Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

Showing Original Post only (View all)Why can't Obama be more like Bush? Who is missing Dubya? [View all]

Matt Taibbi: 'Hands Down' Bush Was Tougher On Corporate America Than Obama"

"Tougher" as in the time Bush ignored the problem until the economy was at its breaking point, and then forced the government into having to bail out the banks.

"Tougher" as in when Bush triggered the mortgage crisis by gutting the Community Reivestment Act?

The evidence strongly suggests the latter. First, consider timing. CRA was enacted in 1977. The sub-prime lending at the heart of the current crisis exploded a full quarter century later. In the mid-1990s, new CRA regulations and a wave of mergers led to a flurry of CRA activity, but, as noted by the New America Foundation's Ellen Seidman (and by Harvard's Joint Center), that activity "largely came to an end by 2001." In late 2004, the Bush administration announced plans to sharply weaken CRA regulations, pulling small and mid-sized banks out from under the law's toughest standards. Yet sub-prime lending continued, and even intensified -- at the very time when activity under CRA had slowed and the law had weakened.

http://prospect.org/article/did-liberals-cause-sub-prime-crisis

http://prospect.org/article/did-liberals-cause-sub-prime-crisis

As the housing bubble burst and the ensuing economic crisis gained steam, conservatives set about trying to find someone to blame for the meltdown of the mortgage market. First, it was Fannie Mae and Freddie Mac, and then loans made to low-income people through the Community Reinvestment Act.

As The Wonk Room has noted, the problem was actually the Bush administration’s failure to regulate the mortgage markets, while financial institutions developed ever-more sophisticated instruments for securitizing mortgage debt and selling it around the world.

http://thinkprogress.org/economy/2008/12/01/172489/bush-warnings/

As The Wonk Room has noted, the problem was actually the Bush administration’s failure to regulate the mortgage markets, while financial institutions developed ever-more sophisticated instruments for securitizing mortgage debt and selling it around the world.

http://thinkprogress.org/economy/2008/12/01/172489/bush-warnings/

The Economic Consequences of Mr. Bush

by Joseph E. Stiglitz

December 2007

<...>

Whoever moves into the White House in January 2009 will face an unenviable set of economic circumstances. Extricating the country from Iraq will be the bloodier task, but putting America’s economic house in order will be wrenching and take years.

The most immediate challenge will be simply to get the economy’s metabolism back into the normal range. That will mean moving from a savings rate of zero (or less) to a more typical savings rate of, say, 4 percent. While such an increase would be good for the long-term health of America’s economy, the short-term consequences would be painful. Money saved is money not spent. If people don’t spend money, the economic engine stalls. If households curtail their spending quickly—as they may be forced to do as a result of the meltdown in the mortgage market—this could mean a recession; if done in a more measured way, it would still mean a protracted slowdown. The problems of foreclosure and bankruptcy posed by excessive household debt are likely to get worse before they get better. And the federal government is in a bind: any quick restoration of fiscal sanity will only aggravate both problems.

And in any case there’s more to be done. What is required is in some ways simple to describe: it amounts to ceasing our current behavior and doing exactly the opposite. It means not spending money that we don’t have, increasing taxes on the rich, reducing corporate welfare, strengthening the safety net for the less well off, and making greater investment in education, technology, and infrastructure.

<...>

Some portion of the damage done by the Bush administration could be rectified quickly. A large portion will take decades to fix—and that’s assuming the political will to do so exists both in the White House and in Congress. Think of the interest we are paying, year after year, on the almost $4 trillion of increased debt burden—even at 5 percent, that’s an annual payment of $200 billion, two Iraq wars a year forever. Think of the taxes that future governments will have to levy to repay even a fraction of the debt we have accumulated. And think of the widening divide between rich and poor in America, a phenomenon that goes beyond economics and speaks to the very future of the American Dream.

- more -

http://www.vanityfair.com/politics/features/2007/12/bush200712

by Joseph E. Stiglitz

December 2007

<...>

Whoever moves into the White House in January 2009 will face an unenviable set of economic circumstances. Extricating the country from Iraq will be the bloodier task, but putting America’s economic house in order will be wrenching and take years.

The most immediate challenge will be simply to get the economy’s metabolism back into the normal range. That will mean moving from a savings rate of zero (or less) to a more typical savings rate of, say, 4 percent. While such an increase would be good for the long-term health of America’s economy, the short-term consequences would be painful. Money saved is money not spent. If people don’t spend money, the economic engine stalls. If households curtail their spending quickly—as they may be forced to do as a result of the meltdown in the mortgage market—this could mean a recession; if done in a more measured way, it would still mean a protracted slowdown. The problems of foreclosure and bankruptcy posed by excessive household debt are likely to get worse before they get better. And the federal government is in a bind: any quick restoration of fiscal sanity will only aggravate both problems.

And in any case there’s more to be done. What is required is in some ways simple to describe: it amounts to ceasing our current behavior and doing exactly the opposite. It means not spending money that we don’t have, increasing taxes on the rich, reducing corporate welfare, strengthening the safety net for the less well off, and making greater investment in education, technology, and infrastructure.

<...>

Some portion of the damage done by the Bush administration could be rectified quickly. A large portion will take decades to fix—and that’s assuming the political will to do so exists both in the White House and in Congress. Think of the interest we are paying, year after year, on the almost $4 trillion of increased debt burden—even at 5 percent, that’s an annual payment of $200 billion, two Iraq wars a year forever. Think of the taxes that future governments will have to levy to repay even a fraction of the debt we have accumulated. And think of the widening divide between rich and poor in America, a phenomenon that goes beyond economics and speaks to the very future of the American Dream.

- more -

http://www.vanityfair.com/politics/features/2007/12/bush200712

Why can't Obama be more like Bush?

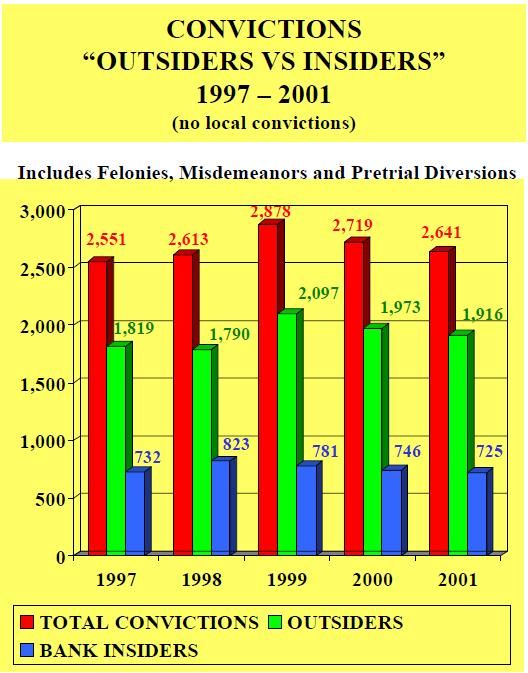

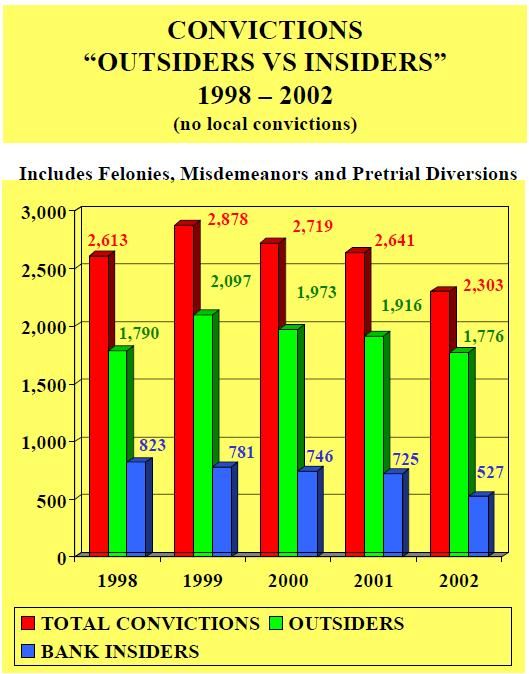

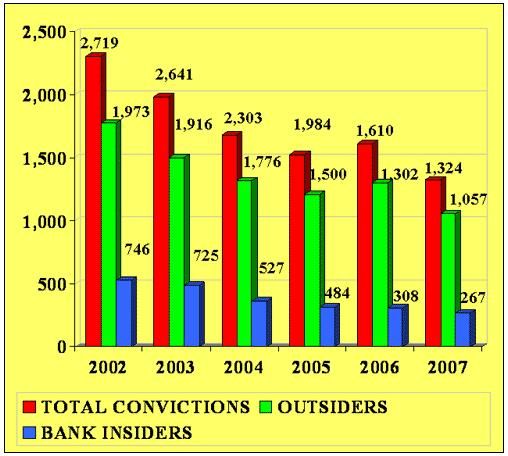

It's a little hilarious that a chart showing a steeper drop in the number of cases after 2001 is being used to hype Bush.

The chart shows that prosecutions started dropping after the repeal of Glass-Steagall, and it shows prosecutions, not convictions. It's also not conclusive because it doesn't state what specifically it includes and appears to be related to bank fraud. Here's the reference:

This category can refer to crimes committed both within and against banks. Defendants include bank executives who mislead regulators, mortgage brokers who falsify loan documents, and consumers who write bad checks. (Here are some recent cases of bank fraud prosecutions.)

http://economix.blogs.nytimes.com/2011/11/15/prosecutions-for-bank-fraud-fall-sharply/

Remember Glass-Steagall? It was repealed and that was followed by the law that created the Enron loophole in 2000, which is likely why prosecutions dropped from the 1999 highs to less than half the number.

Many of the immoral activities were crimes before the repeal of Glass-Steagall. I simply can't understand how people can acknowledge that repealing a law caused the problem, but not understand the the law was what made the activities illegal.

I've seen that chart many times before. http://www.democraticunderground.com/1002990749#post4

I'll repost the full comment here...

Goldman Sachs is not a bank. Still, even if it is bank fraud, it does offer more evidence of Bush's "abysmal" record, as these prosecutions dropped significantly during his Presidency.

The following is from the Financial Institution Fraud and Failure Reports for each fiscal year.

http://www.fbi.gov/stats-services/publications/fiff_00-01

http://www.fbi.gov/stats-services/publications/fiff-2002

(b): Types of Subjects Convicted in FIF Cases During FY 2007*

SUBJECT TYPE NUMBER OF SUBJECTS

Legal Alien 8

Illegal Alien 20

All Other Subjects 1,038

Bank Officer 88

Bank Employee 179

International or National Union Officer 1

President 1

Business Manager 2

Office Manager 2

Financial Secretary 1

Federal Employee - GS 12 & Below 1

State - All Others 1

Local Law Enforcement Officer 1

City Councilman 1

Possible Terrorist Member or Sympathizer 1

Company or Corporation 7

Local - All Others 2

Total 1,354

http://www.fbi.gov/stats-services/publications/fiff_06-07/fiff_06-07

http://www.fbi.gov/stats-services/publications/fiff_06-07/fiff_06-07

Given yhe above charts and the break out for 2007, it appears that most of the convictions were not bank executives. In fact, the majority were bank "outsiders," likely meaning more bad-check writers and document falsifiers.

Also, bank fraud is separate from corporate fraud, mortgage fraud, and securities and commodities fraud.

The following is from the Financial Crimes Report to the Public for each fiscal year:

(Note: The 2005 report does not break out securities and commodities fraud. The 2010-2011 report is the only one that breaks out financial institution fraud. All reports show corporate fraud and mortgage fraud.)

Through Fiscal Year 2005, cases pursued by the FBI resulted in 497 indictments and 317 convictions of corporate criminals. Numerous cases are pending plea agreements and trials. From July 1, 2002 through March 31, 2005, accomplishments regarding Corporate Fraud cases were as follows: $2.2 billion in Restitutions, $34.6 million in Recoveries, $79.1 million in Fines, and $27.9 million in Seizures. As Corporate Fraud statistical accomplishments were not provided before July 1, 2002, the following statistical accomplishments are reflective of this time frame through Second Quarter, Fiscal Year 2005.

http://www.fbi.gov/stats-services/publications/fcs_report2005/fcs_2005#CORPORATE

http://www.fbi.gov/stats-services/publications/fcs_report2005/fcs_2005#CORPORATE

http://www.fbi.gov/stats-services/publications/fcs_report2005/fcs_2005#MORTGAGE

_________

During FY 2006, the FBI investigated 490 Corporate Fraud cases resulting in 171 indictments and 124 convictions of corporate criminals. Numerous cases are pending plea agreements and trials. The following notable statistical accomplishments are reflective in FY 2006 for Corporate Fraud: $1.2 billion in Restitutions, $41.5 million in Recoveries, $14.2 million in Fines, and $62.6 million in Seizures. The chart below is reflective of the number of pending cases from FY 2002 through FY 2006.

http://www.fbi.gov/stats-services/publications/fcs_report2006

http://www.fbi.gov/stats-services/publications/fcs_report2006

During FY 2006, the FBI investigated 1165 cases of Securities and Commodities fraud and recorded 302 indictments and 164 convictions. Many of these Securities Fraud cases are pending plea agreements or trials. The following notable statistical accomplishments are reflective in FY 2006 for Securities and Commodities Fraud: $1.9 billion in Restitutions, $20.6 million in Recoveries, $80.7 million in Fines, and $62.7 million in Seizures. The chart below is reflective of the number of pending cases from FY 2002 through FY 2006.

http://www.fbi.gov/stats-services/publications/fcs_report2006/financial-crimes-report-to-the-public-fiscal-year-2006#Securities

http://www.fbi.gov/stats-services/publications/fcs_report2006/financial-crimes-report-to-the-public-fiscal-year-2006#Securities

Through FY 2006, 818 cases investigated by the FBI resulted in 263 indictments and 204 convictions of Mortgage Fraud criminals. The following notable statistical accomplishments are reflective in FY 2006 for Mortgage Fraud: $388.9 million in Restitutions, $1.4 million in Recoveries, and $231 million in Fines. The chart below is reflective of the number of pending cases from FY 2003 through FY 2006.

http://www.fbi.gov/stats-services/publications/fcs_report2006/financial-crimes-report-to-the-public-fiscal-year-2006#Mortgage

http://www.fbi.gov/stats-services/publications/fcs_report2006/financial-crimes-report-to-the-public-fiscal-year-2006#Mortgage

___________

Through FY 2007, cases pursued by the FBI resulted in 183 indictments and 173 convictions of corporate criminals. Numerous cases are pending plea agreements and trials. During Fiscal Year 2007, the FBI secured $12.6 billion in restitution orders and $38.6 million in fines from corporate criminals. The chart below reflects corporate fraud pending cases from Fiscal Year 2003 through Fiscal Year 2007 as follows: Fiscal Year 2003 - 279 cases; Fiscal Year 2004 - 332; Fiscal Year 2005 - 423; Fiscal Year 2006 - 486; and Fiscal Year 2008 - 529 cases.

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#corporate

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#corporate

As of the end of Fiscal Year 2007, the FBI was investigating 1,217 cases of securities and commodities fraud and had already recorded 320 indictments and 289 convictions. Additional notable accomplishments in Fiscal Year 2007 include: $1.7 billion in restitution orders; $24 million in recoveries; and $202.7 million in fines. The chart below reflects securities and commodities fraud pending cases from Fiscal Year 2003 through Fiscal Year 2007 as follows: Fiscal Year 2003 - 937 cases; Fiscal Year 2004 - 987cases; Fiscal Year 2005 - 1,139 cases; Fiscal Year 2006 - 1,165 cases; and Fiscal Year 2007 - 1,217 cases.

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#securities

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#securities

Through Fiscal Year 2007, 1,204 cases resulted in 321 indictments and 260 convictions of mortgage fraud criminals. The following notable statistical accomplishments are reflective in Fiscal Year 2007 for mortgage fraud: $595.9 million in restitutions, $21.8 million in recoveries, and $1.7 in fines. The chart below reflects mortgage fraud pending cases from Fiscal Year 2003 through Fiscal Year 2007 as follows: Fiscal Year 2003 - 436 cases; Fiscal Year 2004 - 534 cases; Fiscal Year 2005 - 721 cases; Fiscal Year 2006 - 818 cases; and Fiscal Year 2007 - 1,204 cases.

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#mortgage

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#mortgage

______________

Through FY 2008, cases pursued by the FBI resulted in 158 indictments and 132 convictions of corporate criminals. Numerous cases are pending plea agreements and trials. During FY 2008, the FBI secured $8.1 billion in restitution orders and $199 million in fines from corporate criminals. The chart below reflects corporate fraud pending cases from FY 2004 through FY 2008 as follows: FY 2004—332 cases; FY 2005—423; FY 2006—486; FY 2007—529; and FY 2008—545 cases.

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#corporate

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#corporate

As of the end of FY 2008, the FBI was investigating 1,210 cases of securities and commodities fraud and had already recorded 357 indictments and 296 convictions. Additional notable accomplishments in FY 2008 include: $3.1 billion in restitution orders; $43.6 million in recoveries; $151.4 million in fines and $84.2 million in seizures. The chart below reflects securities and commodities fraud pending cases from FY 2004 through FY 2008 as follows: FY 2004—987cases; FY 2005—1,139 cases; FY 2006—1,165 cases; FY 2007—1,217 cases and FY 2008—1,210 cases.

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#securities

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#securities

Through FY 2008, 1,644 cases resulted in 560 indictments and 338 convictions of mortgage fraud criminals. The following notable statistical accomplishments are reflective in FY 2008 for mortgage fraud: $1.1 billion in restitutions, $3.3 million in recoveries, $3.1 million in fines, and 68 seizures valued at $476.7 million. The chart below reflects mortgage fraud pending cases from FY 2004 through FY 2008 as follows: FY 2004—534 cases; FY 2005—721 cases; FY 2006—818 cases; FY 2007—1,204 cases; and FY 2008—1,644 cases.

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#mortgage

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#mortgage

____________

Through FY 2009, cases pursued by the FBI resulted in 153 indictments/informations and 156 convictions of corporate criminals. Numerous cases are pending plea agreements and trials. During FY 2009, the FBI secured $6.1 billion in restitution orders and $5.4 million in fines from corporate criminals. The chart below reflects corporate fraud pending cases from FY 2005 through FY 2009 as follows: FY 2005— 423 cases; FY 2006—486 cases; FY 2007—529 cases; FY 2008—545 cases; and FY 2009—592 cases.

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009

As of the end of FY 2009, the FBI was investigating 1,510 cases of securities and commodities fraud and had already recorded 412 indictments/informations and 306 convictions. Additional notable accomplishments in FY 2009 include: $8.1 billion in restitution orders; $63.4 million in recoveries; $12.8 million in fines; and $126 million in seizures. The chart below reflects securities and commodities fraud pending cases from FY 2005 through FY 2009 as follows: FY 2005—1,139 cases; FY 2006—1,165 cases; FY 2007—1,217 cases; FY 2008—1,210 cases; and FY 2009— 1,510 cases.

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#securities

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#securities

Through FY 2009, 2,794 cases resulted in 822 indictments and 494 convictions of mortgage fraud criminals. The following notable statistical accomplishments are reflective in FY 2009 for mortgage fraud: $2.5 billion in restitutions, $7.5 million in recoveries, and $58.4 million in fines; 128 seizures valued at $5.06 million and 226 criminal indicted assets valued at $510.1 million. The chart below reflects mortgage fraud pending cases from FY 2005 through FY 2009 as follows: FY 2005—721 cases; FY 2006—818 cases; FY 2007—1,204 cases; FY 2008—1,644 cases; and FY 2009—2,794 cases.

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#mortgage

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#mortgage

_____________

During FY 2011, cases pursued by the FBI resulted in 242 indictments/informations and 241 convictions of corporate criminals. Numerous cases are pending plea agreements and trials. During FY 2011, the FBI secured $2.4 billion in restitution orders and $16.1 million in fines from corporate criminals. The chart below reflects corporate fraud pending cases from FY 2007 through FY 2011.

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Corporate

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Corporate

As of the end of FY 2011, the FBI was investigating 1,846 cases of securities and commodities fraud and had recorded 520 indictments/informations and 394 convictions against this criminal threat. Additional notable accomplishments in FY 2011 include: $8.8 billion in restitution orders; $36 million in recoveries; $113 million in fines; and $751 million in forfeitures. The chart below reflects securities and commodities fraud pending cases from FY 2007 through FY 2011.

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Securities

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Securities

During FY 2011, cases pursued by the FBI resulted in 521 informations and indictments, and 429 convictions of FIF criminals. The following are notable statistical accomplishments in FY 2011 for FIF: $1.38 billion in restitutions; $116.3 million in fines; and seizures valued at $15.7 million. The chart below reflects pending FIF cases from FY 2007 through FY 2011.

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Financial-ins

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Financial-ins

Through FY 2011, FBI investigations resulted in 1,223 informations and indictments and 1,082 convictions of mortgage fraud criminals. The following notable statistical accomplishments are reflective in FY 2011 for mortgage fraud: $1.38 billion in restitutions; $116.3 million in fines; seizures valued at $15.7 million; and $7.33 million in forfeitures.

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Mortgage

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Mortgage

Pending cases are important because they can still result in convictions.

The fact is that prosecutions that could go forward did.

President Obama’s Financial Fraud Enforcement Task Force STRIKES AGAIN! $200 Million Fraud

http://www.democraticunderground.com/1002844790

Former BofA Exec Indicted For Fraud

http://www.democraticunderground.com/1002990749

Allen Stanford Convicted in Houston for Orchestrating $7 Billion Investment Fraud Scheme

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-293.html

Former Chief Investment Officer of Stanford Financial Group Pleads Guilty to Obstruction of Justice

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-785.html

Former Corporate Chairman of Consulting Firm and Board Director Rajat Gupta Found Guilty of Insider Trading in Manhattan Federal Court

http://www.stopfraud.gov/iso/opa/stopfraud/NYS-120615.html

Hedge Fund Founder Raj Rajaratnam Sentenced in Manhattan Federal Court to 11 Years in Prison for Insider Trading Crimes

http://www.stopfraud.gov/news/news-10132011.html

CEO and Head Trader of Bankrupt Sentinel Management Indicted in Chicago in Alleged $500 Million Fraud Scheme Prior to Firm’s 2007 Collapse

http://www.stopfraud.gov/iso/opa/stopfraud/ILN-120601.html

Yahoo! Executive and California Hedge Fund Portfolio Manager Plead Guilty in New York for Insider Trading

http://www.stopfraud.gov/iso/opa/stopfraud/NYS-120521.html

Three Former Financial Services Executives Convicted for Roles in Conspiracies Involving Investment Contracts for the Proceeds of Municipal Bonds

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-at-620.html

Former Chairman of Taylor, Bean & Whitaker Sentenced to 30 Years in Prison and Ordered to Forfeit $38.5 Million

http://www.stopfraud.gov/news/news-06302011-2.html

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-342.html

Former Chief Financial Officer of Taylor, Bean & Whitaker Pleads Guilty to Fraud Scheme

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-342.html

Seattle Investment Fund Founder Sentenced to 18 Years in Prison for Ponzi Scheme and Bankruptcy Fraud

http://www.stopfraud.gov/iso/opa/stopfraud/WAW-120210.html

Former Hedge Fund Managing Director Sentenced to 20 Years for Defrauding 900 Investors in $294 Million Scheme

http://www.stopfraud.gov/iso/opa/stopfraud/ILN-111117.html

Peter Madoff, Former Chief Compliance Officer and Senior Managing Director at Bernard L. Madoff Investment Securities LLC, Pleads Guilty in New York to Securities Fraud and Tax Fraud Conspiracy

http://www.stopfraud.gov/iso/opa/stopfraud/NYS-1206291.html

Peter Madoff Is Sentenced to 10 Years for His Role in Fraud

http://dealbook.nytimes.com/2012/12/20/peter-madoff-is-sentenced-to-10-years-for-his-role-in-fraud

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

72 replies, 4616 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (32)

ReplyReply to this post

72 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

You're not convinced by the mountains of conclusive evidence that Prosense provided but Taibbi's

stevenleser

Apr 2014

#7

That person read the better part of 30 articles in admittedly less than three minutes

Number23

Apr 2014

#48

LMAO, good catch. Shows who are the actual sycophants around here. Taibbi's fans won't even read

stevenleser

Apr 2014

#70

I'm convinced you have no intention of reading anything and are here to distract from the OP. I'm

Cha

Apr 2014

#52

but the little libertarian taibbi said so.. so the followers praise him to high hell.. Bad Obama..

Cha

Apr 2014

#55

As I noted in the other thread, Taibbi's articles look good on superficial inspection. When you

stevenleser

Apr 2014

#6

Bush exploited and expanded the changes in the laws that led to the crisis. n/t

ProSense

Apr 2014

#14

K&R I can't believe people here seriously think Bush was tougher than Obama on corporate malfeasance

DanTex

Apr 2014

#12

laws have to be enforced as well. the Sherman Anti-Trust Law is still on the books

yurbud

Apr 2014

#44

Still, that's like comparing intentionally crashing the economy to helping its recovery. n/t

ProSense

Apr 2014

#46

So does that mean we have to direct our 2 minute hate towards Gold...Taibbi today?

Vashta Nerada

Apr 2014

#29

Still, what does that have to do with this claim: "elevate Obama to god status"?

ProSense

Apr 2014

#42

Exactly. This all seems more like Taibbi's fans have elevated HIM to god status.

stevenleser

Apr 2014

#71

it sounds more like frustrated hyperbole on Taibbi's part for Obama not prosecuting the big dogs

yurbud

Apr 2014

#36

I can't see how any progressive Democrat can say that Bush was tougher on corporations than Obama

Chathamization

Apr 2014

#49