Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 19 July 2012

[font size=3]STOCK MARKET WATCH, Thursday, 19 July 2012[font color=black][/font]

SMW for 18 July 2012

AT THE CLOSING BELL ON 18 July 2012

[center][font color=green]

Dow Jones 12,908.70 +103.16 (0.81%)

S&P 500 1,372.78 +9.11 (0.67%)

Nasdaq 2,942.60 +32.56 (1.12%)

[font color=red]10 Year 1.49% +0.02 (1.36%)

30 Year 2.59% +0.02 (0.78%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Demeter

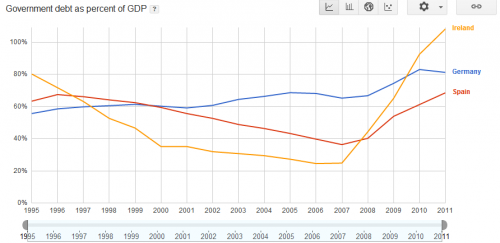

(85,373 posts)A recent story in German magazine Der Spiegel highlights the efforts in 2005 of German Chancellor Gerhard Schroeder to relax the penalties for deficits in breach of the euro zone’s stability and growth pact. It is a good review of the contemporaneous actions of the German government within a wider EU political context. However, I feel there is a lot missing to the article in giving the German context to the present European sovereign debt crisis. Therefore, I am giving you a few tidbits here. First, here’s the chart I want to focus on:

Sovereign government debt as a percentage of gross domestic product in Germany, Ireland and Spain from 1995-2011

As you can see, in the late 1990s, in the run-up to the euro, Germany had a sovereign government debt to GDP that was lower than either Ireland or Spain, both of which were technically in breach of the Maastricht 60% debt hurdle. If you recall, for purely political reasons, the Kohl government in Germany assented to watering down this hurdle in the Maastricht Treaty in order to allow Italy entry into the eurozone. Spiegel documented this earlier this year. (See "Spiegel: Kohl-era German documents reveal euro formation was about politics" http://www.creditwritedowns.com/2012/05/spiegel-euro-kohl-german-politics.html ).

Instead of a hard rule, according to Article 104c(b) of the Maastricht Treaty, the government debt hurdle is a soft one that reads that debt should:

“diminish sufficiently and approach the reference value (60%) at a satisfactory pace”

...The point, of course, is that, having added the "diminish sufficiently and approach the reference value" clause to the Maastricht Treaty debt hurdle, Spain and Ireland were fully eligible for membership in the euro zone...Once the euro was in place, Ireland and Spain prospered as interest rates declined and money from Germany and other eurozone countries with weak domestic economies piled in. Ireland’s sovereign debt levels plunged to 24.8% as a percent of GDP while Spain also saw an impressive decline to 36.3% in 2007. Germany, meanwhile, has been in breach of the Maastricht Treaty in every year from 2002 to present except in 2007 and 2011, the only years in which debt would "diminish sufficiently and approach the reference value" of 60%. However, Germany has been over the 60% hurdle in every single year. Germany was in the throes of a post-re-unification malaise that was brought to a head by a property bubble that began after the German government let it be known that money was to be made in the former East Germany with the Treuhand’s sale of former East German state assets. Western German companies and investors piled in and spawned a bubble which popped....When the Internet bubble popped, Germany was hit hard and the economy lapsed into a corporate balance sheet recession that ended with German Chancellor Schroeder’s efforts to relax the Maastricht Treaty’s deficit hurdle after the Germans had already allowed the debt hurdle to be watered down. The point here is that in each case, the Germans bore primary responsibility for permitting the stability and growth pact to be weakened – for both the deficit and the debt hurdles. France got onside in each instance as the Franco-German alliance dominated euro zone politics, first with Kohl and Mitterand and then with Schroeder and Chirac....

The reason I point this out is because many in Germany and at the ECB are saying the crisis is because the stability and growth pact wasn’t strict enough....the stability and growth pact is an abomination, a pro-cyclical death pact designed to fail in the absence of political union. With the great financial crisis came popped housing bubbles in Ireland and Spain. Government debt rose to 108.2% and 68.5% respectively, higher numbers than when the time series began in 1995. Germany’s sovereign debt is also much higher as well, having risen from 55.6% in 1995 to 81.2%, most of the debt coming during the crisis because of bank bailouts.

I asked it in 2008, so I’ll ask again: Did joining the eurozone bust Ireland? My answer was (and still is) yes. The euro has been a failure for both Spain and Ireland. The euro zone doesn’t work and the recrimination is just beginning.

*************************************************************************************

Edward Harrison is the founder of Credit Writedowns and a former career diplomat, investment banker and technology executive with over twenty years of business experience. He is also a regular economic and financial commentator on BBC World News, CNBC Television, Business News Network, CBC, Fox Television and RT Television. He speaks six languages and reads another five, skills he uses to provide a more global perspective. Edward holds an MBA in Finance from Columbia University and a BA in Economics from Dartmouth College.

Demeter

(85,373 posts)If the leaders of the 17 euro-area countries really want to solve the debt crisis shadowing their currency, they may want to sleep on it.

That’s not likely to happen. Of Europe’s last six summits, three ended no earlier than 4 a.m. The most recent, on June 29, ended at 5 a.m. And finance chiefs’ monthly gatherings routinely extend past midnight.

Those late hours haven’t served European leaders well and may be one reason why their next meeting, to hammer out a bailout for Spain’s banks on July 20, is scheduled to begin at noon. Lack of sleep, the evidence shows, has played a role in faulty decision-making that led to disasters at Three Mile Island, Chernobyl, and the Exxon Valdez oil spill as well as the ill-fated launch of the space shuttle Challenger....

A CONVENIENT EXCUSE FOR THOSE THAT DON'T BELIEVE THE EURO IS A FATALLY FLAWED CONSTRUCT UPON THE EUROPEAN POPULACE...

Demeter

(85,373 posts)WHEN YOU ARE DYING OF STARVATION, THE LAST THING YOU NEED TO DO IS LOSE WEIGHT...

Prime Minister Antonis Samaras is due to meet on Wednesday morning with the leaders of the other two parties in his coalition government in a bid to finalize the 11.5 billion euros in savings for 2013 and 2014 that Greece’s lenders have demanded.

It seems likely that Samaras, PASOK leader Evangelos Venizelos and Democratic Left chief Fotis Kouvelis will not be in a position to sign off on the cuts as some ministers were less than forthcoming in their willingness to propose areas where savings could be made during talks with Finance Minister Yannis Stournaras over the last two days.

Stournaras held a second day of talks with some ministers on Tuesday but was unable to obtain the commitments to the magnitude of cuts that he needs to put together to come up with the 11.5 billion euros the European Commission, the European Central Bank and the International Monetary Fund -- collectively known as the troika -- have demanded.

The finance minister is expected to give the three party leaders a broad outline of the cuts during Wednesday’s meeting, scheduled for 10 a.m. He will indicate how much will be saved by each department without giving further details. Sources said Samaras may seek to hold telephone conversations with German Chancellor Angela Merkel and French President Francois Hollande to convey to them the difficulty that Greece is having finding the 11.5 billion euros and to inform them that the government might need more time to finalize some of the cuts....Finance Ministry sources told Kathimerini that following talks with fellow ministers on Monday, Stournaras had identified 5.6 billion euros of cuts and was trying to agree the remaining 6 billion euros yesterday. Ministry officials do not expect that these savings will have been agreed on by Wednesday’s meeting...Finance Ministry sources could not rule out Stournaras being forced to revert to “horizontal” measures, such as salary or pension cuts, or new taxes. There is also concern in Athens that the troika may ask for supplementary measures this year to make up for the government missing its deficit target.

Demeter

(85,373 posts)Under normal conditions, the interest rates that you and I must pay on a home loan, a car loan, our credit card, a business loan are pegged onto two crucial rates. One is the rate that banks charge one another in order to borrow from each other. The other is the Central Bank’s overnight rate. Alas, neither of these interest rates matter during this Crisis. While such ‘official’ rates are tending to zero (as Central Banks try to squeeze the costs of borrowing to nothing), the interest rates people and firms pay are much, much higher and track indices of fear and subjective estimates of the Eurozone’s disintegration.

Following the Crash of 2008, banks stopped lending to each other, fearful that they will never get their money back (as most banks became, in effect, insolvent). Thus, the interest rate at which they lend to one another simply ceased being a meaningful price (just like the prices of CDOs, following Lehman’s collapse, lost their meaning as no one bought or sold those pieces of paper). The truly scandalous aspect of the Libor scandal of recent weeks is that banks continued to use (and ‘fix’) an estimate of the interest rate at which they lent to each other (for the purposes of fixing all other interest rates; e.g. mortgage and credit card rates) when they did not lend to each other any more…The demise of Libor and other measures of inter-bank lending interest rates left us with the official interest rate of Central Banks, like the European Central Bank. Recently, in an acknowledgment of past errors and of the strength of the European austerity-induced recession, the ECB lowered its key interest rate to 0.75% – the lowest level since the euro’s inception. At the same time, the ECB did something else that is extraordinary by its own standards: it reduced to zero the interest rate it paid private banks for depositing money with the ECB.

Under normal conditions, such an aggressive interest rate reduction would drag downward all interest rates: with private banks being able to borrow at a pitiful 0.75% from the ECB to lend on to the private sector, and having no incentive whatsoever to park their idle capital with the ECB, one might have hoped (as the ECB’s President, Mr Mario Draghi, clearly did) that banks would be more willing to lend and at a lower interest rate. However, such hopes would have been baseless. Indeed, the interest rates paid by households and companies remained high, the banks’ funding costs even increased, and the normal ‘monetary transmission mechanism’ (i.e. the system that converts lower official Central Bank interest rates into an increase in the supply of money) proved to be broken and beyond repair. The question is: Why?

Here is the answer, as provided by Christian Noyer, a governor of the Central Bank of France (in an interview with Handelsblatt): “We are currently observing a failure of the transmission mechanism of monetary policy. From the markets’ perspective, the interest rate facing individual private banks depends on the funding costs of the state where they are domiciled and not on the ECB overnight interest rate… Hence the monetary policy transmission mechanism does not work.”

Read more at http://www.nakedcapitalism.com/2012/07/yanis-varoufakis-it-is-now-official-the-eurozones-monetary-transmission-system-is-broken.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29#SHjpP2yqVTEi554d.99

Demeter

(85,373 posts)I do wish they wouldn't ask the users to be the beta testers....

Demeter

(85,373 posts)Sorry, after singing all those requiems, I've got the Latin puns running through the brain.

&feature=related

Demeter

(85,373 posts)I said yesterday that I could actually envision a few criminal prosecutions on Libor rate-rigging in the coming months. We know that plenty of banks are involved – I don’t think Barclays warned their employees about additional revelations at other banks, they simply prepared them for it, as a pretext to assuring that the heat will be off them soon. So the Justice Department will have plenty of banks to choose from – Deutsche Bank, cooperating with EU and Swiss regulators, is just an example – and can round up a couple low-level bankers for the perp walk photo-op.

But this would be a classic deflection strategy. Because the more you learn about Libor, the more you must reserve some of your fury for the regulators:

Lawmakers in London and Washington have been pressing regulators over what they view as a failure to address problems with the process for setting benchmark interest rates. British politicians are expected to ask regulatory officials when they were first notified about potential issues, and why they did not stop the activities.

Documents released by Barclays indicate that the bank informed regulators about problems with the London interbank offered rate, or Libor, as far back as 2007. But the Financial Services Authority opened its investigation in April 2010.

“It wasn’t just the fault of the banks,” said Mark Garnier, a British politician who sits on the parliamentary committee overseeing testimony on Monday. “The Financial Services Authority should have picked up on the irregularities.”

And regulators in the US face the same problem. We have documentary evidence that the New York Fed was informed of rate-rigging in Libor in April 2008, and the only tangible action taken was Tim Geithner assembling a bunch of big bank recommendations and forwarding them over to the Bank of England. This is classic buck-passing, and it did not stop the activities that ripped off numerous municipalities and investors for at least a year longer.

If there’s been an erosion in the confidence of the financial system – and frankly there should be – then that also must extend to the regulatory apparatus, which has shown themselves to be utterly captured and unable to act on even the most obvious of cases. These banks are too big to regulate and too connected to the regulators.

Demeter

(85,373 posts)There is a line forming to the left for people to beat up on Libor-manipulating banks, and it’s a long line so your beating time is limited and you have to make the most of it if you want anyone to care. Today’s the day for U.S. municipal borrowers. How’d they do?

The municipalities are important because they are the unusual case of a large class of politically sympathetic customers who would have been systematically disadvantaged by low Libor rates, as opposed to you and that mortgage that you won’t shut up about, on which Liborgate probably saved you money. Stephen Gandel nicely sums up the situation here: the problem was that, in astonishing droves, U.S. cities and counties borrowed at variable rates, paying their own idiosyncratic floating SIFMA rate, but they then swapped to fixed, receiving a floating rate based on Libor. This led to badness, as muni credit blew up and SIFMA spiked, while bank credit blew up and Libor mysteriously didn’t, because of the manipulating. So cities who had expected to pay a fixed 5% or whatever a year ended up paying 5% plus the suddenly widening gap between SIFMA and Libor.

Here is a graph I made you, comparing the SIFMA rate that munis paid to their bondholders versus a proxy for the Libor-based rate that they received from their banks*:

So that sort of looks okay outside of 2008, which looks sort of … not okay. Here is perhaps a more suggestive thing:

From 1997-2004, the Libor-based rate averaged 6 basis points higher than the SIFMA rate

From 2005-2009, the Libor-based rate averaged 7 basis points lower than the SIFMA rate

From 2010-2012, the Libor-based rate averaged 4 basis points higher than the SIFMA rate

If you date your Libor manipulations to 2005-2009, and you are a municipality, you have I guess a plausible case for saying “those swaps cost us 11-13 basis points a year.” The municipalities themselves calculate 20 basis points but that is because they are muppets.**

MORE AT LINK

Demeter

(85,373 posts)LET ME KNOW IF YOU CAN'T SEE THE ARTICLE...IT'S TERRIBLY WONKY, AND HARD TO EXCERPT

Demeter

(85,373 posts)Ben Bernanke, the chairman of the US Federal Reserve, has said that revelations a key interbank lending rate had been fixed were "very troubling" and undermined confidence in the financial system. Speaking to the US Congress on Tuesday, Bernanke said the disclosures, which have resulted in a large fine for British bank Barclays, showed the so-called Libor system was "structurally flawed"..."Libor is a critical benchmark to many financial contracts," Bernanke said. "The actions of traders and banks that have been disclosed are not only very troubling in themselves, but they have the effect of undermining markets."

Emails, phone transcripts and internal reports released last week by the New York Fed show the regulator was explicitly told banks were misstating their input to the Libor interbank lending rate. "We'll get more information on that as the investigations continue, but it's clear that beyond these disclosures that the Libor system is structurally flawed and part of the response was to address those flaws," Bernanke said.

Bernanke said that because many of those reforms were not adopted by the British authorities, he could not vouch for the reliability of the rate today.

Emails also show that the NY Fed - which is tasked with assessing the safety and soundness of US banks - in June 2008 shared its concerns with the Bank of England, which regulates the territory where the Libor is set.

MORE

Demeter

(85,373 posts)Demeter

(85,373 posts)The Obama Justice Department is in theater mode, again, pretending to threaten the bankster class with criminal penalties – prison time! – for their manipulation of the global economy’s benchmark interest rates. The Justice Department claims to be building criminal and civil cases in the LIBOR scandal, which in sheer scope is the biggest fraud by international capital in history. But that’s all a front, a farce. Barack Obama has spent his entire presidency protecting Wall Street, starting with his rescue of George Bush’s bank bailout bill after it’s initial defeat in Congress, in the last days of Obama’s candidacy. He packed his administration with banksters, passed his own bailout and, in collaboration with the Federal Reserve, channeled at least $16 trillion dollars into the accounts of U.S. and even European banks – by far the greatest transfer of capital in the history of the world. Obama has reminded the banksters that it was he who saved them from the “pitchforks” of an outraged public. He pushed through Congress so-called financial reform legislation that left derivatives – the deadly instruments of mass financial destruction that were at the heart of the meltdown – untouched.

Wall Street may or may not remain loyal to Obama, but Obama has been loyal to Wall Street, the guys who gave him the campaign cash to become a viable candidate. His Attorney General, Eric Holder, a corporate lawyer to the core, is busily staging a pre-emptive LIBOR prosecution of bankers in order to shield them from legal action by a host of other government agencies and, ultimately, from the global universe of parties that have been harmed by the bankster’s schemes– a list that stretches to infinity. Holder’s job is to monopolize the LIBOR case, to the extent legally and humanly possible, grabbing jurisdiction and consolidating the cases against the banks with the aim of reaching a settlement that does not further destabilize the financial system.

Holder and his boss already pulled that trick earlier this year with settlement of the bank “robo-signing” scandal – a scheme that would have ranked as the “crime of the century” until LIBOR came along. A small group of state attorney generals were holding up an administration-brokered settlement that effectively gave the banksters immunity from prosecution, in return for a measly $25 billion payout. Obama used every power of his office to pressure the state law officers into line. The last one capitulated with a promise from Obama that a “special unit of prosecutors” would expand the investigation into abusive mortgages practices. You haven’t heard a peep about it, since.

Now Obama and Holder are playing the same diversionary game, making tough noises about criminal investigations of the LIBOR conspirators. But the Justice Department has already given immunity to Barclay’s Bank, of Britain, and to the Swiss banking giant UBS. More immunities will follow. The reason Eric Holder is staging criminal investigations is because that’s the only way he can protect the bankers, through immunities and by gradually narrowing the scope of the case. In the end, there will be settlements all around, and the banksters will move on to even more fantastic heights of criminality – thanks to the loyal, protective hands of President Obama.

Demeter

(85,373 posts)Speaking on the Marr Show on BBC One on March 23rd, the former Daily Telegraph editor and historian Max Hastings said a “senior central banker” recently told him that London is now considered to be the “money-laundering capital of the world”. Hastings was discussing the shooting of a Russian banker in London. The remark was all the more pertinent since Russia is now said to be controlled by a ‘gangster culture’ and because of the large number of Russian oligarchs and other business people who now live and work in the UK. A lot of these people carry criminal baggage, but the authorities seem entirely comfortable with the idea they should reinforce London’s position as the world’s “funny” money hub.

How did this state of affairs come about when, on paper at least, the UK has some of the strictest anti-money laundering legislation in the world?

The answer, I believe, lies in the fact that our many laws and regulations have never been effectively enforced by financial regulators, and banks and other financial institutions know they can get away with paying lip service to the rules. Only this year has the Financial Services Authority managed to bring a money laundering charge against a UK-based financier, and he is a very small fish indeed. In an insider trading case against Richard Anthony Joseph, the FSA added two money laundering charges. It charged him with eight counts of insider dealing and two counts of money laundering. The charges follow Joseph’s arrest in May 2010. The interest in the case is not in the insider dealing per se but in the addition of charges of money laundering. Although the FSA has had the power to prosecute this offence for some time, it has rarely, if ever, used it.

There is a world of difference between having rules which are meant to be obeyed, and doing everything within one’s power to avoid providing any meaningful form of compliance with the rules. The purpose of the regulations is to make it as difficult as possible for people who have acquired their money illicitly, anywhere in the world, to find a safe haven in the international banking system. So there are rules and regulations which impose a burden on banks and financial institutions requiring them to ensure that before they accept money from a client, that they have a clear picture of its provenance, that they know as much as possible about their clients, their businesses, the sources of their funds, and if they have held high political office, to make sufficient enquiries to ensure that the monies being deposited are not in fact the proceeds of international aid payments which have been stolen from the country’s Treasury.

These rules are routinely flouted by the financial institutions...

MORE AT LINK

Demeter

(85,373 posts)Last edited Thu Jul 19, 2012, 06:14 AM - Edit history (1)

http://www.bloomberg.com/news/2012-07-17/goldman-settles-class-action-over-698-million-offering.htmlGoldman Sachs Group Inc. (GS) reached a class settlement with investors in a $698 million mortgage- backed securities offering, a lawyer for the plaintiffs told a federal judge in New York.

David Wales, who represents the Public Employees’ Retirement System of Mississippi, told U.S. District Judge Harold Baer in a letter made public today that both sides had accepted a settlement proposed by a mediator. Details of the agreement weren’t disclosed.

Wales said the parties will file papers by July 31 asking Baer to approve the settlement.

The Mississippi retirement fund sued in 2009, claiming New Century Financial Corp. (CYFL), which originated the mortgages underlying the securities, failed to adhere to its underwriting standards and overstated the value of the collateral backing the loans. The fund claimed Goldman Sachs didn’t conduct proper due diligence when it bought the loans in 2005. MORE

Demeter

(85,373 posts)

Character analyses

Demeter

(85,373 posts)This is the second part of a description of my experiences working at D.E. Shaw (HEDGE FUND)...I want to describe the culture of working at D.E. Shaw during the credit crisis, so from June 2007 to June 2009, because I think it’s emblematic of something that most news articles and books written about hedge funds really miss out on when they fixate on the average I.Q. of the people working there, which is in the end a distraction and nothing more, or the bizarre or quirky personalities that exist there, which is only idiosyncratic and doesn’t explain anything deeply....

Most of the quants at D.E. Shaw were immigrant men. In fact I was the only woman quant when I joined, and there were quite a few quants, maybe 50, and I was also one of the only Americans. What nearly all these men had in common was a kind of constant, nervous hunger, almost like a daily fear that they wouldn’t have enough to eat. At first I thought of them as having a serious chip on their shoulder, like they were the kind of guy that didn’t make the football team in high school and were still trying to get over that. And I still think there’s an element of something as simple as that, but it goes deeper. One of my colleagues from Eastern Europe said to me once, “Cathy, my grandparents were coal miners. I don’t want my kids to be coal miners. I don’t want my grandchildren to be coal miners. I don’t want anybody in my family to ever be a coal miner again.” So, what, you’re going to amass enough money so that no descendent of yours ever needs to get a job? Something like that.

But here’s the thing, that fear was real to him. It was that earnest, heartfelt anxiety that convinced me that I was really different from these guys. The difference was that, firstly, they were acting as if a famine was imminent, and they’d need to scrounge up food or starve to death, and secondly, that only their nuclear family was worth saving. This is where I really lost them. I mean, I get the idea of acts of desperation to survive, but I don’t get how you choose who to save and who to let die. However, it was this kind of us-against-them mentality that prevailed and informed the approach to making money.

Once you understand the mentality, it’s easier to understand the “dumb money” phrase. It simply means, we are smarter than those idiots, let’s use our intelligence to anticipate dumb peoples’ trades and take their money. It is our right as intelligent, imminently starving people to do this. Chasing dumb money can take various forms, but is generally aimed at anticipating lazy fund managers: if you know that they always wait until Friday afternoon to balance their books, or that they wait until the end of the month, or that they are required to buy certain kinds of things, you can anticipate their trades, make them yourself a bit before they do, thereby forcing them to pay more, and getting a nice little profit for yourself. In short this works in general, since statistically speaking the anticipated trade wasn’t driving up the intrinsic value of the underlying, but rather was being affected by trade impact for a short amount of time. If we can anticipate big trades by lots of dumb money, then the short-term market impact will be large enough and last long enough to buy in beforehand and sell at the top, while it still lasts, assuming there’s sufficient liquidity. The subtext of taking dumb money, going back to the football team issue, is: if we don’t somebody else will, and then we will feel like fools for not doing it ourselves...

Demeter

(85,373 posts)...I actually never really intended to stay in finance, it was just the only “real job” I could get with my number theory skills. In the end I decided I wanted to work at a startup and there are more internet startups than finance ones. The truth is, there are a bunch of jerks in finance, very likely due to the amount of money floating around, and I noticed a correlation with the size/age of the company and the douchebagginess of the “leaders” of the firms. I don’t know alot about ****** but word on the street is that they are huge douchebags. On the other hand, I myself don’t regret working with douchebags for four years, because it thickened my skin quite a bit (and in particular made me realize how impotent and feeble the academic douchebags are in comparison) and made me strive for something better. Although to be honest it sometimes really sucked.

I could sum it up pretty well thus: people who are successful for a while think they know everything. People who are rich think they are always right. People who are both successful and rich are absolutely incredible douchebags. It seems like a law of nature (i.e. I can only assume that if I ever become rich and successful I will also become a douchebag. One more reason not to be wishing too hard for things like that.).

So instead I work for *pretty good* money (better than I’d have gotten in academics but not as good as at DE Shaw) and I enjoy things like oatmeal in the morning, biking to work on the bike path, my incredible adorable macho developer colleagues, a really cool hands-off boss, and a bunch of awesome karaoke-loving beer-drinking coworkers who think I have special powers since I can do math. Oh, and the possibility that someday my numerous stock options in this startup may make me a douchebag someday...

Demeter

(85,373 posts)Previously I’ve talked about the quant culture of D.E. Shaw as well as the tendencies of people working there. Today I wanted to add a third part about the experience of being “on the inside looking out” during the credit crisis...I started my quant job in June 2007, which was perfect timing to never actually experience unbridled profit and success; within two months of starting, there was a major disruption in the market which caused enough momentary panic and uncertainty that the Equities group decided to liquidate their holdings. This was a big deal and meant they lost quite a bit of money on transaction costs as well as losing money because other investors were pulling out of similar trades at the same time.

The August 2007 market disruption was referred to internally as “the kerfuffle”. I’ve grown to think that this slightly dismissive term, which connotates more of an awkward misunderstanding than any real underlying problem, was indicative of a larger phenomenon. Namely, there was a sense that nothing really bad was afoot, that the system couldn’t be at risk, and that as long as we kept our trades on balance market neutral, we would be fine, except for possibly bizarre moments of exception. The tone would be something like, if an upper class man went to a restaurant and his credit card was denied- the waiter would return the credit card with almost an apology, assuming that it must have expired or something, that surely it is a mistake more than an exposure of underlying bankruptcy.

This framing of the world around us, as individual exceptional moments, as mysterious, almost amusing singularities in an otherwise smooth manifold, continued throughout the credit crisis (I left in May 2009), with the exception of the days after Lehman collapsed (Lehman was a 20% owner of D.E. Shaw at the time of its collapse, as well as a one of our major brokers).

But Lehman fell kind of late in the game, actually, for those in the industry. In other words there were months and months of disturbing signs, especially in the overnight lending market (where banks lend to each other for just the night or over the weekend) leading up to the Lehman moment. I remember one experience during those times that still baffles me...

Demeter

(85,373 posts)Abstract: Several game-theoretical lab experiments helped establish the

belief that economists are more selfish than non-economists. Since

differences in behaviour between experiment participants who are

students of economics and those who are not may be observed among

junior students as well, it is nowadays widely believed that the origin of

the greater selfishness is not the training they undergo, but selfselection.

In other words, selfish people voluntarily enrol in economics.

Yet, I argue that such explanation is unsatisfactory for several reasons. I

also suggest alternative explanations for the observed differences,

which have been so far unduly disregarded.

Do economists make bad citizens? (R. Frank, et al. 1996). Are political

economists selfish and indoctrinated? (Frey and Meier 2003). How

tempting is corruption? More bad news about economists (B. Frank and

Schulze 1998). With so many obvious value judgments, these are

questions one would not expect to read in an economics article and,

with such a dismal depiction of their profession, one would expect

economists to answer negatively. Both expectations would be wrong.

These unflattering questions are but a small sample of the titles of

economics articles from a stream of literature that has waged against

the economics profession a veritable ‘moral trial’ (Lanteri 2008a).

Moreover, although some attempts have been made at defending

economists (Yezer, et al. 1996; Laband and Beil 1999; Lanteri 2008a,

2008b; Hu and Liu 2003; Zsolnai 2003), affirmative answers to these

questions prevail by far, both among economists and non-economists...

A QUESTION OF WHICH CAME FIRST: THE CATERPILLAR, OR THE DESTRUCTION OF THE GARDEN OF EDEN?

Demeter

(85,373 posts)JP Morgan’s jawdropping revelations in its Friday earnings call don’t seem to be attracting the attention they deserve. The market may have shrugged off the size of the losses and the corporate governance modifications plans, but the announcement opens the door wide for the next phase of this scandal. The biggest question is whether Jamie Dimon should keep his job.

The first stunner, that JP Morgan was restating the first quarter financials, should have caused a deafening ringing of alarm bells. For a company of JP Morgan’s stature to be compelled to restate prior period financials is a very clear signal of bigger problems with their overall financial reporting. In isolation we would normally expect to see a massive selloff with an event of that seriousness. Analysts and reporters may have missed the significance since it was dropped into a footnote and overshadowed by the other disclosures.

Add in the magnitude of the restatement which increased the CIO losses by a massive 90% over the previously reported losses and you’d expect to see further panic. The original 1Q12 results included a loss of $718 million. The restated results added another $660 million , bringing the total first quarter loss to $1.4 billion.

But the real cause for alarm is the reason for the restatement. JPM was forced to disclose that it relied on its traders to provide honest and accurate valuations for its financial statement disclosures. That’s like putting the foxes in charge of not just the henhouse, but the entire farm. Much to its chagrin that was a costly choice. Note that was not a mistake, but a conscious choice...MORE

Read more at http://www.nakedcapitalism.com/2012/07/michael-crimmins-why-hasnt-jamie-dimon-been-fired-by-his-board-yet.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29#KuDf8ZAsQdFCRAOg.99

Demeter

(85,373 posts)Every election cycle, Americans are greeted with a bevy of condescending lectures from well-heeled political elites about the importance of voting. It’s your duty. People died for right to vote. And so forth. This year, a far more compelling message about democracy is coming from miners in Spain, who, beset by austerity measures imposed by both political parties, are shooting at riot police with homemade rockets and slingshots.

These miners – who live in a country that was until recently considered a wealthy Western democracy – have the right to vote. But in spite of their right to vote, politicians and bankers in Spain are threatening their families with endemic poverty and powerlessness. These miners feel that they may have a vote, but they have no voice – as one of them said, their democracy is just dictatorship by another name. And so they are doing what people have done for thousands of years when confronted with a series of indignities from their political leaders – they are rebelling.

Before examining similar unrest could occur in America, let’s go to our own leadership’s attitude towards voting. This cycle, the award for cynicism in civics goes to Obama advisor turned millionaire banker Peter Orszag, who wrote an editorial for Bloomberg in June arguing we should make voting mandatory. Just six months before arguing for mandatory voting, Orszag wrote a column in the New Republic subtitled “Why we need less democracy”, arguing we need “depoliticized commissions for certain policy decisions”, most likely in order to cut social spending programs on which normal Americans not in the political class rely. So on the one hand, Orszag wants everyone to vote, to participate in a system, but on the other, he wants those votes to not matter when it comes to preserving their own ability to buy food and medicine. This is exactly the dynamic that led to Spanish miner battles.

Orszag’s attitude is pervasive among political elites, and has been for years. However, such an authoritarian impulse has never in our lifetimes intersected with recent economic, climactic and political circumstances in this country. According to recently released data, wage inequality has risen faster under Barack Obama than under George W. Bush. The biggest source of wealth for most Americans – home equity – has collapsed in value. And the recent sign-of-the-apocalypse heat wave has sent food prices soaring – over the next decade we can expect the food insecurity that sparked the Arab Spring to bite in America...

Read more at http://www.nakedcapitalism.com/2012/07/matt-stoller-voting-this-year-means-choosing-the-one-who-beats-you.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29#uFj1DocbbGiLj1G6.99

Demeter

(85,373 posts)...Both in 2010 and 2011, improvements in economic performance that were hailed as real recoveries faltered. With youth unemployment high, working young adults saddled with high student debt loads, household formation low due to more multi-generational households and older adults contending with diminished wealth thanks to hits to home prices and retirement savings, consumers were not able to be the drivers of renewed growth unless their wage and employment situation improved in a marked fashion. And that just isn’t happening.

What seems to have happened in the last week is that enough “unexpected” data releases, accompanied by a “recession is on” call by the widely-read ECRI, have led some analysts who were on the recovery side of the fence to rethink their view. The ISM manufacturing index went into contractionary territory in June. Some commentators tried arguing that the weak jobs release of last week really wasn’t so bad, since it showed an increase in hours worked and more temp hiring, which they argued would be converted to permanent jobs. But a report by the National Association for Business Economics undermined that hope. Its survey showed that companies had cut their hiring plans. 39% of the respondents intended to add staff in the next six months back in March; as of June, that’s fallen to 23%. continuing bad manufacturing results out of Europe, an “unexpected” 0.5% fall in retail sales (the third monthly decline in a row, and April’s negative result was revised downward) show a broader picture of serious weakness (note Michael Shedlock’s early warning on a sharp falloff in auto sales). Similarly, we’ve been skeptical of reports of a housing recovery, based on widespread evidence of large amounts of “shadow inventory” (as in price improvement was due to manipulation of supply). That was confirmed last week by reports from CoreLogic and Realtytrac. Some analysts expected spending to get a boost as gas prices fell, but the one-two punch of a mild winter (less snow) and a scorcher summer means higher food prices, which may substantially offset the relief provided by lower fuel costs. This grim news comes as the IMF trimmed its growth outlook a tad, but warned that “rapid policy action” was needed to keep things on track. Of course, some of the increased willingness to use the “R” word is the usual suspects, like Bill Gross, trying to increase pressure on the Fed to Do Something.

Nouriel Roubini is predicting 1.2% growth at best for the second quarter. Ed Harrison pointed out on his Credit Writedowns Pro service that manufacturing ex autos is already in recession and that inventory building on the basis of the expectation of continued demand is the only thing that is keeping the US out of an actual recession. We’ve had falling disposable income with households initially treated as a blip (they went into savings and/or increased credit card debt). But as Ed also points out, without a change in incomes, you eventually see the decline translate into a fall in retail sales. And that’s where we seem to be now.

The way out of it would be to have government spending make up the slack. but that remains anathema; indeed, DC is fighting over how much to blunt the impact of the so called fiscal cliff, the cut in stimulus that will result if Bush tax cuts and recessionary spending measures expire at the end of 2012. Even if the full 3-5% GDP hit is forestalled (my tax mavens point out that large sections of the tax code are renewed each year, so the drama may be a tad overplayed), the continued talk of a Grand Bargain suggests that bloodletting from an already weakened patient is still on. And this cheery scenario of course does not consider the big uglies lurking in the wings, like a Eurozone crisis of some sort (Creditanstalt 2.0) or an attack on Iran (even with a new pipeline reducing the importance of the Strait of Hormuz, it’s still an important choke point, and Saudi refineries are also within striking distance of Iranian missiles).

As I keep saying, it would be better if I were wrong, but since I live in the real economy, if you want a happy ending, you may need to go to the movies.

Read more at http://www.nakedcapitalism.com/2012/07/the-sucking-sound-of-air-leaving-the-economy.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29#qZkzYXBTT1hd6bKY.99

Demeter

(85,373 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)And since my brains have liquified and run out my ears in this ongoing climate change, I am yet again solicitiing suggestions for a theme, an artist, a genre, anything to liven up the "dismal science", which while it is in no way qualified to be a science, is certainly more dismal than ever...

Anything you would like to liven up the weekend?

bread_and_roses

(6,335 posts)Just one off-hand thought - I'm not married to it or anything. Or maybe with "the games" looming we could do the Gods "WEE Climb Mount Olympus" or something - or maybe do that when Games start? (just thinking - did we forget Gotterdamurung (sp?) when we did Apocalypse?).

Anyway, I am always content with whatever the theme is - even if it's not one of my interests, there's always plenty to play with.

On edit - or with this heat, we could do Dante's Inferno.

xchrom

(108,903 posts)

Tansy_Gold

(17,860 posts)Come to think of it, I have some too!

Happy Thursday, X!

xchrom

(108,903 posts)you just KNOW i'm all about glitz -- love all that glitzy paste jewelry -- the more vintage the better.

i hope you have some cool pieces.

Tansy_Gold

(17,860 posts)I love Shirley Bassey, too. Talk about vintage -- I have the original Goldfinger vinyl soundtrack album.

xchrom

(108,903 posts)yes, she's over the top -- but she's got the chops to back it up.

i would love to see pictures of the paste -- do you know how old they are?

xchrom

(108,903 posts)Spain sold 2.98 billion euros ($3.66 billion) of notes, in line with its maximum target, and its borrowing costs surged as demand for the securities weakened. The country’s bonds fell after the sale.

The Madrid-based Treasury sold notes due in 2014 at an average yield of 5.204 percent, compared with 4.335 percent when they were last sold on June 7. It sold five-year notes at 6.459 percent, compared with 6.072 percent on June 21 and seven-year securities at an average yield of 6.701 percent.

Demand for the two-year debt was 1.9 times the amount sold, compared with 4.26 last month and the bid-to-cover for the 2017 securities was 2.06, compared with 3.44 in June, the Madrid- based Treasury said. It set a maximum target of 3 billion euros for the sale.

“Nothing looks good,” Ioannis Sokos, a fixed-income strategist at BNP Paribas in London, said in a telephone interview. “Spanish banks have been much less aggressive in buying domestic bonds” as the effect of the European Central Bank’s three-year loans fades.

xchrom

(108,903 posts)UnitedHealth Group Inc. (UNH), the biggest U.S. health insurer, boosted its profit outlook for this year on the strength of rising enrollment for government-backed Medicare and Medicaid policies.

UnitedHealth forecast profit of $4.90 to $5 a share for 2012 in a statement today, the second time this year the Minnetonka, Minnesota-based insurer raised the guidance. The company reported second-quarter net income rose 5.5 percent to $1.34 billion, or $1.27 a share, beating analyst estimates.

The insurer added 1.7 million members to its health plans for the quarter, boosted by February’s $2 billion acquisition of XL Health Corp. The percent of revenue spent on medical costs was little changed, continuing a trend that’s helped insurers over the last three years as consumers have cut back on trips to the doctor amid the weak economy.

The results show “health-care utilization remains largely unchanged or potentially even lower” compared with previous years, said Jason Gurda, a Leerink Swann & Co. analyst in New York, in an e-mail. He called the results “a solid quarter.”

xchrom

(108,903 posts)The International Monetary Fund has warned the eurozone's leaders to take "decisive action" as Spanish bond yields shot up to dangerous levels, signalling a fresh leg of the sovereign debt crisis.

In its annual report on the eurozone's policies, known as an Article IV, the IMF made clear that it believes euro ministers have not yet done enough to underpin the future of the single currency.

It called for the European Central Bank to cut interest rates, implement a "sizeable" package of quantitative easing, and wade into bond markets to drive down borrowing costs.

Madrid saw its 10-year bond yields – a proxy for how much the government must pay to borrow – hit 6.94% on Wednesday, close to the 7% level that many analysts consider to be unsustainable.

Roland99

(53,342 posts)S&P 500 +0.5%

DOW +0.4%

NASDAQ +0.7%

xchrom

(108,903 posts)The rate-rigging scandal that has enveloped Barclays appears to be widening as questions were raised over the relationship between employees at other banks in the ongoing investigations into attempted interest rate manipulation.

According to the Financial Times, regulators are scrutinising relationships that banks such as HSBC, Deutsche Bank of Germany and the French banks Société Générale and Crédit Agricole may have had with a former Barclays trader, raising questions over the allegations relating to attempts to manipulate the European equivalent of Libor, known as Euribor.

According to the FT, sources suggest that one of the unidentified traders in the regulatory notices issued last month may be Philippe Moryoussef.

Barclays was hit with a £290m fine last month for attempting to manipulate interest rates. Moryoussef is not accused of wrongdoing. The Financial Times said Moryoussef had not been interviewed by any authority investigating potential manipulation of Libor or other benchmark rates.

xchrom

(108,903 posts)xchrom

(108,903 posts)xchrom

(108,903 posts)

Location where the SS Gairsoppa was torpedoed

A record 48-ton haul of silver bullion has been recovered from a World War II shipwreck off the coast of Ireland.

The treasure, worth 1.4 million troy ounces of silver, was found on the wreckage three miles beneath the Atlantic.

The operation to retrieve the 1,203 bars from the SS Gairsoppa was the heaviest and deepest underwater mission to remove precious metal from sunken vessels.

It was discovered last September and the metal was reportedly valued at around £155 million in today's prices.

Read more: http://www.businessinsider.com/record-haul-of-silver-bullion-recovered-from-wwii-shipwreck-2012-7#ixzz214kDos00

xchrom

(108,903 posts)

The quiet town of Mittenwalde, about 30 kilometers southeast of Berlin, recently discovered a debt certificate from May 28th, 1562, in which Mittenwalde loaned Berlin 400 guilders (gold coins used as currency), reports Reuters.

The certificate was uncovered by Mittenwalde's town historian, Vera Schmidt. As the debt came with an annual 6 percent interest rate Berlin would owe Mittenwalde 11,200 guilders today — equivalent to about €112 million ($137 million).

Once the number is adjusted for inflation and compound interest, the figure comes out somewhere in the trillions, reports Reuters.

Berlin — a city already €63 million ($77 million) in debt — may have some hope, however. The promissory note is missing the seal, which may render it invalid, the Financial Times of Deutschland reports, though historians are quick to point out that seals weren't widely used until the 17th century. Berlin has repaid part of the debt, at least. A ceremonial guilder, dated back to 1539, was given to Mittenwalde by Berlin's finance minister, Ulrich Nussbaum. If it ever reached the market, the 3.25 ounce, 18 karat gold piece would go for somewhere in the range of €50,000 to €100,000. ($61,000 to $122,000), reports the Berliner Zeitung.

Apparently this isn't the first time the certificate has been found, nor the request for payment been made though. Mittenwalde has been asking Berlin for payment every 50 years or so since 1820, according to the Berliner Zeitung.

*** please note the last sentence.

Read more: http://www.businessinsider.com/berlin-owes-small-german-town-trillions-2012-7#ixzz214lFUBxM

Demeter

(85,373 posts)Must be a cultural tendency....

Demeter

(85,373 posts)Not very hard, and not for very long, it looks like on the weather maps, but!

And it's only 72F, so the windows are open, even if the humidity approaches 99%, and the freezer is defrosting.

xchrom

(108,903 posts)may not be a lot -- but...72f sounds heavenly.

xchrom

(108,903 posts)The headline is deliberately provocative. It is also an exaggeration, but the goal is to call attention to a serious threat facing Portugal. For if the Portuguese population fell in 2010 and again in 2011, there is every indication that this trend will continue. Over the past two years, between a negative natural balance (the difference between the number of births and of deaths) and a negative migration balance (the difference between the number of people immigrating and those emigrating), Portugal has lost 85,000 inhabitants.

Population levels had not dropped since the 1990s. The natural balance was negative once in 2007 but that was compensated for by the rate of immigration. The shift towards a long-term trend came in 2010. There is a series of bad news on the demographic front, be it in terms of birth rates or of migratory flows.

Foreigners returning to home countries

According to the latest available data (based on the number of Gutherie tests made on new born babies), a drop in the birth rate is expected this year. In 2011, 97,000 births were registered in the country, the lowest figure in decades and it could fall further in 2012, to 89,000.

At the same time, the number of deaths has always exceeded 100,000 per year – 104,000 on average since 2007. These figures negatively affect the natural balance which was -6,000 in 2011 and could fall to -12,000 this year if the trend, is confirmed.

DemReadingDU

(16,000 posts)7/19/12

Big Banks Don’t Commit Any Crimes … Do They?

Here are some recent improprieties by the big banks:

Laundering money for drug cartels. See this, this, this and this (indeed, drug dealers kept the banking system afloat during the depths of the 2008 financial crisis)

Laundering money for terrorists

Engaging in mafia-style big-rigging fraud against local governments. See this, this and this

Shaving money off of virtually every pension transaction they handled over the course of decades, stealing collectively billions of dollars from pensions worldwide. Details here, here, here, here, here, here, here, here, here, here, here and here

Charging “storage fees” to store gold bullion … without even buying or storing any gold . And raiding allocated gold accounts

Committing massive and pervasive fraud both when they initiated mortgage loans and when they foreclosed on them (and see this)

Pledging the same mortgage multiple times to different buyers. See this, this, this, this and this. This would be like selling your car, and collecting money from 10 different buyers for the same car

Cheating homeowners by gaming laws meant to protect people from unfair foreclosure

Committing massive fraud in an $800 trillion dollar market which effects everything from mortgages, student loans, small business loans and city financing

Engaging in insider trading of the most important financial information

Pushing investments which they knew were terrible, and then betting against the same investments to make money for themselves. See this, this, this, this and this

Engaging in unlawful “frontrunning” to manipulate markets. See this, this, this, this, this and this

Engaging in unlawful “Wash Trades” to manipulate asset prices. See this, this and this

Otherwise manipulating markets. And see this

Participating in various Ponzi schemes. See this, this and this

Charging veterans unlawful mortgage fees

Cooking their books (and see this)

Bribing and bullying ratings agencies to inflate ratings on their risky investments

The executives of the big banks invariably pretend that the hanky-panky was only committed by a couple of low-level rogue employees. But studies show that most of the fraud is committed by management. Indeed, one of the world’s top fraud experts – professor of law and economics, and former senior S&L regulator Bill Black – says that most financial fraud is “control fraud”, where the people who own the banks are the ones who implement systemic fraud. See this, this and this.

But at least the big banks do good things for society, like loaning money to Main Street, right?

Actually:

The big banks no longer do very much traditional banking. Most of their business is from financial speculation. For example, less than 10% of Bank of America’s assets come from traditional banking deposits. Instead, they are mainly engaged in financial speculation and derivatives. (and see this)

The big banks have slashed lending since they were bailed out by taxpayers … while smaller banks have increased lending. See this, this and this

A huge portion of the banks’ profits comes from taxpayer bailouts. For example, 77% of JP Morgan’s net income comes from taxpayer subsidies

The big banks are literally killing the economy … and waging war on the people of the world

And our democracy and republican form of government as well

http://www.ritholtz.com/blog/2012/07/are-big-banks-criminal-enterprises/

or

http://maxkeiser.com/2012/07/19/ritholtz-a-concise-list-recent-bank-fraud/

edit - check out either link for additional links for all the above fraud

DemReadingDU

(16,000 posts)7/19/12 Thursday Musings On Financial Fraud

What's particularly galling about a list like this is the utter lack of attention that it has garnered in the political sphere. And I'm not talking about Barry's screed or Max picking it up either -- I'm talking about the fact that this has been going on for five years on a more-or-less uninterrupted basis and nobody has been indicted, prosecuted or jailed -- nor have any politicians taken this as a prime campaign issue.

.

.

In the meantime when your lefty and righty friends try to claim that "nobody committed any crimes" may I recommend you feast on the nice list that Barry Ritholz put together -- I don't think I missed many of these but it is nice of Barry to put them all together in one place, complete with links to the original source stories.

I will continue to maintain that until these frauds and felones do matter, and prosecutions follow, there will be no actual economic recovery -- because there can't be. Nobody in their right mind leads with their nuts when some of their competitors are known to have a free pass on any sort of illegal act they might choose to commit in an attempt to squash entrepreneurial upstarts.

Until the outrage, followed by indictments, prosecutions and imprisonment starts of the banksters and those affiliated with them, there will be no actual economic recovery. Markets will go up and they will go down, but the premise of a stock market floating on fraud is one that cannot be trusted or invested in -- and thus for virtually everyone in the "real world" the only defensible act is to stay away.

That's the unfortunate lesson that one must garner from the last five years.

http://market-ticker.org/akcs-www?post=208871

Demeter

(85,373 posts)If there were anyone in power who wasn't actively benefitting from these crimes, we might see some prosecutions, or at least have someone to mail it to.

As it is, they are just begging for the people in the streets to take back those powers vested in the government, and clean out this corruption. And that never ends well for the aristos.

DemReadingDU

(16,000 posts)I have no idea what will set off people, but something will come

Demeter

(85,373 posts)DemReadingDU

(16,000 posts)Demeter

(85,373 posts)Some were lynched on a lamppost.

Eugene

(61,894 posts)Source: Reuters

Key cooperator in Galleon insider cases gets probation

Thu Jul 19, 2012 11:18am EDT

July 19 (Reuters) - A former McKinsey & Co partner whose testimony helped convict Galleon Group founder Raj Rajaratnam and former Goldman Sachs Group Inc director Rajat Gupta was sentenced on Thursday to two years probation.

Anil Kumar, the former McKinsey partner, was also ordered to forfeit $2.26 million. His sentence was handed down by Judge Denny Chin at a hearing in Manhattan federal court.

Kumar is among a handful of people who chose to plead guilty and help prosecutors and the FBI in their wide-ranging probe of illicit trading on Wall Street.

In a letter to Chin on Monday, prosecutors had called Kumar's cooperation "nothing short of extraordinary."

http://www.reuters.com/article/2012/07/19/galleon-kumar-sentence-idUSL2E8IJ7CP20120719

DemReadingDU

(16,000 posts)7/19/12 Timothy Geithner Peppered TARP Inspector General Barofsky With F-Bombs: Book

"I never would have imagined that one day one of the most powerful government officials in the world would be dropping f-bombs on me." That's Neil Barofsky's response to being on the receiving end of an epic tantrum by Treasury Secretary Timothy Geithner in the fall of 2009, after Barofsky dared to suggest that Geithner had perhaps not been the most transparent Treasury secretary in the entire history of the country.

Warning: Sailor talk ahoy!

"Neil, I have been the most fucking transparent secretary of the Treasury in this country's entire fucking history!" Geithner erupted, in an episode that had Barofsky wondering if Geithner was going to "throttle" him. At the time, Barofsky was the special inspector general in charge of oversight of the Troubled Asset Relief Program.

It's one of the juicier episodes in Barofsky's new book, "Bailout: An Inside Account of How Washington Abandoned Main Street While Rescuing Wall Street." The book recounts Barofsky's front-row view of how the Bush and Obama administrations handled the bailouts of banks, auto makers and homeowners after the financial crisis. Few players come off looking great in the book, but Geithner and his Treasury Department are cast in a particularly bad light.

Congress created Barofsky's position of special inspector general to keep tabs on how TARP money would be spent. Though a Democrat who donated to President Obama's 2008 presidential campaign, Barofsky was appointed by President George W. Bush and had a cordial relationship with then-Treasury Secretary Hank Paulson. Barofsky hoped for even better things from the Obama administration. Instead, Geithner's treatment of Barofsky ranged from disdain to thundering rage.

more...

http://www.huffingtonpost.com/2012/07/19/timothy-geithner-neil-barofsky-tarp_n_1686047.html

Demeter

(85,373 posts)It's called "stealing in broad daylight".

What Timmy isn't, is educable.