nc4bo

nc4bo's JournalHRC:"You're asking me to say I have never, I don't believe I ever have. I don't believe I ever will"

The Clinton campaign did not respond to a request for comment or clarification.

http://abcnews.go.com/Politics/hillary-clinton-shes-truth-americans/story?id=37043658

I see them here all the time but certainly not in the millions, it's cold now not nearly as many

As during the warm months.

There really are no good jobs here unless you are military affliated, can pass the security screenings to work for contractors on Bragg, or have college pedigrees you can pad your resume with. Dont have a police record because then even Goodyear dont want you. Lots of shitty service jobs where you work your ass off for $7-8 (and tips if you are a waiter/ress) and hardly any worthwhile benefits. The Mexicans live in trailer parks too, some live on massa's farm in huts and trailers on the land they farm for massa.

Typical con game of how unemployment was lower in a 4th quarter of last year as all the shitty walmarts, etc. needed more slave labor for xmas.

Some of these kids probably make better money selling dope and the prostitutes make way better selling ass on the boulevards than trying to work 2 jobs to make ends meet.

Yes....they ARE on the corners......In the trailer parks and really low income home areas.

Poor whites are a bit less noticeable. We have one friend that brews moonshine and cooks meth in the woods. Lots of meth activity around here.

This fucking country owes its' citizens something in fact.......lots of somethings. We need to stand up together and demand REAL CHANGE that benefits the needs of the many, not just the needs of the few.

God damn it we can do better!! We fucking DESERVE better.

Scathing blog by 3 AA women titled: Black People donít OWE Hillary Clinton SHIT!

I'll just leave this bit here. There's much, much more plus video clips at the link.

https://3chicspolitico.com/2016/02/06/black-people-dont-owe-hillary-clinton-shit/

Posted on February 6, 2016 by Ametia

*SNIP*

Elihaas:

“You know fam, that whole fake it and wing it until you can make it way of the too slick… that slick con that folks like the Clintons pull to wangle their way into mostly unearned esteem and inevitability…

It’s that slick spin that sells you the Bill Clinton is the ‘greatest’ politician ever (sometimes they qualify that with the word ‘retail’) …That it was all thanks to him and his one speech at the DNC that President Obama was re-elected…

It’s that same slick spin that force-feeds the notion of Hillary as the ‘smartest, most accomplished, most qualified and most experienced’ female politician …at first by virtue of having been first lady for 8 years, then because she carpetbagged her way into the Senate via their same strong-arming tactics, and lately, the laughable and blatantly false assertion that President Obama who declined to make her his V.P twice, somehow made her SoS because he ‘trusted’ her ‘judgement’…(It all boils down to that same ‘extraction of concessions’ she repeatedly talked about last night as she and Bernie Sanders went back and forth on normalizing relationships with Iran. How ironic.)

And don’t forget that it was *she* who advised President Obama on that very tough decision on whether to take Bin Laden out or not…LOL…For the duration of her time as SoS, President Obama mostly conferred with and relied on his National Security team led by Tom Donilon…It was only after John Kerry took over as SoS, that we saw the natural and seamless coordination of high stakes foreign policy between the President and his SoS return..

It seems some of "us" ARE paying very close attention AND keeping it real.

From Flint, Michigan to Everywhere, USA, it's the INFRASTRUCTURE stupid.

It's just that damn simple!

Bernie Sanders plan for rebuilding this country's failing infrastructure at the link.

https://berniesanders.com/issues/creating-jobs-rebuilding-america/

For too many years, we have dramatically underfunded the physical infrastructure that our economy depends on. That is why I have proposed the Rebuild America Act, to invest $1 trillion over five years to modernize our infrastructure. It would be paid for by closing loopholes that allow profitable corporations to avoid paying taxes by, among other things, shifting their profits to the Cayman Islands and other offshore tax havens.

Importantly, the Rebuild America Act will support more than thirteen million good-paying jobs – jobs that our economy desperately needs.

— Senator Bernie Sanders

DUer Pa28 found an audio of a 2008 Hillary fundraiser dissing MoveOn to her friends.

http://www.democraticunderground.com/?com=thread&info=1&address=12511142082The two faces of Hillary Clinton.

One face for the richy-rich 1%ers she's wooing.

The second face for the rest of the American idiot voting citizen.

She disgusts me the same way Mitt Romney disgusted me with his 47% comments at a 1%ers fundraising bang-bang.

Hillary's meme generating jukebox is stuck in repeat

Random, CD 1, A Weathervane is for spinnin'.

Greatest Hits include:

He's a racist racer.

He's sexist machine.

He's a commie kinda guy.

Bernie, where'd you get that (Teflon) coat?

He's a Rebel (Establishment blues version)

Sanders' supporters are so mean(I think I'm gonna scream)

So cool, he's got an ice cream in his name.

There's so many on that Greatest hit CD that I can't remember them all.

Can't wait for the release Greatest Hits, volume 2.

Right now, nearly 20,000 people are listening to Bernie in Minnesota.

There are nearly 20, 000 ENTHUSIASTIC people attending a Sanders rally in St. Paul, Minnesota and the entire venue is on fire and feelin' the Bern!

http://m.startribune.com/livestream-sen-bernie-sanders-rally-in-st-paul/324068061/

Just thought some would like to know.

So now we have Obama, Bush, the lessor, Bill Clinton, Biden, Kerry and now Trumpy

starring in (or given cameo appearances) ISIS terror videos.

Oh let's also give a special mention to these fabulous corporations: CITIgroup, GE, Halliburton, The Carlyle Group, ExxonMobile, Shell, AEGIS, Merrill Lynch and a few other choice entites.

Now what?!

Why Hillary Clinton Wonít Prevent the Next Economic Recession

http://observer.com/2015/12/why-hillary-clinton-wont-prevent-the-next-economic-recession/Ms. Warren and many other politicians support reinstating Glass Steagall to help rebuild the wall between investment banking and commercial banking, while taking into account contemporary issues in the financial sector that were non-existent or irrelevant when Glass Steagall was first introduced in 1933. “By itself, the 21st century Glass Steagall Act will not end too big to fail and implicit government subsidies, but it will make financial institutions smarter and safer, and move us in the right direction,” she added.

Ms. Clinton’s comprehensive Wall Street Reform plan has a lot of positive attributes—many of which Ms. Warren and Mr. Sanders agree with—but the dismissal of reinstating Glass Steagall weakens her plan significantly. In her Times op-ed she argued that “we need to tackle excessive risk wherever it lurks, not just the banks.” Ms. Clinton attempts to debunk the reinstatement of the Glass Steagall Act as ineffective, but given the political power of big banks—with the five largest on Wall Street currently holding 45 percent of the nation’s banking assets compared to just 25 percent in 2000—her cautious reforms are insufficient.

Supporting Ms. Warren and Mr. McCain’s 21st century Glass Steagall Act should be a staple of both Ms. Clinton and Mr. Sanders’ Wall Street reforms, but Ms. Clinton is opting for a less aggressive approach, which doesn’t help distance her from Wall Street. Some of the biggest donations to the Clinton Foundation came from Bank of America, CitiGroup and Goldman Sachs. In the second Democratic debate, she fumbled an explanation of her Wall Street ties, going off on a rant about 9/11. Ms. Clinton’s disregard for Glass Steagall is indicative of her unwillingness to actually usher in change on Wall Street by holding banks accountable for their actions. Her vague talking points are just business as usual; political rhetoric from a well-seasoned lawyer who knows what to say to garner as much support as possible.

Senator Sanders believes reinstating Glass Steagall is a very important part of WallStreet Reform.

https://berniesanders.com/yes-glass-steagall-matters-here-are-5-reasons-why/

America’s largest banking institutions are even larger now than they were before the 2008 financial crisis. The nation’s six largest banks issue more than two thirds of all credit cards and more than a third of all mortgages. They control 95 percent of all derivatives and hold more than 40 percent of all US bank deposits.

2. The argument that Glass-Steagall didn’t cause the 2008 financial crisis is wrong.

Hillary Clinton told the Des Moines Register that “a lot of what caused the risk that led to the collapse came from institutions that were not big banks.” This is part of a longstanding pattern, in which she largely absolves the big banks from culpability for the 2008 crisis while emphasizing “shadow banking” in her own Wall Street plan.

Secretary Clinton returned to that theme during Saturday’s debate, pointing an accusing finger at non-bank entities like AIG and Lehman Brothers while giving a pass to Wall Street’s biggest banks for their role in the crisis.

3. Repeal of the Act has not worked as promised.

Given the risks associated with the repeal of Glass-Steagall, what about the benefits? Turns out there aren’t many.

We were told that repealing Glass-Steagall would lead to more efficiency and lower costs, but neither of these promises has come true. No less an expert than John Reed, former CEO of Citigroup, now says those claims were wrong. Reed wrote in a recent op-ed (behind a firewall) that “there are very few cost efficiencies that come from the merger of functions – indeed, there may be none at all.”

4. The repeal of Glass-Steagall is further corrupting the culture of banking – if such a thing is possible.

Sanders was right when he said on Saturday night that “the business model of Wall Street is fraud.” The traditional practice of what Sen. Elizabeth Warren calls “boring” banking – opening savings accounts, reviewing loans, and providing other customer services – has largely been supplanted by high-risk gambling and the aggressive hustling of dubious investments to unwary clients.

The level of fraud unearthed since the 2008 crisis is nothing short of breathtaking. (The fact that no senior banking executive has gone to prison for that fraud is, if anything, even more breathtaking.) How did that happen?

Much more at the link.

Martin O'Malley also has an extensive plan to rein in the corruption AND it includes the reinstatement of Glass Steagel.

https://martinomalley.com/policy/financial-reform/

FINANCIAL REFORM

PROTECTING THE AMERICAN DREAM FROM ANOTHER WALL STREET CRASH

Governor O’Malley knows that the American Dream today remains out of reach for too many families. To attack this problem, it will take a multi-pronged and fearlessly progressive approach to addressing economic inequality. But the results of any steps we take as a nation to raise wages, ensure retirement security, and make the dream of homeownership a reality can be wiped out in an instant by another Wall Street crash.

We need to protect America’s economy. And we can only do it by implementing strong accountability and structural reforms that build upon the Dodd-Frank Act and put an end to too-big-to-fail, too-big-to-manage, and too-big-to-jail financial firms.

PROPOSAL: BREAK UP THE BIGGEST BANKS

Separate Risky Investment Banking from Ordinary Commercial Banking

For 70 years, the 1933 Glass-Steagall Act kept the U.S. economy safe from major financial crises by requiring commercial banks to be separate from investment banks to prevent them from putting everyday Americans’ deposits at risk. If Glass-Steagall hadn’t been repealed in 1999, the financial crisis will likely have been far less severe.

Implement a Financial Transaction Tax to Limit High-Frequency Trading

High-frequency trading creates volatility and unnecessary risk in financial markets, while serving no productive purpose in the real economy. A small tax should be applied to each sale and purchase of a financial instrument to limit this activity—one that would be nearly imperceptible to longer-term investors, but could dramatically cut down on highrisk, speculative activity on Wall Street.

More at the link.

JMHO. It makes zero sense that ANY Democratic candidate would not do everything within his or her power to prevent another catastrophic collapse. I just don't see a middle ground here. The 99% are the ones that suffer the consequences. It's always privatize the profits while socializing the risks with these greedy capitalists. Enough already!

Why aren't all our candidates all on the same page? Why is Hillary Clinton the only Democratic candidate not on the same page as O'Malley and Sanders?

Someone explain it to me.

Senator Obama wasn't doing all that hot either. Perhaps abysmally bad is fairly accurate?

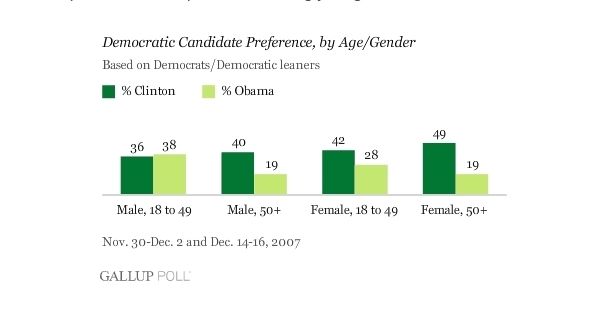

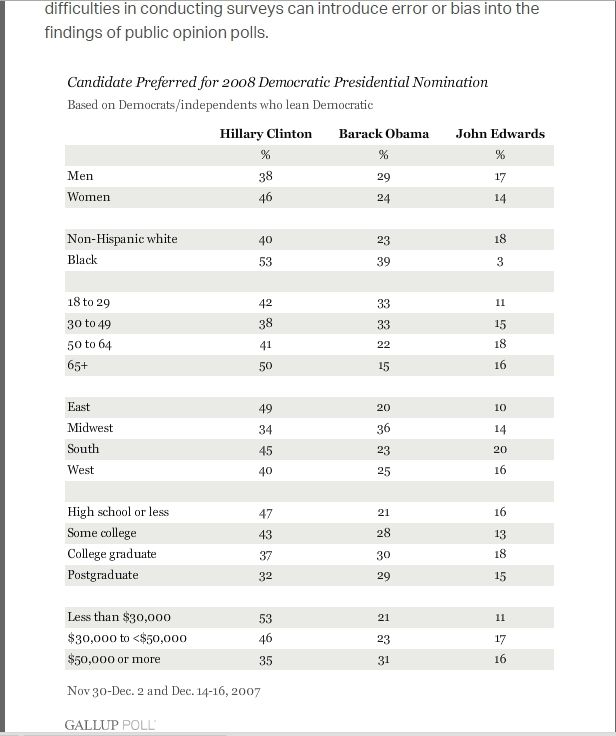

http://www.gallup.com/poll/103477/Clinton-Excels-Among-Seniors-LowIncome-Democrats.aspx?g_source=position5&g_medium=related&g_campaign=tilesThe influence of gender and age in voter preferences between the two leading Democratic candidates -- with Clinton most popular among women and seniors -- is evident when looking at the four major age/gender categories of voters. Clinton has a 30-point lead over Obama among women aged 50 and older, but trails Obama by two percentage points (not a statistically significant margin) among men aged 18 to 49. This is one of the few subgroups among whom Obama comes close to leading Clinton.

Age appears to prevail over gender when it comes to the other two age/gender groups: Clinton has a 21-point lead among older men, compared with a 14-point lead among younger women.

[URL=

.html][IMG]

.html][IMG] [/IMG][/URL]

[/IMG][/URL]

[URL=

.html][IMG]

.html][IMG] [/IMG][/URL]

[/IMG][/URL]

Profile Information

Name: LynGender: Female

Hometown: North Carolina

Member since: Wed Jun 4, 2008, 07:54 AM

Number of posts: 17,651