Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

kristopher

kristopher's Journal

kristopher's Journal

January 19, 2016

Question on debate coverage and analysis

Has anyone seen any mention what-so-ever of the $600K in speaking fees Hillary received from Goldman Sachs?

January 19, 2016

Read more: http://www.politico.com/magazine/story/2016/01/donald-trump-2016-authoritarian-213533

The One Weird Trait That Predicts Whether Youíre a Trump Supporter

The One Weird Trait That Predicts Whether You’re a Trump Supporter

And it’s not gender, age, income, race or religion.

By MATTHEW MACWILLIAMS 1/17/2016

If I asked you what most defines Donald Trump supporters, what would you say? They’re white? They’re poor? They’re uneducated?

You’d be wrong.

In fact, I’ve found a single statistically significant variable predicts whether a voter supports Trump—and it’s not race, income or education levels: It’s authoritarianism.

That’s right, Trump’s electoral strength—and his staying power—have been buoyed, above all, by Americans with authoritarian inclinations. And because of the prevalence of authoritarians in the American electorate, among Democrats as well as Republicans, it’s very possible that Trump’s fan base will continue to grow.

My finding is the result of a national poll I conducted in the last five days of December under the auspices of the University of Massachusetts, Amherst, sampling 1,800 registered voters across the country and the political spectrum. Running a standard statistical analysis, I found that education, income, gender, age, ideology and religiosity had no significant bearing on a Republican voter’s preferred candidate. Only two of the variables I looked at were statistically significant: authoritarianism, followed by fear of terrorism, though the former was far more significant than the latter.

Authoritarianism is not a new, untested concept in the American electorate. Since the rise of Nazi Germany, it has been one of the most widely studied ideas in social science. While its causes are still debated, the political behavior of authoritarians is not. Authoritarians obey. They rally to and follow strong leaders. And they respond aggressively to outsiders, especially when they feel threatened. From pledging to “make America great again” by building a wall on the border to promising to close mosques and ban Muslims from visiting the United States, Trump is playing directly to authoritarian inclinations.

Not all authoritarians are Republicans by any means; in national surveys since 1992, many authoritarians have also self-identified as independents and Democrats...

And it’s not gender, age, income, race or religion.

By MATTHEW MACWILLIAMS 1/17/2016

If I asked you what most defines Donald Trump supporters, what would you say? They’re white? They’re poor? They’re uneducated?

You’d be wrong.

In fact, I’ve found a single statistically significant variable predicts whether a voter supports Trump—and it’s not race, income or education levels: It’s authoritarianism.

That’s right, Trump’s electoral strength—and his staying power—have been buoyed, above all, by Americans with authoritarian inclinations. And because of the prevalence of authoritarians in the American electorate, among Democrats as well as Republicans, it’s very possible that Trump’s fan base will continue to grow.

My finding is the result of a national poll I conducted in the last five days of December under the auspices of the University of Massachusetts, Amherst, sampling 1,800 registered voters across the country and the political spectrum. Running a standard statistical analysis, I found that education, income, gender, age, ideology and religiosity had no significant bearing on a Republican voter’s preferred candidate. Only two of the variables I looked at were statistically significant: authoritarianism, followed by fear of terrorism, though the former was far more significant than the latter.

Authoritarianism is not a new, untested concept in the American electorate. Since the rise of Nazi Germany, it has been one of the most widely studied ideas in social science. While its causes are still debated, the political behavior of authoritarians is not. Authoritarians obey. They rally to and follow strong leaders. And they respond aggressively to outsiders, especially when they feel threatened. From pledging to “make America great again” by building a wall on the border to promising to close mosques and ban Muslims from visiting the United States, Trump is playing directly to authoritarian inclinations.

Not all authoritarians are Republicans by any means; in national surveys since 1992, many authoritarians have also self-identified as independents and Democrats...

Read more: http://www.politico.com/magazine/story/2016/01/donald-trump-2016-authoritarian-213533

January 17, 2016

China pushes global renewable installed capacity beyond 900 gigawatts

GlobalData reports 2015 saw China push global renewable installed capacity beyond 900 gigawatts

13 January 2016

GlobalData has revealed that China was the world’s leading market across a number of renewable energy technologies in 2015 and helped to drive global renewable installed capacity to an estimated 913.48 Gigawatts (GW).

The company’s latest report states that China led the world for annual capacity additions in solar, biopower, small hydropower and onshore wind in 2015, although the National Development and Reform Commission confirmed reductions in the cut to China’s onshore wind feed-in tariffs, for projects approved after January 1, 2015 or commissioned after January 1, 2016.

Ankit Mathur, Practice Head for Power at GlobalData, says that China consolidated its position as the leading installer of solar power capacity in 2015, as part of a bid to increase renewable technologies and drive down greenhouse gas emissions.

Mathur explains: “China became the largest consumer of solar photovoltaic (PV) modules in 2014, overtaking both Japan and the US. China’s annual solar PV installations have grown rapidly over the past few years, from 500 Megawatts in 2010, to 10.6 GW in 2014, and an estimated 18.43 GW in 2015.

“In 2014, Japan and the US...

http://www.renewableenergyfocus.com/view/43562/globaldata-reports-2015-saw-china-push-global-renewable-installed-capacity-beyond-900-gigawatts/

13 January 2016

GlobalData has revealed that China was the world’s leading market across a number of renewable energy technologies in 2015 and helped to drive global renewable installed capacity to an estimated 913.48 Gigawatts (GW).

The company’s latest report states that China led the world for annual capacity additions in solar, biopower, small hydropower and onshore wind in 2015, although the National Development and Reform Commission confirmed reductions in the cut to China’s onshore wind feed-in tariffs, for projects approved after January 1, 2015 or commissioned after January 1, 2016.

Ankit Mathur, Practice Head for Power at GlobalData, says that China consolidated its position as the leading installer of solar power capacity in 2015, as part of a bid to increase renewable technologies and drive down greenhouse gas emissions.

Mathur explains: “China became the largest consumer of solar photovoltaic (PV) modules in 2014, overtaking both Japan and the US. China’s annual solar PV installations have grown rapidly over the past few years, from 500 Megawatts in 2010, to 10.6 GW in 2014, and an estimated 18.43 GW in 2015.

“In 2014, Japan and the US...

January 17, 2016

http://www.japantimes.co.jp/news/2016/01/16/national/media-national/elephant-room-toshiba-nuclear

Nuclear Power as an Industry: Behind the Curtain

The elephant in the room for Toshiba is nuclear

BY PHILIP BRASOR - SPECIAL TO THE JAPAN TIMES

JAN 16, 2016

Japanese press outlets often cover scoops from competing outlets, but it’s rare to build on a competitor’s story with original reporting, especially when the scoop is a few years old. In December, the weekly magazine Aera, which is affiliated with the Asahi Shimbun, ran an article about a secret meeting that took place between representatives of Japan, Mongolia and the United States almost five years ago. This meeting was first reported by Haruyuki Aikawa in the May 9, 2011, issue of the Mainichi Shimbun.

What interested Aera reporter Atsushi Yamada about the article was Aikawa’s assertion that Toshiba Corp. was on hand for the negotiations. In 2006, Toshiba had bought a majority share in the American company Westinghouse, a manufacturer, like Toshiba, that started out in the home electronics field and eventually expanded into nuclear power plant construction. Japan said it would buy uranium mined in the central Asian country and in return Mongolia would tap Japan’s nuclear energy expertise in building power plants and, more significantly, nuclear fuel reprocessing facilities that would incorporate the acceptance of high-level nuclear waste from Japan and other countries.

<snip>

... while ostensibly the negotiations were between the three governments, the plans for the deal were drawn up by the U.S. and Toshiba with the aim of selling nuclear power plants to emerging economies under a scheme called Comprehensive Fuel Service. According to this scheme, vendors assure potential customers that they will handle any future nuclear waste produced by power plants the customers buy, which is why Mongolia’s acceptance of such waste is so important. Due to local resistance, neither the U.S. nor Japan has anywhere to dump spent fuel, even their own.

The reason Yamada became so interested in this topic years after the fact is that in the meantime, Toshiba has been caught up in financial scandals that have brought the company to its knees, and he wanted to explore the connection between Toshiba’s nuclear energy business and its fiscal woes.

The connection itself is not a secret. Toshiba spent almost ¥600 billion to buy its share of Westinghouse, which at the time of the purchase was only worth about ¥250 billion. The extra “goodwill” money (norendai) was in anticipation of future revenues that would accrue as Toshiba expanded its nuclear energy business both in Japan and throughout the world with Westinghouse as its “trump card.” But then Fukushima happened, putting a serious damper on demand for plant construction....

BY PHILIP BRASOR - SPECIAL TO THE JAPAN TIMES

JAN 16, 2016

Japanese press outlets often cover scoops from competing outlets, but it’s rare to build on a competitor’s story with original reporting, especially when the scoop is a few years old. In December, the weekly magazine Aera, which is affiliated with the Asahi Shimbun, ran an article about a secret meeting that took place between representatives of Japan, Mongolia and the United States almost five years ago. This meeting was first reported by Haruyuki Aikawa in the May 9, 2011, issue of the Mainichi Shimbun.

What interested Aera reporter Atsushi Yamada about the article was Aikawa’s assertion that Toshiba Corp. was on hand for the negotiations. In 2006, Toshiba had bought a majority share in the American company Westinghouse, a manufacturer, like Toshiba, that started out in the home electronics field and eventually expanded into nuclear power plant construction. Japan said it would buy uranium mined in the central Asian country and in return Mongolia would tap Japan’s nuclear energy expertise in building power plants and, more significantly, nuclear fuel reprocessing facilities that would incorporate the acceptance of high-level nuclear waste from Japan and other countries.

<snip>

... while ostensibly the negotiations were between the three governments, the plans for the deal were drawn up by the U.S. and Toshiba with the aim of selling nuclear power plants to emerging economies under a scheme called Comprehensive Fuel Service. According to this scheme, vendors assure potential customers that they will handle any future nuclear waste produced by power plants the customers buy, which is why Mongolia’s acceptance of such waste is so important. Due to local resistance, neither the U.S. nor Japan has anywhere to dump spent fuel, even their own.

The reason Yamada became so interested in this topic years after the fact is that in the meantime, Toshiba has been caught up in financial scandals that have brought the company to its knees, and he wanted to explore the connection between Toshiba’s nuclear energy business and its fiscal woes.

The connection itself is not a secret. Toshiba spent almost ¥600 billion to buy its share of Westinghouse, which at the time of the purchase was only worth about ¥250 billion. The extra “goodwill” money (norendai) was in anticipation of future revenues that would accrue as Toshiba expanded its nuclear energy business both in Japan and throughout the world with Westinghouse as its “trump card.” But then Fukushima happened, putting a serious damper on demand for plant construction....

http://www.japantimes.co.jp/news/2016/01/16/national/media-national/elephant-room-toshiba-nuclear

January 17, 2016

Your newest nightmare: The hacked nuclear power plant

Your newest nightmare: The hacked nuclear power plant

Jim Galloway AJC.com

<snip>

... before Sept. 11, 2001, very few people had conceived of domestic airliners as potential weapons. So we must rethink nuclear plants and their dependence on computer systems linked with the outside world, says Nunn – a supporter of civilian nuclear power generation.

...

Access systems could be compromised, the NTI report suggests, allowing thieves inside to wreak havoc or steal nuclear material. Accounting systems could be hacked to hide such thefts. Here’s one for you: “Reactor cooling systems could be deliberately disabled, resulting in a Fukushima-like disaster.”

....

When it came to the sabotage of nuclear power plants (there were other, broader assessments of how nations handle nuclear material), NTI says nearly half the 47 countries it assessed lacked the legal and technical foundation to fight off cyber attacks on their nuclear plants.

There is, of course, the matter of casting your eyes around the world and figuring out where the risks are greatest...

http://politics.blog.ajc.com/2016/01/16/your-newest-nightmare-the-hacked-nuclear-power-plant/

Jim Galloway AJC.com

<snip>

... before Sept. 11, 2001, very few people had conceived of domestic airliners as potential weapons. So we must rethink nuclear plants and their dependence on computer systems linked with the outside world, says Nunn – a supporter of civilian nuclear power generation.

...

Access systems could be compromised, the NTI report suggests, allowing thieves inside to wreak havoc or steal nuclear material. Accounting systems could be hacked to hide such thefts. Here’s one for you: “Reactor cooling systems could be deliberately disabled, resulting in a Fukushima-like disaster.”

....

When it came to the sabotage of nuclear power plants (there were other, broader assessments of how nations handle nuclear material), NTI says nearly half the 47 countries it assessed lacked the legal and technical foundation to fight off cyber attacks on their nuclear plants.

There is, of course, the matter of casting your eyes around the world and figuring out where the risks are greatest...

January 16, 2016

From Alternet

http://www.alternet.org/media/mainstream-media-doesnt-get-its-attempts-belittle-bernie-sanders-are-totally-backfiring

MLK on Democratic Socialism

From Alternet

Mainstream Media Doesn't Get That Its Attempts to Belittle Bernie Sanders Are Totally Backfiring

Is it actually all that extreme to be a democratic socialist, the brand Sanders has adopted?

By Zaid Jilani / AlterNet June 30, 2015

“The media is giving Bernie a pass right now,” complained Sen. Claire McCaskill (D-MO) last week, of Bernie Sanders' surging campaign. “I very rarely read in any coverage that he's a socialist.”

Other than McCaskill's comment about Sanders being false (the media constantly points out that Sanders is a socialist), it's worth asking a very basic question: is it actually all that extreme or undesirable to be a democratic socialist, the brand Sanders has adopted?

As towering a figure as Rev. Martin Luther King Jr. endorsed democratic socialism 49 years ago. As religious scholar Obey Hendricks Jr. noted, King gave an address to his staff in 1966 explaining that he thinks America ought to move toward democratic socialism:

King's disdain for the capitalist system actually began even earlier...

Is it actually all that extreme to be a democratic socialist, the brand Sanders has adopted?

By Zaid Jilani / AlterNet June 30, 2015

“The media is giving Bernie a pass right now,” complained Sen. Claire McCaskill (D-MO) last week, of Bernie Sanders' surging campaign. “I very rarely read in any coverage that he's a socialist.”

Other than McCaskill's comment about Sanders being false (the media constantly points out that Sanders is a socialist), it's worth asking a very basic question: is it actually all that extreme or undesirable to be a democratic socialist, the brand Sanders has adopted?

As towering a figure as Rev. Martin Luther King Jr. endorsed democratic socialism 49 years ago. As religious scholar Obey Hendricks Jr. noted, King gave an address to his staff in 1966 explaining that he thinks America ought to move toward democratic socialism:

[W]e are saying that something is wrong ... with capitalism.... There must be better distribution of wealth and maybe America must move toward a democratic socialism. Call it what you may, call it democracy, or call it democratic socialism, but there must be a better distribution of wealth within this country for all of God's children.

King's disdain for the capitalist system actually began even earlier...

http://www.alternet.org/media/mainstream-media-doesnt-get-its-attempts-belittle-bernie-sanders-are-totally-backfiring

January 15, 2016

New research places the climate liability for this Michigan power plant as high as $1.2 billion.

PHOTO BY Ken Lund / Creative Commons

Michigan researchers put price tag on climate liability for fossil-fuel plants

WRITTEN BY

Andy Balaskovitz

19 hours ago

Coal-fired power plants across the country could be billion-dollar liabilities for utilities if their greenhouse gas emissions are challenged in court, according to researchers at Michigan Technological University.

Should an entity — individuals, groups or governments — take legal action against utilities for their plants’ greenhouse gas emissions and contributions to climate change, researchers have developed a way to determine the amount of monetary damages that might be awarded to plaintiffs.

These polluting plants, therefore, could have significant impact on shareholders, researchers say.

While oil companies are under scrutiny over whether they adequately disclosed climate risks in securities filings, utilities face similar risks by not curbing greenhouse gas emissions from their conventional plants, according to a recent paper published in Renewable and Sustainable Energy Reviews.

The research — co-authored by Michigan Tech electrical engineering and materials science professor Joshua Pearce and research assistant Negin Heidari...

http://midwestenergynews.com/2016/01/14/michigan-researchers-put-price-tag-on-climate-liability-for-fossil-fuel-plants/

Paper "A Review of Greenhouse Gas Emission Liabilities as the Value of Renewable Energy for Mitigating Lawsuits for Climate Change Related Damages"

Introduction

https://www.academia.edu/19418589/A_Review_of_Greenhouse_Gas_Emission_Liabilities_as_the_Value_of_Renewable_Energy_for_Mitigating_Lawsuits_for_Climate_Change_Related_Damages

Michigan researchers put price tag on climate liability for fossil-fuel plants

New research places the climate liability for this Michigan power plant as high as $1.2 billion.

PHOTO BY Ken Lund / Creative Commons

Michigan researchers put price tag on climate liability for fossil-fuel plants

WRITTEN BY

Andy Balaskovitz

19 hours ago

Coal-fired power plants across the country could be billion-dollar liabilities for utilities if their greenhouse gas emissions are challenged in court, according to researchers at Michigan Technological University.

Should an entity — individuals, groups or governments — take legal action against utilities for their plants’ greenhouse gas emissions and contributions to climate change, researchers have developed a way to determine the amount of monetary damages that might be awarded to plaintiffs.

These polluting plants, therefore, could have significant impact on shareholders, researchers say.

While oil companies are under scrutiny over whether they adequately disclosed climate risks in securities filings, utilities face similar risks by not curbing greenhouse gas emissions from their conventional plants, according to a recent paper published in Renewable and Sustainable Energy Reviews.

The research — co-authored by Michigan Tech electrical engineering and materials science professor Joshua Pearce and research assistant Negin Heidari...

http://midwestenergynews.com/2016/01/14/michigan-researchers-put-price-tag-on-climate-liability-for-fossil-fuel-plants/

Paper "A Review of Greenhouse Gas Emission Liabilities as the Value of Renewable Energy for Mitigating Lawsuits for Climate Change Related Damages"

Introduction

Renewable energy technologies (RETs) have well established benefits including: i) improving environmental sustainability [1-3], ii) improving public health [4-6], iii) creating jobs [6-9] and iv) financial benefits [10-12]. For example, the average price of completed solar photovoltaic (PV) systems have dropped 33% since 2011 [13], and the cost of electricity generated from wind also dropped more than 43% in the past four years [14]. As the economic costs of RETs have decreased they are now competitive with traditional electricity sources in many regions [10-12]. Perhaps one of RETs greatest benefits, however, is the value they bring for mitigation of greenhouse gas (GHG) emissions and the concomitant climate change [15- 19]. Both global GHG emissions [20-22] and global atmospheric carbon dioxide (CO2) concentrations are are increasing rapidly [23,24]. The resultant climate change is well established with a high confidence as are the negative impacts on natural and socio-economic systems [25,26] including: i) higher temperatures and heat waves that result in thousands of deaths from hyperthermia [27-29], ii) crop failures [30,31] that aggravate global hunger [32-34], iii) power outages [35,36], iv) rising sea levels which causes the low-lying coastal areas to submerge gradually [37,38], v) erosion of shorelines [37,38], vi) increased risk of flooding [39], and saltwater intrusion [37,40], vii) strong storms which causes more damage to coastal environment, increased risk of floods, [41-44], viii) droughts, [45] and ix) fire [43,46,47]. These negative externalities have been shown to be due to human activities with the confidence level of 95% (primarily combustion of fossil fuels, which are the dominant cause of global warming from 1951 to 2010)[48,49].

Emission trading has been considered as a solution to climate change in order to limit greenhouse gas emissions [50-53]. Unfortunately, it has some disadvantages including relying on a complicated system [54], carbon price uncertainty [55], and encouraging industries that are the most dependent on coal and oil to maintain the status quo because the permits have been historically inexpensive [56]. Thus, at the present time, emissions trading as a method of mitigating climate change has essentially failed [57-59], so another method is needed.(Emphasis added - K)

A method gaining traction to bring these negative externalities into the market is the use of litigation, which provides a different path to motivate reducing corporate actions resulting in climate change [60-69]. If such GHG emission litigation becomes widespread, then the one of the core benefits of RETs for emitters would be a reduction in the liability for climate change. This economic benefit is currently often ignored because of the lack of knowledge of the potential liabilities. To provide the necessary data, this paper first reviews recent literature on the potential for climate change litigation and the seven methods to quantify liability for climate change. Then, this paper provides a formulation is developed to estimate the liability for GHG emitters considering i ) pollution factor (which is a fraction of emissions produced by each major polluter over the overall emissions), ii) probability of human contribution to natural disasters, and iii) estimated cost of disasters. Next, the top ten emitters in the U.S. are identified and their potential liability is quantified using standard carbon costs and this method. Potential liabilities are explored in depth in this paper with a single company comparing the results of the fractional liability from only natural disasters within the U.S. for a single year to a sensitivity of the future costs of carbon emissions from other sources of emission-related liability. Finally, potential climate change victims (potential litigants) are identified and their capacity to bring such lawsuits are evaluated. The results are discussed and conclusions are drawn about the potential value for RETs to reduce GHG emission liability.

https://www.academia.edu/19418589/A_Review_of_Greenhouse_Gas_Emission_Liabilities_as_the_Value_of_Renewable_Energy_for_Mitigating_Lawsuits_for_Climate_Change_Related_Damages

January 14, 2016

Bloomberg Press Release:

More at http://about.bnef.com/press-releases/clean-energy-defies-fossil-fuel-price-crash-to-attract-record-329bn-global-investment-in-2015/

Direct link to Bloomberg slide show on their data: https://www.bnef.com/dataview/clean-energy-investment/index.html

Why clean energy is now expanding even when fossil fuels are cheap

Why clean energy is now expanding even when fossil fuels are cheap

By Chris Mooney January 14 at 10:59 AM

...In a new analysis, Bloomberg New Energy Finance finds that 2015 was a record year for global investment in the clean energy space, with $329 billion invested in wind, solar panels, biomass plants and more around the world. (The number does not include investments in large hydroelectric facilities).

That’s 3 percent higher than the prior 2011 global investment record of $ 318 billion — and most striking is that it happened in a year in which key fossil fuels — oil, coal and natural gas — were quite cheap.

...As BNEF notes, the price of oil — which is burned to generate a fair amount of electricity around the world, though this is rare in the U.S. — tanked in 2015. Coal prices and U.S. natural gas prices also got considerably cheaper over the second half of 2014 and the 12 months of 2015. Nonetheless, China and the UK invested in massive multibillion-dollar offshore wind farms, even as other nations, from the U.S. to Brazil, saw near billion-dollar expenditures on new solar farms and biomass plants.

...Measured in terms of electricity generating capacity, the world saw an additional 64 gigawatts of wind capacity added and 57 gigawatts of solar capacity, BNEF estimates. The most striking figure here is that while 2015 only saw about 4 percent more clean energy investment than 2014 (when $ 316 billion was invested), the growth in renewable energy generating capacity was much higher at 30 percent. This, again, signals declining cost, says Zindler.

“The technologies have reached an important tipping point in a number of markets in the world,” ...

https://www.washingtonpost.com/news/energy-environment/wp/2016/01/14/why-clean-energy-is-now-expanding-even-when-fossil-fuels-are-cheap/

By Chris Mooney January 14 at 10:59 AM

...In a new analysis, Bloomberg New Energy Finance finds that 2015 was a record year for global investment in the clean energy space, with $329 billion invested in wind, solar panels, biomass plants and more around the world. (The number does not include investments in large hydroelectric facilities).

That’s 3 percent higher than the prior 2011 global investment record of $ 318 billion — and most striking is that it happened in a year in which key fossil fuels — oil, coal and natural gas — were quite cheap.

...As BNEF notes, the price of oil — which is burned to generate a fair amount of electricity around the world, though this is rare in the U.S. — tanked in 2015. Coal prices and U.S. natural gas prices also got considerably cheaper over the second half of 2014 and the 12 months of 2015. Nonetheless, China and the UK invested in massive multibillion-dollar offshore wind farms, even as other nations, from the U.S. to Brazil, saw near billion-dollar expenditures on new solar farms and biomass plants.

...Measured in terms of electricity generating capacity, the world saw an additional 64 gigawatts of wind capacity added and 57 gigawatts of solar capacity, BNEF estimates. The most striking figure here is that while 2015 only saw about 4 percent more clean energy investment than 2014 (when $ 316 billion was invested), the growth in renewable energy generating capacity was much higher at 30 percent. This, again, signals declining cost, says Zindler.

“The technologies have reached an important tipping point in a number of markets in the world,” ...

Bloomberg Press Release:

JAN 14, 2016

CLEAN ENERGY DEFIES FOSSIL FUEL PRICE CRASH TO ATTRACT RECORD $329BN GLOBAL INVESTMENT IN 2015

2015 was also the highest ever for installation of renewable power capacity, with 64GW of wind and 57GW of solar PV commissioned during the year, an increase of nearly 30% over 2014.

CLEAN ENERGY DEFIES FOSSIL FUEL PRICE CRASH TO ATTRACT RECORD $329BN GLOBAL INVESTMENT IN 2015

2015 was also the highest ever for installation of renewable power capacity, with 64GW of wind and 57GW of solar PV commissioned during the year, an increase of nearly 30% over 2014.

London and New York, 14 January 2016 – Clean energy investment surged in China, Africa, the US, Latin America and India in 2015, driving the world total to its highest ever figure, of $328.9bn, up 4% from 2014’s revised $315.9bn and beating the previous record, set in 2011 by 3%.

The latest figures from Bloomberg New Energy Finance show dollar investment globally growing in 2015 to nearly six times its 2004 total and a new record of one third of a trillion dollars (see chart on page 3), despite four influences that might have been expected to restrain it.

These were: further declines in the cost of solar photovoltaics, meaning that more capacity could be installed for the same price; the strength of the US currency, reducing the dollar value of non-dollar investment; the continued weakness of the European economy, formerly the powerhouse of renewable energy investment; and perhaps most significantly, the plunge in fossil fuel commodity prices.

Over the 18 months to the end of 2015, the price of Brent crude plunged 67% from $112.36 to $37.28 per barrel, international steam coal delivered to the north west Europe hub dropped 35% from $73.70 to $47.60 per tonne. Natural gas in the US fell 48% on the Henry Hub index from $4.42 to $2.31 per million British Thermal Units.

Michael Liebreich, chairman of the advisory board at Bloomberg New Energy Finance, said: “These figures are a stunning riposte to all those who expected clean energy investment to stall on falling oil and gas prices....

More at http://about.bnef.com/press-releases/clean-energy-defies-fossil-fuel-price-crash-to-attract-record-329bn-global-investment-in-2015/

Direct link to Bloomberg slide show on their data: https://www.bnef.com/dataview/clean-energy-investment/index.html

January 14, 2016

Much more at: http://www.electric-vehiclenews.com/2016/01/chevrolet-bolt-ev-specs-released.html

Chevrolet Bolt EV specs released

TUESDAY, JANUARY 12, 2016

Chevrolet Bolt EV specs released

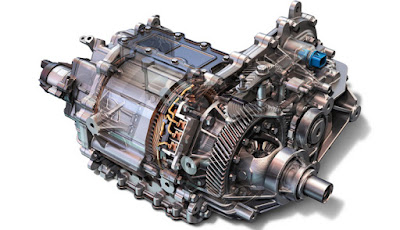

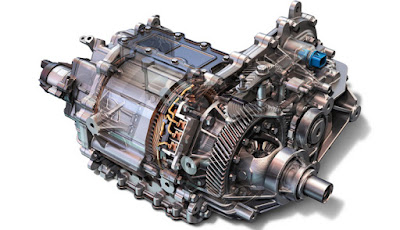

Hard on the heels of the reveal of the production Volt EV at CES 2016 in Las Vegas, Chevrolet used the North American International Auto Show in Detroit to release additional details on the battery and drivetrain of the new BEV. Engineers developed the Bolt EV’s propulsion system to offer more than an estimated 200 miles and a sporty driving experience.

The Bolt EV’s drive system uses a single high capacity electric motor to propel the car. The engineering team designed the Bolt EV’s electric motor with an offset gear and shaft configuration tailored to meet efficiency and performance targets—most notably more than an estimated 200 miles of range. The motor is capable of producing up to 266 lb-ft (360 N·m) of torque and 200 hp (150 kW) of motoring power. Combined with a 7.05:1 final drive ratio, it helps propel the Bolt EV from 0-60 mph in less than seven seconds.

Power delivery is controlled by Chevrolet’s first Electronic Precision Shift system. This shift and park-by-wire system sends electronic signals to the Bolt EV’s drive unit to manage precise feel and delivery of power and torque, based on drive mode selection and accelerator inputs. A by-wire shifter requires less packaging space than a traditional mechanical shifter, resulting in more interior space and improved interior layout.

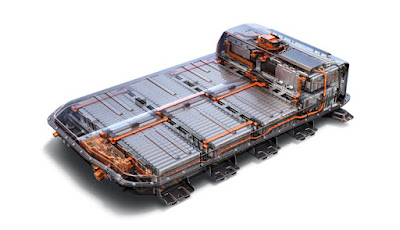

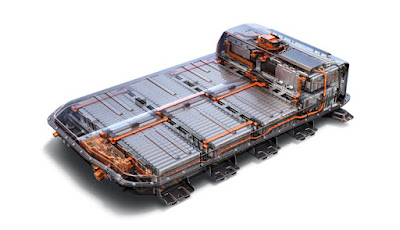

Having more than 1.3 billion miles of EV experience from the Chevrolet Volt helped Bolt EV battery engineers and strategic partner LG Electronics to develop an all-new cell and battery pack to offer more than an estimated 200 miles of range. Battery system preliminary specifications include:

60 kWh lithium-ion battery pack

160 kW peak power

288 lithium ion cells

Five sections

10 modules

96 cell groups – three cells per group

960 lbs. (435 kg) total weight

285 liters

...

Chevrolet Bolt EV specs released

Hard on the heels of the reveal of the production Volt EV at CES 2016 in Las Vegas, Chevrolet used the North American International Auto Show in Detroit to release additional details on the battery and drivetrain of the new BEV. Engineers developed the Bolt EV’s propulsion system to offer more than an estimated 200 miles and a sporty driving experience.

The Bolt EV’s drive system uses a single high capacity electric motor to propel the car. The engineering team designed the Bolt EV’s electric motor with an offset gear and shaft configuration tailored to meet efficiency and performance targets—most notably more than an estimated 200 miles of range. The motor is capable of producing up to 266 lb-ft (360 N·m) of torque and 200 hp (150 kW) of motoring power. Combined with a 7.05:1 final drive ratio, it helps propel the Bolt EV from 0-60 mph in less than seven seconds.

Power delivery is controlled by Chevrolet’s first Electronic Precision Shift system. This shift and park-by-wire system sends electronic signals to the Bolt EV’s drive unit to manage precise feel and delivery of power and torque, based on drive mode selection and accelerator inputs. A by-wire shifter requires less packaging space than a traditional mechanical shifter, resulting in more interior space and improved interior layout.

Having more than 1.3 billion miles of EV experience from the Chevrolet Volt helped Bolt EV battery engineers and strategic partner LG Electronics to develop an all-new cell and battery pack to offer more than an estimated 200 miles of range. Battery system preliminary specifications include:

60 kWh lithium-ion battery pack

160 kW peak power

288 lithium ion cells

Five sections

10 modules

96 cell groups – three cells per group

960 lbs. (435 kg) total weight

285 liters

...

Much more at: http://www.electric-vehiclenews.com/2016/01/chevrolet-bolt-ev-specs-released.html

January 14, 2016

- See more at: http://blog.cleanenergy.org/2016/01/11/how-much-does-it-cost-to-build-southern-co-s-new-nuclear-reactors-at-plant-vogtle/

What will it cost to build Southern Co.ís new nuclear reactors at Plant Vogtle?

What will it cost to build Southern Co.’s new nuclear reactors at Plant Vogtle?

January 11th, 2016 › Nuclear › Sara Barczak ›

So, what is the current cost estimate for building two new Toshiba-Westinghouse AP1000 nuclear reactors at Southern Company’s Plant Vogtle near Waynesboro, Georgia along the Savannah River? It seems like it should be a simple question but it clearly is not. And the answer depends on when you ask, who you ask, what your question is exactly asking, how you ask the question and how much patience you have to wait for an actual answer. ...

Here are the highlights (or “lowlights”) to save you time:

But as I said earlier, when it comes to the Vogtle monitoring docket, getting the “answer” depends on who you ask and when and how. For example, Southern’s 13th VCM report and their witnesses who testified in early November stated that the current estimated project cost was just over $7.4 billion. It wasn’t until expert witnesses on behalf of the PSC’s Public Interest Advocacy Staff filed testimony later that month that we learned the cost is $8.409 billion, a 38 percent increase since certification, which includes the lost fuel savings and the $350 million cost increase for Georgia Power’s share of the project given the settlement between the utility owners and lead contractor Westinghouse that was announced in late October and recently finalized.

Expert witness for Public Interest Advocacy Staff testifies

And then it took our attorney, former PSC Commissioner Robert “Bobby” Baker, to ask the important questions at the December hearing to tease out important details. Such as the fact that the 46 percent tax true up rate on the approximately $2.4 billion in financing costs associated with the 39-month delay should be included, bringing Georgia Power’s estimated cost to over $9.5 billion, more than $3 billion above the certified cost from 2009. And given Georgia Power is just one partner in the project, the total project cost estimate is now around $21 billion. You can watch the full cross examination here or a few short, but revealing excerpts here:

Conveniently for the Company and unfortunately for utility customers...

January 11th, 2016 › Nuclear › Sara Barczak ›

So, what is the current cost estimate for building two new Toshiba-Westinghouse AP1000 nuclear reactors at Southern Company’s Plant Vogtle near Waynesboro, Georgia along the Savannah River? It seems like it should be a simple question but it clearly is not. And the answer depends on when you ask, who you ask, what your question is exactly asking, how you ask the question and how much patience you have to wait for an actual answer. ...

Here are the highlights (or “lowlights”) to save you time:

- The project is at least 39-months delayed; though more than five years in, only 26 percent of construction is complete.

- With more delays come more cost increases, in excess of $2 million per day for Georgia Power’s share of the project (they are 45.7 percent owners).

-Georgia Power’s estimated cost is now over $9.5 billion, more than $3 billion above the certified cost of $6.113 billion.

- All project benefits have been eliminated by the detriments (e.g. increased financing costs, replacement fuel costs, etc.).

- Approximately $21 billion was mentioned as the current total cost estimate for the entire Vogtle project, a staggering increase since the $14.1 billion estimate in 2009 (this figure does not include costs associated with even further delays).

But as I said earlier, when it comes to the Vogtle monitoring docket, getting the “answer” depends on who you ask and when and how. For example, Southern’s 13th VCM report and their witnesses who testified in early November stated that the current estimated project cost was just over $7.4 billion. It wasn’t until expert witnesses on behalf of the PSC’s Public Interest Advocacy Staff filed testimony later that month that we learned the cost is $8.409 billion, a 38 percent increase since certification, which includes the lost fuel savings and the $350 million cost increase for Georgia Power’s share of the project given the settlement between the utility owners and lead contractor Westinghouse that was announced in late October and recently finalized.

Expert witness for Public Interest Advocacy Staff testifies

And then it took our attorney, former PSC Commissioner Robert “Bobby” Baker, to ask the important questions at the December hearing to tease out important details. Such as the fact that the 46 percent tax true up rate on the approximately $2.4 billion in financing costs associated with the 39-month delay should be included, bringing Georgia Power’s estimated cost to over $9.5 billion, more than $3 billion above the certified cost from 2009. And given Georgia Power is just one partner in the project, the total project cost estimate is now around $21 billion. You can watch the full cross examination here or a few short, but revealing excerpts here:

- confirmation of the 46 percent tax gross up not previously included

- confirmation of an additional $1.264 billion in financing costs due to the 39-month delay

- estimated cost of Georgia Power’s share of Vogtle now over $9.5 billion

- estimated total Vogtle price tag of approximately $21 billion

Conveniently for the Company and unfortunately for utility customers...

- See more at: http://blog.cleanenergy.org/2016/01/11/how-much-does-it-cost-to-build-southern-co-s-new-nuclear-reactors-at-plant-vogtle/

Profile Information

Member since: Fri Dec 19, 2003, 02:20 AMNumber of posts: 29,798