Economy

Related: About this forumDr. Housing Bubble 03/17/14

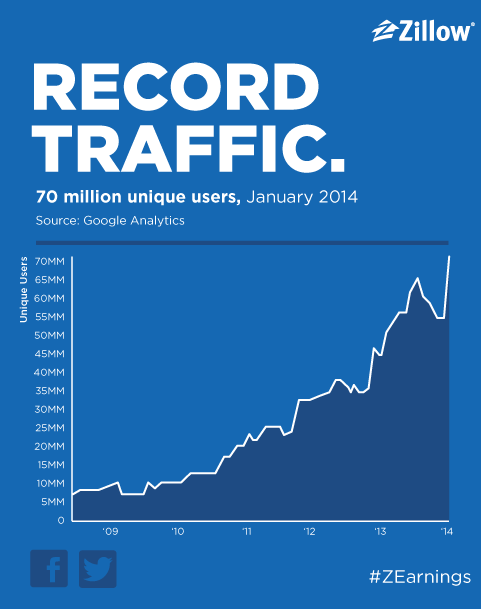

The liberation of real estate data: does having readily available real estate information encourage the boom and bust cycle? Zillow reaches 70 million unique users per month.You can’t stop the internet when it comes to real estate data. Zillow is a great example of technology revolutionizing the way people view real estate. Some of you are old enough to remember when the closely guarded MLS was only accessible by your local real estate agent. Unless you were ready to do some digging, finding out what a home sold for took a bit of time. It was also hard to view a list of available homes for sale. That is no longer the case. When Zillow initially came out the housing bubble was still raging. My initial thought was that access to information would only serve to create bigger booms and deeper busts. Keep in mind that the entire housing system is still built upon the appraisal system. Basically each home is only as good as the last few sales. When a market is booming and people are now able to see the boom in real time the temptation to buy can ramp up. When the boom bursts as it did in 2008, you can also see how quickly things will reverse. Things are already slowing down and sales are dropping dramatically in some areas. Does access to data liberate us from the old model of buying and selling real estate?

The real estate information revolution

I love digging around in the housing data. Real estate by far is going to be the biggest purchase most Americans will ever make. In the past, this big buying decision was usually entrusted to those in the industry. It made sense if the only folks with access to the MLS were real estate agents. They held all the cards. Most people had no idea what homes were for sale until an agent drove them around to view target properties. Now, open houses are posted online and many people arrive agent free.

People are still irrational and that is why markets boom and bust. People had access to great information before the tech meltdown in the early 2000s. Zillow was around in 2006 yet the housing market had its first ever nationwide meltdown starting late in 2007 when data started becoming readily available to all. The housing market has become a speculative asset class that captures the attention of the masses. Entire mythologies are built around real estate. Confirmation bias is extreme in the industry even though we have witnessed 7,000,000 foreclosures since this crisis hit.

The appetite for real estate information is insatiable:

Zillow put out this chart showing the visitors to their site. Back in 2009 Zillow was getting about 5 million unique visitors per month. Today that number is up to 70 million. This is a massive number of people going to a site dedicated to real estate data.

http://www.doctorhousingbubble.com/real-estate-data-liberation-of-housing-search-sites-mls-data/

CrispyQ

(36,461 posts)Just a few months ago they had it valued at $40k less. ![]() There is no way my house is worth what they have it at.

There is no way my house is worth what they have it at.

Warpy

(111,255 posts)in an inner city neighborhood with a bad reputation (no longer deserved) and they rated this little dump at a quarter of a million in 2007. Houses were actually selling for half that at the peak. It was a laugh then and it's a laugh still.

It's a useful tool for seeing what's on the market in a given area. It's not a useful tool for finding out how much houses are actually selling for.

My guess is that they'd gotten Californicated in 2007, jacking up unrealistic prices in areas like this that hadn't seen the bubble. They also overstated the crash in places like Florida, having my dad's house worth less than a third of what I sold it for in 2006 but finally selling for nearly double their fantasy price in 2010.

If you want to know what your house is worth, pay an agent for an assessment. Zillow is pretty useless for such things.