Video & Multimedia

Related: About this forumDid You Know Banks Can Take Your Money in A Crisis?

Published on Jan 8, 2016

When the next financial crisis comes - the big banks could save themselves by stealing right out of your checking account. Banking expert Ellen Brown, Public Banking Institute/Web of Debt/The Public Bank Solution will explain how in tonight's Conversations with Great Minds.

Human101948

(3,457 posts)In the four years of 1930-1933 alone, nearly 10,000 banks failed or were suspended. These banks held deposits of over $6.8 billion (equivalent to perhaps $60 billion today’s dollars, but representing a much larger share of depositor’s wealth then). The depositors in these banks lost nearly 20% of these deposits when the banks failed. Since there was no FDIC yet, and most state deposit insurance schemes had shut down already, this meant that everyday folks lost their savings, their money. Imagine that impact.

http://econproph.com/2009/10/26/fdic-managing-the-crisis-the-fdic-and-rtc-experience/

The FDIC will not have enough money to cover the big one. Of course, things will go faster this time since there are only five or six banks now.

uhnope

(6,419 posts)don't believe the hype

Human101948

(3,457 posts)On the weekend of November 16th, the G20 leaders whisked into Brisbane, posed for their photo ops, approved some proposals, made a show of roundly disapproving of Russian President Vladimir Putin, and whisked out again. It was all so fast, they may not have known what they were endorsing when they rubber-stamped the Financial Stability Board’s “Adequacy of Loss-Absorbing Capacity of Global Systemically Important Banks in Resolution,” which completely changes the rules of banking.

Russell Napier, writing in ZeroHedge, called it “the day money died.” In any case, it may have been the day deposits died as money. Unlike coins and paper bills, which cannot be written down or given a “haircut,” says Napier, deposits are now “just part of commercial banks’ capital structure.” That means they can be “bailed in” or confiscated to save the megabanks from derivative bets gone wrong.

Rather than reining in the massive and risky derivatives casino, the new rules prioritize the payment of banks’ derivatives obligations to each other, ahead of everyone else. That includes not only depositors, public and private, but the pension funds that are the target market for the latest bail-in play, called “bail-inable” bonds.

http://ellenbrown.com/2014/12/01/new-rules-cyprus-style-bail-ins-to-hit-deposits-and-pensions/

Indeed, the FDIC published a paper proposing precisely this back in December 2012. Below are some excerpts worth your attention.

This paper focuses on the application of “top-down” resolution strategies that involve a single resolution authority applying its powers to the top of a financial group, that is, at the parent company level. The paper discusses how such a top-down strategy could be implemented for a U.S. or a U.K. financial group in a cross-border context…

These strategies have been designed to enable large and complex cross- border firms to be resolved without threatening financial stability and without putting public funds at risk…

An efficient path for returning the sound operations of the G-SIFI to the private sector would be provided by exchanging or converting a sufficient amount of the unsecured debt from the original creditors of the failed company into equity. In the U.S., the new equity would become capital in one or more newly formed operating entities.

…Insured depositors themselves would remain unaffected. Uninsured deposits would be treated in line with other similarly ranked liabilities in the resolution process, with the expectation that they might be written down.

http://www.fdic.gov/about/srac/2012/gsifi.pdf

In other words… any liability at the bank is in danger of being written-down should the bank fail. And guess what? Deposits are considered liabilities according to US Banking Law. In this legal framework, depositors are creditors.

So… if a large bank fails in the US, your deposits at this bank would either be “written-down” (read: disappear) or converted into equity or stock shares in the company. And once they are converted to equity you are a shareholder not a depositor… so you are no longer insured by the FDIC.

http://www.zerohedge.com/news/2015-10-06/how-and-why-banks-will-seize-deposits-during-next-crisis

uhnope

(6,419 posts)lol

Human101948

(3,457 posts)You should provide some backup for your award winning theories. Otherwise we can conclude that you are a flatulent blowhard.

uhnope

(6,419 posts)& your automatic recourse to vulgar insults shows us the caliber of your character and lack of critical thinking skills, not unusual for an RT fan. A lot in common with FOX zombies, actually.

Unknown Beatle

(2,672 posts)Instead of providing information that would counter his assessment, you revert to insults. Yes, calling someone a fake expert is an insult.

LiberalArkie

(15,715 posts)just could not find it again. What I read was that if the derivatives etc need to be paid for it will have to come from the stockholder and depositors first. FDIC will probably not cover your loses.

appalachiablue

(41,131 posts)after Thom interviewed Ellen Brown on The Big Pic last Fri. night. People Need to be aware of this very scary stuff.

What she said about the pensioner in Greece whose bonds were taken by his longtime bank so he killed himself, and in Portugal the bankers that moved people's funds from a solid bank to a failing one in order to seize their money is the disturbing reality.

I hope credit unions stay viable, although Ellen suggested they're under attack from excess regulations by greedy big banks/lobbyists who want them to fail. Because TBTF wants ALL the money $$.

LiberalArkie

(15,715 posts)for a harsher banking bill than Glass-Stegall.

appalachiablue

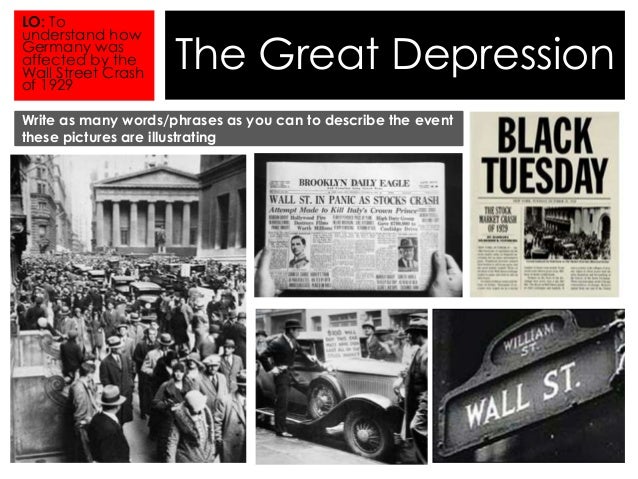

(41,131 posts)My grandparents and parents as children lived through the 1929 Wall Street Crash and the Great Depression of the 1930s. When FDR's landmark reform banking Act Glass-Steagall of 1933 was repealed in 1999, global markets crashed again 9 years later. After 75 years of safe, reliable banking. Uneffing believable.

TygrBright

(20,759 posts)uhnope

(6,419 posts)lol

marmar

(77,078 posts)Human101948

(3,457 posts)They have proven again and again that they will (1) crash the economy and (2)that they will escape with buckets of money for themselves.

uhnope

(6,419 posts)They have proven again and again that they will (1) get fake experts to say anything and (2) that they will escape with buckets of Kremlin money for the next BS piece

Human101948

(3,457 posts)Please.

We know that derivatives crashed the economy and TBTF banks got a government bailout.

They have an even greater amount of derivatives with no hope of getting another government bailout.

What do you think their exit plan is for the next hiccup?

marmar

(77,078 posts)Perhaps a little research is in order before you serve up such a banquet of bullshit.

uhnope

(6,419 posts)anyone pushing fake news from RT is really the one serving up the BS banquet.

About your RT "experts"...

In one article we point out that Karen Hudes, whom RT calls the “World Bank whisteblower,” has never presented any evidence of the fraud that she reports. And the economic collapse that she has predicted for years has never happened. Instead, Hudes has spent much of her life explaining that the Pope is really a part of a species of cone heads that helps rule the world. Manuel Ochsenreiter, a guest who often represents the German point of view on RT, is actually the editor of a neo-Nazi magazine — something which is problematic as RT used Ochsenreiter to defend Russia’s invasion of Crimea, an invasion which the Kremlin said was done to defend the peninsula against neo-Nazis. The column has similarly discussed more than ten different members of RT’s propaganda machine, exposing their conspiracy theories, distortions, and lack of facts, and pointing out that RT often gives these guests a different title each time they appear, assigning non-existent expertise to back up whatever anti-Western theory RT wishes to propagate on any given day.

http://www.interpretermag.com/throwing-a-wrench-in-russias-propaganda-machine/

marmar

(77,078 posts)..... even MSNBC. I suppose those are cesspools of your so-called "fake" experts too? ..... Keep trying, though.

Your obsession with RT seems a little unhealthy, btw.

mmonk

(52,589 posts)risks like derivatives and too big too fail institutions should be broken up. To support positions otherwise is to be immoral.