Washington state makes it extremely difficult to actually receive Working Families Tax Credit

Leave it to the State of Washington to first create a tax credit for low-income people and families - raising their hopes - and then to throw obstacles and red tape in the way that will be insurmountable for many.

My fiance qualified and applied for the credit. Then she got a letter in the mail requiring her to go to their website and upload photos of two forms of ID within 30 days or be denied. Annoying, but ok, we thought that would be the end of it. (She filed her federal return in early February)

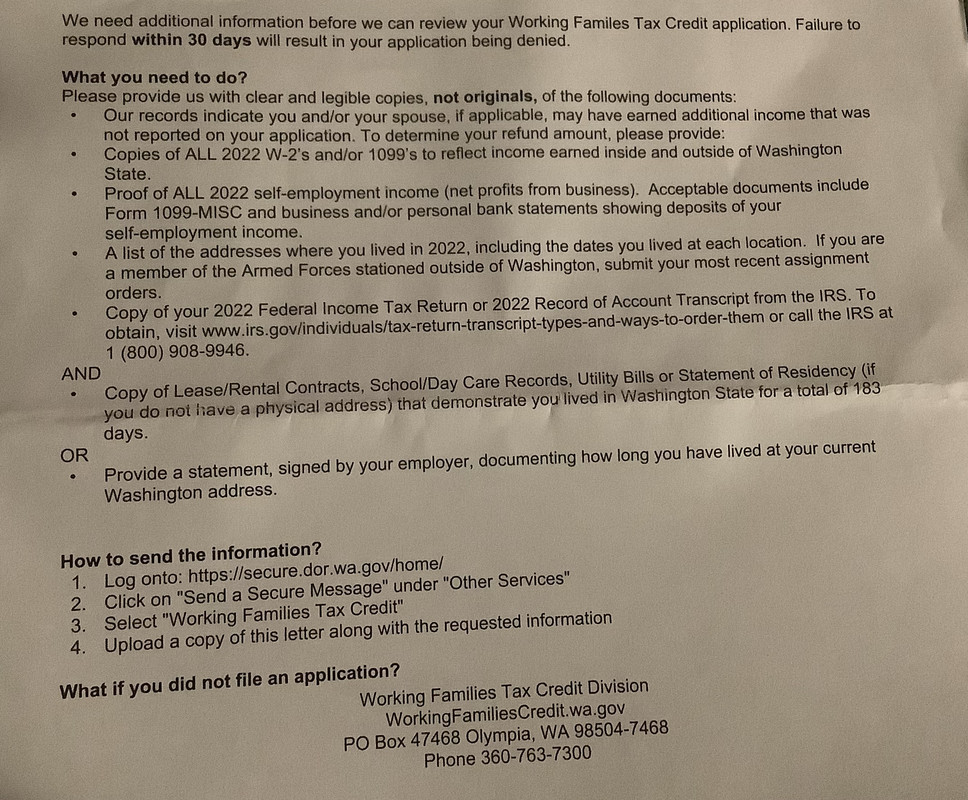

Now she received a letter requesting more information -- a LOT more information.

She has lived in Washington state all her life, but proving that would be prohibitively difficult for her based on what the letter is asking. She lives in her aunt's home, so there is no lease or rental contract. She has no kids, so there are no school/day care records. None of the utility bills are in her name, she pays her aunt. She has a physical address, so I guess a "Statement of Residency" doesn't apply. The only thing left would be a statement from her previous employer (not the current one she just started with) - her previous employer is King County. I can only imagine how difficult a letter like that would be to obtain, especially since she was a temporary seasonal employee with them.

If it's this difficult for her, I can only imagine how difficult it might be for others with no internet access who perhaps don't keep good records or who didn't get a printed or pdf copy of their return when they filed (believe it or not, that's a large number of people). A lot of people toss their W2s shortly after filing as well. Bad idea, but it happens. IRS transcript? That is nearly impossible to get online, and if you want a copy in the mail, they'll only send it to the address they have on file; so if you've moved in the meantime you would first have to send the IRS a change of address, wait for it to be processed, then request the transcript. Even if you knew those were the steps to take, it could easily take 30 days to do.

My fiance only had a single W-2. But a lot of people now have more complex income thanks to the new "gig economy" forcing people to become "contractors" and pay double SS and Medicare tax.

Long story short, there are a LOT of people who have had their hopes raised and will now have them dashed by this huge tangle of red tape. It just pisses me off that the State of Washington is doing this.