Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Demeter

Demeter's Journal

Demeter's Journal

March 30, 2013

Millions of Americans lack adequate health care, using emergency rooms as a costly alternative or getting no care at all. The Patient Protection and Affordable Care Act (ACA), often called "Obamacare," opened the door for an affordable option. The December 31, 2012 deal between Congress and the administration that avoided the so-called "fiscal cliff" has, at least for the moment, closed that door for 26 states.

ACA loans for health care cooperatives

The ACA funds private, nonprofit health insurers called Consumer Operated and Oriented Plans—CO-OPs. It originally set aside $3.4 billion for low-interest loans—seed money for at least one health cooperative in each state, plus Washington, D.C. "Start-up loans" cover such development costs as renting office space, developing provider networks or obtaining contracts with existing provider groups, hiring managers, educating members on how co-ops work, and building enrollment. ACA "solvency loans" are intended to help CO-OPs satisfy state monetary reserve requirements for health insurers. According to the Center for Medicare Services, CO-OP loans could fund cooperatives that operate health care facilities or cooperative insurance that would cover treatment at participating medical organizations. Interest in CO-OPs has been keen. The healthcare.gov website states that, as of December 21, 2012, 24 nonprofits offering coverage in 24 states have been awarded nearly $2 billion.

One of those is the Colorado Health Insurance Cooperative, which received a $69 million ACA grant. "Our state does have a long history of supporting agricultural co-ops to receive better deals and services," CEO Julie Hutchins says. In fact, the Rocky Mountain Farmers Union, founded in 1907, sponsors the new CO-OP. "The CO-OP will be a unique option for the thousands of newly insured Coloradans that will flood the market in 2014," says Hutchins. "We also hope to be a resource for rural Coloradans to access better coverage as these areas of the state have been left with few options in recent years." She expects a minimum of 8,000 people to join the CO-OP in its first year.

Why create CO-OPs?

Health care CO-OPs are not your usual health insurance companies. The National Cooperative Business Association (NCBA) says, "Cooperatives are owned and democratically controlled by their members ... not by outside investors." Health care cooperatives use the money that a private insurer would take as profit to lower premiums, expand benefits, or improve the quality of care for their members. In the medical cooperative model, members are active in the decision-making process, from setting policy to electing, and even sitting on, the board of directors. Group Health Cooperative (GHC), established in 1946 in Washington State, involves consumers in committees, advocacy caucuses, forums, and focus groups. Through GHC's member website, patients have better access to their doctors and their personal medical records. The organization's longevity is a strong indication that this model, with its emphasis on consumer engagement, is viable in the long run. That conclusion is borne out by the success of other cooperatives as well. The National Alliance of State Health Cooperatives (NASHCO) points out "Member ownership [in cooperatives] has worked to serve millions of working families with electrical, telephone, food, farm, and financial services."

Infusing the Market with Real Choice

Michael Booth of the Denver Post reports that CO-OPs receiving ACA grants are "meant to compete with private insurers and bureaucratic nonprofits, adding a consumer-focused policy to the state health benefits exchanges." These insurance exchanges go live in January 2014. Functioning as online marketplaces, they will contain information (and phone assistance) on health care plans available to individuals, families, and businesses with 100 or fewer employees. The public can also discuss plans with informed insurance brokers. An estimated 19 million previously uninsured Americans will use these insurance exchanges in 2014 to buy health coverage, increasing to 30 million by 2022. ACA CO-OP funding will continue in the 24 states where CO-OPs have already been approved in 2012. But, because of the "fiscal cliff" deal, funds have been cut for the additional 26 states still applying for capital loans. NASHCO has fast-tracked their lobbying efforts and is already advocating for the restoration of original ACA CO-OP funding levels.

Perhaps, as the new CO-OPs become operational, they will demonstrate the value of this form of health care and lead to reinstatement of funding for all states, if that has not been accomplished by the time the funded CO-OPs go lives.

Donít Like Your Health Insurance? Make Your Own By Nina Rogozen

http://www.nationofchange.org/don-t-your-health-insurance-make-your-own-1364224477Millions of Americans lack adequate health care, using emergency rooms as a costly alternative or getting no care at all. The Patient Protection and Affordable Care Act (ACA), often called "Obamacare," opened the door for an affordable option. The December 31, 2012 deal between Congress and the administration that avoided the so-called "fiscal cliff" has, at least for the moment, closed that door for 26 states.

ACA loans for health care cooperatives

The ACA funds private, nonprofit health insurers called Consumer Operated and Oriented Plans—CO-OPs. It originally set aside $3.4 billion for low-interest loans—seed money for at least one health cooperative in each state, plus Washington, D.C. "Start-up loans" cover such development costs as renting office space, developing provider networks or obtaining contracts with existing provider groups, hiring managers, educating members on how co-ops work, and building enrollment. ACA "solvency loans" are intended to help CO-OPs satisfy state monetary reserve requirements for health insurers. According to the Center for Medicare Services, CO-OP loans could fund cooperatives that operate health care facilities or cooperative insurance that would cover treatment at participating medical organizations. Interest in CO-OPs has been keen. The healthcare.gov website states that, as of December 21, 2012, 24 nonprofits offering coverage in 24 states have been awarded nearly $2 billion.

One of those is the Colorado Health Insurance Cooperative, which received a $69 million ACA grant. "Our state does have a long history of supporting agricultural co-ops to receive better deals and services," CEO Julie Hutchins says. In fact, the Rocky Mountain Farmers Union, founded in 1907, sponsors the new CO-OP. "The CO-OP will be a unique option for the thousands of newly insured Coloradans that will flood the market in 2014," says Hutchins. "We also hope to be a resource for rural Coloradans to access better coverage as these areas of the state have been left with few options in recent years." She expects a minimum of 8,000 people to join the CO-OP in its first year.

Why create CO-OPs?

Health care CO-OPs are not your usual health insurance companies. The National Cooperative Business Association (NCBA) says, "Cooperatives are owned and democratically controlled by their members ... not by outside investors." Health care cooperatives use the money that a private insurer would take as profit to lower premiums, expand benefits, or improve the quality of care for their members. In the medical cooperative model, members are active in the decision-making process, from setting policy to electing, and even sitting on, the board of directors. Group Health Cooperative (GHC), established in 1946 in Washington State, involves consumers in committees, advocacy caucuses, forums, and focus groups. Through GHC's member website, patients have better access to their doctors and their personal medical records. The organization's longevity is a strong indication that this model, with its emphasis on consumer engagement, is viable in the long run. That conclusion is borne out by the success of other cooperatives as well. The National Alliance of State Health Cooperatives (NASHCO) points out "Member ownership [in cooperatives] has worked to serve millions of working families with electrical, telephone, food, farm, and financial services."

Infusing the Market with Real Choice

Michael Booth of the Denver Post reports that CO-OPs receiving ACA grants are "meant to compete with private insurers and bureaucratic nonprofits, adding a consumer-focused policy to the state health benefits exchanges." These insurance exchanges go live in January 2014. Functioning as online marketplaces, they will contain information (and phone assistance) on health care plans available to individuals, families, and businesses with 100 or fewer employees. The public can also discuss plans with informed insurance brokers. An estimated 19 million previously uninsured Americans will use these insurance exchanges in 2014 to buy health coverage, increasing to 30 million by 2022. ACA CO-OP funding will continue in the 24 states where CO-OPs have already been approved in 2012. But, because of the "fiscal cliff" deal, funds have been cut for the additional 26 states still applying for capital loans. NASHCO has fast-tracked their lobbying efforts and is already advocating for the restoration of original ACA CO-OP funding levels.

Perhaps, as the new CO-OPs become operational, they will demonstrate the value of this form of health care and lead to reinstatement of funding for all states, if that has not been accomplished by the time the funded CO-OPs go lives.

March 29, 2013

Yes, that's him! That's Peter Rabbit, who with his widowed mother and sisters Flopsy, Mopsy, and Cottontail, enchants each new generation since Beatrix Potter first captured him in 1902. The book was a success, and multiple reprints were issued in the years immediately following its debut. It has been translated into 36 languages and with 45 million copies sold it is one of the best-selling books of all time.

The story of the rabbit and his biographer was charmingly portrayed in film: Miss Potter, a 2006 film directed by Chris Noonan. It is a biopic of children's author and illustrator Beatrix Potter, and combines stories from her own life with animated sequences featuring characters from her stories, such as Peter Rabbit. The film stars Renée Zellweger in the title role and Ewan McGregor as her publisher and fiancé.

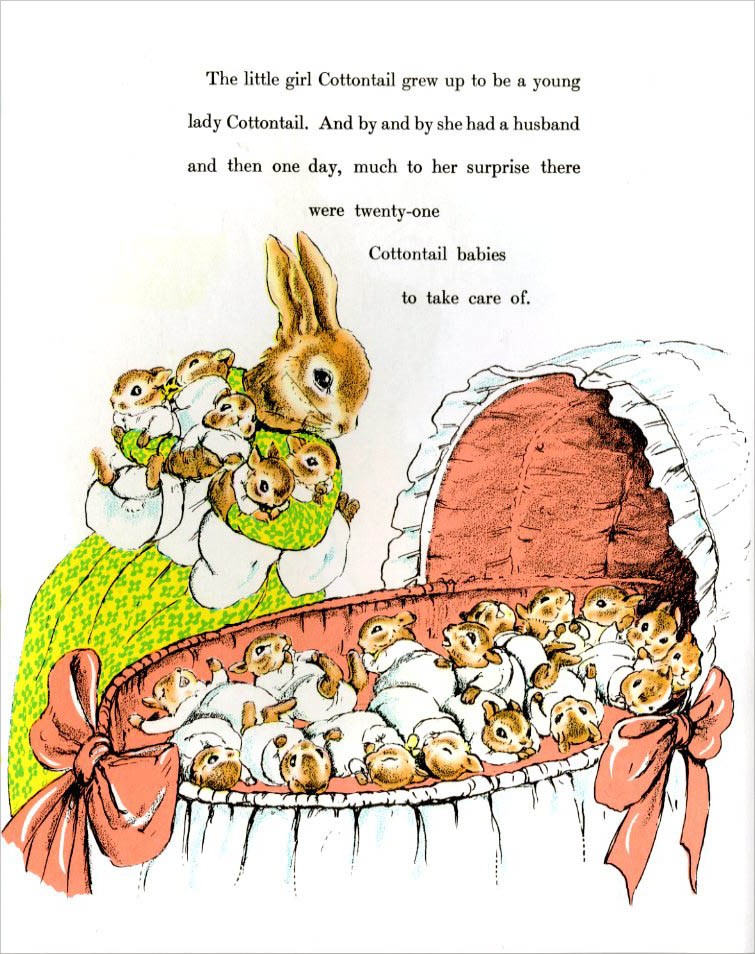

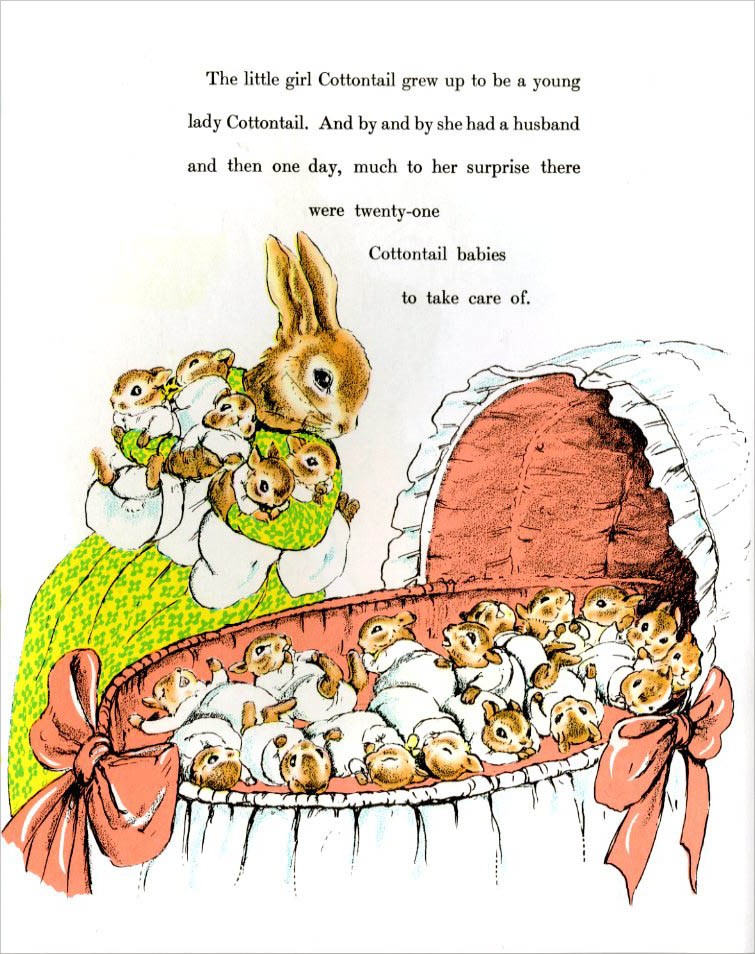

Rabbits have starred in many a folk tale and children's story. One story from my own childhood features another working mother, with affirmative action: The Country Bunny and the Little Gold Shoes, written by Edwin DuBose Heyward, who also wrote Porgy and Bess.

And of course, there's this fellow: Br'er Rabbit (pron.: /ˈbrɛər/), also spelled Bre'r Rabbit or Brer Rabbit or Bruh Rabbit, is a central figure as Uncle Remus tells stories of the Southern United States. Br'er Rabbit is a trickster who succeeds by his wits rather than by brawn, tweaking authority figures and bending social mores as he sees fit. The name "Br'er Rabbit", a syncope of "Brother Rabbit", has been linked to both African and Cherokee cultures.

But when the chips are down and the skies are gray (mercifully, today is sunny and the skies pure blue) there's one bunny who can make anyone smile:

Weekend Economists Salute Our Favorite Bunnies March 29-31, 2013

Yes, that's him! That's Peter Rabbit, who with his widowed mother and sisters Flopsy, Mopsy, and Cottontail, enchants each new generation since Beatrix Potter first captured him in 1902. The book was a success, and multiple reprints were issued in the years immediately following its debut. It has been translated into 36 languages and with 45 million copies sold it is one of the best-selling books of all time.

The story of the rabbit and his biographer was charmingly portrayed in film: Miss Potter, a 2006 film directed by Chris Noonan. It is a biopic of children's author and illustrator Beatrix Potter, and combines stories from her own life with animated sequences featuring characters from her stories, such as Peter Rabbit. The film stars Renée Zellweger in the title role and Ewan McGregor as her publisher and fiancé.

Rabbits have starred in many a folk tale and children's story. One story from my own childhood features another working mother, with affirmative action: The Country Bunny and the Little Gold Shoes, written by Edwin DuBose Heyward, who also wrote Porgy and Bess.

And of course, there's this fellow: Br'er Rabbit (pron.: /ˈbrɛər/), also spelled Bre'r Rabbit or Brer Rabbit or Bruh Rabbit, is a central figure as Uncle Remus tells stories of the Southern United States. Br'er Rabbit is a trickster who succeeds by his wits rather than by brawn, tweaking authority figures and bending social mores as he sees fit. The name "Br'er Rabbit", a syncope of "Brother Rabbit", has been linked to both African and Cherokee cultures.

But when the chips are down and the skies are gray (mercifully, today is sunny and the skies pure blue) there's one bunny who can make anyone smile:

March 29, 2013

Trust but Verify--just don't ask how to verify!

If I had a mattress, I'd be stuffing it.

Since you can't trust the government, what with the active shredding of both the safety net and the Rule of Law, why would you expect to be able to trust the banks?

Trust...that's so 50's!

We are all living on a series of cliff edges...some of which we don't even know about. Yet. Until they crumble away beneath our trusting feet.

The whole point of a social group was mutual support...an extended family. Now, it's all about the benjamins: various forms of slavery and coercion so that the Might makes Right and the Right makes Policy.

We are a sad, sick shadow of our former national greatness.

I'm thinking Iceland. They might actually be having Spring, over there....

March 29, 2013

Rand Paul’s marathon 13-hour filibuster was not the end of the conversation on drones. Suddenly, drones are everywhere, and so is the backlash. Efforts to counter drones at home and abroad are growing in the courts, at places of worship, outside air force bases, inside the UN, at state legislatures, inside Congress--and having an effect on policy.

1. April marks the national month of uprising against drone warfare. Activists in upstate New York are converging on the Hancock Air National Guard Base where Predator drones are operated. In San Diego, they will take on Predator-maker General Atomics at both its headquarters and the home of the CEO. In D.C., a coalition of national and local organizations are coming together to say no to drones at the White House. And all across the nation—including New York City, New Paltz, Chicago, Tucson and Dayton—activists are planning picket lines, workshops and sit-ins to protest the covert wars. The word has even spread to Islamabad, Pakistan, where activists are planning a vigil to honor victims.

2. There has been an unprecedented surge of activity in cities, counties and state legislatures across the country aimed at regulating domestic surveillance drones. After a raucous city council hearing in Seattle in February, the Mayor agreed to terminate its drones program and return the city’s two drones to the manufacturer. Also in February, the city of Charlottesville, VA passed a 2-year moratorium and other restrictions on drone use, and other local bills are pending in cities from Buffalo to Ft. Wayne. Simultaneously, bills have been proliferating on the state level. In Florida, a pending bill will require the police to get a warrant to use drones in an investigation; a Virginia statewide moratorium on drones passed both houses and awaits the governor’s signature, and similar legislation in pending in at least 13 other state legislatures.

3. Responding to the international outcry against drone warfare, the United Nations’ special rapporteur on counterterrorism and human rights, Ben Emmerson, is conducting an in-depth investigation of 25 drone attacks and will release his report in the Spring. Meanwhile, on March 15, having returned from a visit to Pakistan to meet drone victims and government officials, Emmerson condemned the U.S. drone program in Pakistan, as “it involves the use of force on the territory of another State without its consent and is therefore a violation of Pakistan's sovereignty.”

4. Leaders in the faith-based community broke their silence and began mobilizing against the nomination of John Brennan, with over 100 leaders urging the Senate to reject Brennan. And in an astounding development, The National Black Church Initiative (NBCI), a faith-based coalition of 34,000 churches comprised of 15 denominations and 15.7 million African Americans, issued a scathing statement about Obama’s drone policy, calling it “evil”, “monstrous” and “immoral.” The group’s president, Rev. Anthony Evans, exhorted other black leaders to speak out, saying “If the church does not speak against this immoral policy we will lose our moral voice, our soul, and our right to represent and preach the gospel of Jesus Christ.”

5. In the past four years the Congressional committees that are supposed to exercise oversight over the drones have been mum. Finally, in February and March, the House Judiciary Committee and the Senate Judiciary Committee held their first public hearings, and the Constitution Subcommittee will hold a hearing on April 16 on the “constitutional and statutory authority for targeted killings, the scope of the battlefield and who can be targeted as a combatant.” Too little, too late, but at least Congress is feeling some pressure to exercise its authority.

6. The specter of tens of thousands of drones here at home when the FAA opens up US airspace to drones by 2015 has spurred new left/right alliances. Liberal Democratic Senator Ron Wyden joined Tea Party’s Rand Paul during his filibuster. The first bipartisan national legislation was introduced by Rep. Ted Poe, R-Texas, and Rep. Zoe Lofgren, D-Calif., saying drones used by law enforcement must be focused exclusively on criminal wrongdoing and subject to judicial approval, and prohibiting the arming of drones. Similar left-right coalitions have formed at the local level. And speaking of strange bedfellows, NRA president David Keene joined The Nation’s legal affairs correspondent David Cole in an op-ed lambasting the administration for the cloak of secrecy that undermines the system of checks and balances.

7. While trying to get redress in the courts for the killing of American citizens by drones in Yemen, the ACLU has been stymied by the Orwellian US government refusal to even acknowledge that the drone program exists. But on March 15, in an important victory for transparency, the D.C. Court of Appeals rejected the CIA’s absurd claims that it “cannot confirm or deny” possessing information about the government’s use of drones for targeted killing, and sent the case back to a federal judge.

8. Most Democrats have been all too willing to let President Obama carry on with his lethal drones, but on March 11, Congresswoman Barbara Lee and seven colleagues issued a letter to President Obama calling on him to publicly disclose the legal basis for drone killings, echoing a call that emerged in the Senate during the John Brennan hearing. The letter also requested a report to Congress with details about limiting civilian casualties by signature drone strikes, compensating innocent victims, and restructuring the drone program “within the framework of international law.”

9.There have even been signs of discontent within the military. Former Defense Secretary Leon Panetta had approved a ludicrous high-level military medal that honored military personnel far from the battlefield, like drone pilots, due to their “extraordinary direct impacts on combat operations.” Moreover, it ranked above the Bronze Star, a medal awarded to troops for heroic acts performed in combat. Following intense backlash from the military and veteran community, as well as a push from a group of bipartisan senators, new Defense Secretary Senator Chuck Hagel decided to review the criteria for this new “Distinguished Warfare” medal.

10. Remote-control warfare is bad enough, but what is being developed is warfare by “killer robots” that don’t even have a human in the loop. A campaign against fully autonomous warfare will be launched this April at the UK’s House of Commons by human rights organizations, Nobel laureates and academics, many of whom were involved in the successful campaign to ban landmines. The goal of the campaign is to ban killer robots before they are used in battle.

Throughout the US--and the world--people are beginning to wake up to the danger of spy and killer drones. Their actions are already having an impact in forcing the Administration to share memos with Congress, reduce the number of strikes and begin a process of taking drones out of the hands of the CIA.

10 Ways the Public Backlash Against Killer Drones Is Taking Off By Medea Benjamin, Noor Mir

http://www.alternet.org/world/10-ways-public-backlash-against-killer-drones-taking?akid=10246.227380.FWRplf&rd=1&src=newsletter815950&t=16Rand Paul’s marathon 13-hour filibuster was not the end of the conversation on drones. Suddenly, drones are everywhere, and so is the backlash. Efforts to counter drones at home and abroad are growing in the courts, at places of worship, outside air force bases, inside the UN, at state legislatures, inside Congress--and having an effect on policy.

1. April marks the national month of uprising against drone warfare. Activists in upstate New York are converging on the Hancock Air National Guard Base where Predator drones are operated. In San Diego, they will take on Predator-maker General Atomics at both its headquarters and the home of the CEO. In D.C., a coalition of national and local organizations are coming together to say no to drones at the White House. And all across the nation—including New York City, New Paltz, Chicago, Tucson and Dayton—activists are planning picket lines, workshops and sit-ins to protest the covert wars. The word has even spread to Islamabad, Pakistan, where activists are planning a vigil to honor victims.

2. There has been an unprecedented surge of activity in cities, counties and state legislatures across the country aimed at regulating domestic surveillance drones. After a raucous city council hearing in Seattle in February, the Mayor agreed to terminate its drones program and return the city’s two drones to the manufacturer. Also in February, the city of Charlottesville, VA passed a 2-year moratorium and other restrictions on drone use, and other local bills are pending in cities from Buffalo to Ft. Wayne. Simultaneously, bills have been proliferating on the state level. In Florida, a pending bill will require the police to get a warrant to use drones in an investigation; a Virginia statewide moratorium on drones passed both houses and awaits the governor’s signature, and similar legislation in pending in at least 13 other state legislatures.

3. Responding to the international outcry against drone warfare, the United Nations’ special rapporteur on counterterrorism and human rights, Ben Emmerson, is conducting an in-depth investigation of 25 drone attacks and will release his report in the Spring. Meanwhile, on March 15, having returned from a visit to Pakistan to meet drone victims and government officials, Emmerson condemned the U.S. drone program in Pakistan, as “it involves the use of force on the territory of another State without its consent and is therefore a violation of Pakistan's sovereignty.”

4. Leaders in the faith-based community broke their silence and began mobilizing against the nomination of John Brennan, with over 100 leaders urging the Senate to reject Brennan. And in an astounding development, The National Black Church Initiative (NBCI), a faith-based coalition of 34,000 churches comprised of 15 denominations and 15.7 million African Americans, issued a scathing statement about Obama’s drone policy, calling it “evil”, “monstrous” and “immoral.” The group’s president, Rev. Anthony Evans, exhorted other black leaders to speak out, saying “If the church does not speak against this immoral policy we will lose our moral voice, our soul, and our right to represent and preach the gospel of Jesus Christ.”

5. In the past four years the Congressional committees that are supposed to exercise oversight over the drones have been mum. Finally, in February and March, the House Judiciary Committee and the Senate Judiciary Committee held their first public hearings, and the Constitution Subcommittee will hold a hearing on April 16 on the “constitutional and statutory authority for targeted killings, the scope of the battlefield and who can be targeted as a combatant.” Too little, too late, but at least Congress is feeling some pressure to exercise its authority.

6. The specter of tens of thousands of drones here at home when the FAA opens up US airspace to drones by 2015 has spurred new left/right alliances. Liberal Democratic Senator Ron Wyden joined Tea Party’s Rand Paul during his filibuster. The first bipartisan national legislation was introduced by Rep. Ted Poe, R-Texas, and Rep. Zoe Lofgren, D-Calif., saying drones used by law enforcement must be focused exclusively on criminal wrongdoing and subject to judicial approval, and prohibiting the arming of drones. Similar left-right coalitions have formed at the local level. And speaking of strange bedfellows, NRA president David Keene joined The Nation’s legal affairs correspondent David Cole in an op-ed lambasting the administration for the cloak of secrecy that undermines the system of checks and balances.

7. While trying to get redress in the courts for the killing of American citizens by drones in Yemen, the ACLU has been stymied by the Orwellian US government refusal to even acknowledge that the drone program exists. But on March 15, in an important victory for transparency, the D.C. Court of Appeals rejected the CIA’s absurd claims that it “cannot confirm or deny” possessing information about the government’s use of drones for targeted killing, and sent the case back to a federal judge.

8. Most Democrats have been all too willing to let President Obama carry on with his lethal drones, but on March 11, Congresswoman Barbara Lee and seven colleagues issued a letter to President Obama calling on him to publicly disclose the legal basis for drone killings, echoing a call that emerged in the Senate during the John Brennan hearing. The letter also requested a report to Congress with details about limiting civilian casualties by signature drone strikes, compensating innocent victims, and restructuring the drone program “within the framework of international law.”

9.There have even been signs of discontent within the military. Former Defense Secretary Leon Panetta had approved a ludicrous high-level military medal that honored military personnel far from the battlefield, like drone pilots, due to their “extraordinary direct impacts on combat operations.” Moreover, it ranked above the Bronze Star, a medal awarded to troops for heroic acts performed in combat. Following intense backlash from the military and veteran community, as well as a push from a group of bipartisan senators, new Defense Secretary Senator Chuck Hagel decided to review the criteria for this new “Distinguished Warfare” medal.

10. Remote-control warfare is bad enough, but what is being developed is warfare by “killer robots” that don’t even have a human in the loop. A campaign against fully autonomous warfare will be launched this April at the UK’s House of Commons by human rights organizations, Nobel laureates and academics, many of whom were involved in the successful campaign to ban landmines. The goal of the campaign is to ban killer robots before they are used in battle.

Throughout the US--and the world--people are beginning to wake up to the danger of spy and killer drones. Their actions are already having an impact in forcing the Administration to share memos with Congress, reduce the number of strikes and begin a process of taking drones out of the hands of the CIA.

March 27, 2013

There must be some explanation for last week’s economic madness. Take a look:

Cyprus: The European Union acted destructively – and self-destructively – when it tried to seize a portion of the insured savings accounts of the citizens of Cyprus. They were telling anyone with a savings account in the financially troubled nations of the Eurozone: Forget your guaranteed deposits. If we need your money in order to bail out the big banks – banks which have already gambled recklessly with it – we’ll take it. That didn’t just create a political firestorm in Cyprus. It threatened the European Union’s banking system, and perhaps the Union itself. The fact that the tax on deposits has been partially retracted doesn’t change the basic question: What were they thinking?

The Grand Bargain: The President and Congressional Republicans reportedly moved closer to a deal that would cut Social Security and Medicare while raising taxes – mostly on the middle class – without doing more to create jobs. A “Grand Bargain” like that would run counter to both public opinion and informed economic judgement. Who would impose more economy-killing austerity when there’s so much evidence of the harm it does? Why would the White House want to become the face of a deal to cut Social Security, killing its own party’s political prospects for a generation?

There’s more:

Him again: Washington reporters once again sought the opinion of Ex-Wyoming senator Alan Simpson, a vitriolic blowhard with no discernible knowledge of either economics or social insurance, and then wrote up his opinions on those topics in flattering pieces like this one.

Derivatives, the Sequel: Four short years after too-big-to-fail banks nearly destroyed the world economy, as the nation continues to suffer the after-effects of the crisis they created, a Congressional committee moved to undo the already-insufficient safeguards in the Dodd/Frank law.

Within days of a Senate Report which outlined the mendacity, extreme risk, and potentiality criminality surrounding JPMorgan Chase’s “London Whale” fiasco, the House Agriculture Committee approved new bills that would legalize trades like the “London Whale.”

Above the Law: The Attorney General of the United States remained silent as the controversy continued over his recent admission that banks like Dimon’s were too big to face prosecution. And yet there were no moves to change either Holder’s policy or the size of these institutions. Politico, the Washington insiders’ tip sheet, ran a piece entitled “Why Washington won’t break up the big banks.”

Dimon Unbound: The Senate report also provided evidence that JPMorgan Chase’s CEO, Jamie Dimon, failed to manage his bank’s risk and concealed information about its losses from regulators. We learned last week that regulators lowered their rating of Dimon’s bank after chastising the bank’s leadership for management failures that included inadequate safeguards against money-laundering, poor risk management, and failure to separate the banks’ own investments from those of its customers...Illegalities during Dimon’s tenure as CEO have cost his shareholders billions in settlements and fines. Poor risk management (and additional potential illegalities) cost it another $6.2 billion in Whale-related losses. And yet last week Dimon’s own Board “strongly endorsed” his dual role as CEO and Board Chair, an unusual concentration of power at what is (by some measurements) the world’s largest bank, and commended itself in aproxy filing for the “strength and independence” of its oversight, adding: “The Firm has had strong performance through the cycle since Mr. Dimon became Chairman and CEO.”

All this, in just seven days. Has the world gone insane? What is everybody thinking?

That’s where the number “147? comes in. Anthropologist Robin Dunbar tried to find out how many people the typical person “really knows.” He compared primate brains to social groups and published his findings in papers with titles like “Neocortex size as a constraint on group size in primates.” Dunbar concluded that the optimum number for a network of human acquaintances was 147.5, a figure which was then rounded up to 150 and became known as “Dunbar’s Number.” He found groups of 150-200 in all sorts of places: Hutterite settlements. Roman army units. Academic sub-specialties. Dunbar concluded that “there is a cognitive limit to the number of individuals with whom any one person can maintain stable relationships.” Around 150 or 200 people form a human being’s social universe. They shape his or her world view, his or her world. That means that 147 people can change the course of history. Not necessarily the same 147 people, of course. But the small social groups which surround our world’s leaders have extraordinary power. Economist Simon Johnson mentioned Dunbar’s Number last week in a column about incoming Treasury Secretary Jacob Lew and the new SEC chair, Mary Jo White. “The issue is not so much their track record,” Johnson wrote, “because neither has worked directly on financial-sector policy issues; it is much more about whom they know...If most financial experts you know work at, for example, Citigroup,” added Johnson, “then you are more likely to see the financial world through their eyes.” Lew is a former Citigroup executive. That mismanaged megabank is also the former corporate home of ex-Clinton Treasury Secretary Robert Rubin, and the current home of Peter Orszag, formerly President Obama’s OMB Director. For her part, White went from prosecuting criminals to defending Wall Street bankers. That was also Attorney General Eric Holder’s profession before he was appointed to his current position. These are the people who surround our President, our Senators, our Representatives. They talk to them every day. They say, This is how the world works. They say, Everybody knows these things.

Their European counterparts saw the effects of austerity on the economies of their Union: Unemployment up. Gross domestic product down. Even the deficits, which austerity was meant to reduce, have been rising as the result of these unwise cuts. But, they say, we know Angela Merkel. We know George Osborne and Christine Lagarde. We trust their judgement. How did the predictably disastrous plan to tax guaranteed savings accounts in Cyprus get approved? It’s not hard to imagine: “Everybody we know” thought it was a great idea.

That’s how it works here in the US, too. Larry Summers, Alan Greenspan and Robert Rubin were spectacularly wrong about everything: deregulation, the housing bubble, government spending, everything. But we know them. Nobel Prize-winning economists like Paul Krugman and Joseph Stiglitz keep explaining why more stimulus spending is needed. But we don’t know them – not the way we know Larry, Alan, and Bob. Same for Simon Johnson, or William K. Black Jr., or Robert Johnson, or any of the other economists we don’t know very well. And when we don’t know someone very well, their criticisms make us uncomfortable. Bill Clinton’s “Third Way” triangulation led to welfare “reform” that’s proven disastrous. His Wall Street deregulation ruined the economy, and his brand of old-fashioned pseudo-centrism is out of touch with today’s political and economic realities. But we know him. Bill Clinton doesn’t make us uncomfortable at all. Investigate Jamie Dimon, or Lloyd Blankfein, or Robert Rubin? But they were our clients, and will be again once we leave government. Investigate them? We know them. Dimon’s Board of Directors is a case study in Dunbar’s Number. It includes Honeywell CEO David Cote, who was a member of the Simpson Bowles Commission. There’s a retired senior executive with another big defense contractor, Boeing. Together with Dimon, that makes three CEOs who earn their money from government largesse. The CEO of Comcast is on Dimon’s Board, too. (The media’s leaders are always among the 147.) One seat belongs to the head of one of the accounting groups that overlooked massive bank fraud when signing off on their annual statements. Another belongs to the former CEO of Exxon Mobil.

The “147? run companies. They also hold fundraisers for politicians – in both parties. When Senator Obama became President Obama, during the gravest unemployment crisis since the Great Depression, one of his first acts was to create a “Deficit Commission” instead of a “Jobs Commission.” Why? Because “147 people” thought that was the right priority. Then he appointed the dyspeptic, unlikable, and uninformed Sen. Simpson to co-chair it. You see, the “147 people” in Washington’s political and media circles like Alan Simpson. To them he’s not an embarrassment to his President, a paid pitchman for billionaire Pete Peterson’s anti-Social Security jihad. (We know Pete!) To them Simpson’s not an ill-informed and misogynistic bully who taunts women with comments about “310 million tits.” To them he’s Al. They know him. They say he’s a lot of fun when you get to know him.

They really say that.

Then there are the news anchors and journalists who say things like this: Everybody knows that we need to cut Social Security. Everybody knows the deficit is our most urgent problem. Everybody knew that Saddam had weapons of mass destruction, too. Everybody understands that the right-wing, anti-government Simpson Bowles plan represents the “political center,” although it’s far to the right of public opinion – even ofRepublican or Tea Party voters’ opinion – on issues that range from job creation to increasing Social Security benefits.

You can’t fit millions of frustrated voters into a social group of 147 people.

When Teddy Roosevelt became President, J.P. Morgan (the person, not the bank) suggested he “send your man to my man and they can fix it up.” He was shocked that the new President chose instead to operate outside the Circle in order to create real change. And when Franklin D. Roosevelt became President he brought in new faces, new voices, new ideas. He broke the social circle that had paralyzed government and the economy. But the circle of right-wing Republicans and corporatist Clintonite Democrats is still intact. That means Barack Obama, Nancy Pelosi and other Democratic leaders will keep on promoting the right-wing agenda known as Simpson Bowles until their party loses all its political power at the polls. It also means that Republican extremism will still be reported with straight-faced gravity.Congressional committees will keep deregulating big banks, the Justice Department will avoid prosecuting them, and their Boards of Directors will keep rewarding their executives. They’ll all keep doing exactly what they’re doing – until the economy blows up again, perhaps with far worse consequences than the last time.

And when the next crisis comes, “147 people” will react to it exactly the same way they reacted to the last one. You can almost hear them now, can’t you? You can’t blame us, they’ll say. Nobody could’ve seen this coming. How do we know that?

Because we asked everybody we know.

The 147 People Destroying the World MUST READ

http://www.alternet.org/147-people-destroying-world?paging=offThere must be some explanation for last week’s economic madness. Take a look:

There’s more:

All this, in just seven days. Has the world gone insane? What is everybody thinking?

That’s where the number “147? comes in. Anthropologist Robin Dunbar tried to find out how many people the typical person “really knows.” He compared primate brains to social groups and published his findings in papers with titles like “Neocortex size as a constraint on group size in primates.” Dunbar concluded that the optimum number for a network of human acquaintances was 147.5, a figure which was then rounded up to 150 and became known as “Dunbar’s Number.” He found groups of 150-200 in all sorts of places: Hutterite settlements. Roman army units. Academic sub-specialties. Dunbar concluded that “there is a cognitive limit to the number of individuals with whom any one person can maintain stable relationships.” Around 150 or 200 people form a human being’s social universe. They shape his or her world view, his or her world. That means that 147 people can change the course of history. Not necessarily the same 147 people, of course. But the small social groups which surround our world’s leaders have extraordinary power. Economist Simon Johnson mentioned Dunbar’s Number last week in a column about incoming Treasury Secretary Jacob Lew and the new SEC chair, Mary Jo White. “The issue is not so much their track record,” Johnson wrote, “because neither has worked directly on financial-sector policy issues; it is much more about whom they know...If most financial experts you know work at, for example, Citigroup,” added Johnson, “then you are more likely to see the financial world through their eyes.” Lew is a former Citigroup executive. That mismanaged megabank is also the former corporate home of ex-Clinton Treasury Secretary Robert Rubin, and the current home of Peter Orszag, formerly President Obama’s OMB Director. For her part, White went from prosecuting criminals to defending Wall Street bankers. That was also Attorney General Eric Holder’s profession before he was appointed to his current position. These are the people who surround our President, our Senators, our Representatives. They talk to them every day. They say, This is how the world works. They say, Everybody knows these things.

Their European counterparts saw the effects of austerity on the economies of their Union: Unemployment up. Gross domestic product down. Even the deficits, which austerity was meant to reduce, have been rising as the result of these unwise cuts. But, they say, we know Angela Merkel. We know George Osborne and Christine Lagarde. We trust their judgement. How did the predictably disastrous plan to tax guaranteed savings accounts in Cyprus get approved? It’s not hard to imagine: “Everybody we know” thought it was a great idea.

That’s how it works here in the US, too. Larry Summers, Alan Greenspan and Robert Rubin were spectacularly wrong about everything: deregulation, the housing bubble, government spending, everything. But we know them. Nobel Prize-winning economists like Paul Krugman and Joseph Stiglitz keep explaining why more stimulus spending is needed. But we don’t know them – not the way we know Larry, Alan, and Bob. Same for Simon Johnson, or William K. Black Jr., or Robert Johnson, or any of the other economists we don’t know very well. And when we don’t know someone very well, their criticisms make us uncomfortable. Bill Clinton’s “Third Way” triangulation led to welfare “reform” that’s proven disastrous. His Wall Street deregulation ruined the economy, and his brand of old-fashioned pseudo-centrism is out of touch with today’s political and economic realities. But we know him. Bill Clinton doesn’t make us uncomfortable at all. Investigate Jamie Dimon, or Lloyd Blankfein, or Robert Rubin? But they were our clients, and will be again once we leave government. Investigate them? We know them. Dimon’s Board of Directors is a case study in Dunbar’s Number. It includes Honeywell CEO David Cote, who was a member of the Simpson Bowles Commission. There’s a retired senior executive with another big defense contractor, Boeing. Together with Dimon, that makes three CEOs who earn their money from government largesse. The CEO of Comcast is on Dimon’s Board, too. (The media’s leaders are always among the 147.) One seat belongs to the head of one of the accounting groups that overlooked massive bank fraud when signing off on their annual statements. Another belongs to the former CEO of Exxon Mobil.

The “147? run companies. They also hold fundraisers for politicians – in both parties. When Senator Obama became President Obama, during the gravest unemployment crisis since the Great Depression, one of his first acts was to create a “Deficit Commission” instead of a “Jobs Commission.” Why? Because “147 people” thought that was the right priority. Then he appointed the dyspeptic, unlikable, and uninformed Sen. Simpson to co-chair it. You see, the “147 people” in Washington’s political and media circles like Alan Simpson. To them he’s not an embarrassment to his President, a paid pitchman for billionaire Pete Peterson’s anti-Social Security jihad. (We know Pete!) To them Simpson’s not an ill-informed and misogynistic bully who taunts women with comments about “310 million tits.” To them he’s Al. They know him. They say he’s a lot of fun when you get to know him.

They really say that.

Then there are the news anchors and journalists who say things like this: Everybody knows that we need to cut Social Security. Everybody knows the deficit is our most urgent problem. Everybody knew that Saddam had weapons of mass destruction, too. Everybody understands that the right-wing, anti-government Simpson Bowles plan represents the “political center,” although it’s far to the right of public opinion – even ofRepublican or Tea Party voters’ opinion – on issues that range from job creation to increasing Social Security benefits.

You can’t fit millions of frustrated voters into a social group of 147 people.

When Teddy Roosevelt became President, J.P. Morgan (the person, not the bank) suggested he “send your man to my man and they can fix it up.” He was shocked that the new President chose instead to operate outside the Circle in order to create real change. And when Franklin D. Roosevelt became President he brought in new faces, new voices, new ideas. He broke the social circle that had paralyzed government and the economy. But the circle of right-wing Republicans and corporatist Clintonite Democrats is still intact. That means Barack Obama, Nancy Pelosi and other Democratic leaders will keep on promoting the right-wing agenda known as Simpson Bowles until their party loses all its political power at the polls. It also means that Republican extremism will still be reported with straight-faced gravity.Congressional committees will keep deregulating big banks, the Justice Department will avoid prosecuting them, and their Boards of Directors will keep rewarding their executives. They’ll all keep doing exactly what they’re doing – until the economy blows up again, perhaps with far worse consequences than the last time.

And when the next crisis comes, “147 people” will react to it exactly the same way they reacted to the last one. You can almost hear them now, can’t you? You can’t blame us, they’ll say. Nobody could’ve seen this coming. How do we know that?

Because we asked everybody we know.

March 25, 2013

CIVILISATION works only if those who enjoy its benefits are also prepared to pay their share of the costs. People and companies that avoid tax are therefore unpopular at the best of times, so it is not surprising that when governments and individuals everywhere are scrimping to pay their bills, attacks are mounting on tax havens and those that use them.

In Europe the anger has focused on big firms. Amazon and Starbucks have faced consumer boycotts for using clever accounting tricks to book profits in tax havens while reducing their bills in the countries where they do business. David Cameron has put tackling corporate tax-avoidance at the top of the G8 agenda. America has taken aim at tax-dodging individuals and the banks that help them. Congress has passed the Foreign Account Tax Compliance Act (FATCA), which forces foreign financial firms to disclose their American clients. Any whiff of offshore funds has become a political liability. During last year’s presidential campaign Mitt Romney was excoriated by Democrats for his holdings in the Cayman Islands. Now Jack Lew, Barack Obama’s nominee for treasury secretary, is under fire for once having an interest in a Cayman fund.

Getting rich people to pay their dues is an admirable ambition, but this attack is both hypocritical and misguided. It may be good populist politics, but leaders who want to make their countries work better should focus instead on cleaning up their own back yards and reforming their tax systems.

Dodgy of Delaware

The archetypal tax haven may be a palm-fringed island, but as our special report this week makes clear, there is nothing small about offshore finance. If you define a tax haven as a place that tries to attract non-resident funds by offering light regulation, low (or zero) taxation and secrecy, then the world has 50-60 such havens. These serve as domiciles for more than 2m companies and thousands of banks, funds and insurers. Nobody really knows how much money is stashed away: estimates vary from way below to way above $20 trillion...

A MUST READ ARTICLE!

Tax havens: The missing $20 trillion

http://www.economist.com/news/leaders/21571873-how-stop-companies-and-people-dodging-tax-delaware-well-grand-cayman-missing-20CIVILISATION works only if those who enjoy its benefits are also prepared to pay their share of the costs. People and companies that avoid tax are therefore unpopular at the best of times, so it is not surprising that when governments and individuals everywhere are scrimping to pay their bills, attacks are mounting on tax havens and those that use them.

In Europe the anger has focused on big firms. Amazon and Starbucks have faced consumer boycotts for using clever accounting tricks to book profits in tax havens while reducing their bills in the countries where they do business. David Cameron has put tackling corporate tax-avoidance at the top of the G8 agenda. America has taken aim at tax-dodging individuals and the banks that help them. Congress has passed the Foreign Account Tax Compliance Act (FATCA), which forces foreign financial firms to disclose their American clients. Any whiff of offshore funds has become a political liability. During last year’s presidential campaign Mitt Romney was excoriated by Democrats for his holdings in the Cayman Islands. Now Jack Lew, Barack Obama’s nominee for treasury secretary, is under fire for once having an interest in a Cayman fund.

Getting rich people to pay their dues is an admirable ambition, but this attack is both hypocritical and misguided. It may be good populist politics, but leaders who want to make their countries work better should focus instead on cleaning up their own back yards and reforming their tax systems.

Dodgy of Delaware

The archetypal tax haven may be a palm-fringed island, but as our special report this week makes clear, there is nothing small about offshore finance. If you define a tax haven as a place that tries to attract non-resident funds by offering light regulation, low (or zero) taxation and secrecy, then the world has 50-60 such havens. These serve as domiciles for more than 2m companies and thousands of banks, funds and insurers. Nobody really knows how much money is stashed away: estimates vary from way below to way above $20 trillion...

A MUST READ ARTICLE!

March 25, 2013

... The International Cooperative Alliance's recently published "Blueprint for a Cooperative Decade" lays out a long-term vision to make cooperatives not only the fastest-growing form of business but the acknowledged leader in environmental, social, and economic sustainability. From now on, the global mantra for filling market gaps and new demands, according to Eric DeLuca of the National Cooperative Business Association, is going to be, "There's a co-op for that." But co-ops—like any kind of business—need customers, money, training, political support, and help from their communities. How do we shift from business as usual to the work of cooperation? Here are a few strategies.

1. Find Money

Where do you get the money to finance a new co-op? Traditional banks are loath to lend to co-ops, often because they are unfamiliar with them or do not trust that a cooperative business model can yield profits. But there are institutions that can help. The National Cooperative Bank (NCB) has become a leading funder for new housing, business, and consumer cooperatives. Chartered by Congress in 1978 and privatized as a member-owned financial institution in 1982, it has provided more than $4 billion in loans and investments to co-ops all over the country—from a New York City housing co-op to an organic grocery in San Francisco to a solar project at Denver International Airport. Most recently, NCB has been working with PNC Bank in Pittsburgh to allocate $13 million in loans to local co-ops. AND THEY WANT THEIR POUND OF FLESH, FOLKS...OUR CO-OP DEALT WITH THEM. TRY SOMETHING ELSE, FIRST....The nonprofit Heartland Capital Strategies Network—allied with NCB and other credit unions—is another rapidly growing source of funding for cooperatives, especially for the union co-op movement. The organization has committed billions of investment dollars to profitable projects in green construction, manufacturing, affordable housing, and transportation.

2. Convert to a Co-op

Some cooperatives get their start from traditional sole proprietorships or corporations. This can happen, for example, when a business owner wants to retire or move on and the employees buy the business. Franklin Community Cooperative (FCC) in Greenfield, Mass., acquired McCusker's Market, in nearby Shelburne Falls, when the owner of the longstanding natural foods store was ready to retire. A third of FCC's members lived near McCusker's. The purchase allowed FCC to keep its commitment to serve downtown Greenfield while solving its space problem at its popular flagship store. All of McCusker's Market's staff were rehired and retrained, and sales went up 15 percent during the store's first year as a cooperative. Since the purchase, the cooperative has attracted many more members all over the region.

3. Hook Up With Big Partners

Bring co-op business to the mainstays of your community—hospitals, schools, government services—which are already committed to community-scale investment and the public good. It's a mutually beneficial relationship: The co-op keeps money circulating in the community; the institution provides stable demand for the co-ops services or products.

4. Be Co-op Curious

You can learn more about the business of sharing—how co-ops work, why they're important, how to support them, and how to start and manage one—from organizations across the country working to promote cooperative enterprise. The Bay Area group Women's Action to Gain Economic Security (WAGES) was founded in the 1990s to help immigrant women form cooperative housecleaning services. Now they are creating toolkits for anyone looking to start a green cleaning co-op. "With all the emphasis on co-ops coming on the heels of the Occupy movement, we're seeing an increased interest right now," says Elena Fairley, who is working with WAGES as an AmeriCorps VISTA member. College and university programs are also training the next generation of cooperative entrepreneurs. The Cooperative Teach-In is a nationwide initiative that has connected colleges, universities, and programs like AmeriCorps VISTA with cooperatives across rural and urban America...The Teach-In uses creative tools to help participants learn the importance of cooperative economics. For example, the "Democracy Rating Warm-up Exercise," an interactive survey, allows participants to "rate the level of democracy in the institutions they interact with on a daily basis," and group discussions explore how the cooperative model differs from typical business models. And a fun way to gear up for a cooperative future is to play a round of Co-opoly: The Game of Cooperatives. As interest in cooperative business has grown, some young entrepreneurs have taken it upon themselves to learn more. For example, Co-cycle is a group of 15 undergraduates who crossed the country last year on their bicycles, visiting more than 70 co-op organizations and building a network of like-minded communities. "A year ago I didn't know what a cooperative was," writes Co-cycle participant Riko Fluchel on the riders' blog. "Now, after the nine weeks of touring cooperatives across the continental United States, I know first-hand that cooperatives empower people's lives." The Co-cycle journey is chronicled by a team of filmmakers from New York University in the forthcoming feature-length film To The Moon, which will introduce viewers to the ideas that guide cooperatives and Co-cycle—like teamwork and dedication to a new shared economy.

5. Shop Co-op

By buying from co-ops or using cooperative services, you can create local jobs, keep wealth in your community, and shop according to your values. The most comprehensive directory of U.S. cooperatives is CooperateUSA. You can also find your local food co-op through the Cooperative Grocer Network. Looking for a co-op starting near you? The Food Co-op Initiative maintains a map of co-ops still in the organizational stage. The new Data Commons Cooperative is building a "Stone Soup" directory, find.coop, created by members.

6. Make Co-op Friendly Laws

Cooperatives are often at a financial and technical disadvantage in an economy dominated by quarterly profits and shareholder returns. The United Nations recently resolved "to encourage governments and regulatory bodies to establish policies, laws, and regulations conducive to cooperative formation and growth." In 2012, the United Nations celebrated the "International Year of Cooperatives," noting that co-ops "build a better world" and "empower people." At the federal level, supporters of cooperatives are pushing for the National Cooperative Development Act (H.R. 3677) (NCDA), which would create a national development center designed to bring federal resources to cooperative development. From loans and seed capital for start-ups to funding for technical assistance providers, passage of the NCDA would not only help level the playing field for co-ops but increase economic development and create much-needed jobs in underserved areas of the country. A different bill would raise the cap on small business loans from another type of co-op: credit unions. Fifteen years ago, the banking industry lobbied for and obtained this cap to throttle its competition. The Credit Union Small Business Jobs Bill (S. 2231) would more than double the limit to nearly 30 percent of assets. According to the Credit Union National Association, this would enable credit unions to loan an extra $13 billion of their $300 billion lending capacity to small businesses in the first year alone, helping to create as many as 140,000 jobs.

6 Ways to Fuel the Cooperative Takeover By Sven Eberlein

http://www.nationofchange.org/6-ways-fuel-cooperative-takeover-1364051929... The International Cooperative Alliance's recently published "Blueprint for a Cooperative Decade" lays out a long-term vision to make cooperatives not only the fastest-growing form of business but the acknowledged leader in environmental, social, and economic sustainability. From now on, the global mantra for filling market gaps and new demands, according to Eric DeLuca of the National Cooperative Business Association, is going to be, "There's a co-op for that." But co-ops—like any kind of business—need customers, money, training, political support, and help from their communities. How do we shift from business as usual to the work of cooperation? Here are a few strategies.

1. Find Money

Where do you get the money to finance a new co-op? Traditional banks are loath to lend to co-ops, often because they are unfamiliar with them or do not trust that a cooperative business model can yield profits. But there are institutions that can help. The National Cooperative Bank (NCB) has become a leading funder for new housing, business, and consumer cooperatives. Chartered by Congress in 1978 and privatized as a member-owned financial institution in 1982, it has provided more than $4 billion in loans and investments to co-ops all over the country—from a New York City housing co-op to an organic grocery in San Francisco to a solar project at Denver International Airport. Most recently, NCB has been working with PNC Bank in Pittsburgh to allocate $13 million in loans to local co-ops. AND THEY WANT THEIR POUND OF FLESH, FOLKS...OUR CO-OP DEALT WITH THEM. TRY SOMETHING ELSE, FIRST....The nonprofit Heartland Capital Strategies Network—allied with NCB and other credit unions—is another rapidly growing source of funding for cooperatives, especially for the union co-op movement. The organization has committed billions of investment dollars to profitable projects in green construction, manufacturing, affordable housing, and transportation.

2. Convert to a Co-op

Some cooperatives get their start from traditional sole proprietorships or corporations. This can happen, for example, when a business owner wants to retire or move on and the employees buy the business. Franklin Community Cooperative (FCC) in Greenfield, Mass., acquired McCusker's Market, in nearby Shelburne Falls, when the owner of the longstanding natural foods store was ready to retire. A third of FCC's members lived near McCusker's. The purchase allowed FCC to keep its commitment to serve downtown Greenfield while solving its space problem at its popular flagship store. All of McCusker's Market's staff were rehired and retrained, and sales went up 15 percent during the store's first year as a cooperative. Since the purchase, the cooperative has attracted many more members all over the region.

3. Hook Up With Big Partners

Bring co-op business to the mainstays of your community—hospitals, schools, government services—which are already committed to community-scale investment and the public good. It's a mutually beneficial relationship: The co-op keeps money circulating in the community; the institution provides stable demand for the co-ops services or products.

"If you can get even a small bit of a university's goods and services devoted to your co-op," says Democracy Collaborative co-founder Gar Alperovitz, "you can go to any bank, and they'll be happy to finance you, because you've got a market."The Evergreen Cooperative Initiative, a group of local, sustainable, and worker-owned co-ops in Cleveland, is built on a strong partnership between the co-ops and local institutions—such as Cleveland Clinic, University Hospitals, and Case Western Reserve University—which have a combined annual buying power of more than $3 billion...Ohio Cooperative Solar, another Evergreen business, is in the process of installing photovoltaics at these three institutions and has also placed nearly 700 solar panels on the city hall and library rooftops in nearby Euclid. Evergreen Cooperative Laundry (a green cleaning operation) washes bed linens for Judson Retirement and McGregor Homes, two large nursing homes in the area.

4. Be Co-op Curious

You can learn more about the business of sharing—how co-ops work, why they're important, how to support them, and how to start and manage one—from organizations across the country working to promote cooperative enterprise. The Bay Area group Women's Action to Gain Economic Security (WAGES) was founded in the 1990s to help immigrant women form cooperative housecleaning services. Now they are creating toolkits for anyone looking to start a green cleaning co-op. "With all the emphasis on co-ops coming on the heels of the Occupy movement, we're seeing an increased interest right now," says Elena Fairley, who is working with WAGES as an AmeriCorps VISTA member. College and university programs are also training the next generation of cooperative entrepreneurs. The Cooperative Teach-In is a nationwide initiative that has connected colleges, universities, and programs like AmeriCorps VISTA with cooperatives across rural and urban America...The Teach-In uses creative tools to help participants learn the importance of cooperative economics. For example, the "Democracy Rating Warm-up Exercise," an interactive survey, allows participants to "rate the level of democracy in the institutions they interact with on a daily basis," and group discussions explore how the cooperative model differs from typical business models. And a fun way to gear up for a cooperative future is to play a round of Co-opoly: The Game of Cooperatives. As interest in cooperative business has grown, some young entrepreneurs have taken it upon themselves to learn more. For example, Co-cycle is a group of 15 undergraduates who crossed the country last year on their bicycles, visiting more than 70 co-op organizations and building a network of like-minded communities. "A year ago I didn't know what a cooperative was," writes Co-cycle participant Riko Fluchel on the riders' blog. "Now, after the nine weeks of touring cooperatives across the continental United States, I know first-hand that cooperatives empower people's lives." The Co-cycle journey is chronicled by a team of filmmakers from New York University in the forthcoming feature-length film To The Moon, which will introduce viewers to the ideas that guide cooperatives and Co-cycle—like teamwork and dedication to a new shared economy.

5. Shop Co-op

By buying from co-ops or using cooperative services, you can create local jobs, keep wealth in your community, and shop according to your values. The most comprehensive directory of U.S. cooperatives is CooperateUSA. You can also find your local food co-op through the Cooperative Grocer Network. Looking for a co-op starting near you? The Food Co-op Initiative maintains a map of co-ops still in the organizational stage. The new Data Commons Cooperative is building a "Stone Soup" directory, find.coop, created by members.

6. Make Co-op Friendly Laws

Cooperatives are often at a financial and technical disadvantage in an economy dominated by quarterly profits and shareholder returns. The United Nations recently resolved "to encourage governments and regulatory bodies to establish policies, laws, and regulations conducive to cooperative formation and growth." In 2012, the United Nations celebrated the "International Year of Cooperatives," noting that co-ops "build a better world" and "empower people." At the federal level, supporters of cooperatives are pushing for the National Cooperative Development Act (H.R. 3677) (NCDA), which would create a national development center designed to bring federal resources to cooperative development. From loans and seed capital for start-ups to funding for technical assistance providers, passage of the NCDA would not only help level the playing field for co-ops but increase economic development and create much-needed jobs in underserved areas of the country. A different bill would raise the cap on small business loans from another type of co-op: credit unions. Fifteen years ago, the banking industry lobbied for and obtained this cap to throttle its competition. The Credit Union Small Business Jobs Bill (S. 2231) would more than double the limit to nearly 30 percent of assets. According to the Credit Union National Association, this would enable credit unions to loan an extra $13 billion of their $300 billion lending capacity to small businesses in the first year alone, helping to create as many as 140,000 jobs.

March 24, 2013

The DCCC is the Democratic Congressional Campaign Committee, the group of congresspeople and staff supposedly responsible for electing House Democrats. It’s led by “ex”–Blue Dog and New Dem Steve Israel, Nancy Pelosi’s hand-picked choice for the job. We’ve written about Israel before.(SEE LINK AT OP) To the world his job is simply to elect Democrats, but to the moneymen and -women behind the corporate wing of the party, his job is to:

▪ Elect corporate Democrats to the House

▪ Keep progressives out of office

▪ Make sure pro-corporate Republican leaders like Cantor and Paul Ryan never face credible challenges

That last makes sense, right? If you’re a billionaire Wall Street owner (sorry, selfless funder) of the Democratic party — and you also pay good money to keep people like Paul Ryan in office — your message to Mr. Israel goes like this:

“I got boys in both parties. Hands off my boys.”

… to which Mr. Israel says: “Sure thing, boss. So, when will this check be good?”

I’m not joking, and I’m definitely not the only one writing about it. It’s an open “secret” in DC, and all you need to do to prove it is (a) look at Israel and the DCCC’s funding strategies for House races, or (b) read Howie Klein regularly. I’ve done both.

So what did the DCCC do lately?

Six House Dems voted No to raising the minimum wage; four are on the DCCC “extra help” list

Last week there was a vote in the House to raise the minimum wage from $7.25 to $10.10 per hour. It failed. Every Republican voted against it, along with six extremely conservative Democrats:

John Barrow (Blue Dog/New Dem-GA)

Jim Matheson (Blue Dog-UT)

Mike McIntyre (Blue Dog/New Dem-NC)

Bill Owens (New Dem-NY)

Collin Peterson (Blue Dog-MN)

Kurt Shrader (Blue Dog-New Dem-OR)

What’s special about that? Four of them are also on the DCCC’s “Frontline” list, House Democrats who will get extra help financing their return to office:

John Barrow (Blue Dog/New Dem-GA)

Jim Matheson (Blue Dog-UT)

Mike McIntyre (Blue Dog/New Dem-NC)

Bill Owens (New Dem-NY)

Here’s Klein on the Frontline list (my emphasis):

That’s pretty straightforward, isn’t it? When you give money to the DCCC, they give lots of it to people who vote with Republicans. And they protect Republicans like Paul Ryan, whom they pretend to hate. And again, Nancy Pelosi put Israel where he is, twice...The money the DCCC wastes on these Members … is money that could have elected dependable progressive leaders like Rob Zerban [Paul Ryan's 2012 opponent] and Nate Shinagawa, each of whom came close to beating their Republican opponent but got no help from the DCCC…. Just say No to the DCCC, no matter how many War on Women ads they send you. When it comes to your wallet, they’re not your friend.

Donating to the DCCC means helping Dems who vote like Republicans by Gaius Publius

http://americablog.com/2013/03/dccc-corporatist-opposes-progressives.htmlThe DCCC is the Democratic Congressional Campaign Committee, the group of congresspeople and staff supposedly responsible for electing House Democrats. It’s led by “ex”–Blue Dog and New Dem Steve Israel, Nancy Pelosi’s hand-picked choice for the job. We’ve written about Israel before.(SEE LINK AT OP) To the world his job is simply to elect Democrats, but to the moneymen and -women behind the corporate wing of the party, his job is to:

▪ Elect corporate Democrats to the House

▪ Keep progressives out of office

▪ Make sure pro-corporate Republican leaders like Cantor and Paul Ryan never face credible challenges

That last makes sense, right? If you’re a billionaire Wall Street owner (sorry, selfless funder) of the Democratic party — and you also pay good money to keep people like Paul Ryan in office — your message to Mr. Israel goes like this:

“I got boys in both parties. Hands off my boys.”

… to which Mr. Israel says: “Sure thing, boss. So, when will this check be good?”

I’m not joking, and I’m definitely not the only one writing about it. It’s an open “secret” in DC, and all you need to do to prove it is (a) look at Israel and the DCCC’s funding strategies for House races, or (b) read Howie Klein regularly. I’ve done both.

So what did the DCCC do lately?

Six House Dems voted No to raising the minimum wage; four are on the DCCC “extra help” list

Last week there was a vote in the House to raise the minimum wage from $7.25 to $10.10 per hour. It failed. Every Republican voted against it, along with six extremely conservative Democrats:

John Barrow (Blue Dog/New Dem-GA)

Jim Matheson (Blue Dog-UT)

Mike McIntyre (Blue Dog/New Dem-NC)

Bill Owens (New Dem-NY)

Collin Peterson (Blue Dog-MN)

Kurt Shrader (Blue Dog-New Dem-OR)

What’s special about that? Four of them are also on the DCCC’s “Frontline” list, House Democrats who will get extra help financing their return to office:

John Barrow (Blue Dog/New Dem-GA)

Jim Matheson (Blue Dog-UT)

Mike McIntyre (Blue Dog/New Dem-NC)

Bill Owens (New Dem-NY)

Here’s Klein on the Frontline list (my emphasis):

Most of the money the DCCC collects from donors is spent on reelecting incumbents– but not just any incumbent. They have a list of Democrats who they say most need the help. The majority of the Democrats on that list [are] on it because they can’t raise money from the Democratic base on their own because they vote with the GOP so frequently on the most important issues. And wouldn’t you know it– all the ConservaDems who voted against the minimum wage increase (except Collin Peterson and Kurt Schrader who [fund] their campaigns by extorting legalistic bribes from lobbyists with business before their committees)– are on the DCCC’s Frontline list.

That’s pretty straightforward, isn’t it? When you give money to the DCCC, they give lots of it to people who vote with Republicans. And they protect Republicans like Paul Ryan, whom they pretend to hate. And again, Nancy Pelosi put Israel where he is, twice...The money the DCCC wastes on these Members … is money that could have elected dependable progressive leaders like Rob Zerban [Paul Ryan's 2012 opponent] and Nate Shinagawa, each of whom came close to beating their Republican opponent but got no help from the DCCC…. Just say No to the DCCC, no matter how many War on Women ads they send you. When it comes to your wallet, they’re not your friend.

March 23, 2013

Massachusetts Senator Elizabeth Warren’s credentials, support, and savvy make her almost untouchable — and she knows it.

Elizabeth Warren was the only senator on the Health, Education, Labor, and Pensions (HELP) Committee, aside from the chair and ranking minority, to show up at last Thursday's hearing on indexing the minimum wage to inflation. This was unfortunate for the two witnesses representing the National Restaurant Association in opposition of the idea, because it meant that every 15 minutes it was Warren's turn to ask questions again.

She carved them up like a Thanksgiving turkey. Has their association ever, in its history, supported an increase in the minimum wage, Warren asked — and if not, does that mean they believe it should still be one dollar an hour? Where, she inquired, had the extra $14.75 per hour gone, representing the difference since 1960 between increased worker productivity and the increase in the minimum wage? And which should we take as more meaningful, your speculation about what might happen at your store, or this study of what did happen at tens of thousands of companies in states that adopted minimum-wage indexing?

It was quite a brazen performance for a Senate freshman, let alone one not yet three months into her first job in elected office. But it was relatively tame, compared with Warren's behavior in other recent hearings, where the victims were not such obvious foils for a Democrat. Like a trial lawyer exposing a witness's false alibi, Warren has used Banking Committee hearings to fluster Federal Reserve Chairman Ben Bernanke, Treasury and Comptroller executives, and a Securities and Exchange Commission nominee — and by proxy, Barack Obama's Attorney General Eric Holder, whose approach to financial institutions Warren viciously summed up as "too big for trial."

This is not the head-down, limelight-avoiding playbook typically followed by Senate freshmen — especially celebrities, such as Hillary Clinton in 2001 or Barack Obama in 2005. In fact, it is the kind of behavior that would get a lot of new lawmakers smacked down hard, or marginalized into ineffectiveness. Few new Senators behave this way — other than the occasional bomb-thrower more interested in headlines than results. (Ted Cruz of Texas currently fits this category.) But Warren has an independence and authority that frees her to be outspoken without getting alienated. She can embarrass the Barack Obama administration for failing to send bankers to jail without fear.

MORE GOOD NEWS AT LINK

Mrs. Warren goes to Washington By DAVID S. BERNSTEIN

http://thephoenix.com/Boston/news/153162-mrs-warren-goes-to-washington/Massachusetts Senator Elizabeth Warren’s credentials, support, and savvy make her almost untouchable — and she knows it.

Elizabeth Warren was the only senator on the Health, Education, Labor, and Pensions (HELP) Committee, aside from the chair and ranking minority, to show up at last Thursday's hearing on indexing the minimum wage to inflation. This was unfortunate for the two witnesses representing the National Restaurant Association in opposition of the idea, because it meant that every 15 minutes it was Warren's turn to ask questions again.

She carved them up like a Thanksgiving turkey. Has their association ever, in its history, supported an increase in the minimum wage, Warren asked — and if not, does that mean they believe it should still be one dollar an hour? Where, she inquired, had the extra $14.75 per hour gone, representing the difference since 1960 between increased worker productivity and the increase in the minimum wage? And which should we take as more meaningful, your speculation about what might happen at your store, or this study of what did happen at tens of thousands of companies in states that adopted minimum-wage indexing?

It was quite a brazen performance for a Senate freshman, let alone one not yet three months into her first job in elected office. But it was relatively tame, compared with Warren's behavior in other recent hearings, where the victims were not such obvious foils for a Democrat. Like a trial lawyer exposing a witness's false alibi, Warren has used Banking Committee hearings to fluster Federal Reserve Chairman Ben Bernanke, Treasury and Comptroller executives, and a Securities and Exchange Commission nominee — and by proxy, Barack Obama's Attorney General Eric Holder, whose approach to financial institutions Warren viciously summed up as "too big for trial."