Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 25 July 2012

[font size=3]STOCK MARKET WATCH, Wednesday, 25 July 2012[font color=black][/font]

SMW for 24 July 2012

AT THE CLOSING BELL ON 24 July 2012

[center][font color=red]

Dow Jones 12,617.32 -104.14 (-0.82%)

S&P 500 1,338.31 -12.21 (-0.90%)

Nasdaq 2,862.99 -27.16 (-0.94%)

[font color=red]10 Year 1.39% -0.07 (-4.79%)

30 Year 2.45% -0.08 (-3.16%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Fuddnik

(8,846 posts)UPS sees global economy getting worse

Published: Tuesday, July 24, 2012, 5:30 PM Updated: Tuesday, July 24, 2012, 5:33 PM

NEW YORK -- UPS expects the global economy to get worse before it gets better. Again.

The world's largest package delivery company is more pessimistic about U.S. growth than many economists. It predicts global trade will grow even slower than the world's economies -- a trend not seen since the recession. It's making cuts in its business and reducing its earnings projections.

UPS on Tuesday lowered its forecast for all of 2012 and said its third-quarter earnings will fall below last year's results.

Customers are worried about the global economy weakening in the second half of the year, the company said. Their skittishness was also felt in the second quarter, where UPS missed analysts' expectations for both earnings and revenue. The stock fell nearly 5 percent Tuesday.

(snip)

UPS said it expects the U.S. economy, by far the world's largest, will grow just 1 percent this year. The company cited stalling growth from U.S. service companies, lower retail sales and still-high unemployment as signals that the U.S. isn't holding up as well as UPS anticipated just three months ago.

(snip)

http://www.cleveland.com/business/index.ssf/2012/07/ups_sees_global_economy_gettin.html

DemReadingDU

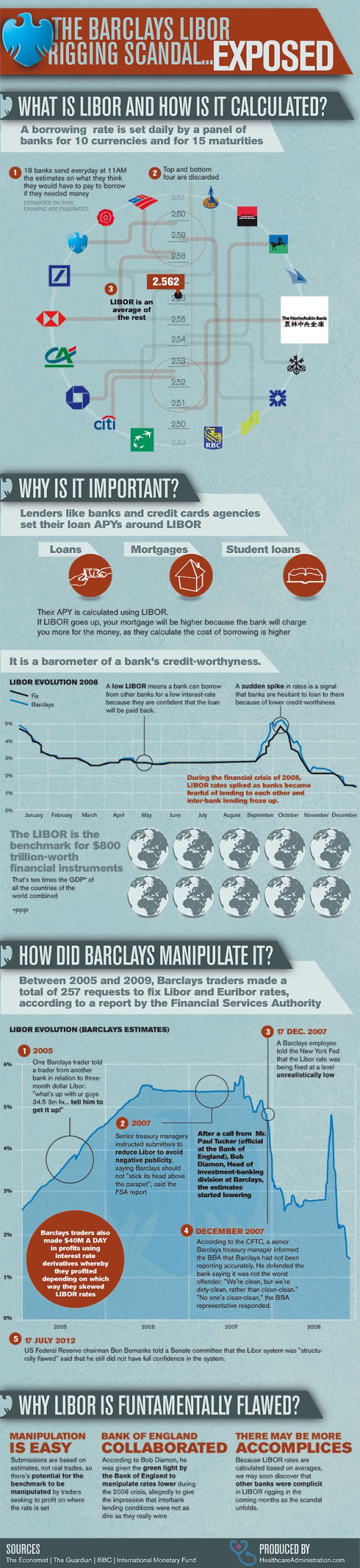

(16,000 posts)7/24/12 Exposing the Barclays LIBOR Rigging Scandal (Infographic)

Since (at least) 2005, Barclay’s has been manipulating LI(E)BOR, and their traders have been allegedly pocketing $40MM A DAY betting on interest rate derivatives. If the LIBOR, one of the most fundamental metrics of our banking system can be rigged, can you imagine what other elements of our financial system are a fraud?

http://www.zerohedge.com/news/liebor-rigging-scandal-infographic-dummies

Tansy_Gold

(17,857 posts)Last edited Wed Jul 25, 2012, 09:30 AM - Edit history (1)

DemReadingDU

(16,000 posts)You're on Candid Camera!

Tansy_Gold

(17,857 posts)Eagle-eyed proofreader here, except of her own wrok. ![]()

TalkingDog

(9,001 posts)U.S. prosecutors and European regulators are close to arresting individual traders and charging them with colluding to manipulate global benchmark interest rates, according to people familiar with a sweeping investigation into the rigging scandal.

Federal prosecutors in Washington, D.C., have recently contacted lawyers representing some of the suspects to notify them that criminal charges and arrests could be imminent, said two of those sources, who asked not to be identified because the investigation is ongoing.

Defense lawyers, some of whom represent suspects, said prosecutors have indicated they plan to begin making arrests and filing criminal charges in the next few weeks. In long-running financial investigations it is not uncommon for prosecutors to contact defense lawyers before filing charges to offer suspects a chance to cooperate or take a plea, these lawyers said.

Demeter

(85,373 posts)Put your mouth where your money is. And bite, hard.

Fuddnik

(8,846 posts)mbperrin

(7,672 posts)How about a homeless guy who is often near the bank?

Demeter

(85,373 posts)And all I did was the surfaces in the kitchen, dishes, and squeezed limes for limeade. Not even the floor, and it took 1.5 hours. I gotta get a new life. Or a maid. Or put the Kid somewhere that she can't create such disaster.

Demeter

(85,373 posts)Only a month after Greece installed a new government, the country is facing renewed peril. Its official lenders are signaling a growing reluctance to keep paying the bills of the nearly bankrupt nation, even as the government is seeking more leniency on the terms of its multibillion-euro bailout.

Adding to the woes, there is little agreement within either side. The Greek government is itself a motley coalition of conservatives and Socialists, and the leaders of the European Commission, the International Monetary Fund and the European Central Bank, known as the troika, are increasingly divided among themselves. That is creating even more uncertainty as Greece and the rest of Europe head for yet another showdown, renewing doubts about how long Athens can remain within the euro zone.

Even as fears mount in Europe about the rapidly worsening situation in Spain, Greece’s problems are far from solved. The president of the European Commission, José Manuel Barroso, is expected to make his first visit to Athens since 2009 on Thursday to meet with Prime Minister Antonis Samaras as the troika begins yet another assessment of how well the country has complied with a spate of harsh austerity measures imposed as the price for loans. Greece’s lenders say they will not finance the country any further unless it meets its goals. But many experts say that the targets were never within reach and that pushing three increasingly weak Greek governments to comply has only profoundly damaged the economy.

“We knew at the fund from the very beginning that this program was impossible to be implemented because we didn’t have any — any — successful example,” said Panagiotis Roumeliotis, a vice chairman at Piraeus Bank and a former finance minister who until January was Greece’s representative to the International Monetary Fund. Because Greece is in the euro zone, he noted, the nation cannot devalue its currency to help improve its competitiveness as other countries subject to I.M.F. interventions almost always are encouraged to do...

GOOD SUMMARY/REHASH

Tansy_Gold

(17,857 posts)

Demeter

(85,373 posts)...the stock market is not happy about this: Since the company announced the news after the market closed this afternoon, Apple's shares have fallen by nearly $30, or just shy of 5%, in after-hours trading.

The problem, of course, is that investors wanted Apple to — hoped Apple would, even expected Apple to — make a good bit more.

They were looking for profits of $10.4 billion (a little bigger than Armenia's gross domestic product) and revenues of $37.2 billion, according to John Paczowski over at All Things Digital. Apple's revenue was a mere $35 billion (the economies of Latvia and Tajikistan, with enough left over to cover the Marshall Islands and Tuvalu)...

xchrom

(108,903 posts)

Demeter

(85,373 posts)Except for the dirt, which is bone dry. I should go water...but I'm crashing after all the cleaning.

xchrom

(108,903 posts)Not about the cleaning - just that you're cool - & it's muggy here.

Tansy_Gold

(17,857 posts)You need to package some of that and send it my way.

(Okay, I just googled for pictures of "messy house" and decided I'm not that bad. . . . . .yet!)

Demeter

(85,373 posts)1). Sheldon Adelson, owner of the Las Vegas Sands Casino, is worth nearly $25 billion, making him the 14th wealthiest person in the world and the 7th richest person in America. While median family income plummeted by nearly 40% from 2007-2010, Mr. Adelson has experienced a nearly eightfold increase in his wealth over the past three years (from $3.4 billion to $24.9 billion). Forbes recently reported that Adelson is willing to spend a “limitless” amount of money or more than $100 million to help defeat President Obama in November.

2. The Kochs (David, Charles, and William) are worth a combined $103 billion, according to Forbes. They have pledged to spend about $400 million during the 2012 election season. The Kochs own more wealth than the bottom 41.7 percent of American households or more than 49 million Americans.

3. Jim Walton is worth $23.7 billion. He has donated $300,000 to super PACs in 2012.

4. Harold Simmons is worth $9 billion. He has donated $15.2 million to super PACs this year.

5. Peter Thiel is worth $1.5 billion. He has donated $6.7 million to Super PACs this year.

6. Jerrold Perenchio is worth $2.3 billion. He has donated $2.6 million to super PACs this year.

7. Kenneth Griffin is worth $3 billion and he has given $2.08 million to super PACs in 2012.

8. James Simons is worth $10.7 billion and he has given $1.5 million to super Pacs this year.

9. Julian Robertson is worth $2.5 billion and he has given $1.25 million to super PACs this year.

10. Robert Rowling is worth $4.8 billion and he has given $1.1 million to super PACs.

11. John Paulson, the hedge fund manager who made his fortune betting that the sub-prime mortgage market would collapse, is worth $12.5 billion. He has donated $1 million to super PACs.

12. Richard and J.W. Marriott are worth a combined $3.1 billion and they have donated $2 million to super PACs this year.

13. James Davis is worth $1.9 billion and he has given $1 million to super PACs this year.

14. Harold Hamm is worth $11 billion and he has given $985,000 to super PACs this year.

15. Kenny Trout is worth more than $1.2 billion and he has given $900,000 to super PACs this year.

16. Louis Bacon is worth $1.4 billion and he has given $500,000 to super PACs this year.

17. Bruce Kovner is worth $4.5 billion and he has given $500,000 to super PACs this year.

18. Warren Stephens is worth $2.7 billion and he has given $500,000 to super PACs this year.

19. David Tepper is worth $5.1 billion and he has given $375,000 to super PACs this year.

20. Samuel Zell is worth $4.9 billion and he has given $270,000 to super PACs this year.

21. Leslie Wexner is worth $4.3 billion and he has given $250,000 to super PACs this year.

22. Charles Schwab is worth $3.5 billion and he has given $250,000 to super PACs this year.

23. Kelcy Warren is worth $2.3 billion and he has given $250,000 to super PACs this year.

MANY THANKS TO THE DANCING SUPREMES FOR MAKING THIS TRAVESTY POSSIBLE

Demeter

(85,373 posts)...We are told repeatedly that when Wall Street’s deeply flawed incentive system leads to one bad outcome after another, year after year, it will never happen again. Yet it does. And you can add this vital business to the list: The way state and local government officials hire Wall Street firms to raise the billions of dollars their municipalities need to build schools, hospitals, airports and sewers, and provide other essential services.

For some reason, Wall Street never seems to get the message that bribing government officials -- and paying each other off - - to get access to lucrative municipal-bond underwriting business is illegal. Wall Street has never learned this lesson because the miniscule price it ends up having to pay for misbehaving has absolutely no deterrent value whatsoever.

Indeed, what the cartel of the major banks does over and over again to win underwriting business from local government officials, and the way the cartel then sorts out among itself who gets what fees, is a microcosm of a much wider problem of the increasing power that the Wall Street survivors of the financial crisis have over the rest of us...

VARIOUS SORDID TALES OF THE STREET FOLLOW

xchrom

(108,903 posts)Ford Motor Co. (F), the second-largest U.S. automaker, lowered its outlook for full-year profit while reporting second-quarter net income fell 57 percent as losses in Europe ballooned and overshadowed earnings in North America.

A growing crisis in Europe is denting the turnaround Chief Executive Officer Alan Mulally has engineered at Ford. European pretax operating losses widened to $404 million, from a loss of $149 million in the first quarter and profit of $176 million a year earlier. Ford said it now expects full-year European losses to exceed $1 billion and that it no longer forecasts total pretax operating profit to equal last year’s $8.8 billion.

“It’s brutal, man, just brutal,” said Gary Bradshaw, a fund manager at Dallas-based Hodges Capital Management, which owns about 250,000 Ford shares. “They’ve done a remarkable job here in the U.S., paying down debt and getting an investment- grade rating, but the European stuff is just killing them.”

Ford reported its 13th consecutive profitable quarter, with net income of $1.04 billion, or 26 cents a share, compared with $2.4 billion, or 59 cents, a year earlier. Excluding one-time items, the profit was 30 cents a share, beating the 29-cent average estimate of 17 analysts surveyed by Bloomberg.

xchrom

(108,903 posts)Roddale Smith knew he could do better than toting chairs around at Cincinnati Children’s Hospital Medical Center. And when he decided to pursue an education, he didn’t have to go far. His employer brought the classroom to him.

It paid off for both sides. Smith, 32, graduated from nursing school last month and Children’s Hospital, in need of skilled workers, has a new job waiting for him. His salary, now $12 an hour, will almost double.

“Moving furniture does not have a direct impact on patient care,” said Smith, who started his training in 2008. “I wanted a career, earning a larger salary and making a more significant difference.”

Even with almost 13 million Americans looking for work and 8 million more settling for part-time jobs, almost half the 1,361 U.S. employers surveyed in January by ManpowerGroup say they can’t find workers to fill positions. At the same time, American employers are less likely than their counterparts overseas to invest in training, the Milwaukee-based staffing company reported last month.

xchrom

(108,903 posts)WellPoint Inc. (WLP), the second-biggest U.S. health plan, reduced its full-year forecast after quarterly profit missed analyst estimates because of higher medical costs.

Net income is expected to be $7.30 to $7.40 a share, the Indianapolis-based company said in a statement today. Second- quarter earnings excluding one-time items were $2.04 a share, lower than the $2.08 average of 19 analyst estimates compiled by Bloomberg.

Medical costs have stabilized this year as Americans seek treatment after putting off doctor’s visits because of high unemployment. WellPoint has said the number of its members will decline as the company pulls out of less-profitable markets. UnitedHealth Group Inc., (UNH) the biggest U.S. health plan, last week raised its forecast after increasing enrollment.

The lowered forecast will hurt “a stock that investors already dislike,” Thomas A. Carroll, a Stifel Nicolaus & Co. analyst in Baltimore, said in an e-mail. “There was lots of talk of medical trends rising and higher utilization. That will have sector-wide implications.”

xchrom

(108,903 posts)China, the world’s biggest steel producer, is exporting at the highest level in two years, exacerbating a global glut that may hurt competitors from ArcelorMittal (MT) to U.S. Steel (X) Corp.

Monthly shipments abroad rose to 8.7 percent of domestic output last month, the highest proportion since July 2010. Chinese steel mills, set for a record production in 2012, are ramping up overseas sales to avoid a softer domestic market, where prices for the commodity have dropped to a two-year low.

ArcelorMittal of Luxembourg, which posted a 28 percent slump in second-quarter profit today, and peers in developed markets are closing plants amid slower economies and lower prices. In contrast, Chinese Premier Wen Jiabao is overseeing a $23 billion investment in new mills to stimulate automaking and housing to reignite growth that fell in the second quarter to the slowest in three years. The strategy already is sparking unfair-trade charges by Western rivals.

“Increased Chinese exports take sales directly away from American producers,” Alan Price of Wiley Rein LLP, which acts as the trade attorney for Nucor Corp. (NUE), the largest U.S. steelmaker by market value, said in an e-mail response to questions. “It is highly likely that current Chinese exports across a range of products are being dumped.”

xchrom

(108,903 posts)Caterpillar Inc. (CAT), the world’s largest maker of construction and mining equipment, posted second-quarter profit that beat analysts’ estimates and raised its full-year earnings forecast as demand increased from North American builders and overseas miners.

Net income rose to $1.7 billion, or $2.54 a share, from $1.02 billion, or $1.52, a year earlier, the Peoria, Illinois- based company said in a statement today. Profit was more than the $2.28 average of 20 estimates compiled by Bloomberg. The shares rose 4.4 percent to $85.01 at 7:42 a.m. before the start of regular trading in New York.

Caterpillar sees 2012 profit of about $9.60 a share, compared with a previous forecast of $9.50 a share. Sales are projected at $68 billion to $70 billion, compared with a previous expectation of $68 billion and $72 billion.

***my dad worked for cat for 45 years.

i miss my dad.

Demeter

(85,373 posts)

xchrom

(108,903 posts)xchrom

(108,903 posts)BERLIN (Reuters) - The eurozone faces economic disaster unless its financially stronger states and its central bank commit to bearing a larger share of the region's debt burden, leading global economists including two advisers to the German government said.

"We believe that ...Europe is sleepwalking toward a disaster of incalculable proportions... The sense of a never-ending crisis, with one domino falling after another, must be reversed," the Institute for New Economic Thinking (INET), backed by veteran investor George Soros, wrote in its report.

Policymakers must tackle two problems separately - dealing with the legacy costs of the "initially flawed design" of the euro zone, and fixing the structure of the bloc itself.

Among their recommendations, the economists called for an early partial mutualisation of the region's debt - which Germany has refused to consider - and the eventual creation of a supranational financial watchdog with authority over national regulators.

Read more: http://www.businessinsider.com/economists-europe-is-sleepwalking-toward-a-disaster-of-incalculable-proportions-2012-7#ixzz21dTUByIx

xchrom

(108,903 posts)

The UK economy is contracting at a faster rate than expected.

GDP fell 0.7 percent in Q2 from Q1. This is the third straight quarter of declines.

Economists were expecting a more modest 0.2 percent decline.

On a year-over-year basis, GDP fell 0.8 percent, versus expectations for a 0.3 percent decline.

According to Bloomberg's Linda Yueh, this is the sharpest decline in 3 years.

Read more: http://www.businessinsider.com/uk-gdp-2012-7#ixzz21dU3V6ji

***can i just say -- that i LOVE that hat?

Tansy_Gold

(17,857 posts)Is her hat made out of the same fabric as the suit, or the suit out of the same fabric as the hat?

I also love hats. Ask AnneD. ![]()

xchrom

(108,903 posts)but that hat is so wonderful -- it might've come first.

i think you and i are were separated at birth --

Demeter

(85,373 posts)She buys a hat for a wedding, supposedly just like one the Queen has, and the snide remark is, "Well, it DOES look like road kill..."

xchrom

(108,903 posts)

Sandy Weill was the CEO and chairman of Citigroup during Wall Street's bad old days. He oversaw the growth of that bank into the massive, global business that it is now and as a philanthropist, the Weill name is all over New York City.

Today, though, he's on Squawk Box calling for banks to be broken up and "do something that doesn't risk tax payer dollars."

He thinks investment banks should be spun off from banks that provide retail and commercial banking services, and quite frankly, the fact that he's saying this is blowing our minds

Read more: http://www.businessinsider.com/sandy-weill-is-calls-for-the-break-up-of-wall-street-banks-2012-7#ixzz21dUt5WJV

Po_d Mainiac

(4,183 posts)That tie wood look better if it was soaked hemp with one end attached to a lamp post

xchrom

(108,903 posts)Hotler

(11,420 posts)Demeter

(85,373 posts)Sounds like wheeling-dealing to cop a plea.

xchrom

(108,903 posts)Hopes that the euro crisis may take a summer break like scores of European Union leaders, including German Chancellor Angela Merkel, have been dashed. The currency, at two-year lows against the dollar, has been pummelled by a raft of bad news on Spain, Greece and the credit ratings outlook for Germany.

Madrid's troubles are perhaps most concerning. The country's borrowing costs have surged amid new fears the euro zone's fourth-largest economy will need a full sovereign bailout that the currency union's backstop funds can ill afford. Investors were demanding 7.6 percent interest on 10-year sovereign bonds on Tuesday, a new euro-era high and well above the 7 percent level seen as unsustainable for public finances.

Even worse, the Spanish government said last week it expected the economy to remain in recession well into next year and the autonomous region of Valencia became the first to ask Madrid for aid to pay debt obligations it cannot meet. The northeastern region of Catalonia, responsible for a fifth of the country's economic output, indicated on Tuesday that it too may apply for central government funds.

The new Spanish woes coincided with an annoucement from Moody's Investors Service on Tuesday night that it was cutting the outlook on its triple-A long-term rating for the EU's temporary bailout fund, the European Financial Stability Facility (EFSF) to negative from stable, dealing a blow to one of the EU's two firefighting funds. Moody's also said late on Tuesday it would review German states and lowered its outlook from stable to negative for Baden-Württemberg, Bavaria, Brandenburg, North Rhine-Westphalia and Saxony-Anhalt.

xchrom

(108,903 posts)German business confidence fell in July to its lowest level in 28 months, according to a closely watched survey.

The Ifo think tank's index stood at 103.3, down from 105.2 in June, citing a "significant deterioration" in the manufacturing business climate.

It was the third month in a row the Ifo registered a fall in sentiment.

The news comes shortly after the Moody's rating agency put Germany's top AAA rating on negative outlook, citing risks from the rest of the eurozone.

xchrom

(108,903 posts)The International Monetary Fund (IMF) has warned that the worsening debt crisis in the eurozone poses a "key risk" to China's growth.

The IMF added that China also faces domestic risks, not least from a sharper-than-anticipated decline in the property market.

However, the fund said China had ample room and the fiscal tools "to respond forcefully" to any such developments.

Growth in China's economy slowed to a three-year low in the second quarter

DemReadingDU

(16,000 posts)7/24/12 Are regulators seeing the world through Wall Street–colored glasses?

Neil Barofsky, former special inspector general for the Troubled Asset Relief Program, weighs in on the Libor scandal and whether or not Treasury Secretary Timothy Geithner — formerly the president of the New York Federal Reserve Bank — did his job.

“Geithner’s going to claim that they reacted swiftly and significantly with all the furor necessary. But look, common sense says if you find out something in April of 2008 and more than four years later nothing has happened about it — I mean, that tells you everything you need to know about what’s wrong with Washington,” Barofsky says.

video appx 2.5 minutes

http://current.com/shows/viewpoint/videos/are-regulators-seeing-the-world-through-wall-street-colored-glasses/

Iggy

(1,418 posts)The ASCE periodically grades our infrastructure condition; we're currently at "D", with F being

FAIL.

The ASCE recommends expenditure of around $2 Trillion dollars to repair existing infrastructure

where needed and build new. not sure if this includes the new smart power grid our nation

needs.

for every $1 Billion spent on infrastructure, 50,000 jobs are created. these are well paying, good benny

jobs for architects, engineers, construction workers, truck drivers, etc.

I think the number is 1.5 - 2 million construction workers UNemployed right now. the housing market

ain't coming back any time soon folks. forget that.

this is all moot, since our ignorant congress intends to coast/get by with the crappy infrastructure we

currently have. the deficit/debt hysteria rules.

but it's OK to spend Trillions on terminal war on terra.

weak, very weak

Demeter

(85,373 posts)That must be costing a lot of the Black Budget, right there.

Iggy

(1,418 posts)is _not_ even debated much in Congress... they just keep signing the big phat checks

year after year... the cost is estimated in the $60 Billion per year range-- but of course

nobody can say for certain as it's "top secret". what a load.

I don't mind surveillance-- but these agencies are obviously surveilling the wrong people.

![]()

Roland99

(53,342 posts)DOW +1.0%

[font color="red"]NASDAQ -0.1% [/font]

xchrom

(108,903 posts)MINNEAPOLIS (AP) -- For an airline, the whole idea of fuel hedging is to protect against big run-ups in oil prices. It didn't work out that way for Delta Air Lines Inc.

Its bets on oil prices went the wrong way, pushing it to a second-quarter loss of $168 million, or 20 cents per share. During the same period last year, Delta had net income of $198 million, or 23 cents per share.

The airline said Wednesday that it lost $561 million on wrong oil price bets that haven't settled yet. It also had $171 million in severance costs from voluntary staff reductions.

If not for special items, Delta would have earned $586 million for the quarter, or 69 cents per share. Analysts surveyed by FactSet expected 68 cents per share.

xchrom

(108,903 posts)TOKYO — Japan posted its biggest first-half trade deficit on record, according to government figures released Wednesday, highlighting the economic consequences as this nuclear-averse country imports fossil fuels to meet its energy needs.

The Ministry of Finance reported a 2.92 trillion yen (or $37.3 billion) trade deficit, which reflected not only Japan’s surging need for oil and liquefied natural gas (LNG), but also weakened exports to slumping markets like Europe and China.

The world’s third-largest economy has averted economic crisis this year largely because of a spike in domestic demand, spurred by reconstruction of the earthquake- and tsunami-devastated northeast.

But long term, Japan faces some troubling challenges: Its famed exporters — automakers and tech giants — are pinched by a global economic slowdown. Meanwhile, the country’s sustained wariness of nuclear energy has led to record imports of fossil fuels, which arrive here on hulking tankers and help prevent the nightmare scenario of blackouts during the sweltering summer.

xchrom

(108,903 posts)WASHINGTON (AP) -- Americans bought fewer new homes in June after sales jumped to a two-year high in May. The steep decline suggests a weaker job market could make the housing recovery slow and uneven.

The Commerce Department says sales of new homes fell 8.4 percent last month to a seasonally adjusted annual rate of 350,000. That's the lowest in five months. Sales in the Northeast plunged 60 percent to the lowest level since November.

Nationwide, sales in May and April were revised much higher. And June's sales pace is still 15.1 percent higher than in June 2011.

The number of unsold new homes is near record lows. There were 144,000 new homes for sale in June, just above May's 143,000 - the lowest on records dating back to 1963.

Demeter

(85,373 posts)Introduction: The United States has experienced the biggest political upheaval in its recent history: the transformation of a burgeoning welfare state into a rapidly expanding, highly intrusive and deeply entrenched police state, linked to the most developed technological innovations.

The ‘Great Transformation’ occurred exclusively from above, organized by the upper echelons of the civil and military bureaucracy under the direction of the Executive and his National Security Council. The ‘Great Transformation’ was not a single event but a process of the accumulation of powers, via executive fiats, supported and approved by compliant Congressional leaders. At no time in the recent and distant past has this nation witnessed the growth of such repressive powers and the proliferation of so many policing agencies engaged in so many areas of life over such a prolonged period of time (a time of virtually no internal mass dissent). Never has the executive branch of government secured so many powers to detain, interrogate, kidnap and assassinate its own citizens without judicial restraint.

Police state dominance is evident in the enormous growth of the domestic security and military budget, the vast recruitment of security and military personnel, the accumulation of authoritarian powers curtailing individual and collective freedoms and the permeation of national cultural and civic life with the almost religious glorification of the agents and agencies of militarism and the police state as evidenced at mass sporting and entertainment events.

The drying up of resources for public welfare and services is a direct result of the dynamic growth of the police state apparatus and military empire. This could only take place through a sustained direct attack against the welfare state – in particular against public funding for programs and agencies promoting the health, education, pensions, income and housing for the middle and working class....

DETAILS AT LINK

Demeter

(85,373 posts)Unlike the manufacturing sector, financial capital does not need a population of educated, healthy and productive workers. Its own ‘labor force’ is composed of a small educated elite of speculators, analysts, traders and brokers at the top and middle levels and a small army of ‘contract’ office sweepers, secretaries and menial workers at the bottom. They have their own ‘invisible’ army of domestic servants, cooks, caterers, gardeners and nannies devoid of any ‘Social Security’, health coverage and pension plans. And the financial sector has its own private networks of doctors and clinics, schools, communications systems and messengers, estates and clubs, and security agencies and body guards; it needs not an educated, skilled public sector; and it certainly does not want national wealth to support high quality public health and educational systems. It has no interest in supporting this mass of public institutions which it views as an obstacle to ‘freeing up’ vast amounts of public wealth for speculation. In other words, the dominant sector of capital has no objection to ‘Homeland Security’; indeed it shares many sentiments with the proponents of the police state and supports the shrinking the welfare state. It is concerned about lowering taxes on finance capital and increasing Federal bail-out funds for Wall Street while controlling the impoverished citizenry.

Demeter

(85,373 posts)What can Europe learn from the United States? - First, the United States – like Canada, England and China – have central banks that do what central banks outside of Europe were created to do: finance the budget deficit directly.

I have found that it is hard to explain to continental Europe just how different the English-speaking countries are in this respect. There is a prejudice here that central bank financing of a domestic spending deficit by government is inflationary. This is nonsense, as demonstrated by recent U.S. experience: the largest money creation in American history has gone hand in hand with debt deflation.

It is the commercial banks that have created the Bubble Economy’s inflation, from North America to Europe. They have recklessly lent mortgage credit and other credit far beyond the ability of domestic economies to pay. A real central bank can create credit on its electronic keyboards just as easily as commercial banks can do. But central banks do not create credit for speculative purposes. They do not make junk mortgages based on “liars’ loans” (the liars are the banks, not the borrowers), based on fictitious evaluations by crooked appraisers, and sold fraudulently to investment banks to package and sell to gullible Europeans, pension funds and other customers.

In short, there is no need for the present austerity. If Europe acted like the United States, it could bail out the banks.

But would this be a good thing? My second point is that there are good reasons not to fund a dysfunctional debt overhead, financial and tax system. It is preferable to change these systems....

DETAILS AT LINK

Demeter

(85,373 posts)...1. Security

In his "People's History," Howard Zinn described colonial opposition to inequality in 1765: "A shoemaker named Ebenezer Macintosh led a mob in destroying the house of a rich Boston merchant named Andrew Oliver. Two weeks later, the crowd turned to the home of Thomas Hutchinson, symbol of the rich elite who ruled the colonies in the name of England. They smashed up his house with axes, drank the wine in his wine cellar, and looted the house of its furniture and other objects. A report by colony officials to England said that this was part of a larger scheme in which the houses of fifteen rich people were to be destroyed, as part of 'a war of plunder, of general levelling and taking away the distinction of rich and poor.'" That doesn't happen much anymore. Of course, the super-rich aren't taking any chances, with panic shelters and James Bond cars and personal surveillance drones. But the U.S. government will be helping them by spending $55 billion on Homeland Security next year, in addition to $673 billion for the military. The police, emergency services, and National Guard are trained to focus on crimes against wealth. In the cities, business interests keep the police focused on the homeless and unemployed. And on drug users. A "Broken Windows" mentality, which promotes quick fixes of minor damage to discourage large-scale destruction, is being applied to human beings. Wealthy Americans can rest better at night knowing that the police are "stopping and frisking" in the streets of the poor neighborhoods.

2. Laws and Deregulations

The wealthiest Americans are the main beneficiaries of tax laws, property rights, zoning rules, patent and copyright provisions, trade pacts, antitrust legislation, and contract regulations. Tax loopholes allow them to store over $1 trillion in assets overseas. Their companies benefit, despite any publicly voiced objections to regulatory agencies, from SBA and SEC guidelines that generally favor business, and from FDA and USDA quality control measures that minimize consumer complaints and product recalls. The growing numbers of financial industry executives have profited from 30 years of deregulation, most notably the repeal of the Glass-Steagall Act. Lobbying by the financial industry has prolonged the absurdity of a zero sales tax on financial transactions. Big advantages accrue for multinational corporations from trade agreements like NAFTA, with international disputes resolved by the business-friendly World Bank, International Monetary Fund, and World Trade Organization. Federal judicial law protects our biggest companies from foreign infringement. The proposed Trans-Pacific Partnership would put governments around the world at the mercy of corporate decision-makers. The euphemistically named JOBS Act further empowers business, exempting startups from regulatory accounting requirements. There are even anti-antitrust measures, such as the licensing rules that allow the American Medical Association to restrict the number of doctors in the U.S., thereby keeping doctor salaries artificially high. Can't have a free market if it hurts business.

3. Research and Infrastructure

A publicly supported communications infrastructure allows the richest 10% of Americans to manipulate their 80% share of the stock market. CEOs rely on roads and seaports and airports to ship their products, the FAA and TSA and Coast Guard and Department of Transportation to safeguard them, a nationwide energy grid to power their factories, and communications towers and satellites to conduct online business. Private jets use 16 percent of air traffic control resources while paying only 3% of the bill. Perhaps most important to business, even as it focuses on short-term profits, is the long-term basic research that is largely conducted with government money. Especially for the tech industry. Taxpayer-funded research at the Defense Advanced Research Projects Agency (the Internet) and the National Science Foundation (the Digital Library Initiative) has laid a half-century foundation for technological product development. Well into the 1980s, as companies like Apple and Google and Microsoft and Oracle and Cisco profited from the fastest-growing product revolution in American history, the U.S. Government was still providing half the research funds. Even today 60% of university research is government-supported. Public schools have helped to train the chemists, physicists, chip designers, programmers, engineers, production line workers, market analysts, and testers who create modern technological devices. They, in turn, can't succeed without public layers of medical support and security. All of them contribute to the final product. As the super-rich ride in their military-designed armored cars to a financial center globally connected by public fiber optics networks to make a trade guided by publicly funded data mining and artificial intelligence software, they might stop and re-think the old Horatio Alger myth.

4. Subsidies

The traditional image of 'welfare' pales in comparison to corporate welfare and millionaire welfare. Whereas over 90% of Temporary Assistance for Needy Families goes to the elderly, the disabled, or working households, most of the annual $1.3 trillion in "tax expenditures" (tax subsidies from special deductions, exemptions, exclusions, credits, and loopholes) goes to the top quintile of taxpayers. One estimate is $250 billion a year just to the richest 1%. Senator Tom Coburn's website reports that mortgage interest and rental expense deductions alone return almost $100 billion a year to millionaires. The most profitable corporations get the biggest subsidies. The Federal Reserve provided more than $16 trillion in financial assistance to financial institutions and corporations. According to Citizens for Tax Justice, 280 profitable Fortune 500 companies, which together paid only half of the maximum 35 percent corporate tax rate, received $223 billion in tax subsidies. Even the conservative Cato Institute admitted that the U.S. federal government spent $92 billion on corporate welfare during fiscal year 2006. Recipients included Boeing, Xerox, IBM, Motorola, Dow Chemical, and General Electric. In agriculture, most of the funding for commodity programs goes to large agribusiness corporations such as Archer Daniels Midland. For the oil industry, estimates of subsidy payments range from $10 to $50 billion per year.

5. Disaster Costs

Exxon spokesperson Ken Cohen once said: "Any claim we don't pay taxes is absurd...ExxonMobil is a leading U.S. taxpayer." Added Chevron CEO John Watson: "The oil and gas industry pays its fair share in taxes" But SEC documents show that Exxon paid 2% in U.S. federal taxes from 2008 to 2010, Chevron 4.8%. As if to double up on the insult, the petroleum industry readily takes public money for oil spills. Cleanups cost much more than the fines imposed on the companies. Government costs can run into the billions, or even tens of billions, of dollars.Another disaster-prone industry is finance, from which came the encouraging words of Goldman Sachs chairman Lloyd Blankfein: "Everybody should be, frankly, happy...the financial system led us into the crisis and it will lead us out." Estimates for bailout funds from the Treasury and the Federal Reserve range between $3 trillion and $5 trillion. That's enough to pay off both the deficit and next year's entitlement costs. All because of the irresponsibility of the super-salaried CEOs of our most profitable corporations.

Common Sense

Patriotic Millionaires recently addressed the President and Congress: "Given the dire state of our economy, it is absurd that one-quarter of all millionaires pay a lower tax rate than millions of working, middle-class American families...Please do the right thing for our country. Raise our taxes."

MORE