Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 29 January 2013

[font size=3]STOCK MARKET WATCH, Tuesday, 29 January 2013[font color=black][/font]

SMW for 28 January 2013

AT THE CLOSING BELL ON 28 January 2013

[center][font color=red]

Dow Jones 13,881.93 -14.05 (-0.10%)

S&P 500 1,500.18 -2.78 (-0.18%)

[font color=green]Nasdaq 3,154.30 +4.59 (0.15%)

[font color=green]10 Year 1.96% -0.03 (-1.51%)

30 Year 3.14% -0.03 (-0.95%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)since they have the money and the egotism to spare.

And they think they can steal the election, win without the backing of the nation, using technology and bribes and propaganda.

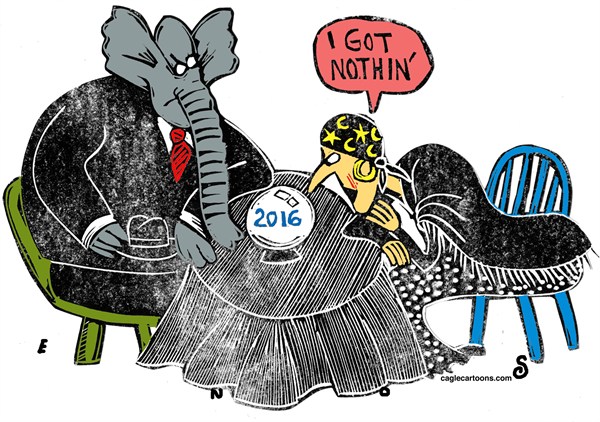

We used to be talking of doing away with the Electoral College. Now the GOP wants to distort it beyond all possible belief, just so they can put their stooge in power.

tclambert

(11,085 posts)Have they finally given up on the stupid-heads? The types of Romney, Palin, Bachmann all seem to be out of consideration. I can't think of anyone they think of as a prominent respected Republican. They may have to recruit an unknown.

Or maybe they go full blow-hard and run Rush Limbaugh his own self. (Naw, he probably wouldn't accept the pay cut.)

I'm thinking they finally split. A "reasonable" Republican, if any such still exist, wins the main party, desperate to taken seriously. This would trigger the teabaggers to run an alternative choice. Now, that's entertainment.

Demeter

(85,373 posts)His party needs him (and Poppy's operatives) enough to have forgot all about what's-his-name.

AnneD

(15,774 posts)for one. There are other moderate GOP but the trick is getting them through the GOP primary. The winner takes all favors the RW nutjobs.

Demeter

(85,373 posts)BLESS YOU, OF COURSE THEY DID! THEY COULDN'T SAY NO, NOW, COULD THEY?

http://www.washingtonpost.com/business/report-treasury-approved-excessive-pay-for-executives-at-bailed-out-aig-gm-and-ally/2013/01/28/7e9f52ba-697d-11e2-9a0b-db931670f35d_story.html

A government report Monday criticized the U.S. Treasury Department for approving “excessive” salaries and raises at firms that received taxpayer-funded bailouts during the financial crisis. The Special Inspector General for the Troubled Asset Relief Program said Treasury approved all 18 requests it received last year to raise pay for executives at American International Group Inc., General Motors Corp. and Ally Financial Inc. Of those requests, 14 were for $100,000 or more; the largest raise was $1 million. Treasury also allowed pay packages totaling $5 million or more for nearly a quarter of the executives at those firms, the report says.

“We ... expect Treasury to look out for taxpayers who funded the bailout of these companies by holding the line on excessive pay,” said Christy Romero, the special inspector general for TARP. “Treasury cannot look out for taxpayers’ interests if it continues to rely to a great extent on the pay proposed by companies that have historically pushed back on pay limits.”

The report says Treasury bypassed rules under the 2008 bailout that limited pay. Treasury approved raises that exceeded pay limits and in some cases failed to link compensation to performance, it notes. Romero said the guidelines say compensation should not exceed the 50th percentile of pay for executives in similar positions at other financially distressed companies. But pay surpassed that level for 63 percent of the executives whose pay was approved, according to the report. The report also said Treasury officials had been warned a year ago that the department needed to reform its procedures to ensure that the pay guidelines are followed.

Patricia Geoghegan, the Treasury official who approved the raises, disputed the findings of the report. In a letter to Romero, Geoghegan said it’s unfair to call the pay excessive. She said Treasury must strike a balance between limiting compensation and approving pay packages that are consistent with executives in similar jobs. Geoghegan called the 50th percentile “a benchmark.” She noted that some pay packages at the three companies exceeded that level in 2012. But she said more than half at AIG were at or below that level, while nearly half at GM and Ally were below it...

A BENCHMARK, EH? SHOULD HAVE "BENCHED" THE TREASURY OFFICIAL....HARD ENOUGH TO LEAVE A MARK

Demeter

(85,373 posts)...Now the Obama administration’s first-term posse is riding off into the sunset. The most visible departure is Deputy Attorney General Lanny Breuer. Remember those submissive or avaricious sheriffs in the old Westerns, the ones who were always letting the bad guys run wild ? ”Sorry, Ma’am, I’d like to help you and the boy but there ain’t nothin’ I can do.” That’s Breuer, whose shattered credibility and extreme reluctance to prosecute has become the stuff of legend. But he’s not the only one. Meet the senior partners in a firm that is more aptly named “Covington, Burling and Justice.”

Lanny Breuer

All it took was a well-edited compilation of his own words on PBS’ Frontline to spur an announcement of Breuer’s unscheduled resignation. (Mary Bottari has the Frontlinehighlights.) They’re denying any connection between the program and the resignation, of course, but the denials ring false. Breuer was already on the record in a speech before the New York City Bar Association as saying that “we must take into account the effect of an indictment on innocent employees and shareholders” at major Wall Street firms. That’s like not arresting Tony Soprano because they’d all be out of a job down at the Bada Bing Club. And note that Breuer did not say “We must take into account the effect of unpunished wrongdoing on defrauded investors, homeowners, or the American and global economies.” The entire premise is bogus anyway. It’s possible to criminally indict individual bankers without bringing down the whole bank. If necessary, the government can assume control of a failing institution to make sure that its workforce stays employed.

Besides, when did prosecutors start worrying about stock market value before deciding whether or not to indict suspected crooks? MORE

Robert Khuzami

Robert Khuzami was Breuer’s partner in crime non-punishment over at the SEC. Khuzami ran the agency’s enforcement division until his resignation was announced earlier this month. That inspired a Ben Protess puff piece in The New York Times Dealbook page that reads like a regulatory ”Fifty Shades of Gray” - call it ”Fifty Shades of Gray Pinstripe” - with Khuzami as the “dominant” and the rest of us as “submissives.” We’re told that Khuzami is “an imposing presence with a piercing stare,” an effect he tries to replicate for the camera with lamentable results.

We’re also told Khuzami had “a knack for grilling lawyers” who worked for him – a knack that clearly did not extend to bankers under his scrutiny. Dealbook claimed that Khuzami’s accomplishments include “becoming the public face of Wall Street enforcement and reining in firms like Goldman Sachs.” Make that the public face of non-enforcement, as firms like Goldman Sachs openly mocked and defied enforcement efforts. While his Justice Department colleagues looked the other way – at behavior that allegedly included Congressional perjury by Goldman CEO Lloyd Blankfein – Khuzami dutifully allowed executives at Goldman and other firms to buy their way out of trouble with other people’s money while “neither admitting nor denying wrongdoing.”

Note to journalists: It’s possible for a fine to be “record-breaking” in its size and also be inadequate for the gravity of the offense. That’s the Goldman Sachs story – and Khuzami’s. And since the fine was paid by shareholders, not the perps themselves, there’s no incentive not to keep committing the same crimes. Dealbook informs us that Khuzami, the former general counsel for Deutsche Bank, is “is positioned for a lucrative job at a white-shoe law firm.” Tell us something we didn’t know. We’re also told that Khuzami told his attorneys to ask themselves every evening, “How did I add value today?” Which begs the question: Value for whom?

Halls of Injustice

CONTINUES AT LINK

..........................................................................

It’s the president and the attorney general who call the shots, and who will ultimately be judged by their actions – or lack thereof. Change can only come from the top. What are the prospects? Judge for yourselves: Last week the Obama/Holder Justice Department told producers of the hard-hitting “Frontline” report that “they thought (the bank crime episode) was a hit piece” and that “they will never cooperate” with the program again.

SO THERE!

Demeter

(85,373 posts)A secretive funding organisation in the United States that guarantees anonymity for its billionaire donors has emerged as a major operator in the climate "counter movement" to undermine the science of global warming, The Independent has learnt.

The Donors Trust, along with its sister group Donors Capital Fund, based in Alexandria, Virginia, is funnelling millions of dollars into the effort to cast doubt on climate change without revealing the identities of its wealthy backers or that they have links to the fossil fuel industry.

However, an audit trail reveals that Donors is being indirectly supported by the American billionaire Charles Koch who, with his brother David, jointly owns a majority stake in Koch Industries, a large oil, gas and chemicals conglomerate based in Kansas.

Millions of dollars has been paid to Donors through a third-party organisation, called the Knowledge and Progress Fund, with is operated by the Koch family but does not advertise its Koch connections...

MORE CLOAK AND DAGGER AND BLACK BAGGING AT LINK

Demeter

(85,373 posts)Nearly half of working Americans with college degrees are in jobs for which they're overqualified, a new study out Monday suggests. The study, released by the non-profit Center for College Affordability and Productivity, says the trend is likely to continue for newly minted college graduates over the next decade.

"It is almost the new normal," says lead author Richard Vedder, an Ohio University economist and founder of the center, based in Washington.

The number of Americans whose highest academic degree was a bachelor's grew 25% to 41 million from 2002 to 2012, statistics released last week from the U.S. Census Bureau show. The number with associate's degrees increased 31%, while the number of Americans for whom the highest level of education attainment was a master's or doctorate degree grew fastest of all — 45% and 43%, respectively. Earnings in 2011 averaged $59,415 for people with any earnings ages 25 and older whose highest degree was a bachelor's degree, and $32,493 for people with a high school diploma but no college, the Census data show.

Vedder, whose study is based on 2010 Labor Department data, says the problem is the stock of college graduates in the workforce (41.7 million) in 2010 was larger than the number of jobs requiring a college degree (28.6 million). That, he says, helps explain why 15% of taxi drivers in 2010 had bachelor's degrees vs. 1% in 1970. Among retail sales clerks, 25% had a bachelor's degree in 2010. Less than 5% did in 1970.

"There are going to be an awful lot of disappointed people because a lot of them are going to end up as janitors," Vedder says. In 2010, 5% of janitors, 115,520 workers, had bachelor's degrees, his data show

MORE JOY AT LINK

Demeter

(85,373 posts)Thomas Friedman's latest column touting online education "is another exercise in (1) finding a potential positive dimension of capital's latest profit-driven move, (2) hyping it and (3) ignoring its contradictions, especially those that are negative."

Every technological change, from small to large, has had its hyper promoters. Those are the people who celebrate that technical change with wild exaggerations of its historic importance. Of course, part of their motivation is self-serving. How brilliant of them to have understood that particular technical change and its enormity. How generous, too, that their promotion overcomes our skepticism or ignorance.

A recent example is Thomas L. Friedman in The New York Times, January 27, 2013: "Revolution Hits the Universities." This captures a change in universities as historic as when soft drink companies applied the term "revolution" to changes in their product. Or perhaps the better comparative metaphor might be the revolutionary transition from hamburger to "hamburger helper." It's more about advertising and, above all, about profitability and using any and all concepts in their service.

Freidman takes the celebration of online university courses up another notch of hype as in, "Nothing has more potential to lift more people out of poverty." Preacher Friedman is on a roll. No actual thought about the contradictions in this technological change is going to slow him down. He wastes no time pondering all those past technological changes with the potential to free human beings from mind-numbing drudgery that have left us working longer and harder than ever...

MORE AT LINK

Demeter

(85,373 posts)AN INTERESTING DISCUSSION, BUT NOT MUCH IN THE WAY OF FACTS OR PROPOSALS...

jtuck004

(15,882 posts)Monday, May. 14, 2012

Learning That Works

By Joe Klein -

...

Two years later, with the $2.4 million agricultural- and technical-sciences building up and running, Martin says, "It's without doubt the best program we have. It's an alternative way to teach them math, science and reading. They love it. They're attentive, working hard, hands on." McBride imports veterinarians from around the country to visit the reservation and work with the 226 students, who assist in both operating theaters, prepping animals for surgery and learning how to suture, draw blood and give injections. The veterinary clinic has become a valued resource on the reservation, but more than that, the academic results have been spectacular. "Nearly every one of these kids passed the state comprehensive test we give to 17-year-olds in Arizona," Martin told me. "Less than about 40% of my non-vocational-education students passed."

...

Unfortunately, the education establishment's response to the voc-ed problem only made things worse. Over time, it morphed into the theology that every child should go to college (a four-year liberal-arts college at that) and therefore every child should be required to pursue a college-prep course in high school. The results have been awful. High school dropout rates continue to be a national embarrassment. And most high school graduates are not prepared for the world of work. The unemployment rate for recent high school graduates who are not in school is a stratospheric 33%. The results for even those who go on to higher education are brutal: four-year colleges graduate only about 40% of the students who start them, and two-year community colleges graduate less than that, about 23%. "College for everyone has become a matter of political correctness," says Diane Ravitch, a professor of education at New York University. "But according to the Bureau of Labor Statistics, less than a quarter of new job openings will require a bachelor of arts degree. We're not training our students for the jobs that actually exist." Meanwhile, the U.S. has begun to run out of welders, glaziers and auto mechanics--the people who actually keep the place running.

In Arizona and more than a few other states, that is beginning to change. Indeed, the old notion of vocational education has been stood on its head. It's now called career and technical education (CTE), and it has become a pathway that even some college-bound advanced-placement students are pursuing. About 27% of the students in Arizona opt for the tech-ed path, and they are more likely to score higher on the state's aptitude tests, graduate from high school and go on to higher education than those who don't. "It's not rocket science," says Sally Downey, superintendent of the spectacular East Valley Institute of Technology in Mesa, Ariz., 98.5% of whose students graduate from high school. "It's just finding something they like and teaching it to them with rigor." Actually, it's a bit more than that: it's developing training programs that lead to jobs or recognized certification, often in partnership with local businesses. Auto shop at East Valley, for example, looks a lot different from the old jalopy that kids in my high school used to work on. There are 40 late-model cars and the latest in diagnostic equipment, donated by Phoenix auto dealers, who are desperate for trained technicians. "If you can master the computer-science and electronic components," Downey says, "you can make over $100,000 a year as an auto mechanic."

...

But his real triumph wasn't in teaching the Navajo the technical skills. These students also knew how to make an impression; they had learned the soft skills necessary to be good employees. They looked you in the eye, introduced themselves and shook your hand (which was universally true at East Valley as well). This was striking, given the history of depression and despair on the reservation. "These kids are thirsty. All you've got to do," McBride says, eyes brimming, "is let them drink."

...

http://www.time.com/time/magazine/article/0,9171,2113794,00.html

Demeter

(85,373 posts)The accolades for Timothy Geithner came on so thick and heavy in the last week that it’s necessary for those of us in the reality-based community to bring the discussion back to earth. The basic facts of the matter are very straightforward. Timothy Geithner and the bailout he helped engineer saved the Wall Street banks. He did not save the economy.

We can’t know exactly what would have happened if we did not have the TARP in October of 2008. We do know there was a major effort at the time to exaggerate the dangers to the financial system in order to pressure Congress to pass the TARP. For example, Federal Reserve Board Chairman Ben Bernacke highlighted the claim that the commercial paper market was shutting down. Since most major companies finance their ongoing operations by issuing commercial paper, this raised the threat of a full-fledged economic collapse because even healthy companies would not be able to get the cash needed to pay their bills. What Bernanke neglected to mention was that he personally had the ability to sustain the commercial paper market through direct lending from the Fed. He opted to go this route by announcing the creation of a Fed special lending facility to support the commercial paper market the weekend after Congress voted to approve the TARP. It is quite likely that Bernanke could have taken whatever steps were necessary himself to keep the financial system from collapsing even without the TARP. The amount of money dispersed through the Fed was many times larger than the TARP, much of which was never even lent out. The TARP was primarily about providing political cover and saying that the government stood behind the big banks.

Of course we can never know the right counterfactual had the TARP and related Treasury efforts not been put in place, but even if we assume the worst, the idea that we would have seen a second Great Depression was always absurd on its face. The example of Argentina proves otherwise. In December of 2001 Argentina did have a full-fledged financial collapse. In other words, all the horrible things that we feared could happen in the United States in 2008 actually did happen in Argentina. Banks shut down. People could not use their ATMs or get access to their bank accounts. This led to a 3-month period in which the economy was in free fall. It stabilized over the next 3 months. Then it began growing rapidly in the second half of 2002. By the middle of 2003 it had made up all the ground lost in financial crisis. Its economy continued to grow strongly until the world economic crisis brought it to a standstill in 2009.

Even if Obama’s economic team may not have been quite as competent as the folks in Argentina, they would have to be an awful lot worse to leave us with a decade of double-digit unemployment, the sort of story that would be associated with a second Great Depression. In short, the second Great Depression line was just a bogeyman used to justify the government bailout of the Wall Street banks.

As it is, the economy has already lost more than $7 trillion in output ($20,000 per person) compared to what the Congressional Budget Office projected in January of 2008. We will probably lose at least another $4 trillion before the economy gets back to anything resembling full employment. And, millions of people have seen their lives turned upside down by their inability to get jobs, being thrown out of their homes, or their parents’ inability to get a job. And this is all because of the folks in Washington’s inability to manage the economy. But the Wall Street banks are bigger and fatter than ever. As a result of the crisis, many mergers were rushed through that might have otherwise been subject to serious regulatory scrutiny. For example, J.P. Morgan was allowed to take over Bear Stearns and Washington Mutual, two huge banks that both faced collapse in the crisis. Bank of America took over Merrill Lynch and Countrywide. By contrast, there can be little doubt that without the helping hand of Timothy Geithner, most or all of the Wall Street banks would have been sunk by their own recklessness. MORE

LEAVE TIMMY IN THE WELL...DROP HIM GIRL. DROP HIM, I SAY!

Demeter

(85,373 posts)If asked why we live in a great country, an American is likely to respond: "Because we are free." Fortunately for the respondent, explanation is rarely required. Freedom is difficult to define, and today it seems to exist more in our minds than in reality...In a 1941 Message to Congress Franklin Delano Roosevelt tried to explain what it means to be free. He outlined the "four essential human freedoms":

The second is freedom of every person to worship..

The third is freedom from want..

The fourth is freedom from fear.

The 2013 version shows how our freedoms have been diminished, or corrupted into totally different forms...

Freedom from Want? Poverty Keeps Getting Worse

For every three people in poverty in the year 2000, there are now four. Almost 50 million people were impoverished in 2011. Over 20 percent of our children live in poverty, including almost half of young black children. Among industrialized countriesonly Romania has a higher child poverty rate than the United States..It goes well beyond economics. Not long after the FDR era, in 1960, the U.S. ranked near the top among 34 OECD countries in Life Expectancy and Infant Mortality. By 2008 we were close to the bottom. A 2007 UNICEF report ranked us last among 21 OECD nations in an assessment of child health and safety...Freedom from Want has been least attainable for people of color. For every $100 owned by a white family, a black family has $2. For every $100 owned by a single white woman, a single black or Hispanic woman has 25 cents.

Freedom from Fear? The New Jim Crow

In the decades before FDR young black men were under constant threat of arrest for 'vagrancy,' and the resulting slave-like conditions of forced labor. Today vagrancy has been replaced by petty drug offenses. In "The New Jim Crow," Michelle Alexander documents the explosion of the prison population for drug offenses, with blacks and Hispanics the main targets even though they use drugs at about the same -- or lesser -- rate as white Americans. In Colorado and Washington and New York City and Seattle the patterns are disturbingly similar: minority arrests are vastly out of proportion to their percentages of the population.

Freedom of Worship? Distorted by Visions of the Rapture

In 2005 Bill Moyers wrote about the far-right evangelical beliefs that dominate much of conservative American thinking, and which impact social and environmental policies. He repeats a theology professor's summary of the Rapture credo: "The world cannot be saved." Believers are not responsible for the environment, and should focus only on personal salvation. Droughts and floods, which have been occurring with greater regularity as the earth warms, are simply signs of the apocalypse as foretold in the Bible, and thus should be welcomed. With this attitude, freedom of worship is twisted into a radical dogma that threatens the health and safety of our entire population. Senator James Inhofe (R-OK), like many on the conservative right, favors the Bible over science. "My point is," notes Inhofe with reference to a verse from Genesis, "God's still up there. The arrogance of people to think that we, human beings, would be able to change what He is doing in the climate is to me outrageous." Also to be welcomed by extremists is war with Islam in the Middle East, for it is an "essential conflagration on the road to redemption." At a Florida conference on "Biblical Prophecy about End Times," diatribes poured forth with a vengeance: "Islam is an intolerant religion...Islam is a Satanic religion." A reporter came away convinced that "A terrible, final war in the Middle East is inevitable."

Freedom of Speech? No, Surveillance and Harassment

In De Jonge v. Oregon, 1937, the Supreme Court decided that the right of peaceable assembly is "cognate to those of free speech and free press and is equally fundamental." Recently released FBI documents reveal that the agency repeatedly monitored Occupy Wall Street activities, viewing them as possible terrorism. Peaceable assembly and free speech might also describe the act of young men gathering on the streets of New York City. But their First Amendment rights, along with the Fourth Amendment prohibition against illegal search, are constantly violated by Stop & Frisk abuses by the police, which at times border on sexual assault. In addition, our freedom of expression is increasingly compromised by advanced surveillance technologies. The Foreign Intelligence Surveillance Act Amendments Act gives the government license to spy on us. New techniques such as Iris Scans, License Plate Recognition, GPS devices in pharmaceutical products, and Facial Recognition Technology invade our privacy. Drones are flying over our homes. The National Security Agency is building a data center big enough to store every email, text, phone call, web search, and video in the United States. With the Electronic Communications Privacy Act on its side, government is authorized to take anything it can get.

Franklin Delano Roosevelt once said, "True individual freedom cannot exist without economic security." As inequality destroys our economic security, and the prison population grows, and religion continues to impact public policy, and our privacy is invaded, our precious freedoms become more and more a failed American dream.

********************************************************************

Paul Buchheit is the founder and developer of social justice and educational websites (UsAgainstGreed.org, PayUpNow.org, RappingHistory.org), and the editor and main author of "American Wars: Illusions and Realities" (Clarity Press). He can be reached at paul@UsAgainstGreed.org.

elleng

(130,895 posts)Asia Stocks Rise as Wall Street Flirts With Highs.

Asian stock markets posted modest gains Tuesday as the feel-good factor lingered from near-record highs on Wall Street and signs of an upswing in U.S. manufacturing.

http://www.nytimes.com/aponline/2013/01/29/world/asia/ap-world-markets.html?hp

Demeter

(85,373 posts)A European court has cleared the Icelandic government of failing to guarantee minimum levels of compensation for UK and Dutch savers in the collapsed Icesave bank. Icesave, run by the Icelandic Landsbanki, collapsed in 2008 along with all of Iceland's banking system. The UK and Dutch savers were bailed out completely by their governments. The ruling may halt the UK's attempt to get all of its money back from the Icelandic government.

The Icelandic government said it took "considerable satisfaction" from the ruling from the European Free Trade Agreement (EFTA) Court.

"Iceland has from the start maintained that there is legal uncertainty as to whether a state is responsible for ensuring payments of minimum guarantees to depositors using its own funds and has stressed the importance of having this issue clarified in court," it said.

When Icesave, an online savings bank, went bust in the autumn of 2008 at the height of the international banking crisis, the UK government stepped in. To maintain public confidence and prevent a run on any other banks, the then UK Chancellor Alistair Darling decided to bail out 230,000 UK savers in Icesave to the full extent of their savings - about £3.5bn - not just to the maximum decreed by European rules for deposit compensation schemes. At the time, the Icelandic scheme was responsible for the first 20,887 euros (£16,300) of compensation, with that being topped up to then ceiling of £50,000 per person by the UK Financial Services Compensation Scheme (FSCS).

The Icelandic government said the failed Landsbanki had in fact already paid out 90% of the maximum compensation it should have paid under the European rules, and would continue with more repayments.

Since 2008, the UK government has been thwarted in its attempts to force the Icelandic government to repay all of the compensation the UK had paid to its citizens who had money in Icesave....At first, in 2009, the Icelandic government agreed to repay the compensation given by the UK and Dutch governments.However most of the Icelandic people were bitterly opposed to the suggested deal, fearing that it would bankrupt their country and was, in any case, fundamentally unfair because the UK and Dutch governments had awarded compensation far in excess of the levels required by European legislation.

A full-scale constitutional and diplomatic crisis ensued when the country's president refused to ratify the deal and instead called a referendum, which overwhelmingly rejected the deal in March 2010. A second deal struck between the three governments was followed by a second referendum in April 2011 but this also rejected proposed repayments, though by the much narrower margin of 59% to 41%.

The UK and Dutch governments then threatened to sue for the money - a move which now appears to have hit the buffers.

A ruling from the little known EFTA court has put a fundamental objective of European idealists in doubt; that banks should be able to offer savings accounts to customers across Europe and that customers, in turn, should be confident that their deposits will be protected.

The court says that Iceland did not have to compensate Icesave customers in the UK because the relevant European directive did not oblige the government to set a minimum amount for compensation, nor did it force the state to pick up the tab if banks themselves could not pay. That is a big worry and a disappointment for the UK. But it may not be a reason to panic over future failures of foreign banks with British customers. All this happened at the height of the financial crisis in 2008. Since then, the European directive on deposit guarantee schemes has been amended, so that it now lays down that the state shall ensure that the guarantee is set at a minimum level of 100,000 euros for each saver.

However, there is still an element of doubt over how robust this guarantee would be if a country as small as Iceland was engulfed by another major crisis.

Demeter

(85,373 posts)A MASSIVE ARTICLE

http://truth-out.org/news/item/14097-with-new-constitution-post-collapse-iceland-inches-toward-direct-democracy

When the global financial system crumbled over four years ago, Iceland played host to one of the most dramatic economic collapses in modern history. Its three largest banks were unable to refinance debt roughly ten times the size of the country's gross domestic product (GDP), causing one of the world's wealthiest nations to limp with hat in hand to the International Monetary Fund (IMF). The island became a symbol for capitalism's systemic failure.

Now, Iceland is making headlines for more positive reasons: activists there are in the process of advancing some of the strongest freedom of information laws and journalist protections in the world, and the Icelandic economy, while still beset by problems, is significantly outperforming other crisis-stricken countries. Most recently, on October 20, a remarkable constitution - written by an elected council with help from the public - took a step closer toward ratification after it was approved in a referendum by a 2-1 margin. Before the changes are signed into law, the draft must be approved by the Althingi, Iceland's Parliament, approved again by referendum and finalized once more by the legislature after a fresh parliamentary election in April.

Uncertainty is swirling around the status of the constitution, however. Those opposed to it - primarily right-wingers - claim that the 48.9 percent turnout for October's vote doesn't lend the document legitimacy. There is also fear among the constitution's supporters in Parliament that some of their colleagues are trying to abrogate the public's influence by altering the document's content instead of offering the technical revisions they were given the mandate to make.

"I truly believe that our democracies have been hijacked by bureaucrats," said Parliamentarian Birgitta Jónsdóttir, a self-described "realist-anarchist" elected after the Kitchenware Revolution protests which ensued following the 2008 financial crisis and forced the long-ruling conservative government to resign in 2009.

"I don't want the new constitution to be plagued with their language, but the language of the people," she insisted in a Skype conversation with Truthout. "Their time is over. They just can't get over it."

I AM SERIOUSLY CONSIDERING RETIRING TO ICELAND...SAME LOUSY WEATHER, BUT A MUCH BETTER SOCIETY...

Demeter

(85,373 posts)A glimmer of hope amid the never-ending futile game of Extend and Pretend being played in the U.S. and Europe. Here the Icelandic President tells how the Icelandic economy is now outperforming the rest of Europe, by doing the exact opposite of what the Goldman Sachs-installed stooges are attempting across the Euro area:

1) Let the banks fail

2) Support the poor

3) Limit austerity measures

4) Allow the economy to rebuild

i.e. Wipe out the debts and start over. It's the only way out of this ongoing fiasco. Meanwhile, this guy has way too much commonsense to be at Davos...

VIDEO AT LINK

DemReadingDU

(16,000 posts)First, per WSJ:

Iceland won a sweeping victory in a court fight over its responsibilities to foreign depositors in the Icelandic bank Landsbanki, which failed in 2008. The court of the European Free Trade Association on Monday said Iceland didn't breach European Economic Area directives on deposit guarantees by not compensating U.K. and Dutch depositors in Landsbanki's online savings accounts, known as Icesave accounts.

http://online.wsj.com/article/SB10001424127887323375204578269550368102278.html?KEYWORDS=iceland

Karl Denninger response:

Iceland's banks took a lot of deposits for very high interest rates from Europeans. Then Iceland's banks blew up. The nation's deposit insurance fund didn't have anywhere near enough money to pay everyone else -- so it paid their citizens first, and left everyone else to twist in the wind. A vote on this matter was taken and the citizens decided.

The other EU nations screamed, threatened and ultimately sued. Well, now they've lost. Not only did they lose, they lost in a court where is no path for appeal. In other words, they really lost; it's over.

This, incidentally, is not just a matter for Iceland, you see. There are other nations where demands have been made for citizens to cover other, non-citizen losses. I can think of a few... like, for instance.... Greece.

Now it is true that the situations are not exactly analogous, and this particular precedent is only going to bind in a circumstance where an EEA nation but not an EU member has a similar situation where some sort of guarantee program (e.g. a deposit guarantee program, in this case) has insufficient funds.

What this decision does is provide a solid backstop to the opinion that such a guarantee program does not reach beyond the fund and into the general finances of the nation involved, nor can that nation be forced to do so retroactively.

This matters folks. A lot. The fuse has gone inside the box.

http://market-ticker.org/cgi-ticker/akcs-www?post=216771

Demeter

(85,373 posts)Maybe the banksters will be blown up at last! (It's not like the ordinary people ever stood a chance, anyway....)

Demeter

(85,373 posts)There’s a provocative new op-ed Thursday in the Wall Street Journal from economists Donald Boudreaux and Mark Perry, who argue that the middle class isn’t stagnating, even though middle-class incomes have flatlined for decades. Their basic point is that middle-class living standards keep going up and that middle-class consumers have “more buying power than ever before.”

Here are their two key paragraphs:

“Americans are also much better able to enjoy their longer lives. According to the Bureau of Economic Analysis, spending by households on many of modern life’s “basics” — food at home, automobiles, clothing and footwear, household furnishings and equipment, and housing and utilities — fell from 53% of disposable income in 1950 to 44% in 1970 to 32% today.”

It’s undeniable, and a great thing, that Americans are living longer. But the second point – that we’re spending less on “basics” – well, that turns out to depend a lot on what you call “basic.” Boudreaux and Perry count the basics as food, clothing, shelter and cars. Fine. But what if we add in gasoline (to run those cars), health care (to help us live longer) and education (which is increasingly required for getting and keeping a middle-class job)? Then the math looks a lot different.

Using consumer spending data from the Bureau of Economic Analysis, I calculated that the Boudreaux/Perry group of basics took up about half of total consumer spending in the United States in 1970. By 2011, it was down to 35 percent. That’s basically what Boudreaux and Perry found, too...But if you expand the “basics” group to include gas, health care, health insurance, medical prescriptions and education, there’s little change over the last 40 years. That group of basics ate up 64 percent of American consumer spending in 1970, and 62 percent in 2011.

Put a different way, we spend less of our incomes today on clothes and food. We spend more on doctors and fuel. It’s hard to see how the former are “basics” and the latter are not.

Demeter

(85,373 posts)In 2010, Aaron Tobey engaged in a silent protest over airport security procedures by writing the 4th Amendment on his chest.... AND was handcuffed and detained by the Transportation Security Administration (TSA) for 90 minutes... But now it’s Tobey who could get the last laugh. Last week, Tobey won the right to go to trial over his lawsuit seeking $250,000 in damages after being detained by the TSA over alleged “disorderly conduct.” Tobey was handcuffed and detained after he “wrote an abbreviated version of the Fourth Amendment on his body and stripped to his shorts at an airport security screening area,” according to Wired magazine. The words were written on his chest in black magic marker.

The federal lawsuit claims violations of the First and Fourth Amendments.

“Tobey didn’t want to go through the advanced imaging technology X-ray machines, or so-called nude body scanners, that were cropping up at airports nationwide,” notes Wired. “Instead, when it was his turn to be screened, he was going to opt for an intrusive pat-down, and removed most of his clothing in the process.”

The 4th Circuit Court of Appeals decision to allow Tobey to go to trial reverses a lower court judge’s decision. Judge Roger Gregory defended Tobey’s protest in the decision: “Mr. Tobey engaged in a silent, peaceful protest using the text of our Constitution—he was well within the ambit of First Amendment protections. And while it is tempting to hold that First Amendment rights should acquiesce to national security in this instance, our Forefather Benjamin Franklin warned against such a temptation...We take heed of his warning and are therefore unwilling to relinquish our First Amendment protections—even in an airport.”

While Tobey was being detained by the TSA, they asked him about “his affiliation with, or knowledge of, any terrorist organizations, if he had been asked to do what he did by any third party, and what his intentions and goals were.”

THE IRONY...IT BURNS...THEY HATE US FOR OUR FREEDOMS....THE TSA, THAT IS!

jtuck004

(15,882 posts)Do terrorists write a lot of excerpts from our constitution on their chest with a magic marker?

As the TSA makes clear, you don't need airplanes to destroy a country if you can get government employees to do the work for you.,

Demeter

(85,373 posts)Of course, they ARE the bad guys, but we won't mention that in an airport, clear?

jtuck004

(15,882 posts)after they asked him about any terrorist organizations, and he said

"Ok, there were about 40 of us in the room. We only used candles so we couldn't be seen from the outside. I only knew a couple of them. Ben, Ben Franklin, was one, the guy with the burned-up looking hair. They wrote some stuff on a parchment, I just copied it later".

Demeter

(85,373 posts)

Demeter

(85,373 posts)NO, THERE ISN'T...BUT DELUSIONAL THINKING IS THE NORM...

http://www.truth-out.org/opinion/item/14081-japans-fiscal-stimulus-yes-there-is-such-a-thing-as-a-free-lunch

Economists like to say there’s no such thing as a free lunch – this was even the title of a 1975 book by Milton Friedman. But sometimes there is a free lunch – in a vitally important sense – and now is one of those times for a lot of countries suffering from unnecessary unemployment and in some cases, recession.

Adam Posen doesn’t want to recognize that this is the case for Japan at present. Posen is president of the Peterson Institute for International Economics, which is probably Washington’s most influential think tank on international economics. Posen is not an “austerian” economist – in the second half of the 1990s he supported expansionary fiscal policy in Japan; and more recently, as a member of the Bank of England’s Monetary Policy Committee from 2009-2012, he supported expansionary monetary policy, including quantitative easing and very low interest rates.

So it is worth looking at his argument, because it may help us understand how the mainstream of the economics profession can sometimes be an obstacle to global economic recovery, as well as to important social goals such as reducing unemployment and poverty.

The Japanese government of Shinzo Abe recently announced a large stimulus program; the exact size is not clear but the government is seeking to boost GDP growth by 2 percentage points. That would seem to be a good idea, since the Japanese economy is currently in recession, and the world economy to which it exports is not doing so well either. Japanese inflation is currently negative, which means that the government can create money to pay for the stimulus without having to worry about increasing inflation. In fact, deflation is the much greater worry, and the government wants the central bank to target a 2 percent inflation rate. (Deflation tends to discourage consumption, because purchases will be cheaper in the future; and investment, because investors are looking at shaky demand in the future, especially with the economy already in recession).

This is what I mean by a free lunch. In fact, it’s a free lunch and a five-course dinner plus dessert. It costs the central bank nothing to create this money for the government to spend; and any resulting increase in inflation actually helps get the Japanese economy out of its slump. It also means that the government doesn’t have to add anything to its net debt – so, no increase in the public debt burden for the future...

IT GOES ON

Demeter

(85,373 posts)Demeter

(85,373 posts)READ THE METER AT LINK...FOR SOME REASON, I CAN'T LIFT THE IMAGE...

COURTESY OF PONZI WORLD, WHO ADDS THIS:

Let Them Drink Bubbly...

The real question on the table, is why with all of the unresolved issues that we face would anyone be experiencing extreme greed at this juncture? It makes absolutely no sense. Just today I was reading this article about the "sigh of relief" at Davos. Apparently financial markets have head faked everyone into believing that the worst is past, even though the wine soaked bureaucrats attending their phony Summit have made no economic changes whatsoever. The article then notes this obvious "disconnect" between financial markets and the real economy, and states that the "feel-good factor in the financial markets has yet to filter through to the real economy". No kidding. For the last million years of human history, it was the economy that drove the markets, but now in the era when Central banks levitate markets, we are to believe that history will now be conveniently inverted to where markets drive economies. All those bread crumbs falling off of the table, in the form of food stamps for the "ne'er do wells"...

http://www.ponziworld.blogspot.com/2013/01/extreme-greed.html#more

Demeter

(85,373 posts)The need to avoid complacency is a regular theme at every Davos meeting - but this was the first in five years that there seemed a genuine risk of it breaking out. As Mark Carney - our soon-to-be Bank of England governor - joked at the traditional session on the global economy on the final day, he arrived on Thursday to find people saying the "tail risk" in the global financial system had been reduced. By Friday night it had been "eliminated". The Financial Times's Martin Wolf said it would go down as the "sigh of relief Davos". The collapse of the euro now looks much less likely. A hard landing in China, or debt crisis in the US, also look more distant.

The optimism is not hard to miss in the stock markets, the US especially. The S&P 500 closed above 1,500 points on Friday for the first time since 2007, after the 8th consecutive day of gains. That's the longest winning streak since 2004. And the FT's "all-world" index is the highest it has been in 20 months.

There was also that good news from the European Central Bank this week, announcing that a good chunk of the emergency lending it had offered to European banks in the dark days of the eurozone crisis just over a year ago was being repaid early.

Disconnect

Of course, the big wrinkle in the relief scenario is that the feel-good factor in the financial markets has yet to filter through to the real economy, or do it very much good...

BECAUSE THE 99% HAVEN'T YET FIGURED OUT HOW TO STEAL FROM THE RICH

Demeter

(85,373 posts)Obama will give his State of the Union address FEBRUARY 12TH. If politicians were capable of telling the truth, below is what he would say. However, unfortunately, because we live in a shrink wrapped bubble inflated by cheap debt, society is overrun by child-like dunces in leadership positions who spend their entire time convincing us that reality can be ignored indefinitely. The stewed masses of course willfully believe that these factors all belong to that indefinite future. So when the bubble bursts, we can expect plenty of shock and awe from the Idiocracy, when they realize that the future just got here ahead of time:

1) We face a stagnant and bloated economy which is no longer self-sustaining and hence totally dependent upon ongoing debt accumulation

2) A stagnant jobs market with fewer jobs today than six years ago, despite a larger population. Fools and apologists say we added 5 million jobs since 2008, however, the U.S. accumulated $5 trillion in debt in the meantime which works out to $1 million per job.

3) A bloated and dysfunctional post-secondary education system now bankrupting its own students

4) A bloated and corrupt military industrial complex which has doubled its size in the past decade, and is sucking the lifeblood out of the political and economic system

5) Medicare and Social Security programs that are totally unfunded, now facing an overwhelming rise in recipients at the same time as the number of payers into the system is falling off commensurately

6) A totally dysfunctional political system that ignores all of the larger issues and focuses all of its attention on campaigning, partisan bickering and legal contrivances with an ever-dwindling half life

7) An incoherent foreign policy with troops in 140 countries while geopolitical instability verges on spinning out of control

8) A clueless corporate media focused on amusing, entertaining, confusing, obfuscating and otherwise ignoring the underlying causes or solutions to the major problems of the day

10) An oblivious general populace stewed in junk food, junk culture, and Prozac. Now becoming mentally unstable as the overwhelming issues of the day exert their inevitable toll on mental health

11) A rising trend towards mass violence propagated by 300 million guns floating around in god knows whose hands. A too-little-too-late gun control movement just enough to light a fire under gun owners who are considering taking up arms against their own government

12) A massively leveraged stock market levitated by Central Bank debt monetization programs, now strongly diverging from economic reality

And the biggest issue of all which is that none of these issues are being confronted or addressed head on in any meaningful way, as society's overwhelming preoccupation at this juncture is to hide from reality.

Other than that, everything is A-Ok...

Demeter

(85,373 posts)It must be snowing on Wall St. and I don't mean the H2O kind.