Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 27 March 2015

[font size=3]STOCK MARKET WATCH, Friday, 27 March 2015[font color=black][/font]

SMW for 26 March 2015

AT THE CLOSING BELL ON 26 March 2015

[center][font color=red]

Dow Jones 17,678.23 -40.31 (-0.23%)

S&P 500 2,056.15 -4.90 (-0.24%)

Nasdaq 4,863.36 -13.16 (-0.27%)

[font color=red]10 Year 1.99% +0.05 (2.58%)

30 Year 2.58% +0.06 (2.38%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)which is still happening in Michigan. The little ones get bought up, pretty soon there's only a handful of TBTF banks to select from.

I'm in a credit union, these days. Until they start buying those up.

Demeter

(85,373 posts)THEY WILL BE READING ENTRAILS, NEXT

http://www.cnbc.com/id/102537610

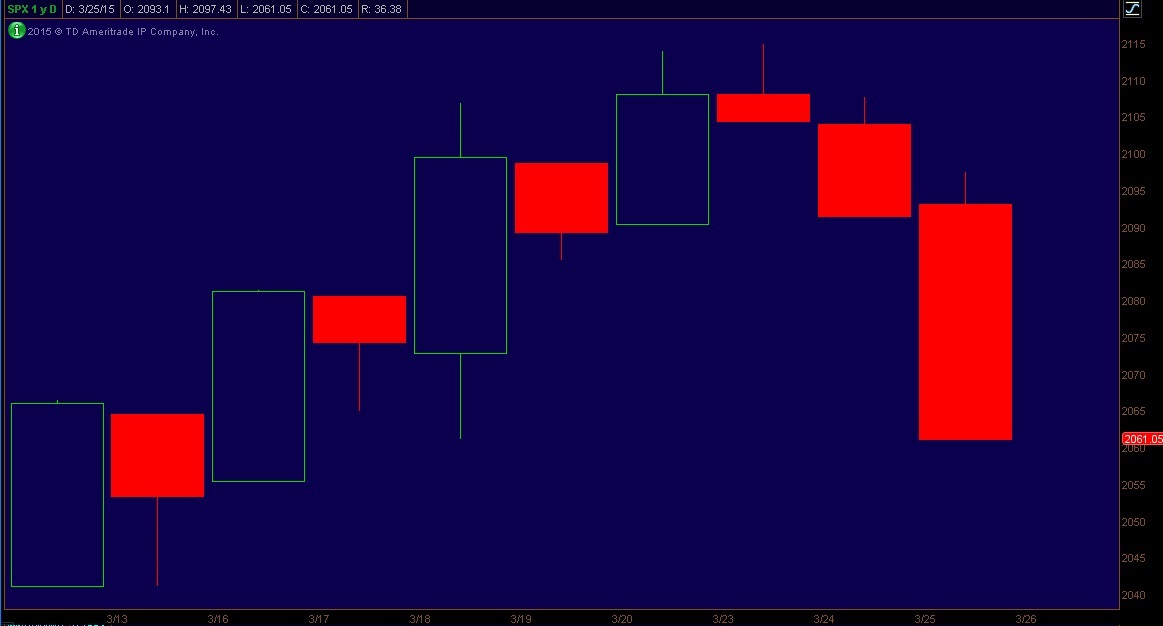

Something highly unusual, and potentially quite bearish, has just happened to the stock market. On Monday, Tuesday and Wednesday, the S&P 500 closed at the lows of the day in three-straight sessions. It is rare for stocks to close at the dead lows on any given day. Until Monday, it only happened once this year, on March 10. Something highly unusual, and potentially quite bearish, has just happened to the stock market.

On Monday, Tuesday and Wednesday, the S&P 500 closed at the lows of the day in three-straight sessions. Now that it's happened three days in a row, some traders are worried.

"Traders like to watch the tone of the close," said Scott Nations of NationsShares. "On Monday it meant things were weak. On Tuesday it meant thing were weak. After three days—the tone is just horrible, there's no other way to look at it. And I don't know what would turn it around."

Mark Luschini, chief investment strategist at Janney Montgomery Scott, said that "on a candle chart, those three declines represent 'three black crows,' a bearish omen."

Demeter

(85,373 posts)According to a Department of Defense press release, the Pentagon is sending 290 US service members into Ukraine to train Ukrainian military units in April. The training will reportedly occur in the Ukrainian city of Yavoriv near the Ukraine-Poland border. The US soldiers will be from the 173rd Airborne Brigade based in Vicenza, Italy.

The basis for the training mission, per the press release, is to further “ongoing efforts to help sustain Ukraine’s defense and internal security operations. In particular, the training will help the Ukraine government develop its National Guard to conduct internal defense operations.”

As Assistant Secretary of State for European and Eurasian Affairs Victoria Nuland herself pointed out before Congress, the US does not have a defense treaty with Ukraine making the act of sending in troops to train Ukraine forces seemingly inappropriate if not openly provocative to Russia. Or maybe that’s the point?

Fuddnik

(8,846 posts)I can't seem to find the words to express my thoughts on this government anymore.

Well, I could,but I'd get an express delivered pizza in record time.

MattSh

(3,714 posts)Eric Zuesse

Apparently, Obama, though he says he hasn’t made up his mind about whether to send weapons to Ukraine, actually has and is. He now seems to be quietly trashing the spirit though no provision in the Minsk II truce that was arranged by Merkel, Hollande, Putin, and Poroshenko, and signed by the OSCE, Russia, Ukraine, and both of the rebelling former parts of Ukraine, the Donetsk People’s Republic and the Lugansk People’s Republic. Obama now appears to be sending heavy weapons to Ukraine, and thus assisting Ukraine to resume attacking the DPR & LPR.

Even conservative Europeans are expressing outrage. Followers of Italy’s Sylvio Berlusconi, and even the leader of Austria’s anti-immigrant “Freedom Party,” are shocked and appalled by this Obama action.

Heinz-Christian Strache, leader of Austria’s Freedom Party, posted online a photo alleged to be of Bradley tanks now on rail-cars in Linz Austria en-route to Ukraine; he estimated 50 of them.

http://www.washingtonsblog.com/2015/03/43822.html

Isn't that special?

Demeter

(85,373 posts)Washington’s EU vassals might be finding their backbone. Britain, Germany, France, and Italy are reported to have defied Washington’s orders and applied to join the Chinese-led Asian Investment Bank. Australia, Japan, South Korea, Switzerland and Luxembourg might also join.

Washington uses its development banks such as the Asian Development Bank, the World Bank, along with the IMF, in order to exercise financial and political hegemony. These banks are crucial elements of American economic and political imperialism.

The Chinese-led bank will, of course, be much more effective. The Chinese will use the bank to actually help countries and thereby make friends and grow trust, whereas Washington uses its banks for domination by force. This new bank, together with the BRICS Bank, will provide countries with escape routes from Washington’s domination.

The Evil Empire is beginning to crack. It will crack more as the Russian-Chinese alliance unfolds its potentials and when European capitals understand that hegemonic Washington has put their existence at risk in order to try to prevent Russia’s rise. The crazed American and British neocon nazis, and their dupes among the populations, comprise the greatest human threat that the world has ever known. The sooner the Evil Empire collapses, the safer the world will be.

Here is the report: http://thebricspost.com/eu-allies-defy-us-to-join-china-led-asian-bank/#.VQe4BCkRW-M

Dr. Paul Craig Roberts was Assistant Secretary of the Treasury for Economic Policy and associate editor of the Wall Street Journal. He was columnist for Business Week, Scripps Howard News Service, and Creators Syndicate. He has had many university appointments. His internet columns have attracted a worldwide following. Roberts' latest books are The Failure of Laissez Faire Capitalism and Economic Dissolution of the West and How America Was Lost.

MattSh

(3,714 posts)Rumors going around yesterday and today about Privat Bank, Billionaire Igor Kolomoisky's bank. (More about the BofB in earlier SMW).

Basically, if you have money in this bank, one of Ukraine's largest (if not the largest), get it out. But I've been unable to find any official news so far today. Could it be that some in the government are trying to create a bank run to keep this oligarch in line?

And I'm sure the government has measures to counteract a bank run, IF it wanted to. But maybe they don't want to?

But I'm sure Privat Bank will do just fine. They were a major recipient of IMF funds last year, and will probably get a good sum this time around, unless certain politicians have their say.

Politicians swaying IMF decision? Who'd have thunk?

Demeter

(85,373 posts)keeps popping up, fomenting trouble in Yugoslavia, Georgia, and now, Ukraine...

And what is Pinchuk doing, he of the beneficent gifts to the Clintons' foundation?

http://sputniknews.com/columnists/20150316/1019554833.html

With “friends” like European Council President Donald Tusk and top NATO commander Gen. Philip Breedlove, the EU certainly doesn’t need enemies. "Gen. Breedhate" has been spewing out his best Dr. Strangelove impersonation, warning that evil Russia is invading Ukraine on an everyday basis. The German political establishment is not amused...Tusk, while meeting with US President Barack Obama, got Divide and Rule backwards; he insisted, “foreign adversaries” were trying to divide the US and the EU – when it’s actually the US that is trying to divide the EU from Russia. And right on cue, he blamed Russia — side by side with the fake Caliphate of ISIS/ISIL/Daesh. Tusk’s way out? The EU should sign the US corporate-devised racket known as Transatlantic Trade and Investment Partnership (TTIP), or NATO on trade. And then the “West” will rule forever.

NATO may indeed incarnate the ultimate geopolitical/existential paradox; an alliance that exists to manage the chaos it breeds. And still, revolving around NATO, there are many more diversionist tactics than meet the eye. Take the latest uttering by notorious Russophobe Dr. Zbigniew “Grand Chessboard” Brzezinski. In a conference at the Center for Strategic and International Studies, Dr. Zbig advanced that the US and Russia should have an understanding that if Ukraine becomes a member of the EU, it won’t become a member of NATO. Well, dear Doctor, we got a problem. The EU has zero interest in incorporating a failed state on (immensely expensive) life support by the IMF, and technically mired in a civil war. On the other hand the US has undivided interest in a Ukraine as NATO member; that’s the whole rationale of the relentless post-Maidan demonization of Russia. Call it the Dr. Zbig maneuver; neo-con wishful thinking; what certain key Empire of Chaos/Masters of the Universe factions would die for; or all of the above; the ultimate target is regime change and dismemberment of Russia. Russian intelligence knows all about the inside story.

To forestall it, there would be only one possible settlement, including; end of sanctions on Russia; end of the raid on the ruble/oil price war; eastern European nations out of NATO; Crimea recognized as part of Russia; eastern Ukraine totally autonomous but still part of Ukraine. We all know this won’t happen anytime soon – if ever. So a nasty Cold War 2.0 atmosphere is bound to prevail – alongside with relentless demonization reaping its benefits. A new Gallup poll shows most Americans now see Russia – ahead of North Korea, China and Iran – as the US’s public enemy number one and the greatest threat to the West.

***

What the Empire of Chaos achieved in Ukraine, at least for now, was to divide Eurasia into three competing blocks; Germany-France allied with the US (but with both now having second thoughts); Russia; and China offset by Japan. Once again, that’s Divide and Rule — with the US as perpetual hegemon always capable of adapting and tweaking its proverbial bomb-and-bully foreign policy strategy. Yet it ain’t over till the fat (geopolitical) lady sings. The Russia-China strategic partnership keeps evolving – check out the upcoming BRICS and SCO summits in Russia this summer. The oil and natural gas wealth of Russia and Central Asia will keep performing their U-turn towards China and Asia. And in a few years the “Exceptionalists Rule the Waves” mantra will cease to be a game-changer.

Demeter

(85,373 posts)Even a seasoned cynic sometimes gasps in disbelief.

“President Putin misinterprets much of what the U.S. is doing or trying to do,” U.S. Secretary of State John Kerry told a press conference in Geneva on March 2. “We are not involved in ‘numerous color revolutions’ as he asserts. In the case of Ukraine, such assumptions are also wrong. The United States support international law with respect to the sovereignty and integrity of other people.”This is akin to Count Dracula asserting his strict adherence to a vegan diet and his principled respect for the integrity of blood banks worldwide. Various quasi-NGOs funded by American taxpayers and funneled through organizations such as the National Endowment for Democracy, Freedom House and the National Democratic Institute, not to mention George Soros’s Open Society Foundations (partly funded by U.S. and other Western governments), have been actively engaged in dozens of “regime-change” operations for a decade and a half. Their work is conducted in disregard of international law and in violation of the sovereignty and integrity of the people whose governments are thus targeted.

The overthrow of Slobodan Milosevic in Belgrade (October 2000) provided the blueprint, in strict accordance with Gene Sharp’s manual. Widespread popular discontent was manipulated by the U.S./Soros funded and trained Otpor! network to bring to power a government subservient to Western political and economic interests. The moderately patriotic yet hapless new president, constitutional lawyer Vojislav Kostunica, was used as a battering ram to bring Milosevic down. Once that goal was achieved, Kostunica was promptly marginalized by Prime Minister Zoran Djindjic and his successors – Serbia’s two-term president Boris Tadic in particular – who turned the country into a pliant tool of foreign interests. Wholesale robbery of Serbia’s state and public assets promptly followed the 2000 coup, resulting in the Balkan country’s comprehensive de-industrialization. Official Belgrade was forced to accept Kosovo’s de facto “independence” in the name of the elusive goal of joining the European Union.

Georgia’s 2003 “Rose Revolution” was carried out by the Kmara (“Enough”) network, a carbon copy of Serbia’s “Otpor,” including the clenched fist logo. Its activists were trained and advised by the U.S.-affiliated Liberty Institute and funded by the Open Society Institute. It brought to power Mikhel Saakashvili, a corrupt “pro-Western” politician currently wanted by Georgia’s government on multiple criminal charges. The coup was largely financed by Soros’s network, which spent $42 million in the three months before the coup preparing the overthrow of the government of Eduard Shevardnadze. The most important geopolitical result was Georgia’s NATO candidacy, supported by Washington, which is currently stalled but which has the potential to be as perniciously destabilizing as the crisis in Ukraine.

Speaking in Tblisi in June 2005, Soros said: “I am very pleased and proud of the work of the Foundation in preparing Georgian society for what became a Rose Revolution, but the role of the Foundation and me personally has been greatly exaggerated.” The new government, as it happens, included Alexander Lomaia, former Secretary of the Georgian Security Council and minister of education and science, who at the time of the coup was Executive Director of the Open Society Georgia Foundation. David Darchiashvili, ex-chairman of the Committee for European Integration in the Georgian parliament, was also an executive director of the Foundation. As former Georgian foreign minister Salomé Zourabichvili wrote in 2008, “all the NGO’s which gravitate around the Soros Foundation undeniably carried the revolution… [A]fterwards, the Soros Foundation and the NGOs were integrated into power.” Interestingly, the U.S. Ambassador in Georgia at the time of the 2003 regime-change operation, Richard Miles, was the Ambassador in Belgrade at the time of Milosevic’s downfall three years earlier.

***

The regime-change mania will go on and on. It is inseparable from the psychotic belief in one’s indispensability and exceptionalism. It is a form of self-defeating grandomania that can only stop with America’s long-overdue abandonment of the global hegemony experiment.

And yes, John Kerry is a liar.

Demeter

(85,373 posts)...It so happens that the fate of the world is now being decided in Ukraine, not so much by the Ukrainians themselves as by the US, EU and Russia, whose geopolitical interests have clashed in this region. The talk about WWIII figures increasingly often in the media and conversations among the scholars and general public. Politicians try to allay their compatriots' fears, but their vociferous statements merely boost this scenario.

The Minsk 2 Agreement offers at least a slim chance of moving away from a military confrontation that would destroy a good deal of the northern hemisphere, if not indeed the entire world. Yet those who view this agreement as Putin’s triumph are not at all willing to pressure Kiev into abiding by it.

There is no mystery here. The bloody chaos in Ukraine was devised not to help its people, but to weaken Russia geopolitically and topple the current leadership while mouthing noble slogans of promoting freedom, democracy and other fine Western values. So in view of those who started this mess as long as these goals are not achieved the war in Ukraine must go on even if it may escalate into an open conflict between Russia and the West. The hawks, or the War Party, do not realize that their policies contravene America’s long-term strategic interests, and are turning an important potential ally into a dangerous foe.

Read more: http://sputniknews.com/analysis/20150313/1019469397.html#ixzz3VaLzVBEs

Demeter

(85,373 posts)

http://www.zerohedge.com/news/2015-03-26/why-banksters-hate-peace

Bankers hate peace …

Lee Fang reports: https://firstlook.org/theintercept/2015/03/20/asked-iran-deal-potentially-slowing-military-sales-lockheed-martin-ceo-says-volatility-brings-growth/

Hewson replied that “that really isn’t coming up,” but stressed that “volatility all around the region” should continue to bring in new business. According to Hewson, “A lot of volatility, a lot of instability, a lot of things that are happening” in both the Middle East and the Asia-Pacific region means both are “growth areas” for Lockheed Martin.

The Deutsche Bank-Lockheed exchange “underscores a longstanding truism of the weapons trade: war — or the threat of war — is good for the arms business,” says William Hartung, director of the Arms & Security Project at the Center for International Policy. Hartung observed that Hewson described the normalization of relations with Iran not as a positive development for the future, but as an “impediment.” “And Hewson’s response,” Hartung adds, “which in essence is ‘don’t worry, there’s plenty of instability to go around,’ shows the perverse incentive structure that is at the heart of the international arms market.”

The President of Stanford University (David Starr Jordan) reported that banksters are the true power behind the throne, and that – for many centuries – they’ve made their fortunes by financing war. http://www.amazon.com/Unseen-Empire-Study-Plight-Nations/dp/1103931628

Former managing director of Goldman Sachs – and head of the international analytics group at Bear Stearns in London (Nomi Prins) – notes: http://www.salon.com/2014/04/15/we_are_in_great_danger_ex_banker_details_how_mega_banks_destroyed_america/

***

In the beginning of World War I, Woodrow Wilson had adopted initially a policy of neutrality. But the Morgan Bank, which was the most powerful bank at the time, and which wound up funding over 75 percent of the financing for the allied forces during World War I … pushed Wilson out of neutrality sooner than he might have done, because of their desire to be involved on one side of the war.

Now, on the other side of that war, for example, was the National City Bank, which, though they worked with Morgan in financing the French and the British, they also didn’t have a problem working with financing some things on the German side, as did Chase …

When Eisenhower became president … the U.S. was undergoing this expansion by providing, under his doctrine, military aid and support to countries under the so-called threat of being taken over by communism … What bankers did was they opened up hubs, in areas such as Cuba, in areas such as Beirut and Lebanon, where the U.S. also wanted to gain a stronghold in their Cold War fight against the Soviet Union. And so the juxtaposition of finance and foreign policy were very much aligned.

So in the ‘70s, it became less aligned, because though America was pursuing foreign policy initiatives in terms of expansion, the bankers found oil, and they made an extreme effort to activate relationships in the Middle East, that then the U.S. government followed. For example, in Saudi Arabia and so forth, they get access to oil money, and then recycle it into Latin American debt and other forms of lending throughout the globe. So that situation led the U.S. government.

Indeed, JP Morgan also purchased control over America’s leading 25 newspapers in order to propagandize US public opinion in favor of US entry into World War 1. http://query.nytimes.com/mem/archive-free/pdf?res=9504E7DA1538EE32A25757C1A9649C946696D6CF

The U.S. Senate’s Special Committee on Investigation of the Munitions Industry found connections between the wartime profits of the banking and munitions industries to America’s involvement in World War I. http://en.wikipedia.org/wiki/Nye_Committee Specifically, the Committee reported that between 1915 and January 1917, the United States lent Germany 27 million dollars, and in the same period, it lent to the United Kingdom and its allies 2.3 billion dollars, almost 100 times as much, and so the US entered the war so that the lenders would get repaid by their biggest debtors: The UK and its allies. Subsequently, many big banks funded the Nazis. BBC reported in 1998: http://news.bbc.co.uk/2/hi/business/237392.stm

***

Chase Manhattan Bank, which has acknowledged seizing about 100 accounts held by Jews in its Paris branch during World War II ….”Recently unclassified reports from the US Treasury about the activities of Chase in Paris in the 1940s indicate that the local branch worked “in close collaboration with the German authorities” in freezing Jewish assets.

The New York Daily News noted the same year: http://articles.nydailynews.com/1998-12-07/news/18083963_1_chase-manhattan-bank-largest-bank-nazis

Niedermann’s letter was written in May 1942 five months after the Japanese bombed Pearl Harbor and the U.S. also went to war with Germany.

The BBC reported in 1999: http://news.bbc.co.uk/2/hi/world/europe/270849.stm

It says their Paris branches handed over to the Nazi occupiers about one-hundred such accounts.

One of Britain’s main newspapers – the Guardian – reported in 2004: http://www.guardian.co.uk/world/2004/sep/25/usa.secondworldwar

The Guardian has obtained confirmation from newly discovered files in the US National Archives that a firm of which Prescott Bush was a director was involved with the financial architects of Nazism.

His business dealings … continued until his company’s assets were seized in 1942 under the Trading with the Enemy Act

***

The documents reveal that the firm he worked for, Brown Brothers Harriman (BBH), acted as a US base for the German industrialist, Fritz Thyssen, who helped finance Hitler in the 1930s before falling out with him at the end of the decade. The Guardian has seen evidence that shows Bush was the director of the New York-based Union Banking Corporation (UBC) that represented Thyssen’s US interests and he continued to work for the bank after America entered the war.

***

Bush was a founding member of the bank UBC … The bank was set up by Harriman and Bush’s father-in-law to provide a US bank for the Thyssens, Germany’s most powerful industrial family.

***

By the late 1930s, Brown Brothers Harriman, which claimed to be the world’s largest private investment bank, and UBC had bought and shipped millions of dollars of gold, fuel, steel, coal and US treasury bonds to Germany, both feeding and financing Hitler’s build-up to war.

Between 1931 and 1933 UBC bought more than $8m worth of gold, of which $3m was shipped abroad. According to documents seen by the Guardian, after UBC was set up it transferred $2m to BBH accounts and between 1924 and 1940 the assets of UBC hovered around $3m, dropping to $1m only on a few occasions.

***

UBC was caught red-handed operating a American shell company for the Thyssen family eight months after America had entered the war and that this was the bank that had partly financed Hitler’s rise to power.

Indeed, banks often finance both sides of wars: https://www.google.com/search?q=sold+arms+both+sides+war&ie=utf-8&oe=utf-8&aq=t&rls=org.mozilla:en-US

And they are one of the main sources of financing for nuclear weapons. http://www.opednews.com/articles/U-S-Banks-Bankrolling-Nuc-by-Sherwood-Ross-Armageddon_Banks_Investing_Nuclear-Energy-Weapons-150309-479.html

(The San Francisco Chronicle also documents that leading financiers Rockefeller, Carnegie and Harriman also funded Nazi eugenics programs … but that’s a story for another day.)

The Federal Reserve and other central banks also help to start wars by financing them. http://www.washingtonsblog.com/2011/01/war-causes-inflation-and-inflation-allows-the-government-to-start-unnecessary-wars.html Thomas Jefferson and the father of free market capitalism, Adam Smith, both noted that the financing wars by banks led to more – and longer – wars. http://www.washingtonsblog.com/2012/04/it-is-incumbent-on-every-generation-to-pay-its-own-debts-as-it-goes-a-principle-which-if-acted-on-would-save-one-half-the-wars-of-the-world.html

And America apparently considers economic rivalry to be a basis for war, and is using the military to contain China’s growing economic influence....

THERE'S SO MUCH MORE...GO READ AND REMEMBER!

Hotler

(11,420 posts)mother earth

(6,002 posts)Demeter

(85,373 posts)and headache. Congestion building in my sinuses...

mother earth

(6,002 posts)Demeter

(85,373 posts)More than six years after Lehman Brothers Holdings collapsed, creditors will receive $7.6 billion. Lehman said its general unsecured creditors will have received nearly $100 billion after the distribution next week, more than 32 cents on the dollar. In 2012, creditors were expected to get less than 20 cents on the dollar.

http://www.wsj.com/articles/lehman-to-pay-out-additional-7-6-billion-to-creditors-1427390417

https://secure.marketwatch.com/story/lehman-to-pay-out-additional-76-billion-to-creditors-2015-03-26

The team winding down Lehman Brothers Holdings Inc. said Thursday it would be paying $7.6 billion to creditors next week, more than six years after the investment bank’s collapse triggered the financial crisis.

The bulk of the latest payout, some $6.3 billion, is earmarked for third-party claimants, which include Lehman affiliates that are being wound down separately from the New York-based holding company.

Lehman, which is in liquidation, said that its general unsecured creditors, who were estimated to receive less than 20 cents on the dollar when Lehman’s bankruptcy plan went into effect in early 2012, will have received nearly $100 billion, or more than 32 cents on the dollar, after the next distribution is completed. That is up from about 29 cents when Lehman made its sixth distribution last year.

The Chapter 11 payment plan for Lehman Brothers Holdings treats similarly situated creditors of its subsidiaries better than those of the parent. For example, general unsecured creditors of Lehman’s Specialty Finance unit, the heart of the failed investment bank’s derivatives business, have so far recovered more than 34 cents on the dollar, though they are limited to how much they can claim.

http://www.thewire.com/business/2014/03/vulture-hedge-funds-are-still-making-billions-off-the-ghost-of-lehman-brothers/359746/

While Lehman Brothers might be dead and buried in the Wall Street catacombs, there is still money to be made on its corpse.

The amount of money to earn just increased, too...

Interestingly, the vast majority of claim distributions thus far, over two-thirds, have been to third-party creditors — companies that purchased Lehman's debt after the bankruptcy was underway. Lehman’s claims are currently owned by some of the industry’s largest distressed hedge funds, including Elliot Associates, King Street, CarVal and Baupost. None of these firms are strangers to profiting from bankruptcies. These so-called “vulture funds” buy debt at a low price during the most vulnerable time, then later recover for the full value of the loans, plus interest...These third-party creditors include hedge funds, many of which purchased these claims at a steep discount following the Lehman bankruptcy. The purchase of Lehman's debt has become a valuable and crowded trade among hedge funds, as creditors are guaranteed a stream of income while holding Lehman debt. Because Lehman Brothers was a behemoth company with immense value, its liquidation would release substantial cash that would eventually pad the pockets of the creditors. Though creditors have had to wait years for this cash to come their way, the sheer size of the distributions has shown that patience does indeed pay off...

So how much exactly do these third-party creditors stand to make on Lehman’s collapse and eventual distribution? The exact number is difficult to quantify, but it is safe to say it will be well into the billions. The total payout of $80 billion is much less than the $308.7 billion in claims authorized by the bankruptcy court, but these creditors purchased Lehman’s debt at an undisclosed, but guaranteed, lower price.

Demeter

(85,373 posts)The New York Federal Reserve officials tasked with prying interest rates off the floor have been meeting with bankers and traders to plot how best to do it, amid deep uncertainty over how much control they will really have over short-term lending markets. With the U.S. central bank expected to raise rates later this year, Simon Potter and his team of market technicians have the tricky job of implementing higher rates using some new and lightly tested tools as well as some that may not work as well as in the past. They'll be operating under intense global scrutiny that's centered on the prospects for the world’s biggest economy. Even while testing new methods meant to sweep up trillions of dollars of reserves from financial markets, Potter's team is preparing for volatility and to make on-the-fly adjustments when the time comes, according to interviews with Fed officials and market participants.

The trouble is that the federal funds market, the intra-bank trading pool traditionally used by the Fed to meet its policy goals, has shrunk to about a quarter of its pre-crisis size after more than six years of unprecedented monetary stimulus. "There is a lot more uncertainty in the mechanical features of the outlook than people admit to," said Joseph Abate, a money-market strategist at Barclays Capital.

The Fed wants to avoid a scenario in which yields don't rise enough after it lifts the fed funds rate because banks, flush with $2.5 trillion of reserves parked at the central bank, don't need short-term funding. The central bank also risks being drawn so deeply into money markets that it destabilizes things. That's why the New York Fed, already under political pressure due to regulatory missteps, is taking every precaution it can to protect its credibility and that of the central bank. It wants to make sure that when the central bank decrees higher rates, yields will actually rise. To combat anxieties on Wall Street and in Washington, Potter and his deputies have been hosting regular lunches with market participants to ask and field questions about what sort of market tinkering might be needed or avoided to get it right, and how banks and funds will react. He has also met with officials at the European Central Bank and other global counterparts to outline the U.S. plan to tighten when most of them are easing.

"The New York Fed is thinking about these things a lot, and so are we," said Barclays' Abate, who attended a recent lunch with Potter.

IT'S MADNESS...ALL THEY HAVE TO DO IT TAKE BACK THE BAILOUTS, AND INTEREST RATES WILL RISE--GUARANTEED!

Demeter

(85,373 posts)PRINCIPLES? LIKE BUY LOW, SELL HIGH?

http://www.bloomberg.com/news/articles/2015-03-26/global-currency-trading-principles-said-to-be-ready-for-release

Central banks in the world’s biggest currency markets will publish on Monday principles of behavior and ethics for foreign-exchange trading, according to a person familiar with the document.

The “Global Preamble: Codes of Best Market Practice and Shared Global Principles,” inspired by a Financial Stability Board proposal in September, was ratified after consultations in eight markets around the world, according to the person, who asked not to be identified because the talks are private.

The global move to improve standards of behavior is part of an overhaul after allegations traders colluded to rig rates in the $5.3 trillion-a-day currency market. The list of principles was the first item for discussion at the annual global meeting of foreign-exchange committees that was hosted by the Bank of Japan on Monday, according to an agenda posted on the Federal Reserve Bank of New York’s website.

The delivery of the principles is on schedule after a consultation period that was slated to end this month. The proposal was circulated to local foreign-exchange market committees managed by central banks in Australia, Canada, Hong Kong, Britain, New York, Singapore, Tokyo and by the European Central Bank, which have backed the preamble, the person said....

WOULD A BANKSTER EVEN KNOW WHAT A PRINCIPLE LOOKED LIKE?

Demeter

(85,373 posts)I won't call it snow, because it's barely there....and the sun shines brightly. We might get up to freezing today, for an hour. And I've got the Kid's cold...

Transitions are the hard part.

Fuddnik

(8,846 posts)Mid 80's, for the last week, cold front tonight with a high in the upper 60's to low 70's tomorrow.

The pool has been 84-88 for the last week.

Demeter

(85,373 posts)I am shivering in two layers inside....it's not flu, but near enough. I'm not going out until the shivering stops.

Fuddnik

(8,846 posts)Demeter

(85,373 posts)I'm thinking I will need to get one for next winter....the Kid's got the other cat (now the only cat) firmly wrapped around her can opener hand...

and nobody will lend me their doggie, either. Boo-hoo, boo-hoo...