gains in ambulatory health care services (+31,000), nursing and residential care facilities (+11,000), and hospitals (+11,000). So far in 2022, health care employment has increased by an average of 47,000 per month, compared with 9,000 per month in 2021.

Professional and technical services added 43,000 jobs in October. Employment continued to trend up in management and technical consulting services (+7,000), architectural and engineering services (+7,000), and scientific research and development services (+5,000). Monthly job growth in professional and technical services has averaged 41,000 thus far in 2022, compared with 53,000 per month in 2021.

Manufacturing added 32,000 jobs in October, mostly in durable goods industries (+23,000). Manufacturing employment has increased by an average of 37,000 per month thus far this year, compared with 30,000 per month in 2021.

Employment in social assistance increased by 19,000 in October and is slightly below (-9,000) its pre-pandemic level in February 2020. Within social assistance, employment in individual and family services continued to trend up in October (+10,000).

Wholesale trade added 15,000 jobs in October. Employment in wholesale trade has increased by an average of 17,000 per month thus far in 2022, compared with 13,000 per month in 2021.

Employment in leisure and hospitality continued to trend up in October (+35,000), with accommodation adding 20,000 jobs. Employment in food services and drinking places changed little over the month (+6,000). Leisure and hospitality has added an average of 78,000 jobs per month thus far this year, less than half of the average gain of 196,000 jobs per month in 2021. Employment in leisure and hospitality is down by 1.1 million, or 6.5 percent, from its February 2020 level.

Employment in transportation and warehousing changed little in October (+8,000). Within the industry, job growth occurred in truck transportation (+13,000), couriers and messengers (+7,000), and air transportation (+4,000). These gains were partially offset by a job loss in warehousing and storage (-20,000). Monthly job growth in transportation and warehousing has averaged 25,000 thus far this year, compared with 36,000 per month in 2021.

In October, financial activities employment was little changed (+3,000). Within the industry, job gains in insurance carriers and related activities (+9,000) and in securities, commodity contracts, and investments (+5,000) were partially offset by a job loss in rental and leasing services (-8,000). Employment in financial activities has changed little over the past 6 months.

Employment changed little over the month in other major industries, including mining, construction, retail trade, information, other services, and government.

In October, average hourly earnings for all employees on private nonfarm payrolls rose by 12 cents, or 0.4 percent, to $32.58. Over the past 12 months, average hourly earnings have increased by 4.7 percent. In October, average hourly earnings of private-sector production and nonsupervisory employees rose by 9 cents, or 0.3 percent, to $27.86. (See tables B-3 and B-8.)

In October, the average workweek for all employees on private nonfarm payrolls was 34.5 hours for the fifth month in a row. In manufacturing, the average workweek for all employees was little changed at 40.4 hours, and overtime decreased by 0.1 hour to 3.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls held at 34.0 hours. (See tables B-2 and B-7.)

The change in total nonfarm payroll employment for August was revised down by 23,000, from +315,000 to +292,000, and the change for September was revised up by 52,000, from +263,000 to +315,000. With these revisions, employment gains in August and September combined were 29,000 higher than previously reported. (Monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors.)

_____________

The Employment Situation for November is scheduled to be released on Friday, December 2, 2022, at 8:30 a.m. (ET).

{snip}

Johnny2X2X

(21,900 posts)Next on CNBC, how great economic news is a bad sign for Dems.

republianmushroom

(18,223 posts)Orrex

(64,350 posts)Just heard it on the ATC intro at 16:00 Eastern, lest anyone be inclined to tell me I’m wrong.