Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 27 July 2015

[font size=3]STOCK MARKET WATCH, Monday, 27 July 2015[font color=black][/font]

SMW for 24 July 2015

AT THE CLOSING BELL ON 24 July 2015

[center][font color=red]

Dow Jones 17,568.53 -163.39 (-0.92%)

S&P 500 2,079.65 -22.50 (-1.07%)

Nasdaq 5,088.63 -57.78 (-1.12%)

[font color=black]10 Year 2.26% 0.00 (0.00%)

[font color=red]30 Year 2.96% +0.01 (0.34%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)The police, the FBI, the NSA, and for all we know, the military with their drones...

Stop the world (or at least, the USA) I want to get off!

Demeter

(85,373 posts)3 GUESSES...FIRST 3 DON'T COUNT!

http://gizmodo.com/is-it-ok-to-shoot-down-your-neighbors-drone-1718055028

Before you decide to shoot that drone out of your backyard, there are a few important things you need to know. First of all, damaging any flying robot is a federal crime. It doesn’t matter if it’s crashing your pool party or watching you in your skivvies through the skylight in your master bath.

“In my legal opinion,” says Peter Sachs, a Connecticut attorney and publisher of Drone Law Journal, “it is never okay to shoot at a drone, shoot down a drone, or otherwise damage, destroy or disable a drone, or attempt to do so. Doing so is a federal crime.”

Here’s the thing. You might view a drone as many things: Creepy. Loud. Annoying. Scary. A sophisticated robot. A really cool toy. Target practice. But in the eyes of the law, a drone is a full-fledged aircraft, and deserves the same kind of respect. Here’s what federal law (18 USC § 32) has to say:

(1) sets fire to, damages, destroys, disables, or wrecks any aircraft in the special aircraft jurisdiction of the United States or any civil aircraft used, operated, or employed in interstate, overseas, or foreign air commerce;

...shall be fined under this title or imprisoned not more than twenty years or both.

What does that mean for you? If you attempt to gun down a flying robot, you could face those two decades in the slammer, and/or a fine of up to a quarter of a million dollars. So, legally speaking, shooting a drone could be the same as trying to damage a chopper or a 747. “Aircraft” is a pretty sweeping definition, it turns out, and it could work in drones’ favor.

“This applies even if a drone is hovering over your backyard,” says Sachs. “According to the FAA, it controls all airspace from the blades of the grass up. However, even if you did own X feet above your property, you would not be permitted to shoot a drone that flies within that space because shooting any aircraft is a federal crime.”

Under the Law, You Just Shot at an Airplane

Since when did a flying, remote-controlled robot become a legally binding “aircraft”? Not that long ago—only last November, as a matter of fact. In 2011, a photographer named Raphael Pirker shot a commercial at the University of Virginia with one of his drones. The FAA decided to fine him because he’d flown his hobbyist drone way too low, close to buildings, cars, and pedestrians. A legal battle ensued, and ultimately the National Transportation Safety Board ruled in November that drones are considered aircraft, and are subject to FAA regulations. Recently, people have continued to take literal aim at drones. Last September, a New Jersey man was arrested after shooting down a neighbor’s drone. Just last month, a viral video showed a firefighter spraying a drone with a firehose. Another man had to pay $850 after shooting down his neighbor’s UAV. FAA spokesperson Laura Brown told Gizmodo: “We do consider unmanned aircraft to be ‘aircraft,’ but the damage issue is more a destruction of personal property question that is outside our jurisdiction.” The Department of Justice didn’t respond for a comment for this story.

Unfortunately, you can’t bring drones down just because you think they’re a nuisance, even if they’re invading your privacy. There is, however, one plausible reason that could result in your whipping out a shotgun and felling the flying vehicle: Self-defense. ...if you ever found yourself in a situation where a drone is not only trespassing on your property, but is intentionally trying to harm you, then you can probably shoot it down. But this is only if the drone is swooping and trying to ram itself into you, or was outfitted with some (illegal) ammo of its own and started opening fire.

Since as early as 2013,... anti-drone citizens have pushed for laws that allow shooting the aerial devices.

Demeter

(85,373 posts)Like the War on Drugs, cyberwarfare turns a very real problem into a money-making bureaucratic machine...This spring, upwards of 22 million people—including all government workers and their families—were affected by the largest data breach of government computers ever, putting their personal histories—including information about bankruptcies, mental health issues and finances, not to mention Social Security numbers, at risk.

In a seeming moment of candor, Department of Homeland Security Secretary Jeh Johnson said in July that the two separate hacks of the Office of Personnel management first discovered in June were a “wake up call” for the federal government regarding the urgency of the cybersecurity threat, and that “we need to improve out mission” to secure the nation’s networks from further harm.

“To be frank,” he said before an audience at the Center for Strategic and International Studies, the preeminent national security think tank, “our federal cybersecurity is not where it needs to be.”

The sound heard shortly thereafter was of 22 million simultaneous face palms across the bureaucratic universe. After spending two decades and untold billions in taxpayer dollars on federal cyber priorities, not to mention the dedication of new agencies, programs, departments, task forces, a czar, and a cyber command under the U.S. military, the idea that the DHS needed an “a-ha” moment to put the threat into perspective is absurd, even bordering on cheap sentiment considering the circumstances. Perhaps Johnson, on the job for a year and a half while playing defense all the way, was just happy that it was OPM director Katherine Archuleta on the chopping block. She resigned under broad congressional pressure on July 10, just a day after Johnson declared his epiphany. Federal workers are not buying it...

MORE

Fuddnik

(8,846 posts)She never seems to have the time to post much anymore (neither do I), but she manages to religiously start our thread every day.

For this I say thank you very much for your perseverance, and reliability.

This thread means a lot to all of us, and I just wanted to say thanks.

I'll get to Demeter on the week-end. Thank you too.

Demeter

(85,373 posts)and that's the truth!

DemReadingDU

(16,000 posts)Appreciate both of your dedication and postings.

antigop

(12,778 posts)snot

(10,538 posts)Demeter

(85,373 posts)FINNS ARE STUBBORN PEOPLE THOUGH==THEY PUT POLLACKS TO SHAME! DON'T EXPECT THEM TO CATCH ON ANY TIME SOON.

http://www.washingtonpost.com/blogs/wonkblog/wp/2015/07/23/finland-is-the-poster-child-for-why-the-euro-doesnt-work/?tid=sm_tw

Sometimes bad things happen to good economies.

Take Finland. Its schools are among the best in the world, its government is among the least corrupt, and, for rich countries, its public debt is among the lowest. But despite the fact that the fundamentals of its economy are strong, its economy is not, in fact, strong. Finland is actually stuck in its longest recession in living memory. Why? Well, the short story is the euro.

The slightly longer version is Finland has had some bad luck that the euro has turned into a bad recession, or at least a worse one that it had to be. It started when Apple made Nokia go from being synonymous with smartphones to being synonymous with old smartphones. As Finland found out, it isn't easy to replace a company that, at its peak, made up 4 percent of your economy. Obsolescence came for the timber companies next. There was nothing they could do to make people need as much paper, which until now had been a major export, in a post-paper world. And, on top of that, Finland has felt the effects of Russia, one of its biggest trading partners, staggering under the weight of low oil prices and Western sanctions. Put it all together, and Finland was always going to have a tough time. But it's been tougher than it needed to be, since Finland hasn't been able to do what a country would normally do in this situation: devalue its currency. That's because Finland doesn't have a currency to devalue. It has the euro.

But how would a cheaper currency return Nokia to relevancy? Well, it wouldn't. What it would do, though, is make the rest of Finland's economy competitive enough that things that aren't strengths today would become ones tomorrow. It would also keep inflation from falling too much—it's actually negative now—which, in turn, would make debts a little easier to pay back and keep households spending and businesses investing a little more. Think about it like this. Anytime a shock hits, whether that's banks failing or an industry dying, the economy needs to cut costs to regain competitiveness. There are only two ways to do that: cut the value of the currency so wages aren't worth as much, or cut wages themselves. Now, this might sound like a distinction without a difference, but it's not. It's a lot easier to cut one price (the exchange rate) than it is to cut millions of prices (people's wages). And it's a lot less painful, too. You don't have to fire anyone to devalue the currency, but you do to make people take pay cuts.

Here's where things get tricky, though. How much should we blame the euro for Finland's problems, and how much we should blame, well, the problems themselves. After all, it's not like the common currency had anything to do with the iPhone turning Nokia's flip phones into little more than cultural artifacts. Although, on the other hand, it has had something to do with how long it's taken Finland to adjust to this new reality. There's no easy answer here. But what we can do, as Paul Krugman points out, is compare how Finland has done to a similar country that doesn't use the euro—a country like Sweden. And that, as you can see below, is a pretty ugly picture. Finland and Sweden grew almost identical amounts between 1989 and 2008, before diverging 20 percent since then. The fairest conclusion is that, given that so much has befallen it, Finland would have fallen behind even if it'd kept its old currency, the markka, but that it's fallen even more than that because the euro has taken away its ability to do anything about everything that has happened to it. All it can do is try to cut costs ever more religiously.

But facts are no match for faith, and Finland has plenty of that in its economic strategy. Finnish finance minister Alexander Stubb told the New York Times' Neil Irwin that "devaluation is a little like doping in sports" in that "it gives you a short-term boost, but in the long run, it's not beneficial." The problem is that although this sounds like a cost-benefit analysis, it's more a moral one. It's really pooh-poohing devaluation as the easy way out. But why shouldn't we want that? The two best things about the easy way out are that it's easy and is, in fact, a way out. Finland could use one of those given that its economy is still 5 percent smaller than it was in 2008.

The only way the euro could possibly be worth it is if it helped Finland more before the crash than it's hurt Finland since. That's a hard case to make, though, considering that Sweden did just as well without the euro as Finland did with it during that time.

Bad things have always happened to good economies, and they always will. Such are the vicissitudes of life. That's not fair, but at least governments can make it a little more so by doing something about it—unless, of course, they're part of the euro. Then their only recourse is punishing themselves again and again and again.

Morale still hasn't improved. Neither has the economy.

Demeter

(85,373 posts)Staff economists at the Federal Reserve expect a quarter-point U.S. interest rate increase this year, according to forecasts the Fed mistakenly published on its website in a gaffe that drew criticism about its ability to keep secrets. The rate forecast was included with a series of bearish projections on U.S. economic growth and inflation that were presented to policymakers at their June 16-17 meeting. The disclosure of the sensitive information is the latest blow to the Fed's reputation for secrecy around policy deliberations. Later on Friday evening, the Fed said the inadvertently released document was not the correct document. It provided a new table showing slightly lower outlooks for gross domestic product and inflation in 2015, as well as other revisions.

Federal prosecutors are currently probing an alleged leak at the Fed of market-sensitive information to a private financial newsletter in 2012. "It regrettably appears once again that proper internal controls are not in place to safeguard confidential Federal Reserve information," said Representative Jeb Hensarling of Texas, a Republican who chairs the House Financial Services Committee and is pressing Fed Chair Janet Yellen for documents regarding the 2012 leak. The Fed said in a statement that the forecasts were "inadvertently" included in a computer file posted to its website on June 29. Fed officials said the disclosure was due to procedural errors at a staff level and that the mistake was discovered on Tuesday this week. The matter has been referred to the Fed's inspector general.

The forecasts do not represent the views of the central bankers who set interest rate policy. Those policymakers, many based outside of Washington in regional Fed branches, create their own forecasts, the most recent of which were released on June 17. But Board of Governors' staff views are sensitive and influential enough that the Fed normally releases them about five years after they were made.

FIVE YEARS??!! SEEMS LIKE BLACKMAIL PROTECTION. SURELY EXCESSIVE IN THESE RAPIDLY-CHANGING TIMES. AFTER 5 YEARS, WHAT DIFFERENCE DOES IT MAKE? HELL, AFTER 5 MONTHS, WHAT DIFFERENCE DOES IT MAKE?

ONE HIKE IN 2015

In the projections prepared in June, and in the revised table released on Friday, the staff expected policymakers would raise their benchmark interest rate, known as the Fed funds rate, enough for it to average 0.35 percent in the fourth quarter of 2015. That implies one quarter-point hike this year, as the Fed funds rate is currently hovering around 0.13 percent. Analysts at JPMorgan and Barclays said this suggested the staff expected a rate hike before a scheduled Dec. 15-16 policy meeting. The Fed also has policy meetings scheduled for July 28-29, Sept. 16-17, and Oct. 27-28. All but two of the Fed's 17 policymakers said last month they think rates should rise in 2015. They were divided between whether it would be best to raise rates once or twice this year.

The staff views were less optimistic about the economy than several key policymaker forecasts. In the revised projections, which stretched from 2015 to 2020, the staff did not expect inflation to ever reach the Fed's 2.0 percent target. By the fourth quarter of 2020, they saw the PCE (personal consumption expenditure) inflation index rising 1.97 percent from a year earlier. The Fed's staff also took a dimmer view of long-run economic growth, expecting gross domestic product to expand 1.73 percent in the year through the fourth quarter of 2020. The views of Fed policymakers for long-term growth range from 1.8 percent to 2.5 percent.

The Fed goes to great lengths to manage the release of sensitive information. Policymakers and staff avoid making public comments just ahead of policy meetings, and the Fed makes journalists turn in their phones before letting them into a locked room to see a policy statement and prepare news stories just before the interest rate decision is published electronically. A Department of Justice probe is looking into an analyst note in 2012 that included details on a policy meeting before that information was made public.

"It is baffling that these leaks continue to occur," said Congressman Randy Neugebauer, a Texas Republican who chairs the House subcommittee on financial institutions and consumer credit.

Demeter

(85,373 posts)The last few years has witnessed a rising tide of academic studies that have concluded that financial systems in advanced economies like the US have become outsized and are a drag on growth. One of the most recent and particularly devastating pieces came out of the IMF. That study found that Poland’s banking system was at the optimal level of product sophistication and penetration.

Since the financial services industry also so heavily subsidized that it should not properly be considered private enterprise, these articles are an indictment of how the sector operates. Banks should be regulated like utilities, or at least have their subsidies greatly reduced.

Yet the Fed is firmly against taking even mild steps to rein in hypertrophied banks, and no less that Janet Yellen herself acting as subsidy-shill-in-chief.

Budgeteers have woken up to the fact that banks get a difficult-to-justify perk from membership in the Federal Reserve system, that of getting 6% annual dividend on the preferred stock that they bought at the time they joined. A draft bill by Senate Majority leader Mitch McConnell includes a provision that would cut the dividends to member banks with more than $1 billion in assets from 6% to 1.5%. He’s proposing to use it to help shore up the highway trust fund.

The Wall Street Journal describes how the banks are really unhappy about this plan...

WHEN ARE THE BANKS EVER HAPPY? MORE AT LINK

Demeter

(85,373 posts)Republicans on the House Financial Services Committee took their first step toward stripping the New York Federal Reserve bank of a key designation that could have an impact on how US monetary policy is set in the future.

Right now the New York Fed has a permanent seat on the Federal Open Market Committee, an internal monetary policymaking part of the Federal Reserve that will make the decision on when to increase interest rates. But if GOP lawmakers have their way, the New York Fed's elevated influence will come to an end. They want to strip the New York central bank branch of its permanent FOMC status and reduce its standing on the committee.

It is the latest in a series of contentious battles between the Federal Reserve, led by chair Janet Yellen, and Congressmen who have harshly criticized the central bank's management and policies. It would not be in the central bank's interest to have William Dudley, president of the New York Fed, excluded from key policy-making decisions because New York City is the East Coast's financial center, a source familiar with the Federal Reserve said. Few feel other central bank presidents would have up-to-the-moment understanding of policy decisions and their ramifications, the source said.

As Business Insider previously reported, lawmakers on the House Financial Services Committee Monetary Policy and Trade Subcommittee this week would hear a proposal that would strip the New York branch of the Federal Reserve of its elevated status on the FOMC. That proposal was, in fact, pitched by one Republican on July 22. A bill drafted by Michigan Republican committee member Bill Huizenga aims to rotate in and out every Federal Reserve bank branch in alternating years. This means that in odd-numbered years, the Fed banks of Boston, Philadelphia, Richmond, Chicago, Minneapolis, and Dallas would send a representative to the FOMC to make key policy decisions. In even-numbered years, New York, Cleveland, Atlanta, St. Louis, Kansas City and San Francisco would provide representatives to the FOMC.

The draft also aims to expand the authority of the Government Accountability Office to audit the bank's interest rate policies, something that Yellen and other Fed members have historically opposed. But the latest leak scandal at the Fed could weaken the central bank's defenses before lawmakers the next time she visits Capitol Hill.

Demeter

(85,373 posts)The Greek stock exchange will remain closed on Monday but might reopen on Tuesday after a one-month shutdown, official sources said. "It's certain that it will not open on Monday, maybe on Tuesday," a spokesperson for the Athens Stock Exchange told Reuters on condition of anonymity. Another person with direct knowledge of the matter confirmed that Greek authorities aimed to reopen the bourse on Tuesday.

The stock market has been closed since June 29 when Athens shut its stricken banks and imposed capital controls to stem a run on deposits that threatened to collapse the tottering Greek financial system. The shutdown has put at risk the bourse's place in global securities indices.

Banks reopened last Monday and Greece submitted a plan to the European Central Bank last week for an opinion before a decision was made by the Greek finance ministry which would allow the stock market to resume trading as early as Monday.

The Athens Stock Exchange official said Greece needed more time to finalise the details which would allow the market to reopen based on ECB's opinion.

Demeter

(85,373 posts)Greek banks are set to keep broad cash controls in place for months, until fresh money arrives from Europe and with it a sweeping restructuring, officials believe.

Rehabilitating the country's banks poses a difficult question. Should the euro zone take a stake in the lenders, first requiring bondholders and even big depositors to shoulder a loss, or should the bill for fixing the banks instead be added to Greece's debt mountain? Answering this could hold up agreement on a third bailout deal for Greece that negotiators want to conclude within weeks. The longer it takes, the more critical the banks' condition becomes as a 420 euro ($460) weekly limit on cash withdrawals chokes the economy and borrowers' ability to repay loans.

"The banks are in deep freeze but the economy is getting weaker," said one official, pointing to a steady rise in loans that are not being repaid.

This cash 'freeze' is unlikely to thaw soon, although capital controls may be slightly softened, such as the loosening on Friday of restrictions on foreign transfers by businesses.

"Ultimately, you can only lift the capital controls when the banks are sufficiently capitalized," said Jens Weidmann, the head of Germany's Bundesbank, which pushed the ECB to pare back bank funding, leading to their three-week closure.

The debate is interlinked with a wrangle over reforms, about Greek sovereignty in the face of European controls and whether the country can recover with ever rising debts that have topped 300 billion euros, far bigger than its economy. Were another 25 billion euros to be piled on top - the amount foreseen for the recapitalization of Greek lenders - it would add to debts that the International Monetary Fund has argued are excessive.

BERLIN CALLING

Greek officials, alarmed by a downward spiral in the economy, want an urgent release of funds for their banks. Four big banks dominate Greece. Of those, National Bank of Greece, Eurobank and Piraeus fell short in an ECB health check last year, when their restructuring plans were not taken into account. The situation is now dramatically worse.

"We want, if possible, an initial amount to be ready for the first needs of the banks," said one official at the Greek finance ministry, who spoke on condition of anonymity. "That should be about 10 billion euros."

Others, including Germany, however, are lukewarm and could push for losses for large depositors with more than 100,000 euros on their accounts, or bondholders. There are more than 20 billion euros of such deposits in Greece's four main banks, dwarfing the roughly 3 billion euros of bonds the banks have issued. Imposing a loss, something the Greek government has repeatedly denied any planning for, would be controversial, not least because much of this money is held by small Greek companies rather than wealthy individuals.

"This is not like Cyprus where you can say these are just Russian oligarchs," said an insolvency lawyer familiar with Greece.

"It's the very community everyone is hoping will resuscitate Greece, namely the corporates. You'll end up depriving them of their cash."

Christian Noyer, who heads France's central bank and sits on the ECB's Governing Council, also cautioned against such a step and said many of his peers on the policy-setting body agreed with him. The tone in Berlin is different, where some advocate not only that bank creditors foot the bill but also that the ESM steer clear of any direct stake, lumbering Athens with the banks' clean-up.

"The recapitalization will have to be done by the Greek government so that means more money in the third program," said Marcel Fratzscher, president of the Berlin-based German Institute for Economic Research.

"It's a loan they have to repay but there is no risk-sharing on the European side. They will have to bail in the private creditors. I can't see how this could not happen."

To avoid such orders, Athens is battling to keep autonomy in deciding the fate of its banks. Ceding further control could cost it dearly. Bondholders are nervous. Cyprus is a case in point. When Cyprus was bailed out, one of the island's two main banks was closed. Capital controls, although gradually scaled back, remained in place for two years.

One option, according to euro zone officials, is the direct recapitalization of Greece's banks by the euro zone's rescue fund, the European Stability Mechanism (ESM). This could grant the Luxembourg-based authority a direct stake in the banks and greater control over their future. That, however, would take Greece closer to the Cyprus model. Any such direct ESM aid requires that losses first be imposed on some of the banks' bondholders and even large depositors. In Athens, officials would like the money without such strings attached.

"We don't know yet if the ESM will take direct control," said one senior Greek banker. "It will be an issue at the negotiations."

With its economy starved of cash and the threat of its departure from the euro zone hanging over talks, Athens' room for maneuver is limited. One euro zone official summarized the mood: "Whatever sympathy there was for Greece has evaporated."

Demeter

(85,373 posts)Talks between Greece and its international creditors over a new bailout package will be delayed by a couple of days because of organizational issues, a finance ministry official said on Saturday. The meetings with officials from the European Commission, European Central Bank and International Monetary Fund were supposed to start on Monday after being delayed for issues including the location of talks and security last week. A finance ministry official, who declined to be named, said talks between the technical teams of the lenders will start on Tuesday, while the mission chiefs will arrive in Athens with a delay of a couple of days for technical reasons.

"The reasons for the delay are neither political, nor diplomatic ones," the official added.

Greeks have viewed inspections visits by the lenders in Athens as a violation of the country's sovereignty and six months of acrimonious negotiations with EU partners took place in Brussels at the government's request. Another finance ministry official denied earlier on Saturday that the government was trying to keep the lenders' team away from government departments and had no problem with them visiting the General Accounting Office. Asked if the government would now allow EU, IMF and ECB mission chiefs to visit Athens for talks on a new loan, State Minister Alekos Flabouraris said: "If the agreement says that they should visit a ministry, we have to accept that."

The confusion around the expected start to the talks on Friday underlined the challenges ahead if negotiations are to be wrapped up in time for a bailout worth up to 86 billion euros to be approved in parliament by Aug. 20, as Greece intends. Already, Prime Minister Alexis Tsipras is struggling to contain a rebellion in his left-wing Syriza party that made his government dependent on votes from pro-European opposition parties to get the tough bailout terms approved in parliament.

CALL FOR CLEAR SOLUTION

One of Tsipras' closest aides said that the understanding with the opposition parties could not last long and a clear solution was needed, underlining widespread expectations that new elections may come as soon as September or October.

"The country cannot go on with a minority government for long. We need clear, strong solutions," State Minister Nikos Pappas told the weekly Ependysi in an interview published on Saturday.

Apart from the terms of a new loan, Greece and its lenders are also expected to discuss the sustainability of its debt, which is around 170 percent of GDP. Greece has repeatedly asked for a debt relief and the IMF has said this is needed for the Greek accord to be viable. European Commission Vice President Valdis Dombrovskis told Italy's La Stampa daily in an interview that a recent analysis on the issue "justified some concerns". He added a Greek exit from the euro was "certainly out of the question now".

Tsipras, who is by far the most popular politician in Greece according to opinion polls, has said his priority is to secure the bailout package before dealing with the political fallout from the Syriza party rebellion. According to a poll by Metron Analysis for Parapolitika newspaper on Saturday, 61 percent of Greeks had a positive view of Tsipras against 36 percent who disapproved. An overwhelming majority - 78 percent - still wanted Greece to stay in the euro zone against 19 percent in favor of going back to the drachma. Tsipras insists there is no viable alternative to the bailout but has been wary of striking out against his party opponents in a bid to keep it together, at least while talks proceed. Flabouraris called on Syriza rebels to drop their opposition.

"They are still my comrades and I urge them to get back to their senses even at the last moment," he told Skai television. "They should realize that the Left movement is now in power. It's not an opposition party. Now we have to discuss the new landscape."

Demeter

(85,373 posts)Silly me! I thought that given that the Greek government had prostrated itself and had complied with the creditor demand to pass legislation double-plus-quick or else, that the worst of the hurdles to getting the third bailout passed had been surmounted.

I should know better than to let any optimism cloud my view as far as Greece is concerned. And I have to confess it was out of a hope that Greece would not longer be front page news pretty much every day.

We are again in the midst of what Lambert calls an “overly dynamic situation” with respect to the Greek negotiations. And it’s going to be a bit in flux because the parties are again fighting over process, or what is often called “shape of the table”. That’s already a bad sign, since it has the potential to create rancor even before the two sides get to working out substantive issues. And it’s not as if the parties to these talks harbor much in the way of good will toward each other to begin with.

So rather than do anything in depth, let’s just flag some key issues:

AND THERE ARE SEVERAL PAGES OF THEM--SEE LINK

Demeter

(85,373 posts)Pacific Rim officials meet in Hawaii this week for talks that could make or break an ambitious trade deal which aims to boost growth and set common standards across a dozen economies ranging from the United States to Brunei. Trade ministers go into the talks, which run from July 28 to 31 on the island of Maui, with high hopes of a pact to conclude the Trans-Pacific Partnership (TPP), the most sweeping trade deal in a generation and a legacy-defining achievement for U.S. President Barack Obama. But although officials in Maui said the mood was optimistic, the toughest issues have been left until last, including monopoly periods for new life-saving medicines and preferential treatment for state-owned companies, besides more traditional issues such as allowing more competition in protected markets.

"This meeting will be extremely important to decide the fate of the TPP negotiations," Japanese Economy Minister Akira Amari told reporters on Friday. "I believe all the nations will come to the meeting with their strong determination that it has to be the last one."

Canadian Trade Minister Ed Fast was more cautious, warning last week that there was a lot of hard work still to be done. Canada's refusal so far to accept more dairy imports is a major sticking point in the talks, infuriating the United States as well as New Zealand, which has said it will not sign a deal that fails to open new dairy markets.

Mexico, which buys half its imports from Canada and the United States and very few from other TPP countries, was also falling short in opening its markets, a source close to the talks said.

Failure to agree this week will endanger an already tight timeline to get a deal through the divided U.S. Congress this year, before the 2016 presidential campaign dominates the agenda. A six-week battle over U.S. legislation to streamline the passage of trade deals through Congress finally ended in late June, sparking a rush of negotiations to ready ministers to take the tough decisions needed to wrap up the talks. Tami Overby, senior vice president for Asia with the U.S. Chamber of Commerce, said it would be very difficult to keep the momentum going if ministers failed to reach agreement this week, although she added that she was optimistic of success.A U.S. official said talks would continue if there was no finalized agreement in Maui.

Peruvian unions, however, recently filed a complaint with the U.S. Department of Labor, saying their government was falling short of standards in a 2009 U.S.-Peru trade deal, which, like the TPP, is supposed to ensure internationally-recognized labor benchmarks. Workers' rights in TPP countries, especially Vietnam, have been a key concern for U.S. Democratic lawmakers, many of whom fear the trade deal will eliminate U.S. jobs partly because of lower labor standards overseas.

Some trade diplomats from TPP nations doubted whether ministers could produce a detailed agreement by Friday. One option would be to reach an in-principle deal and then finalize details later, one official said.

Demeter

(85,373 posts)By Joe Firestone, Ph.D., Managing Director, CEO of the Knowledge Management Consortium International (KMCI), and Director of KMCI’s CKIM Certificate program. He taught political science as the graduate and undergraduate level and blogs regularly at Corrente, Firedoglake and New Economic Perspectives.

The trade agreements currently being negotiated by the Obama Administration are potentially enormously important in their possible impact on the United States. The Trans-Pacific Partnership (TPP) is being negotiated by 12 Asian-Pacific nations, and, if agreed to by Congress could be expanded in membership later on under the President’s sole authority. The Trans-Atlantic Trade and Investment Partnership (TTIP) will encompass 29 nations, including the United States. And the third agreement, the Trade in Services Agreement (TiSA), perhaps the most dangerous of the three, will likely encompass 52 nations, if agreed to by all.

These agreements would bind the United States to multilateral terms with much of the world with some notable exceptions, such as Brazil, Russia, India, China, South Africa, Uruguay, and Indonesia. In other words, their scope is unprecedented and their provisions are not yet public. Based on leaks of drafts of the agreements, the book discusses many possible implications of the likely content of these agreements.

By far the most important are the potential effects of the agreements on the consent of the governed, the sovereignty, the monetary sovereignty, the separation of powers, the Federalism, if any, and the democracies, of the participating states. In short, the agreements provide for the governments of the participating states to be subject to external private authorities beholden to multinational corporations, which, in Investor State Dispute Settlement (ISDS) proceedings, can subject nations to fines in unlimited amounts in response to complaints from corporations at the discretion of three-judge tribunals having no accountability to the parties to the agreements. The agreements are, in effect, declarations of dependence!

Most disturbing about the potential effects of the agreements, is the likely constraint on the policy space of participating nations, including the United States, they would produce in relation to legislation and regulations affecting the profits or expectations of profits of multinational corporations. It is the policies of all levels of government: national, state, and local that make it possible for societies to adapt to changes when they meet new challenges. With severely constrained policy spaces they cannot try new policy innovations, nor even use old policy expedients that have been effective at other times in the past to meet particular problems.

It is folly to disarm the governments of nations, and with it their political systems, so they cannot do their jobs in helping peoples and societies to adjust to such changes. That way lies repression, chaos, human suffering, violence, bloodshed, extreme conflict, and loss of life. Ossified and paralyzed political systems have spawned all of the major bloody political and social revolutions we have seen in the history of man. And we are asking for all of that if we stop or hinder national governments from following adaptive policies that solve various problems of change, and that produce social and economic justice. Yet these three trade agreements are likely to do exactly that...

MORE

Demeter

(85,373 posts)The pitched battle over a relatively unknown federal agency further inflamed the Republican Party’s ideological feud as the Senate voted Sunday to extend the life of the Export-Import Bank over intense conservative objections. On a roll-call vote of 67 to 26, the chamber included language in a federal highway bill that would renew the charter of the bank, which extends loan guarantees to help U.S. corporations sell goods abroad. The vote split the GOP caucus almost evenly and exposed a deep division among the party’s leaders and presidential contenders.

“We serve the people, not our own egos,” Sen. Orrin G. Hatch (Utah), a 39-year member of the chamber, said before the vote. His speech served as a rebuke to a trio of first-term senators who are running for the 2016 Republican presidential nomination, with a sharp focus on Sen. Ted Cruz (Tex.), who on Friday accused Majority Leader Mitch McConnell (Ky.) of lying about his intentions regarding the Ex-Im amendment. The fight over the bank has taken on a life of its own in some corners of the conservative movement, particularly among tea party activists who are trying to move Republicans away from their traditional support for corporate America. Opponents of the amendment such as Cruz deride the bank as a form of corporate welfare, particularly in its help for major corporations such as Boeing in its bid to sell jets overseas. Supporters say that dozens of other countries use similar agencies to prop up their companies in the global markets, noting that many U.S. jobs are linked to global trade backed by Ex-Im loans.

The Ex-Im Bank’s charter expired June 30 because House conservatives blocked any vote to allow it to issue new loans. In the 4 1/2 years since taking control of the House, including the past seven months in the Senate majority, Republicans can count the bank’s shuttering as the only significant federal agency to close on their watch. Sunday’s vote did little to guarantee that the bank would resume business as usual anytime soon. The underlying highway bill remains anathema to many House Republicans, not just because of the Ex-Im language. The Senate’s proposed three-year plan does not meet the usual six-year authorization for highway funding, and its policy prescriptions differ from those backed by members of the House Transportation and Infrastructure Committee. The trust fund for highway programs will dry up Friday, just as Congress is slated to begin a nearly six-week recess. If the House cannot approve the Senate highway plan, then McConnell may have no choice but to pass the House’s short-term extension of highway funding to buy more time to craft a six-year plan.

The House bill does not include extending the Ex-Im charter, which would leave the agency in a continued state of limbo: It can continue administering the loans it already has guaranteed but cannot do new loan work.

TED CRUZ ROCKING THE BOAT AT LINK

Demeter

(85,373 posts)WHERE'S THE FUN IN THAT? ALSO, WHERE'S THE MEANS?

http://in.reuters.com/article/2015/07/27/us-usa-puertorico-debt-idINKCN0Q101P20150727

Puerto Rico can crawl out of its $72 billion debt hole without defaulting on its government debt, says a report commissioned by holders of $5.2 billion of the U.S. commonwealth’s government-backed bonds. By cutting expenses, including on education, and improving tax collection, Puerto Rico could erase its deficit by 2017, according to a report by Jose Fajgenbaum, Jorge Guzman and Claudio Loser, former International Monetary Fund economists and now consultants at Centennial Group...Centennial was retained by a group of holders of so-called general obligation Puerto Rican bonds, including Fir Tree Partners, Brigade Capital Management and Monarch Capital Group...

Puerto Rico Gov. Alejandro Garcia Padilla's office criticized the report on Sunday. The governor's chief of staff, Victor Suarez, responded in a statement that the island has "already enacted significant fiscal reforms," including pension concessions...Trying to right its ship after a decade of stagnation and a shrinking population, Puerto Rico wants to negotiate concessions from creditors keen on protecting their investments. With analysts expecting a default, the island could wind up in messy litigation with creditors. A month ago, a report by former IMF official Anne Krueger, commissioned by Puerto Rico’s government, said the island’s woes must be solved through concessions from bondholders combined with fiscal and economic adjustments. Around the same time, Padilla called for a wide-ranging debt restructuring, deeming the island’s debt “unpayable.” Suarez on Sunday said "the simple fact remains that extreme austerity" alone "is not a viable solution for an economy already on its knees."

But Puerto Rico has a “deficit problem, not a debt problem,” Centennial said in its report. “The debt in the medium term is sustainable,” Loser told reporters in a conference call on Sunday. “There is no need for a general restructuring.” Loser said Puerto Rico will face a roughly $2.5 billion financing gap in fiscal year 2016. But, the report said, the island collects only 56 percent of potential sales tax revenue, and has increased education expenditures by 39 percent in the last decade as enrollment has dropped 25 percent. Fixing those ratios could yield a surplus by fiscal 2017, the report said. Loser said Puerto Rico’s debt is not “monolithic,” coming from some 18 issuers, and acknowledged some individual debt issuers may try to restructure.

The island's fate is muddied by the lack of a restructuring statute akin to U.S. bankruptcy law.

antigop

(12,778 posts)Beijing managed to stabilize markets with a dramatic rescue in late June and early July, intervening in a number of ways to limit losses for investors.

But the rout has now resumed: Monday's slump was the biggest daily percentage decline since 2007.

The vast majority of companies listed in Shanghai, including many large state-owned firms, fell by the maximum daily limit of 10%. Losses in Shanghai, and on the smaller Shenzhen Composite index, accelerated into the close. Shenzhen, which is heavy on tech stocks, closed down 7%.

Demeter

(85,373 posts)the rest of the table gets trashed.

At 11:35 EDT, DJIA down 128 pts at 17,440.52

MattSh

(3,714 posts)and no, this was not some type of heritage park where you pay to learn the skills your ancestors 200 years ago knew by the age of 5. This was real, unrehearsed cow herding practice.

Demeter

(85,373 posts)By Igor Korotchenko

Translated from Russian by J.Hawk

An anonymous source in one of Ukraine's security agencies said that the Malaysian Boeing was shot down as a result of an unauthorized Ukrainian Buk-M1 launch. RIA Novosti reports citing a source in a Ukrainian security agency that the MH17 catastrophe may have been the result of an unanticipated situation during the training of one of Ukraine's air defense units. The anonymous source states the following:

"On July 17 2014, the commander of the 156th Anti-Aircraft Missile Regiment was instructed to conduct missile crew training on providing coverage for Ukrainian ground forces in the suburbs of Donetsk, which entailed deploying the battalions, training target acquisition and tracking procedures, and carry out a simulated destruction of an aerial target using Buk-M1 missiles."

He said that battery commanders were issued launch keys, however, there were no plans to launch an actual 9M38M1 missile. The training exercise involved two Su-25 aircraft, their task was to conduct aerial reconnaissance and designated training targets in the vicinity of Ukrainian troop concentration to the West of Donetsk.

"After one of the aircraft entered Buk detection zone, it began to be tracked by a missile crew located near Zaroshchenskoye. In all likelihood, due to a tragic coincidence the flight paths of the Malaysian Boeing and the Su-25 coincided and, in spite of the altitude difference, were indicated on the Buk radar as a single target which proved fatal for the Boeing. If two targets are located on the same azimuth from the launch vehicle, the tracking system automatically shifts to the one which represents the largest radar target."

SBU is trying to establish why the unauthorized launch took place. The source does not possess information about the course of that investigation. We should note that the scenario described above is consistent with the results of the recent investigation conducted by Almaz-Antey. According to Russian experts, the Boeing was shot down by a 9M38M1 missile launched by a Buk-M1 system located near the village of Zaroshchenskoye which was under Ukrainian control.

Netherlands are conducting the main investigation of the July 17 catastrophe. The majority of victims were citizens of that country. Final results are expected in October.

J.Hawk's Comment: I've translated the Almaz-Antey investigation presentation some months ago, and I also wrote more than once that whoever was shooting at the MH17 likely thought he was shooting at something else. And that "something else" was most likely deemed to be a Russian military aircraft intruding into Ukraine's airspace. Because the airliner (which was following a non-standard route) would not only be visible as a significantly bigger target than the single-seat Su-25, it also would not be equipped with a Ukrainian military IFF. And to make things worse, Ukrainian press at the time carried not only stories about a Russian ground invasion of Ukraine, but also stories of Russian aircraft intruding into Ukrainian airspace. So what started as a training exercise may have morphed into "this is not a drill" shooting war scenario...

That's the most likely Su-25 connection to the shooting, for my money. It is extremely unlikely the MH17 was shot down by an Su-25 because that aircraft is capable of carrying only short-range heat-seekers with small warheads that would not cause the sort of damage the MH17 sustained. If the MH17 was struck by an air-to-air heat-seeking missile, that missile would have struck one of its engines causing a engine fire but not much else--the warhead is too small to even blow off the engine. This, in turn, would have given the crew time to issue a mayday call and take other measures to try and save the aircraft. They were not able to do that because the cockpit crew was killed almost instantly by the heavy Buk warhead exploding in close proximity of the cockpit.

That still leaves the small matter of whether the anonymous source is legit and we have no way of knowing that. However, if that aspect of the story is true, it would indicate a certain desire to make amends with Moscow which of course implies the need to find a scapegoat...

Turchinov? Or how about the former SBU head Nalivaichenko who's been spilling the beans on Turchinov's corruption?

Or, again assuming that aspect of the story is legit, it might be an indication that the Ukrainian military might be in the mood for a little coup of its own to finally be rid of this crew of extremist mediocrities that passes for the country's civilian leadership.

MattSh

(3,714 posts)Though the MSM no doubt have firm instructions to ignore this story. And if it actually was Kiev, you will never know the truth because Kiev has veto power over the final report. So it absolutely can't blame Kiev.

This author believes it wasn't shot down by an SU-25, though when you see photos of the cockpit, it shows damage that in my opinion is inconsistent with a missile. But I'm no expert on that sort of stuff.

Demeter

(85,373 posts)This week’s G7 Summit highlights the emergence of a new era where the struggle for power between countries will be waged through economic means. President Barack Obama was in the Bavarian Alps this week for the annual Group of Seven Leaders’ Summit, complete with the time-honored awkward Group photo, a rite that even the leaders of the free world seem powerless to end (2013’s entry remains the one to beat). Yet for all of its timeworn familiarity, this year’s photo offered hints of something new. It captured the Group’s first real gathering as a body of seven again, down from eight — or, at least the first that all sides had the benefit of a year to plan (while the Group did meet as seven last year, that meeting came just weeks after the Group’s decision to uninvite Russia for conduct unbecoming of a G8 member, upending the planned agenda and forcing a last-minute change of venue from Sochi to the Hague). As such, this week’s Summit suggested the return of a more familiar form of “global governance” – Trans-atlanticism plus Japan. It was the most concrete admission yet that global governance in the post-Cold War era had bitten off more than it could manage, and was in need of downscaling.

Back among true friends, then, how did the G7 do? First the good news. Leaders seized the occasion to keep their gaze on Russia, as the United States and the United Kingdom sought to stiffen the resolve of EU countries waning in their enthusiasm for the current U.S. – EU sanctions on Russia. The spectacle underscored just how novel the current U.S.- EU coordination on sanctions is; never before has Washington exercised this much restraint in refusing to get out ahead of a European Union foreign policy apparatus that can be maddeningly slow and unwieldy. Such difficulties maintaining a unified line on sanctions drew especially sharp contrast with the routine and sophisticated coordination—the basic habits of cooperation and shared understandings—that the U.S. and Europe enjoy on the military and security side. No doubt NATO has its flaws, but nor are Washington and Brussels inventing military redlines from scratch. Whether or not the specific decisions coming out of NATO over the past 12 months have been the right ones, NATO’s leaders have in relatively short-order managed to settle on, communicate, and execute a concrete set of responses to Russian provocations. The U.S. and Europe have no such economic counterpart similar to what NATO represents on the security side, no such framework or foundation for jointly exercising economic muscle. So long as that is the case, U.S and EU leaders will continue to struggle with many of the most important ingredients to resolving this conflict —from coordinated sanctions capable of pushing back on Russian aggression, to a joint blueprint for stabilizing Ukraine from economic freefall, to adequate defenses against the pipeline politics and other forms of economic coercion so favored by Moscow.

It is no accident that these economic dimensions are proving central to this crisis and its eventual outcomes. This contrast—the most sophisticated alliance system to answer military threats in the modern world on one hand, and no meaningful counterpart when it comes to advancing the economic aspects of our common foreign policy objectives—is precisely why President Putin has taken to economic tatics as a first resort (of course military tactics are in full evidence, too, but in dialing up or down aggression at will, President Putin’s military strategy seems calculated to fatigue Ukraine economically and exhaust Europe’s pain tolerance for maintaining sanctions). And it is why China, too, has opted for economic means of working its will in the world. Welcome to the era of geo-economic statecraft, where more and more, geopolitics and state power struggles will be waged through economic means.

This week’s Summit was a heartening sign that the leaders assembled at the leaner, more nimble G7 table are at least beginning to wake up to this new era of geo-economic statecraft, and the new habits of cooperation it will require. That is the opportunity of the newly returned G7: to offer a foundation for the kind of geo-economic cooperation the West will need if it is to meet the challenges of a rising China, a belligerent Russia, and a sophisticated financing outfit like the Islamic State.

But to evolve in this direction, the G7 will need to make some conscious decisions. It will need new norms that give all sides better baseline presumptions. Take sanctions, for instance, and the structural design flaws inherent to the current EU sanctions approach. Why, when wrangling 27 member nations is certain to prove challenging, are the EU’s sanctions designed so as to automatically expire? Why place the default burden on EU member countries to renew these sanctions, rather than on Moscow to earn their removal through delivering on stated commitments? The G7 would be a useful venue for member countries to agree to a basic architecture for how their respective sanctions regimes should work jointly—a place where leaders could smooth the many design and enforcement wrinkles plaguing important sanctions regimes against both Russia and Iran.

Finally, a return to the G7 should also allow for more ambition and meaningful linkages across issues of genuine, unanimous concern in the United States, Europe and Japan—in short, more “two-fers” and “three-fers.” In addition to the Russia – Ukraine crisis, another of the Group’s major agenda items this week was climate. Here, the Group could have targeted fuel subsidies. Recent work I have done with colleagues at the Council on Foreign Relations and experts in the field makes clear how centrally fuel subsidies figure into Ukraine’s economic viability (fuel subsidies have cost Ukraine roughly $10 billion per year in recent years—an amazing sum, especially considering that the country’s current IMF bailout totals $17.5 billion over four years); how they reward Russia along with other major oil and gas producers, and how, if dismantled, oil consumption could fall by 3 to 4 million barrels of oil per day. Instead, G7 leaders contented themselves with a pledge to ween themselves from carbon by the end of this century—when neither they will be around to answer for failure, nor we to point it out. At least now back among friends, can’t we agree to do better?

Jennifer M. Harris is a senior fellow at the Council on Foreign Relations (CFR). Prior to joining CFR, Jennifer was a member of the policy planning staff at the U.S. Department of State responsible for global markets, geo-economic issues, and energy security. Jennifer is currently writing a book on the modern use of economic and financial instruments as tools of statecraft.

Demeter

(85,373 posts)http://www.businessinsider.com/remittance-explainer-report-2015-7

Over the past few centuries, the world has become increasingly globalized. Immigrants are pouring into developed countries like the US, where many jobs pay higher rates than in their home markets.

As migrants shuffle around the globe, they have family members and friends back home who they continue to support through cross-border money transfers, called remittances.

Three remittance companies — Western Union, MoneyGram, and Ria — have dominated this market for years, operating a combined 1.1 million retail locations across 200 countries to facilitate cash pickups. However, digital-first players are emerging, leveraging mobile and online platforms to compete with the legacy firms on scale and fees. Fees remain a huge pain point for migrants sending money home, and offering lower fees gives startups a huge advantage.

In a new report from BI Intelligence, we size the total remittance market, the countries on both the send and receive sides that dominate remittance volume, and how remittances differ depending on payment mechanisms. We also look at the top challenges faced by remittance companies and what factors digital-first remittance startups are capitalizing on to disrupt the traditional remittance model.

DETAILS AT LINK

Demeter

(85,373 posts)Medicare turns 50 this week, and it has been a very good half-century. Before the program went into effect, Ronald Reagan warned that it would destroy American freedom; it didn’t, as far as anyone can tell. What it did do was provide a huge improvement in financial security for seniors and their families, and in many cases it has literally been a lifesaver as well. But the right has never abandoned its dream of killing the program. So it’s really no surprise that Jeb Bush recently declared that while he wants to let those already on Medicare keep their benefits, “We need to figure out a way to phase out this program for others.” What is somewhat surprising, however, is the argument he chose to use, which might have sounded plausible five years ago, but now looks completely out of touch. In this, as in other spheres, Mr. Bush often seems like a Rip Van Winkle who slept through everything that has happened since he left the governor’s office — after all, he’s still boasting about Florida’s housing-bubble boom.

Actually, before I get to Mr. Bush’s argument, I guess I need to acknowledge that a Bush spokesman claims that the candidate wasn’t actually calling for an end to Medicare, he was just talking about things like raising the age of eligibility. There are two things to say about this claim. First, it’s clearly false: in context, Mr. Bush was obviously talking about converting Medicare into a voucher system, along the lines proposed by Paul Ryan. And second, while raising the Medicare age has long been a favorite idea of Washington’s Very Serious People, a couple of years ago the Congressional Budget Office did a careful study and discovered that it would hardly save any money. That is, at this point raising the Medicare age is a zombie idea, which should have been killed by analysis and evidence, but is still out there eating some people’s brains. But then, Mr. Bush’s real argument, as opposed to his campaign’s lame attempt at a rewrite, is just a bigger zombie.

The real reason conservatives want to do away with Medicare has always been political: It’s the very idea of the government providing a universal safety net that they hate, and they hate it even more when such programs are successful. But when they make their case to the public they usually shy away from making their real case, and have even, incredibly, sometimes posed as the program’s defenders against liberals and their death panels. What Medicare’s would-be killers usually argue, instead, is that the program as we know it is unaffordable — that we must destroy the system in order to save it, that, as Mr. Bush put it, we must “move to a new system that allows [seniors] to have something — because they’re not going to have anything.” And the new system they usually advocate is, as I said, vouchers that can be applied to the purchase of private insurance.

The underlying premise here is that Medicare as we know it is incapable of controlling costs, that only the only way to keep health care affordable going forward is to rely on the magic of privatization. Now, this was always a dubious claim. It’s true that for most of Medicare’s history its spending has grown faster than the economy as a whole — but this is true of health spending in general. In fact, Medicare costs per beneficiary have consistently grown more slowly than private insurance premiums, suggesting that Medicare is, if anything, better than private insurers at cost control. Furthermore, other wealthy countries with government-provided health insurance spend much less than we do, again suggesting that Medicare-type programs can indeed control costs.

Still, conservatives scoffed at the cost-control measures included in the Affordable Care Act, insisting that nothing short of privatization would work. And then a funny thing happened: the act’s passage was immediately followed by an unprecedented pause in Medicare cost growth. Indeed, Medicare spending keeps coming in ever further below expectations, to an extent that has revolutionized our views about the sustainability of the program and of government spending as a whole. Right now is, in other words, a very odd time to be going on about the impossibility of preserving Medicare, a program whose finances will be strained by an aging population but no longer look disastrous. One can only guess that Mr. Bush is unaware of all this, that he’s living inside the conservative information bubble, whose impervious shield blocks all positive news about health reform.

Meanwhile, what the rest of us need to know is that Medicare at 50 still looks very good. It needs to keep working on costs, it will need some additional resources, but it looks eminently sustainable. The only real threat it faces is that of attack by right-wing zombies.

http://www.nytimes.com/2015/07/27/opinion/zombies-against-medicare.html?ref=opinion&_r=1

Demeter

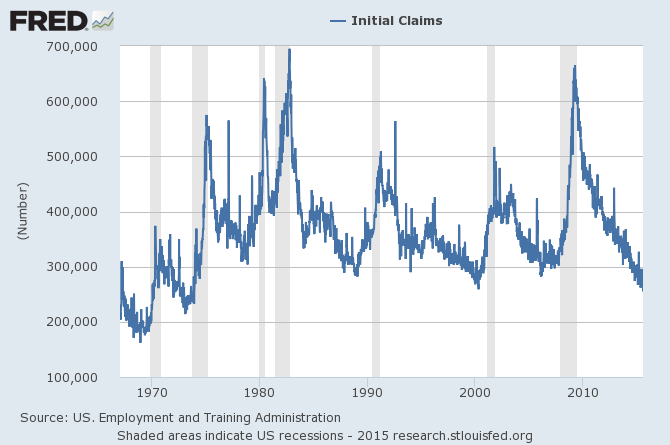

(85,373 posts)New claims for unemployment insurance this week came in at the lowest level in over 40 years. How much slack can there be left in the labor market?

Initial claims for unemployment insurance, weekly, 1967-01-07 to 2015-07-18. Source: FRED.

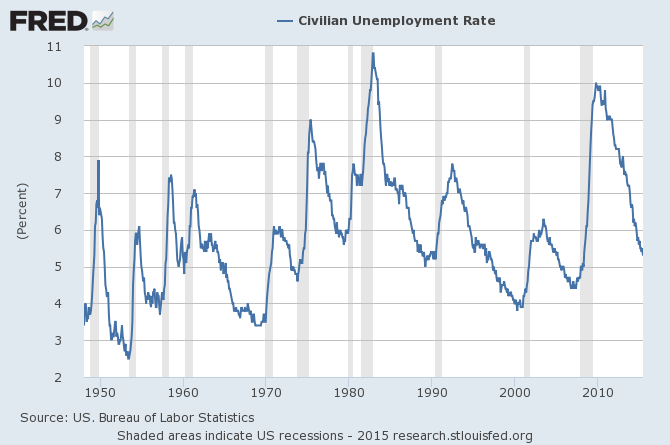

The most common measure of unemployment (known as U3) counts the number of people who are not currently working and are actively looking for a job. You’re put in that category by the BLS if you report taking active measures over the last month to find work. In June U3 amounted to 5.3% of the labor force, where the labor force is defined as the sum of U3 plus people who are currently employed. That’s well below the average rate of 6.5% seen over the last 40 years.

U3 unemployment rate, monthly 1948:M1 to 2015:M6. Source: FRED.

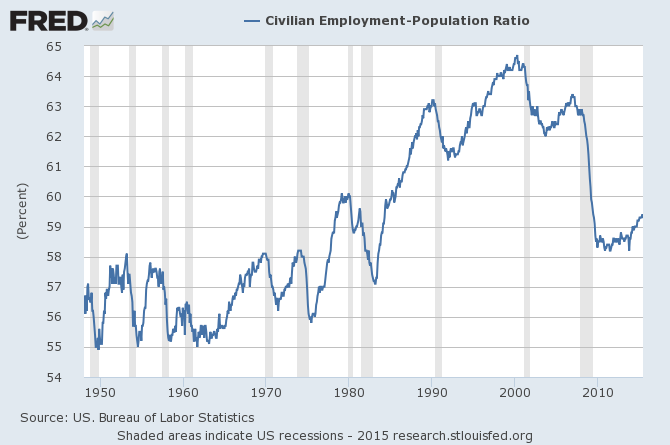

But if you simply count the number of people who are working as a percent of the population 16 years and over, you come up with only 59%. That’s up a little from the lows reached during the Great Recession, but significantly below what it had been over the last several decades.

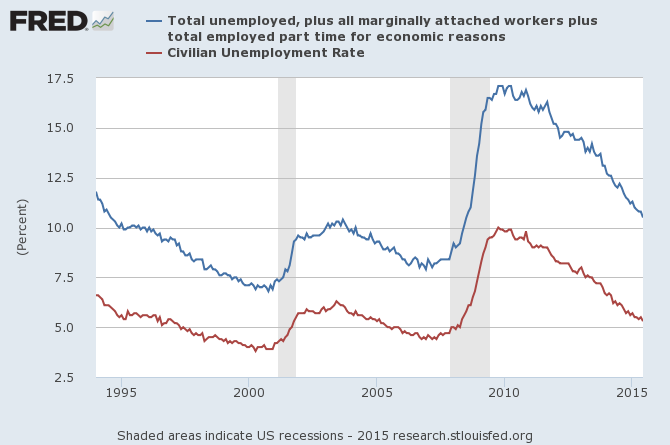

...And there are a number of people who say they’re employed, but only part-time, and are hoping to get a full-time position. When we add these to the U5 count, we get the broader unemployment measure known as U6. Last month the U.S. unemployment rate as measured by U3 was 5.3%, but when measured by U6, it came in at 10.5%.

U.S. unemployment rate as measured by U3 (in red) and U6 (in blue), monthly, 1994:M1 to 2015:M6.

MORE

Demeter

(85,373 posts)Three Supreme Court justices didn’t recuse themselves from cases in which they held stock in companies interested in the outcomes...

3 GUESSES WHICH 3, SAME DEAL AS BEFORE!

http://www.alternet.org/economy/rampant-corporatism-scotus-justices-rule-favor-companies-they-own-stock-90-time?akid=13333.227380._NtRBA&rd=1&src=newsletter1039927&t=21

Three Supreme Court justices didn’t recuse themselves from cases in which they held stock in companies interested in the outcomes. Nearly 90 percent of the time, they sided with these businesses that filed ‘friend of the court’ briefs, a new report said.

Chief Justice John Roberts and Associate Justices Stephen Breyer and Samuel Alito own shares in several publicly traded companies, according to their 2014 financial disclosure reports. From July 2014 through June 2015, seven cases before the Supreme Court featured amicus curiae ‒ or friend of the court ‒ briefs by companies in which the three justices were stockholders. These filings allow parties that will be affected by a ruling, but are not directly involved in a case, to introduce“relevant matter not already brought to [the Court’s] attention,” the Supreme Court rules read.

Justices are not obligated by law to disclose if they have relation to parties that act as amici ‒ Latin for “friends” ‒ although they have to sit out if they are involved with one of the named parties.

None of the three men recused themselves from the bench in any of those seven cases. On top of not recusing themselves, the three justices “sided with their amici 89 percent of the time, or eight out of nine times,” an analysis by Fix the Court, a non-partisan organization dedicated to increasing transparency and accountability by the Supreme Court, found (emphasis original)....

MORE CORRUPTION AT LINK

Demeter

(85,373 posts)Summary:

- Lackluster earnings followed announcements of two executive being disposed: the CFO and Vice Chairman of Wealth Management.

- This spells a potential lack of integrity and dissent in BAC’s upper ranks, which should cause concern for shareholders.

- BAC lags behind all major domestic large bank peers; current BAC shareholders have an array of other, less risky and more promising options.

- We suggest cashing out now as downside could come.

Bank of America (NYSE: BAC) reported earnings last week. While some bright spots surfaced, CEO Brian Moynihan is facing increased pressure to improve BofA’s overall situation, and his approaches have been causing dissent.

CFO Bruce Thompson and Wealth Management Vice Chairman David Darnell announced their departures amid additional executive management repositioning.