Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Crewleader

Crewleader's Journal

Crewleader's Journal

June 30, 2014

What’s the reason for the tempest in the teapot of Hillary and Bill Clinton’s personal finances?

It can’t be about how much money they have. Great wealth has never disqualified someone from high office. In fact, some of the nation’s greatest presidents, who came to office with vast fortunes – JFK, Franklin D. Roosevelt, and his fifth cousin, Teddy – notably improved the lives of ordinary Americans.

The tempest can’t be about Hillary Clinton’s veracity. It may have been a stretch for her to say she and her husband were “dead broke” when they left the White House, as she told ABC’s Diane Sawyer. But they did have large legal bills to pay off.

And it’s probably true that, unlike many of the “truly well off,” as she termed them in an interview with the Guardian newspaper, the Clintons pay their full income taxes and work hard.

http://robertreich.org/post/90301409750

Hillary’s Hardest Choice (and the Democrat’s Dilemma) by Robert Reich

Sunday, June 29, 2014What’s the reason for the tempest in the teapot of Hillary and Bill Clinton’s personal finances?

It can’t be about how much money they have. Great wealth has never disqualified someone from high office. In fact, some of the nation’s greatest presidents, who came to office with vast fortunes – JFK, Franklin D. Roosevelt, and his fifth cousin, Teddy – notably improved the lives of ordinary Americans.

The tempest can’t be about Hillary Clinton’s veracity. It may have been a stretch for her to say she and her husband were “dead broke” when they left the White House, as she told ABC’s Diane Sawyer. But they did have large legal bills to pay off.

And it’s probably true that, unlike many of the “truly well off,” as she termed them in an interview with the Guardian newspaper, the Clintons pay their full income taxes and work hard.

http://robertreich.org/post/90301409750

June 20, 2014

In the prime of the home selling season, new home starts and existing home sales both retreated, a sign of ongoing weakness in the housing sector.

Source: http://ochousingnews.com/blog/new-resale-home-sales-slump-2014-prime-home-selling-season/#ixzz359A31BLY

New and resale home sales slump in 2014 prime home selling season

Irvine Renter 30 Astute ObservationsIn the prime of the home selling season, new home starts and existing home sales both retreated, a sign of ongoing weakness in the housing sector.

Source: http://ochousingnews.com/blog/new-resale-home-sales-slump-2014-prime-home-selling-season/#ixzz359A31BLY

June 20, 2014

by Charles Hugh Smith

We will all discover that the economy is much more fragile than advertised by the Central Planners and their media toadies.

This week I have made the case that the past 13.5 years have been the most destructive to the core values of the nation in U.S. history. The same holds true for the economy, which has been critically weakened by 6 years of unprecedented Central Planning.

What do I mean by Central Planning?

Here are the key characteristics of Central Planning:

1. The central bank/state intervene in the economy in a dominant fashion, controlling functions such as interest rates by order of central authorities that were once set by decentralized, self-organizing markets.

2. The central bank/state pick winners and losers: for example, the Too Big To Fail Banks (TBTF) were selected to win, as the central bank/state bailed out their private losses with public-taxpayer money. In effect, the central state/bank enrich cronies at the expense of everyone else.

3. The central bank/state manipulate the nominally "free" market to boost asset valuations as a way of enriching cronies who own most of the financial assets and as a public-relations charade to mask the failure of their picking winners and losers.

In other words, in centrally planned economies, markets are not allowed to discover price--they exist only to reflect positively on Central Planners

http://www.oftwominds.com/blogjune14/central-planning6-14.html

After 6 Years of Unprecedented Central Planning, the Economy Is More Fragile Than Ever

(June 19, 2014)by Charles Hugh Smith

We will all discover that the economy is much more fragile than advertised by the Central Planners and their media toadies.

This week I have made the case that the past 13.5 years have been the most destructive to the core values of the nation in U.S. history. The same holds true for the economy, which has been critically weakened by 6 years of unprecedented Central Planning.

What do I mean by Central Planning?

Here are the key characteristics of Central Planning:

1. The central bank/state intervene in the economy in a dominant fashion, controlling functions such as interest rates by order of central authorities that were once set by decentralized, self-organizing markets.

2. The central bank/state pick winners and losers: for example, the Too Big To Fail Banks (TBTF) were selected to win, as the central bank/state bailed out their private losses with public-taxpayer money. In effect, the central state/bank enrich cronies at the expense of everyone else.

3. The central bank/state manipulate the nominally "free" market to boost asset valuations as a way of enriching cronies who own most of the financial assets and as a public-relations charade to mask the failure of their picking winners and losers.

In other words, in centrally planned economies, markets are not allowed to discover price--they exist only to reflect positively on Central Planners

http://www.oftwominds.com/blogjune14/central-planning6-14.html

June 19, 2014

Wednesday, June 18, 2014

by Robert Reich

A few weeks ago I was visited in my office by the chairman of one of the country’s biggest high-tech firms who wanted to talk about the causes and consequences of widening inequality and the shrinking middle class, and what to do about it.

I asked him why he was concerned. “Because the American middle class is the core of our customer base,” he said. “If they can’t afford our products in the years ahead, we’re in deep trouble.”

I’m hearing the same refrain from a growing number of business leaders.

They see an economic recovery that’s bypassing most Americans. Median hourly and weekly pay dropped over the past year, adjusted for inflation.

http://robertreich.org/post/89189063320

Summer Plans

How America’s Real Business Leaders Want to Save Capitalism

How America’s Real Business Leaders Want to Save CapitalismWednesday, June 18, 2014

by Robert Reich

A few weeks ago I was visited in my office by the chairman of one of the country’s biggest high-tech firms who wanted to talk about the causes and consequences of widening inequality and the shrinking middle class, and what to do about it.

I asked him why he was concerned. “Because the American middle class is the core of our customer base,” he said. “If they can’t afford our products in the years ahead, we’re in deep trouble.”

I’m hearing the same refrain from a growing number of business leaders.

They see an economic recovery that’s bypassing most Americans. Median hourly and weekly pay dropped over the past year, adjusted for inflation.

http://robertreich.org/post/89189063320

Summer Plans

June 18, 2014

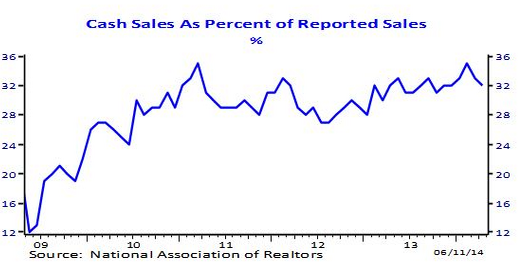

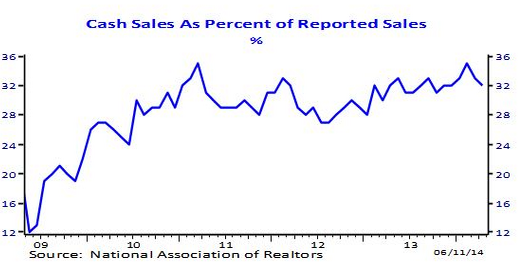

Apparently very few people need mortgages to purchase homes in the market today. One out of every three homes sold (at least those on the MLS) are going to those “all cash” buyers. Investors continue to dominate the percentage of all sales but the total number of sales is actually pathetically weak given the rise in prices. You would expect that somewhere in the rush to purchase regular buyers were the engine of this price increase. They are not. Even builders are not tempted to go out and build. Why build? For the younger broke generations living at home because of the weak economy? In California we have 2.3 million adults living at home. These people live at home because even a rental is out of reach let alone a $700,000 box with walls that are so thin, you can poke your finger through the crappy drywall and waive high to your other massively indebted neighbor. Looking at mortgage application data, it seems that people are simply not applying for loans. This is why in this housing “recovery” I’m not hearing the constant glee from mortgage brokers and real estate agents. Sales volume is low and mortgages are for the plebs in the streets trying to squeeze into these overpriced homes. Who needs a mortgage? Apparently traditional buyers but they are hard to find in this market. Even in high priced California, sales fell in May to 37,734 from 37,988 in April. This is a time when sales heat up. To put this in perspective, we had 67,958 homes sold back in 2004, a full decade ago.

Cashy cash cash

While investors slowly begin to pullback their suitcases of juicy Fed induced money, cash sales still make up a large portion of all sales. Going back to 2009, nearly 1 out of 3 purchases has gone to non-traditional buyers circumventing the mortgage process. It is actually higher because in the panic days, many big investors were buying in bulk off the MLS books via auctions and direct deals with banks. These were the best deals and of course, the public (the folks bailing out the banks) got no shot at these fantastic deals. Did you have access to borrowing rates near zero percent from the Fed? Of course not! You should be happy with the current 4 percent mortgage rates so long as you pay $700,000 for some Cracker Jack box with one functional toilet.

Here is the latest cash sales data:

http://www.doctorhousingbubble.com/cash-buying-real-estate-who-needs-a-mortgage-application/

Dr. Housing Bubble 06/17/14

Who needs a mortgage? Cash sales continue to dominate market while mortgage applications run near levels last seen in 2000. Housing starts remain weak and expectations for price increases run wild.Apparently very few people need mortgages to purchase homes in the market today. One out of every three homes sold (at least those on the MLS) are going to those “all cash” buyers. Investors continue to dominate the percentage of all sales but the total number of sales is actually pathetically weak given the rise in prices. You would expect that somewhere in the rush to purchase regular buyers were the engine of this price increase. They are not. Even builders are not tempted to go out and build. Why build? For the younger broke generations living at home because of the weak economy? In California we have 2.3 million adults living at home. These people live at home because even a rental is out of reach let alone a $700,000 box with walls that are so thin, you can poke your finger through the crappy drywall and waive high to your other massively indebted neighbor. Looking at mortgage application data, it seems that people are simply not applying for loans. This is why in this housing “recovery” I’m not hearing the constant glee from mortgage brokers and real estate agents. Sales volume is low and mortgages are for the plebs in the streets trying to squeeze into these overpriced homes. Who needs a mortgage? Apparently traditional buyers but they are hard to find in this market. Even in high priced California, sales fell in May to 37,734 from 37,988 in April. This is a time when sales heat up. To put this in perspective, we had 67,958 homes sold back in 2004, a full decade ago.

Cashy cash cash

While investors slowly begin to pullback their suitcases of juicy Fed induced money, cash sales still make up a large portion of all sales. Going back to 2009, nearly 1 out of 3 purchases has gone to non-traditional buyers circumventing the mortgage process. It is actually higher because in the panic days, many big investors were buying in bulk off the MLS books via auctions and direct deals with banks. These were the best deals and of course, the public (the folks bailing out the banks) got no shot at these fantastic deals. Did you have access to borrowing rates near zero percent from the Fed? Of course not! You should be happy with the current 4 percent mortgage rates so long as you pay $700,000 for some Cracker Jack box with one functional toilet.

Here is the latest cash sales data:

http://www.doctorhousingbubble.com/cash-buying-real-estate-who-needs-a-mortgage-application/

June 16, 2014

Celente - This Key Bubble Will Collapse The House Of Cards

On the heels of more chaotic trading in the markets, today the top trends forecaster in the world warned King World News that a key bubble will collapse the house of cards that is the U.S economy. Below is what Gerald Celente, founder of Trends Research and the man considered to be the top trends forecaster in the world, had to say in this fascinating interview.

Eric King: “Gerald, the Financial Times recently ran the front page headline, ‘Volatility extinguished by moves from central banks.’ When you see these types of headlines in major media, they do serve as a contrarian indicator. It’s interesting that since the day that headlined the Financial Times stocks have shown weakness.”

Celente: “There are so many outside forces that are influencing the markets. How could anyone possibly think that moves by central banks are intelligent decisions that are going to stop volatility? The central banks have been wrong continually....

Continue reading the Gerald Celente interview below...

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/6/15_Celente_-_This_Key_Bubble_Will_Collapse_The_House_Of_Cards.html

Celente - This Key Bubble Will Collapse The House Of Cards

June 15, 2014Celente - This Key Bubble Will Collapse The House Of Cards

On the heels of more chaotic trading in the markets, today the top trends forecaster in the world warned King World News that a key bubble will collapse the house of cards that is the U.S economy. Below is what Gerald Celente, founder of Trends Research and the man considered to be the top trends forecaster in the world, had to say in this fascinating interview.

Eric King: “Gerald, the Financial Times recently ran the front page headline, ‘Volatility extinguished by moves from central banks.’ When you see these types of headlines in major media, they do serve as a contrarian indicator. It’s interesting that since the day that headlined the Financial Times stocks have shown weakness.”

Celente: “There are so many outside forces that are influencing the markets. How could anyone possibly think that moves by central banks are intelligent decisions that are going to stop volatility? The central banks have been wrong continually....

Continue reading the Gerald Celente interview below...

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/6/15_Celente_-_This_Key_Bubble_Will_Collapse_The_House_Of_Cards.html

June 14, 2014

Friday, June 13, 2014

By Robert Reich

Rather than confront poverty by extending jobless benefits to the long-term unemployed, endorsing a higher minimum wage, or supporting jobs programs, conservative Republicans are taking a different tack.

They’re peddling three big lies about poverty. To wit:

Lie #1: Economic growth reduces poverty.

“The best anti-poverty program,” wrote Paul Ryan, the House Budget Committee chairman, in the Wall Street Journal, “is economic growth.”

Wrong. Since the late 1970s, the economy has grown 147 percent per capita but almost nothing has trickled down. The typical American worker is earning just about what he or she earned three decades ago, adjusted for inflation.

Meanwhile, the share of Americans in poverty remains around 15 percent. That’s even higher than it was in the early 1970s.

How can the economy have grown so much while most people’s wages go nowhere and the poor remain poor? Because almost all the gains have gone to the top.

http://robertreich.org/post/88708262000

The Three Biggest Right-Wing Lies About Poverty

The Three Biggest Right-Wing Lies About PovertyFriday, June 13, 2014

By Robert Reich

Rather than confront poverty by extending jobless benefits to the long-term unemployed, endorsing a higher minimum wage, or supporting jobs programs, conservative Republicans are taking a different tack.

They’re peddling three big lies about poverty. To wit:

Lie #1: Economic growth reduces poverty.

“The best anti-poverty program,” wrote Paul Ryan, the House Budget Committee chairman, in the Wall Street Journal, “is economic growth.”

Wrong. Since the late 1970s, the economy has grown 147 percent per capita but almost nothing has trickled down. The typical American worker is earning just about what he or she earned three decades ago, adjusted for inflation.

Meanwhile, the share of Americans in poverty remains around 15 percent. That’s even higher than it was in the early 1970s.

How can the economy have grown so much while most people’s wages go nowhere and the poor remain poor? Because almost all the gains have gone to the top.

http://robertreich.org/post/88708262000

Profile Information

Gender: FemaleCurrent location: Florida

Member since: 2001

Number of posts: 17,005